Quick Links

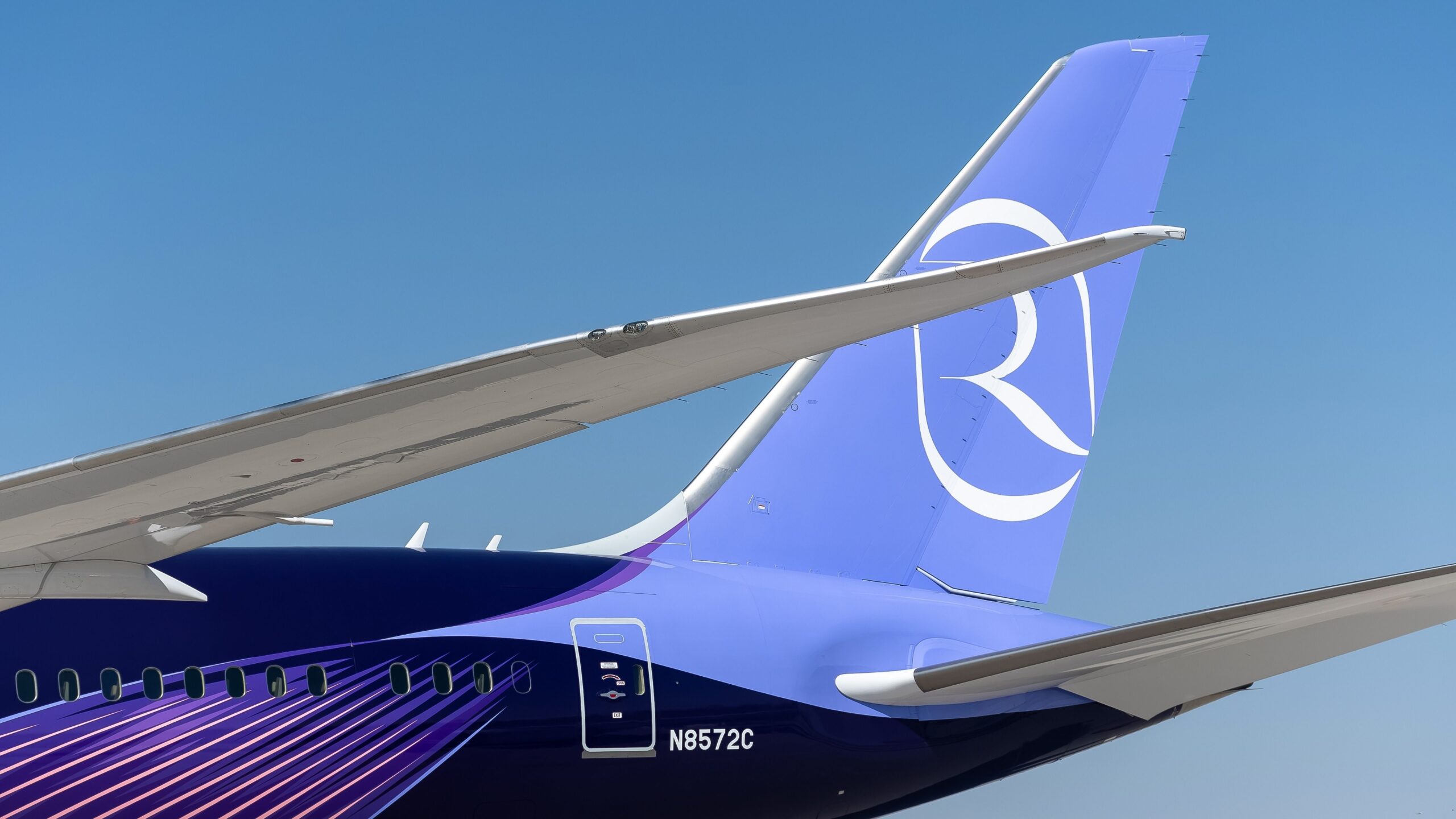

Riyadh Air

is advancing its efforts to obtain its air operator’s certificate (AOC) as the newest airline in Saudi Arabia and the general Middle East region – barring Israel’s airHaifa – is moving closer to launching operations in 2025.

Riyadh Air obtaining its AOC by the end of 2024

Speaking at Routes World in 2024, Tony Douglas, the chief executive officer (CEO) of Riyadh Air, said that the airline was currently progressing through route-proving flights, with the process to be completed within days, according to a report by AviationWeek.

