Skift Take

Spirit is the latest U.S. low-cost airline to make a premium pivot in a bid to boost profitability. Wall Street will be watching closely.

Spirit Airlines is making major changes to its passenger proposition. On Tuesday, the ultra-low-cost carrier revealed that it is moving upmarket with a series of new travel options. Spirit said these will “empower travelers to choose an elevated guest experience at an affordable price.”

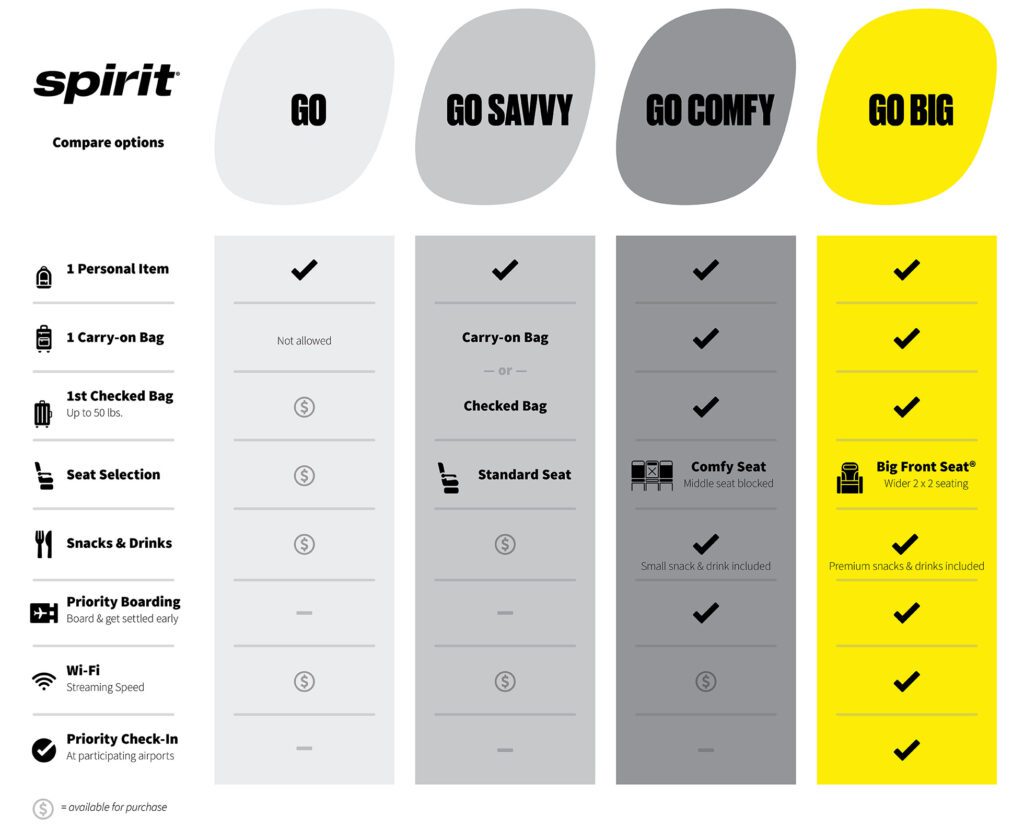

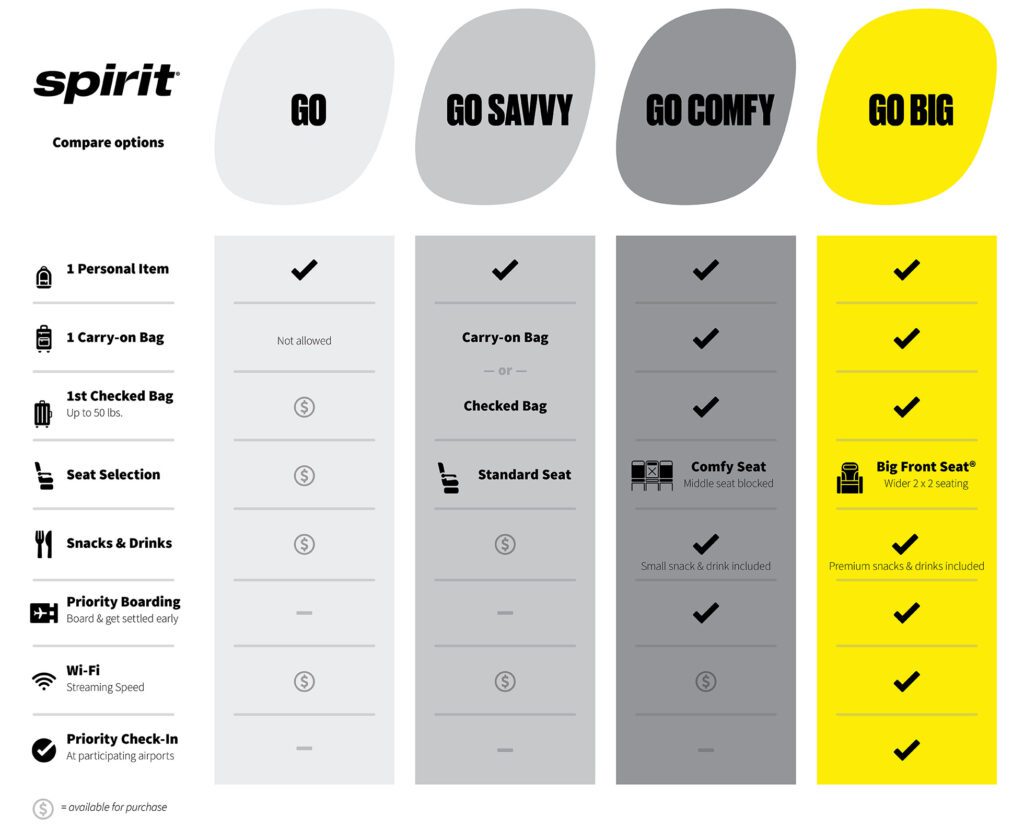

The most eye-catching change is its move to attract more premium-focused customers. Branded as ‘Go Big’, Spirit’s new top-tier option includes a ‘Big Front Seat’, snacks, and alcoholic beverages. Other perks include a checked bag, carry-on, priority check-in and boarding, and complimentary onboard Wi-Fi.

A further all-new option is ‘Go Comfy’. The main selling point here is a guaranteed blocked middle seat. It also comes with checked baggage, priority boarding, snacks, and a non-alcoholic drink.

Spirit’s other fare classes are branded ‘Go Savvy’, which offers the choice of one carry-on bag or one checked bag and standard seat selection. Its most basic product is called ‘Go’, with almost all extras coming at an additional cost.

All four options have fee-free changes and cancellations as part of an earlier shake-up of Spirit’s ticketing policies.

Spirit CEO Says He’s Listening

Ted Christie, Spirit Airlines President and CEO described the changes as a “new era” for the company. “We’re taking low-fare travel to new heights with enhanced options that are unlike anything we’ve offered before. We listened to our guests and are excited to deliver what they want: choices for an elevated experience that are affordable and provide unparalleled value.”

The new travel options are available for booking from August 16, with the onboard changes taking place from August 27.

