Summary

- By managing capital efficiently, airlines can increase return on invested capital (ROIC) and drive profits.

- Paying attention to market structure and offering ancillary revenue options can boost airline profitability.

- Building a positive reputation is crucial for airlines to attract passengers and ensure long-term success in a competitive market.

In today’s competitive market, airlines must use a variety of strategies to ensure profitability. While different airlines may employ different methods, some are fairly universal and tend to be very efficient in generating overall profits.

One major way airlines can make money is through capital base management to ensure a high return on invested capital (ROIC). Airlines can accomplish this by purchasing newer aircraft and sticking to aircraft types appropriate for specific routes.

Another key strategy airlines use is paying attention to the market structure and consolidating as needed to ensure profitability and healthy competition. Airlines also make large profits from ancillary revenue, such as charging for extra baggage, seat choice, and in-flight amenities.

Network privilege also helps many airlines make profits. By ensuring they can provide passengers with routes other airlines do not, carriers can monetize niches in their respective networks.

Perhaps the most important way an airline can ensure profitability is by focusing on building a positive reputation. Airline customers have many choices in today’s world, and many do not make travel decisions based solely on price. An airline’s reputation and respectability play a large role in the number of passengers who choose to fly with it.

1

Capital base management

Higher airline capital turnover is correlated with higher ROIC performance.

According to Morgan Stanley, ROIC represents a company’s rate of return on the cash it invests in its business. Theoretically, the ROIC can be seen as a measure of an airline’s value creation. More practically, this figure is used to determine the efficiency of how an airline uses its capital to generate profitable returns.

ROIC is determined with a simple formula: Net Operating Profit After Tax (NOPAT) divided by the average invested capital, which is the company’s fixed assets and net working capital (NWC). According to the Corporate Finance Institute, NOPAT represents an airline’s theoretical income if it had no debt or interest expense.

Photo: Simple Flying

Most airlines focus on increasing the numerator in this equation, that is, their NOPAT figure. Many tend to overlook the importance of also focusing on the denominator in the ROIC equation. According to McKinsey & Company, capital turnover, or the revenue earned per dollar invested in capital, leads to better ROIC performance.

For airlines, this can often be seen in aircraft choice. A narrowbody aircraft, such as a Boeing 737 or Airbus A320, generates a higher capital turnover than a widebody plane. These smaller aircraft are much cheaper to operate and, because they are typically deployed on shorter flights, can complete more trips per day than an average widebody aircraft.

When examining the age of aircraft, regardless of the type, we can also see a marked difference in profitability. Airlines must ensure maximum utilization of new aircraft (typically ten to 12 hours of daily flight time for narrowbodies and 15 to 15 for widebodies). Therefore, airlines can be more profitable if they are strategic in choosing the type and age of aircraft on specific routes.

2

Market structure

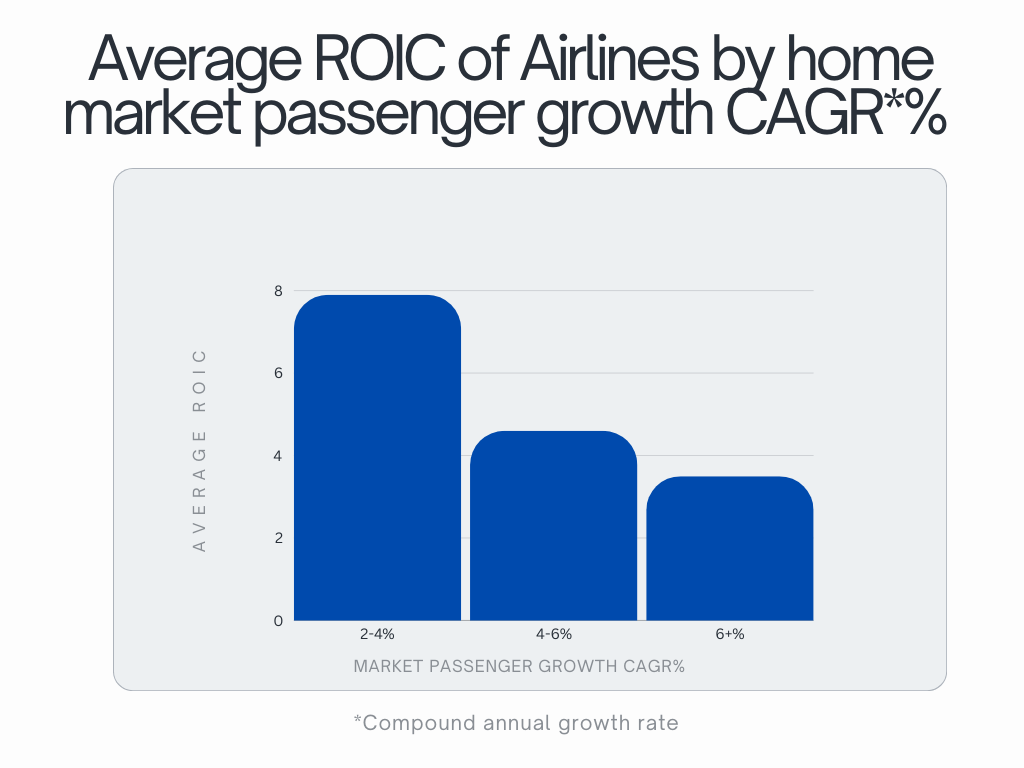

Airlines operating in slower-growing markets tend to perform better.

