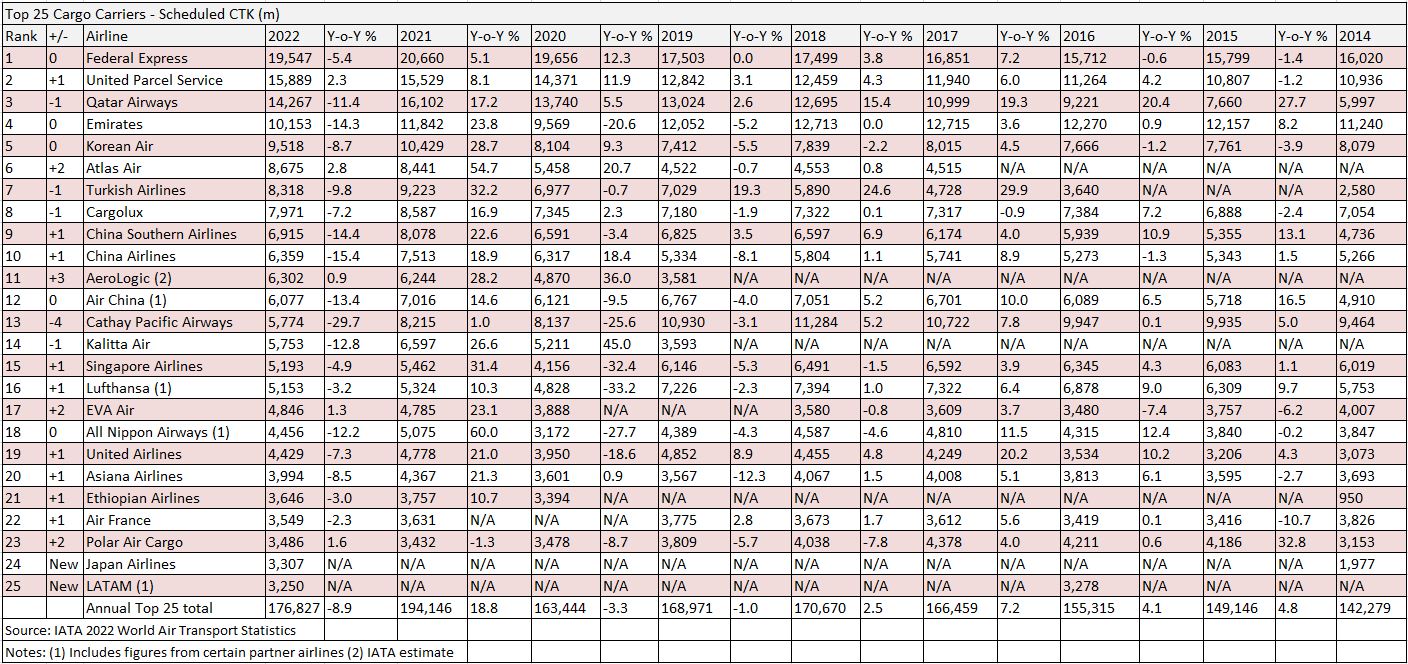

Cargo carriers faced multiple challenges to business growth in 2022, a year that presented a dramatically different operating landscape to 2021 (full chart at end of article).

2022 proved to be a testing year for air cargo carriers following the boom years of the pandemic.

The start of the Ukraine-Russia war had an immediate impact on routes and fuel costs, while taking freighter capacity out of the market.

Economic conditions then toughened. As well as trade flow disruption due to the war, inflation rose, and volumes decreased.

Post-pandemic belly capacity trickled back with the phased return of airline passenger flights, and seafreight supply chain congestion eased.

As a result of volume declines and the return of belly capacity, rates also began to dip in the second half of the year.

Clearly reflecting the increasingly tough market conditions, traffic in scheduled cargo tonne km (CTK) terms decreased by 8% year on year, and 1.6% compared to pre-Covid 2019, according to IATA.

This was a sharp drop from the 18.7% year on year increase registered in 2021.

Likewise, the airline association’s World Air Transport Statistics (WATS) report showed the top 25 cargo airlines in 2022 suffered a drop in cargo traffic of 8.9% year on year.