Douglas added that Riyadh Air should obtain its AOC by the end of the year. While so far, Riyadh Air has only ordered Boeing 787-9

aircraft, the airline’s chief executive noted that the airline was nearing a narrowbody order. In addition, the Saudi Arabian carrier will look to order larger twin-aisle jets in the near future.

Photo: Riyadh Air

In early 2025, Riyadh Air will reveal its route network, with Douglas indicating that there will be few surprises on its served destination map, the AviationWeek report added.

Riyadh Air began its route-proving flights on September 12, using a SAUDIA

787-9, registered as HZ-ARA.

The first flight was operated under the flight code RXI5001, with the 787-9 flying between Riyadh King Khalid International Airport (RUH) and Jeddah King Abdulaziz International Airport (JED).

Potential routes

Data from the aviation analytics company Cirium showed that the most popular international destinations out of Saudi Arabia

were within other Arab League nations in October.

The most popular international destination was Cairo International Airport (CAI), Egypt, with 500 weekly departures from Saudi Arabia to the Egyptian capital, followed closely by  Dubai International Airport

Dubai International Airport

(DXB). Airlines, including  Emirates

Emirates

, flyadeal (a low-cost subsidiary of SAUDIA), flydubai, SAUDIA, and Flynas, have scheduled 462 weekly departures to the main airport serving Dubai, the United Arab Emirates, in October.

The most popular non-Arab League destination was Istanbul Airport

(IST, 117 weekly flights), Mumbai Chhatrapati Shivaji Maharaj International Airport (BOM, 94 weekly flights), and Islamabad International Airport (ISB, 67 weekly flights).

Photo: Riyadh Air

To note, the Turkish Ministry of Foreign Affairs (Dışişleri Bakanlığı) said that while the country was not a part of the Arab League, the two sides have established the Turkish-Arab Cooperation Forum (TAF).

Meanwhile, the busiest destinations in Europe, except the aforementioned Istanbul Airport, were London Heathrow Airport

(LHR, 43 weekly flights), Rome Leonardo da Vinci–Fiumicino Airport (FCO, 26 weekly flights), and Paris Charles De Gaulle Airport (CDG) and Frankfurt Airpot (FRA), with both being tied at 14 weekly flights.

There are only three routes from Saudi Arabia to North America, namely to New York John F. Kennedy International Airport

(JFK), Washington Dulles International Airport (IAD), and Toronto Pearson International Airport (YYZ), with six, six, and four weekly departures, respectively.

Expanding its network through codeshares

However, many of these destinations, including JFK, are slot-constrained, which could impede Riyadh Air’s growth plans.

The International Air Transport Association (IATA) has scheduled the next slot conference between November 19 and November 22 in Singapore. There, airlines can participate in “the forum for the coordination of planned operations at Level 2 and Level 3 airports, held twice each year for the summer and winter seasons,” according to IATA’s Worldwide Airport Slot Guidelines (WASG).

The November WASG addressed the following summer season, which, during the slot conference in 2024, will coincide with Riyadh Air’s planned launch date of spring 2025.

Nevertheless, Riyadh Air has signed several memorandums of understanding (MoU) with airlines throughout the globe, which could help the airline develop its network with the help of foreign partners.

Photo: Delta Air Lines

The list includes Air China, China Eastern Airlines, EgyptAir, Singapore Airlines, Delta Air Lines, and others.

At the same time, SAUDIA, another government-owned airline, has also signed a codeshare agreement with Delta Air Lines, which is pending approval from authorities, including the Department of Transportation

(DOT).

Considering the lackluster route network between the US and Saudi Arabia, two Saudi Arabian airlines signing agreements with ![]() Delta Air Lines

Delta Air Lines

– ![]() American Airlines

American Airlines

is already associated with ![]() Qatar Airways

Qatar Airways

through  oneworld

oneworld

, while ![]() United Airlines

United Airlines

has a partnership with Emirates – could indicate the country’s effort to expand its potential pool of visitors.

After all, Riyadh Air was launched as Saudi Arabia is undergoing its ‘Saudi Vision 2030,’ a plan to diversify its economy away from fossil fuels. The country hopes that, among other things, Saudi Arabia will become more integrated globally.