Several studies, such as that in Transport Policy, have examined airline profitability in various markets. Results show that airlines in slow-growing home markets tend to outperform their peers in high-growth markets. This is typically because fast-growing markets attract new entrants, causing ticket prices to fall. Stiff competition, therefore, can lead to lower profits for many airlines.

An example of this is the Asia-Pacific market. Before the 2020 COVID-19 pandemic, this market became less consolidated, and stiff competition led to negative results for many airlines there. Late reopenings post-pandemic further hindered airlines’ success in the region. According to a June 2024 article by the Bangkok Post, the Asia-Pacific market is forecasted to have the second-lowest aviation profit per region this year.

Related

Asia-Pacific Airlines Growing But Profits Under Pressure

The airlines of Asia-Pacific are rebuilding strong foundations as they emerge from the pandemic, keeping load factors high while adding capacity.

In contrast, US airlines have had more success, partly due to mergers that led to a more consolidated market. According to the Transportation Research Board, the many mergers of US airlines between 2008 and 2016 helped airlines re-examine their networks and consolidate operations in more profitable hubs.

Photo: Vincenzo Pace | Simple Flying

However, McKinsey & Company is quick to point out that market structure isn’t the only factor at play here. The Latin American market, which also experienced a similar consolidation, has not fared as well as the US market. This is because US carriers made intentional efforts to add capacity at a slower rate than GDP and only on routes where a competitive advantage already existed.

The state of a market, while important for airlines, is therefore not as significant as one might think. Even airlines in those rapidly growing markets can improve returns by reassessing capacity addition.

Photo: Simple Flying; Data: IATA

3

Ancillary revenue

High-performing airlines give customers choice.

Another way airlines can ensure profitability is by allowing customers to purchase ancillaries or add-ons. These additional travel options provide customers with choice, allowing airlines to make additional profits while ensuring customer satisfaction.

Ancillaries tend to represent an invaluable revenue stream for airlines in competitive markets, per OAG Aviation. For many airlines, ancillary options include things such as:

- Premium seat selection

- Priority boarding

- Additional baggage

- Inflight food/beverages and amenities

- Hotel bookings and car rentals

Ancillaries tend to have high margins and can be extremely profitable for airlines. According to McKinsey & Company, carriers whose passengers each spent at least $20 on ancillaries generate an average of 8.2% ROIC, more than 5% higher than airlines whose passengers spend less than $5 on ancillaries.

Photo: Lukas Souza | Simple Flying

4

Network privilege

Airlines with greater network privilege tend to perform better.

A fourth way airlines can ensure profitability is by having a greater network privilege, i.e., providing passengers with a unique itinerary that other carriers don’t. While every airline’s flight network has some privileges, successful carriers identify, create, and monetize niches in their individual networks.

An example of an airline who has successfully taken advantage of this is Panama’s Copa Airlines, which serves more than 80 destinations with its narrowbody fleet. By providing passengers with thousands of O&D (origin and destination) pairs, Copa has managed to triple the number of passengers on its privileged O&Ds compared to the industry average.

Related

The King Of Connections: Inside Panama’s Copa Airlines

5

Reputation matters

Carriers with more positive reputations enjoy higher returns.

In today’s world, with so much information readily accessible, price and schedule are no longer the ultimate deciding factors for passengers. Especially with recent safety concerns, customers tend to make air travel decisions based on the differences between individual airlines rather than simply seeking the cheapest deal.

Rankings of the world’s best airlines, such as those released by Forbes and

JD Power

, consider airline safety, performance, timeliness, and amenities. Therefore, it is essential that airlines maintain high standards to build positive reputations among potential customers. Investments to ensure reliability, innovation, and loyalty can lead to increased revenue.

An example of an airline that has consistently been successful in maintaining a good reputation is Delta Air Lines. The major US carrier has been ranked the best in North America by Skytrax and WalletHub and also received an award for the region’s best airline staff service. Delta’s focus on on-time performance and low cancellation rates provide it with high customer satisfaction and an overall very positive reputation. The airline, in turn, reaps the benefits of a yield advantage among its peers.

|

Airline |

2023 WalletHub Rating |

|---|---|

|

Delta |

66.79 |

|

Spirit |

66.57 |

|

SkyWest |

63.71 |

|

United |

62.83 |

|

Alaska |

59.03 |