honglouwawa

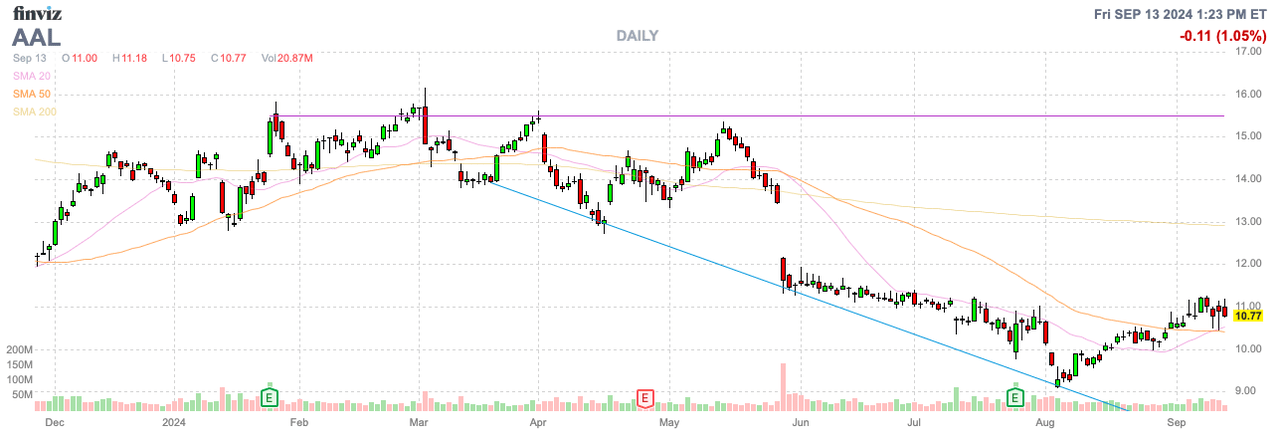

As with the other airlines, American Airlines Group Inc. (NASDAQ:AAL) can’t appear to catch a break. The stock is being stripped from the S&P 500 index just as airlines are confirming a rebuild in Q3 profits as capacity reductions are boosting numbers. My investment thesis remains ultra-bullish on the airline stock still trading near the COVID lows.

S&P 500 Removal

In the upcoming quarterly rebalance, S&P Dow Jones Indices will remove American Airlines from the S&P 500. The airline has a market cap of $7 billion, but Dell Technologies Inc. (DELL) and Palantir Technologies Inc. (PLTR) are being added to the index with market caps over 10x the size at ~$77 billion.

The move will occur on Sept. 23 before the market opens. American Airlines will be removed from the S&P 500 and added to the S&P MidCap 400 index.

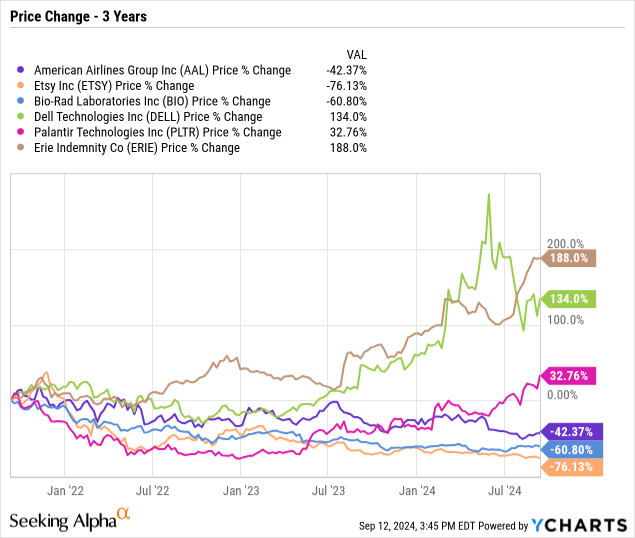

While future performance isn’t guaranteed, most major index changes are based on past results. An investor looking at the below chart can quickly derive which stocks are entering the index and which ones are exiting.