In terms of airport experience, priority check-in featuring a dedicated lane, will be rolled out at more than 20 airports from August 27. This includes major hubs such as Atlanta, Los Angeles, Orlando, and Newark.

For boarding, a redesigned process will see passengers assigned into one of five groups. Spirit says the aim is to reduce boarding time and enhance operational performance. This will also be introduced from August 27.

Will it be Enough to Secure Spirit’s Long-term Future?

Spirit has had a tough 2024 so far. A proposed merger with JetBlue would have been a lifeline, but a judge struck down the partnership, arguing it would reduce competition in the industry and hurt consumers. It has also been exposed to problems with Pratt & Whitney geared turbofan engines, that have grounded many of its planes.

More broadly, business models at U.S. low-cost airlines have been coming under pressure amid overcapacity concerns, rising costs, and a surge in demand for international premium travel.

Speaking earlier in the year, Christie described analyst speculation that Spirit could face bankruptcy as “a misguided narrative… advanced by an assortment of pundits.” Last month, the CEO told shareholders at an annual meeting that the carrier is not considering a Chapter 11 bankruptcy.

“We are proudly executing to our plan as we’ve exited the merger agreement with JetBlue and are encouraged by the initial results of our standalone plan,” Christie said.

The changes at Spirit come just a week after Southwest Airlines announced its own premium pivot. In recent weeks, carriers including Frontier and JetBlue have also made changes to their fares classes and onboard products.

Airlines Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of airline sector stocks within the ST200. The index includes companies publicly traded across global markets including network carriers, low-cost carriers, and other related companies.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance.