Summary

- Ancillary revenue in the airline industry is projected to increase by 15% by the end of 2023, reaching $117.9 billion.

- Low-cost carriers have been successful in driving ancillary revenue streams, accounting for approximately 31% of the market share.

- Seat selection and baggage fees are the most significant contributors to ancillary revenue, followed by baggage delivery services and loyalty programs.

In the wake of the pandemic, many airlines have figured out that there is a ton of money to be made through selling ancillary items and bundling ticket prices with these extra products. Although low-cost airlines figured this out years ago and have since mastered it, global network carriers are now following suit to extract this particular profitable revenue source.

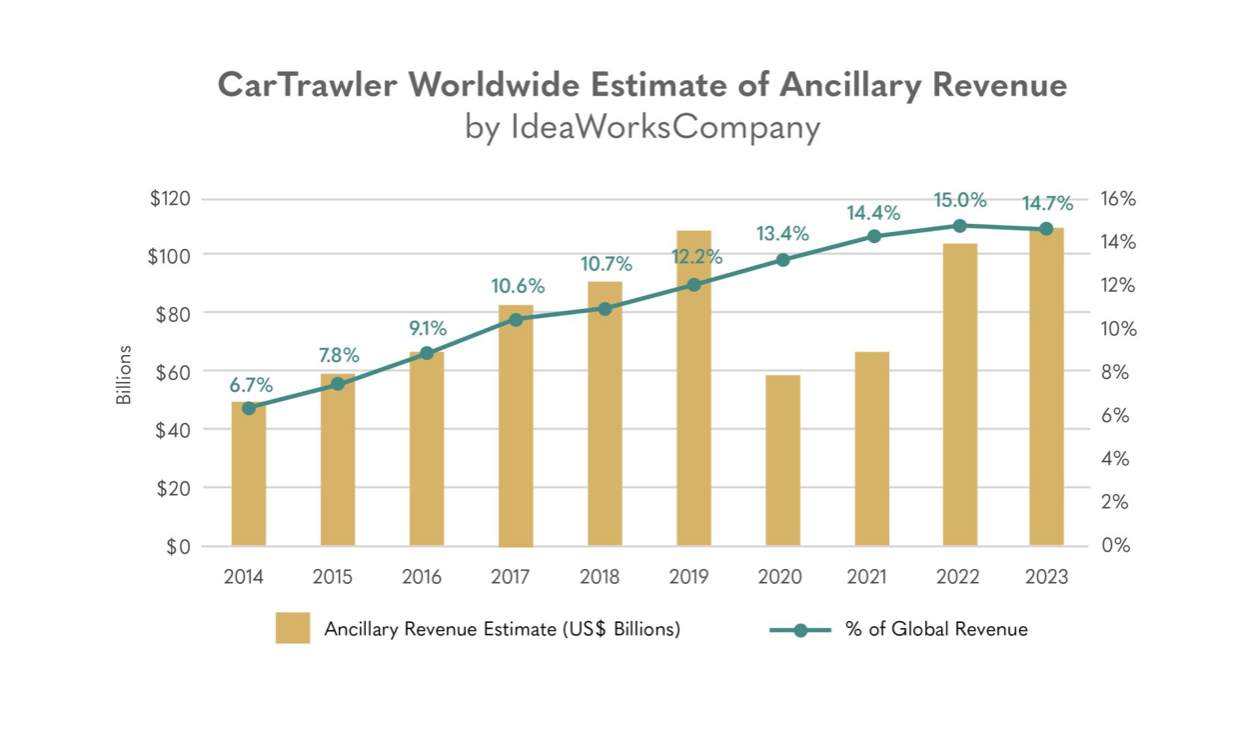

At the end of October, Car Trawler and IdeaWorksCompany, the premier consultant on ancillary revenue, released the CarTrawler Worldwide Estimate of Ancillary Revenue. The report projects that by the end of 2023, ancillary revenue will deluge by 15%, with a significant increase from $102.8 billion in 2022 to $117.9 billion in 2023.

