Travellers are eager to hit the skies but are keeping a close eye on their budgets, with younger generations less influenced by traditional airline loyalty programs, a new OAG survey has revealed.

The study, titled Beyond the Ticket: Winning Traveler Loyalty with Rewards & Ancillary Services, revealed that traditional airline loyalty programs are becoming less appealing to younger generations, despite their overall popularity.

The hard numbers paint a clear picture. According to the study, which gathered insights from 2,000 travellers, only 65 per cent of Gen Z and 70 per cent of Millennials are enrolled in frequent flyer programs, compared to 89 per cent of Baby Boomers and 80 per cent of Gen X.

The main barrier, flagged by 61 per cent of Gen Z and 49 per cent of Millennials polled, is inconsistent travel with a single carrier or brand.

Many younger travellers are also turned off by how long it takes to redeem rewards (14 per cent and 19 per cent of Gen Z and Gen Y respectively).

To appeal to an increasingly mobile younger clientele, OAG urges carriers to think differently. For starters, it suggests airlines improve loyalty programs by allowing points to be used for other travel-related expenses, which would align with younger generations’ preferences.

The study found that 50 per cent of Gen Z and 49 per cent of Gen Y want to use points with holiday rental companies, with 73 per cent of travellers interested in using points for hotel stays and 53 per cent for car rentals.

Younger travellers also prioritise experiences over cost, with Gen Z and Millennials significantly (27 per cent) more likely to pay up to US$100 more for a legacy carrier ticket than a low-cost carrier.

“The loyalty program landscape is shifting, especially as younger generations make up a larger share of the travelling population,” OAG chief analyst John Grant said.

“Savvy airlines who create more meaningful rewards programs that align with the evolving preferences of today’s travellers, and who understand how to tap into real-time aviation insights to customise their marketing strategies, will deepen connections with their customers and redefine how to win their loyalty.”

When it comes to ancillaries, most travellers are purchasing add-on services through an airline’s website (48 per cent) or mobile app (37 per cent), with Gen Z most likely to buy add-ons in-flight (12 per cent).

Half of those polled said they prefer buying add-ons at booking, with one in four (26 per cent) between booking and check-in, and one in eight (12 per cent) at check-in.

Despite most (67 per cent) being willing to pay up to US$20 for extra carry-ons, exactly half agree with stricter carry-on policies.

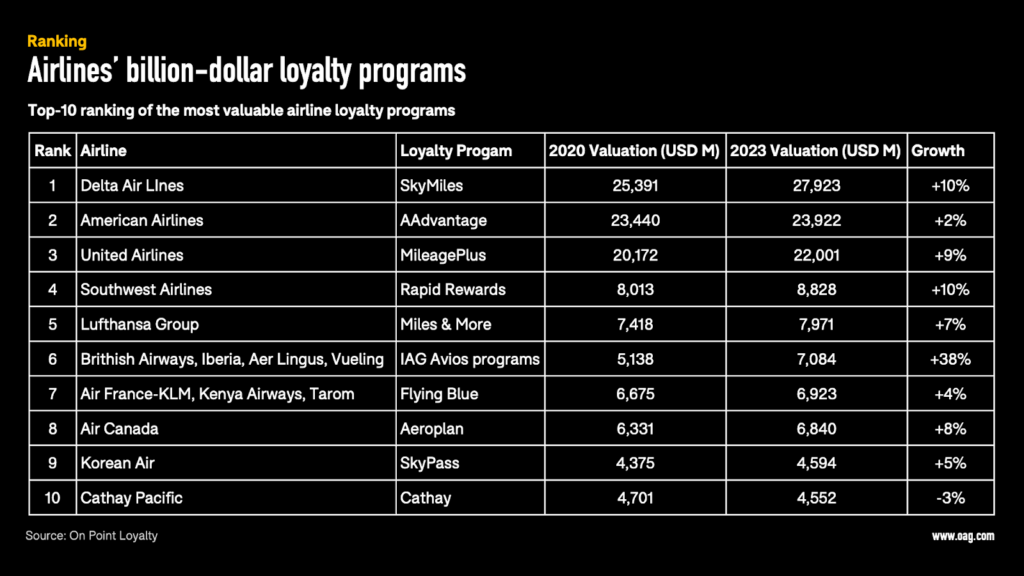

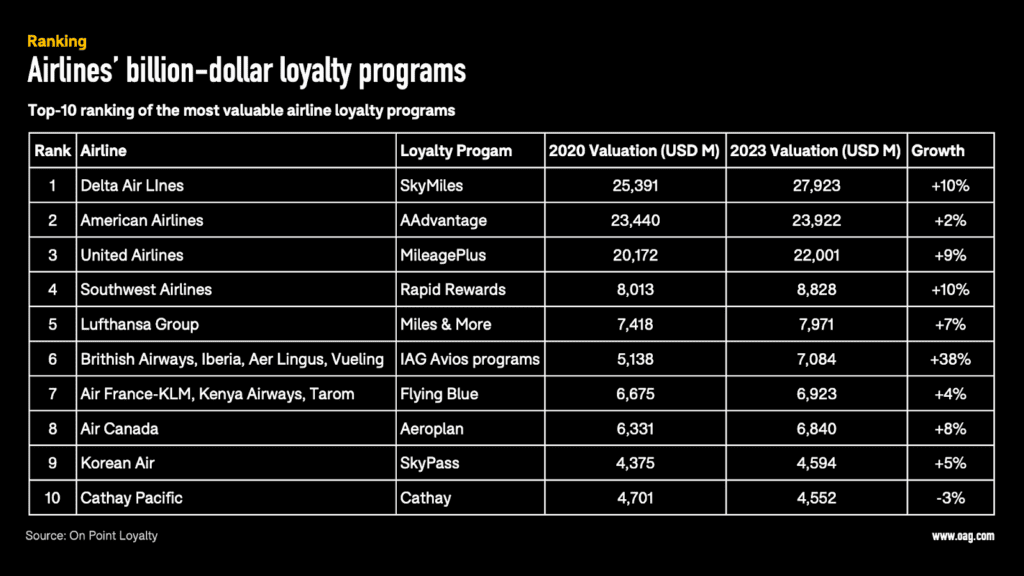

According to Forbes, Delta CEO Ed Bastian said in April that “loyalty to our brand has never been stronger”. The US carrier’s SkyMiles program is the world’s most valuable airline loyalty scheme.

“We continue to set new records with our remuneration from American Express, our most important commercial relationship, and are well on our way to our long-term target of $10 billion,” he remarked.

While the OAG study only polled North Americans who have flown in the past year, it’s still a good indicator of overall flyer sentiment in a highly mobile market. The world’s four largest loyalty programs are all US-based.