The Commonwealth Ports Authority has drafted a resolution to establish an airline incentive program to help lower the cost of landing in the CNMI for airline partners as well as to exempt certain aircraft from paying airport fees. However, due to some concerns, the resolution has been tabled.

During a special board meeting last week, CPA board members drafted three resolutions; two in relation to the use of Tinian divert lease funds to pay off airport debt, and one to amend CPA regulations to establish an airline incentive program as well as authorize fee exemptions for certain aircrafts.

Specifically, the third resolution (if passed) would exempt diplomatic U.S. military aircraft, Marianas government aircraft, and other aircraft operators that have a valid written agreement with CPA from paying terminal rental rates, rent for preferential use premises, common use charges, and turn fees.

The first two resolutions were passed unanimously by all seven members but due to some concerns, the board had to table the last resolution to allow ample time to discuss concerns.

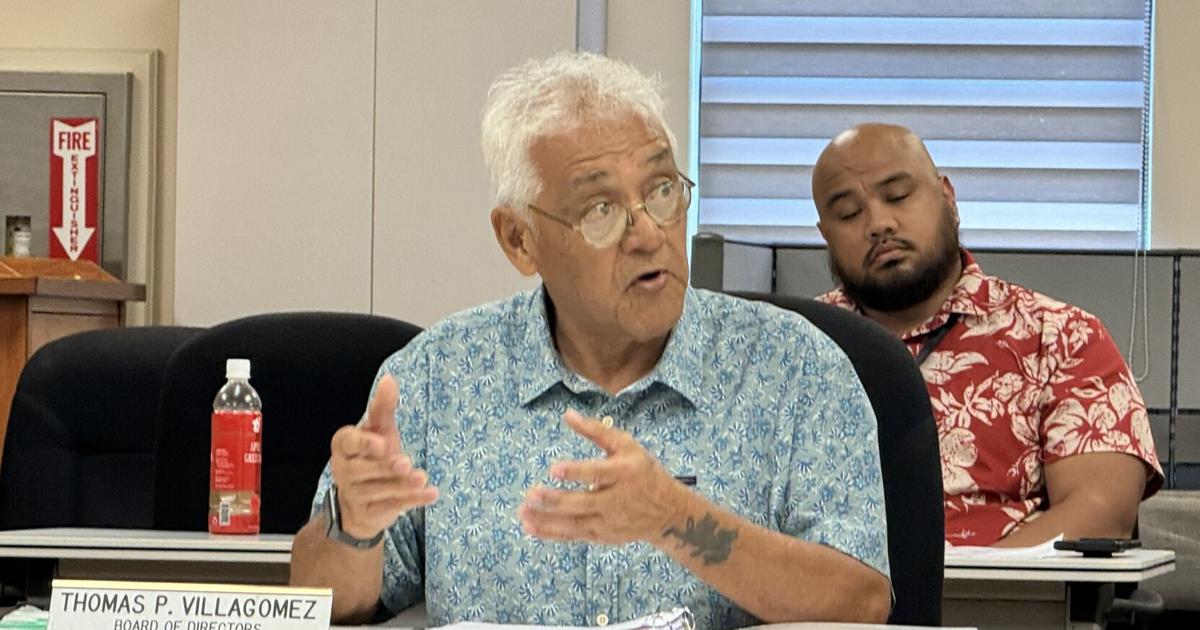

Board member Thomas Villagomez raised concerns about the exemption stating that he would like to further discuss the details.

In addition, Villagomez said the resolution lacked figures and would like a special committee to provide the board with numbers and specifics like if a 50% discount is implemented for airline partners, would it be 50% of the original 2022 rate methodology, or would it be 50% of the adjusted rate implemented back in 2023.

CPA board chair Joe Ayuyu, for his part, appointed board member Doris Kiyoshi to head the special committee and asked that she form a team to come up with these figures as soon as possible.

CPA is set to discuss the establishment of an airline incentive program today during another special board meeting.

According to Saipan Tribune archives, as a way to implement an airline incentive program to help lower current landing and airport fees for airline partners, CPA unanimously approved two resolutions in relation to authorizing the use of Tinian divert lease funds to pay off the airport’s 1998 senior bonds amounting nearly $6 million.

By paying off the airport’s 1998 senior bonds, CPA would be able to implement an airline incentive program to lower the current rates and fees airline partners must pay to do business in the CNMI.

The current airport rates and fees have been a concern for all CNMI’s airline partners, even partially resulting in the closure of Asiana Airlines.

With seven yes votes, the CPA board of directors unanimously voted in favor of adopting two resolutions; the first one authorizing the expenditure of up to $8 million of the divert lease funds, and the second authorizing CPA to deposit up to $6 million of the funds to the Optional Redemption Fund Account under Bank of Guam (the trustee of the 1998 Airport Bond Agreement) exercising CPA’s right to redeem itself from the entirety of the 1998 bond agreement.

“Our economy is really dying, and we cannot continue to live the way we have. We must become more creative. I understand the money is for Tinian, but we are facing an emergency where we have to make a decision that would be best for the CNMI,” said Ayuyu.