“In the face of significant political and economic uncertainties, air cargo performance declined compared to the extraordinary levels of 2021. That brought air cargo demand to 1.6% below 2019 (pre-pandemic) levels,” said Willie Walsh, IATA’s director general.

Europe suffers, Latin America prospers

All regions suffered a downturn in demand in 2022 compared to 2021, apart from Latin America.

There was an 11.5% decrease in demand (measured in CTKs) in 2022 compared to 2021 for European carriers.

“Airlines in the region continue to be most affected by the war in Ukraine,” said IATA.

Middle Eastern carriers reported a 10.7% decrease in CTKs, while North America saw a 5.1% decrease.

Asia Pacific airlines saw an 8.8% decline, said IATA. The association commented that airlines in the region continued to be impacted by lower levels of trade and manufacturing activity and disruptions in supply chains due to China’s rising Covid cases.

Of those regions with a decline, African airlines had the lowest reported decrease in demand, at 1.4%.

Latin American was the only region to see an increase in demand, at 13.1%, and with a capacity increase of 27.1%. Several airlines had completed restructuring processes during the year, which had boosted performance.

FedEx takes top spot again

Federal Express (FedEx) retained the top spot in the top 25 airlines rankings overall but recorded a fall in volumes year on year due to economic conditions and continued challenges presented by the pandemic.

According to WATS, volumes for the US express giant dropped 5.4% year on year to 19.5bn CTK.

In its fiscal first quarter results for the period ended August 31 2022, FedEx said decreased volumes, as well as revenues below forecasted figures, had prompted it to undertake cost reduction initiatives including cancellation of certain planned network capacity and other projects; reducing flight frequencies and temporarily parking aircraft; closing more than 90 FedEx Office locations; and deferral of staff hiring.

In its second-quarter results for the period ending November 30 2022, FedEx again noted a “weaker demand environment”, with reduced FedEx Express revenues a particular pain point, although its previously implemented cost reduction plans had helped soften the blow.

The company’s 2022 annual report stated: “Our operating results for 2022 were negatively affected by the coronavirus pandemic, labour market challenges, and inflationary cost pressures.

“Labour market challenges contributed to global supply chain disruptions and affected the availability and cost of labour resulting in network inefficiencies, higher purchased transportation costs, and higher wage rates.

“In addition, global recovery from the impacts of the Covid-19 pandemic slowed with the onset of new variants, which resulted in reduced shipping demand and caused network disruptions, particularly at FedEx Express during 2022.”

Although volumes were down the carrier sought to strengthen operations with the delivery of four Boeing 777 freighters and 12 Boeing 767-300F during the year, as recorded in its annual report.

FedEx also began taking delivery of Cessna SkyCourier 408 aircraft from an order of 50.

The company additionally took delivery of four ATR 72-600Fs, to give it a total of six of the aircraft. FedEx is investing in 30 new ATR 72-600F aircraft overall for shorter feeder routes.

Furthermore, the company retired its MD-10 fleet at the end of 2021.

The annual report showed the fleet consisted of 696 owned and leased aircraft, compared with 684 a year earlier.

To continue its fleet renewal, FedEx plans to take delivery of eight more B777F aircraft between 2023 and 2025, and 38 more B767F aircraft between 2023 and 2025.

UPS takes second place

In comparison to FedEx, rival US express carrier United Parcel Service (UPS) climbed back up to second place after dropping to third in 2021. The company recorded growth of 2.3% to 15.8bn CTK last year.

Core airfreight verticals, including express, e-commerce and healthcare, aided volumes, though like FedEx, UPS cited macroeconomic issues and Covid lockdowns as impacting its overall performance.

UPS said in its 2022 annual report: “A number of macroeconomic factors contributed to a challenging operating environment in 2022, including global inflation and rising interest rates, recessionary forecasts, wage and labour market pressures, geopolitical uncertainties and foreign currency exchange rates relative to the US dollar.

“We continued to be affected by Covid-19 lockdowns in China that impacted both manufacturing and supply chains. In addition, consumers returned to more pre-pandemic shopping patterns.