Profitable revenue source

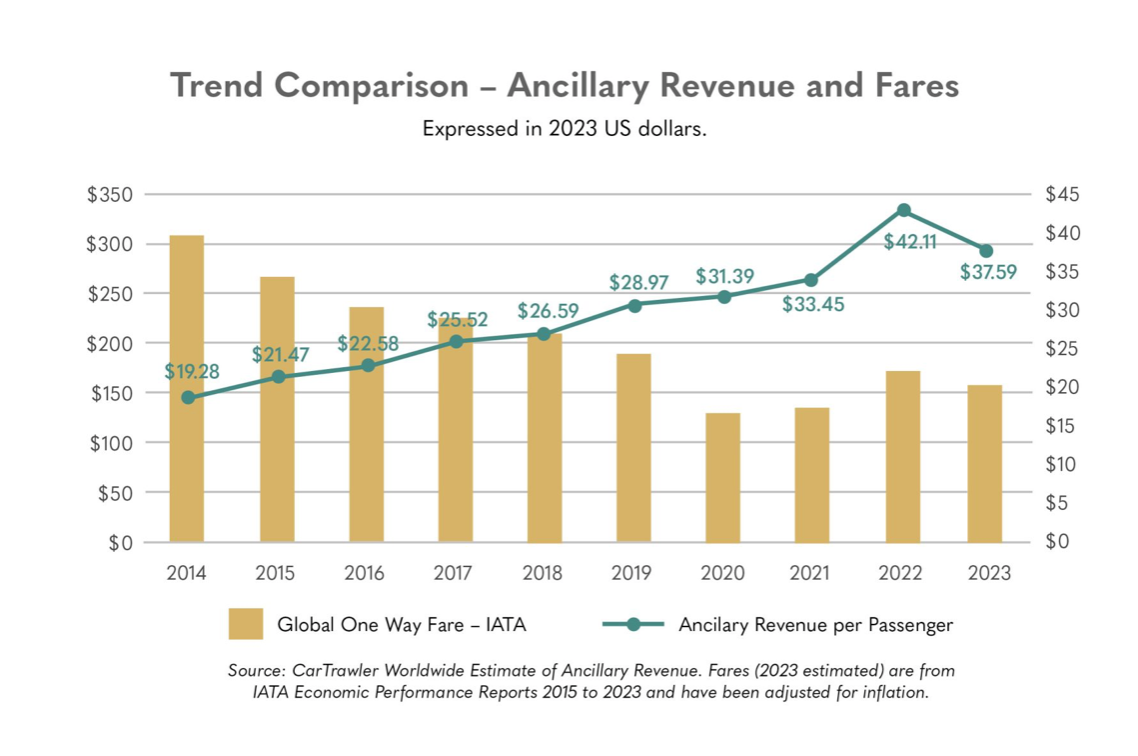

In 2019, the last full year before the pandemic, ancillary revenues were $28.97 per passenger, up from $19.28 in 2014. Despite the worst parts of the pandemic, ancillary revenue continued to climb and hit its apex in 2022 at $42.11 per passenger. According to the CarTrawler report, ancillary revenue is forecasted to reach $37.59 by the end of the year, which is still a steep decline from a year ago.

Photo: CarTrawler Worldwide Estimate of Ancillary Revenue

When low-cost carriers began emerging on the scene, they revolutionized the industry with their distinctive business model, culminating in extremely low base fares and generating profit through additional services. The expanding subset of income that falls under ancillary revenue includes:

- Sale of frequent flyer miles

- Fees for seat assignments

- Checking baggage and boarding

- Commissions from hotel bookings

The report further stated that the 15% increase in ancillary revenues generated by passenger growth culminated with the increasing market share gains by low-cost carriers. The low-cost segment accounted for 31% of the market share. Aileen McCormack, Chief Commercial Officer of CarTrawler, said that ancillary revenue has been a consistent measuring metric for airlines when airline ticket prices fluctuate daily. Furthermore, airlines must identify this additional revenue stream, especially as they look to generate as much revenue as possible after the pandemic. McCormack further added:

“Low-cost carriers continue to have the edge on driving ancillary revenue streams, accounting for approximately 31% of market share in this area. However, US airlines are increasingly gaining momentum with the successful rollout of loyalty programs and frequent flyer benefits. I expect airlines in Europe and the rest of the world are taking note of this development and evidence of the real returns it’s bringing in terms of yield.”

New ancillary services

The data shows that many US airlines have substantially increased their ancillary revenue numbers. To add more ancillary options, many established airlines have made significant strides in ancillary innovation. United Airlines and American Airlines have introduced a luggage delivery service that delivers travelers’ luggage to their final destination. Lufthansa began offering a sleeper’s row option for long-haul flights, allowing travelers to reserve a whole row with a mattress cover, pillow, and blanket. AirAsia also launched the Xpress Baggage program through the airline’s app for select cities, where passengers can pay to have their bags delivered first at the baggage claim.

Photo: Sundry Photography | Shutterstock

Even with all of these innovations to boost ancillary revenue, according to McKinsey, seat selection and baggage fees are the most ample ancillary services and account for over half of the total ancillary revenue. This is followed by baggage fees, which comprise over one-third of all ancillary revenue alone.

What ancillaries do you purchase when you fly? Let us know in the comments.

Sources: McKinsey, IdeaWorksCompany & CarTrawler