American Airlines has had a brutal few years after the COVID rebound. Despite the airline forecasting strong profits this year and recent signs of industry improvements, the stock has slumped 42% during the three-year period.

On the flip side, Erie Indemnity Company (ERIE) and Dell are both up far above 100% during the period. Similar to Dell, Palantir is benefiting from AI excitement along with the enterprise AI software company finally reporting the GAAP profits needed in order to join the index.

Besides just the optics, past research has shown a strong correlation with a snap back rally in the stocks in the following year after exiting the major indexes. Otherwise, a company leaving an index isn’t the reason to sell.

A couple of prime examples of removals this year that have done well is Comerica Incorporated (CMA) removed on June 24 at around $48 while trading at nearly $57 now. Illumina, Inc. (ILMN) was removed on June 24 at $105 and now trades at $129. V.F. Corporation (VFC) was removed on April 3 at ~$14 and the stock trades at over $18 today. On the flip side, CrowdStrike Holdings, Inc. (CRWD) was added on June 24 when the stock traded at $380 with a dip sub-$220 on the IT outage.

While this isn’t an exhaustive list, these examples highlight how an investor making the opposite move of the S&P 500 index can profit.

Improving Industry

Our prior research highlighted how a warning from Delta Air Lines, Inc. (DAL) wasn’t a reason to sell American Airlines. At the time, the industry was addressing overcapacity in the domestic sector and now the sector is seeing the forecasted improvements.

In the last few weeks, Delta, JetBlue Airways Corporation (JBLU) and Alaska Air Group, Inc. (ALK) have all come out and guided up numbers. Delta is the most relevant to American Airlines with the legacy airline guiding Q3 EPS estimates to the high end of the $1.70 to $2.00 target, when excluding the IT outage charge of $0.45, but most importantly the guidance for 2024 was pushed back to at or above the mid-point of its initial guidance of $6 to $7 per share.

The consensus estimates for Delta sat at only $6.09, suggesting the airline now soars past estimates by at least $0.50. In the case of American Airlines, the airline cut guidance for 2024 to only $1 per share back during the Q2 slump.

The consensus EPS targets are down at only $1.04, but the issue is the stock price relative to the opportunity with normalized business revenues. Not only did analysts get far too bearish on forward numbers, but the market bought into the negative valuing the stock at only 3x more normalized EPS targets of up to $3 per share in 2025/26.

The airline faced a challenging revenue period leading to the removal of the CCO back prior to the end of Q2. American Airlines confirmed a 2024 EPS target of $2.25 to $3.25 after reporting Q1 results. The airline has the capacity to deliver this level of profits when removing the self-inflicted wounds of the business sales and distribution strategy discussed by management to vast impacts on corporate travel.

Back on the Q2’24 earnings call, CEO Robert Isom discussed this impact suggestion the airline might not see the benefits of readjusting the business dynamics as follows:

In late May, I said our sales and distribution strategy was not working and we needed to make a change. We’re taking actions that will improve our performance, but a reset will take some time and we will continue to feel the impact of our prior sales and distribution strategy on revenue and earnings through the remainder of this year, which is reflected in our updated full year guidance.

in June, we reinstated fares in the distribution channel traditionally used by travel agencies and corporate managed travel programs. Approximately $14 billion of our annual revenue was booked through this system in 2023. This action ensures our product is available wherever customers want to buy it, and removes the most objected-to pain point of our previous distribution strategy.

The airline was a pace for a $3 EPS this year while Delta Air Lines has ended up awarding the high end of the original plan for the year after the hiccup mid-year. Assuming American Airlines can iron out the sales and distribution strategy heading into 2025, the airline should have a big rebound in profits.

Takeaway

The key investor takeaway is that investors should use any weakness from the S&P 500 removal as another opportunity to build up a position in America Airlines. The airline sector deserves better stock valuations and the removal from the S&P 500 is irrelevant to the long-term story.