“These factors resulted in disruptions to certain parts of our business, negatively impacted demand for our services and contributed to increases in certain of our operating costs.”

UPS noted in the report that the volatile market also eroded revenues within its divisions, but it was helped by growth in some business areas.

Source: Shutterstock

“In our International Package segment, revenue increased slightly, driven by fuel revenue, revenue quality actions and favourable shifts in customer and product mix. These increases were mostly offset by lower volume, the impact of the strengthening US Dollar and reductions in demand-related surcharges, primarily in the fourth quarter.

“In Supply Chain Solutions, the decrease in revenue was driven by volume and market rate declines in Forwarding, as well as the impact of divesting UPS Freight in 2021. These decreases were partially offset by growth in our healthcare operations and in a number of our other businesses.”

Like FedEx, UPS continued to invest in cargo capacity, but also scaled back its leased aircraft, reflecting the weakening market throughout the year.

UPS had 586 aircraft at the end of 2022, compared with 595 a year earlier. Its 767F fleet totalled 81 at the end of 2022, up one from the previous year. The company has 28 aircraft of this type on order.

Its 747Fs numbered 41, up from 39 in 2021. There are also two 747-8F on order.

Six MD-11 aircraft are expected to be retired from operational use during 2023.

UPS also reduced the number of operating leases and charters from other companies by nine, from 307 to 295 aircraft.

Qatar places third

Qatar Airways also felt the impact of the tough operating climate, with a decrease of 11.4% year on year to 14.3bn CTK in 2022, dropping one place to third position compared with 2021.

The carrier’s 2022/23 report for the period April 1 2022 to March 31 2023 stated: “With a tonnage of 159,730,903 kg in chargeable weight, Qatar Airways Cargo declined by 9.4% in chargeable weight compared to the same period in the previous year.”

However, the airline, which continued to bring back its passenger capacity last year, said pharmaceuticals and medical supplies remained a major part of volumes, although the transportation of vaccines and PPE equipment began to slow down last year as the pandemic progressed.

The 2022/23 report stated that Qatar Cargo had handled “84,000 tonnes of pharmaceutical products transported, including 4,000 tonnes of vaccines and over 1,200 tonnes of Covid vaccines”.

Animal transport was also big business for the carrier, with 12,600 horses transported during the period.

Plus, Qatar Cargo undertook more than 1,400 charter flights during the period for e-commerce, animals, music band tours and FIFA (football world cup) related activities.

Not deterred by a tough operating climate, Qatar also pledged further investment in aircraft in 2022 with the order of up to 50 777-8Fs and two current generation 777Fs.

Photo: Qatar Airways Cargo

How did other airlines fare?

Lessor specialist Atlas Air achieved a 2.8% increase in volumes. The airline said it took delivery of four new 747-8Fs and the first of four 777Fs, all of which are operating for customers under long-term agreements.

At the end of 2021, Atlas Air Worldwide Holdings brought the operations of Southern Air, acquired in 2016, under a Single Operating Certificate (SOC) with Atlas Air.

AeroLogic, the joint venture between DHL Express and Lufthansa Cargo, also achieved growth of 0.9% year on year.

The airline operated 21 777Fs on behalf of the two shareholders, according to Lufthansa’s 2022 annual report.

Lufthansa Cargo is responsible for marketing the capacities of five of these aircraft.

Meanwhile, Hong Kong-headquartered Cathay Pacific Airways experienced a steep drop in volumes of 29.7%. The airline continued to experience difficulties with pandemic lockdown and quarantine restrictions imposed by the government in the first half of the year.

These restrictions significantly curtailed passenger flights and belly capacity until May when the rules began to be relaxed progressively, enabling the airline, said chief executive Ronald Lam, to “gradually resume more flights, especially between October and December”.

Freighter operations did not resume fully until August.

Japan Airlines and LATAM were new to the list, entering at places 24 and 25 respectively.

But Etihad Airways exited the list, as did Volga-Dnepr group-owned AirBridgeCargo Airlines, whose aircraft have been on the ground for most of 2022 due to airspace bans and restrictions on leasing aircraft to Russia-based airlines as a result of the Ukraine-Russia war.