Summary

- All but one of BA EuroFlyer’s routes compete directly with easyJet

- Among others, it recently introduced Sharm el Sheikh. The Egyptian resort was last served by BA itself in 2015

- The return of Algiers and Porto to Gatwick should benefit from EuroFlyer’s lower-cost platform and Gatwick’s lower fees, increasing profitability for the Group while freeing up Heathrow slots

BA EuroFlyer (IATA: A0) took to the sky last year, and ch-aviation shows it has 18 Airbus A320ceos and A321ceos (much more fuel-efficient neos are used by the premium Heathrow-based parent instead). EuroFlyer, which is a lower-cost airline-within-an-airline, is Gatwick’s second-largest operator. As it has a different air operator’s certificate and operating license to BA, its call sign is Griffin rather than Speedbird (or Shuttle on domestic flights).

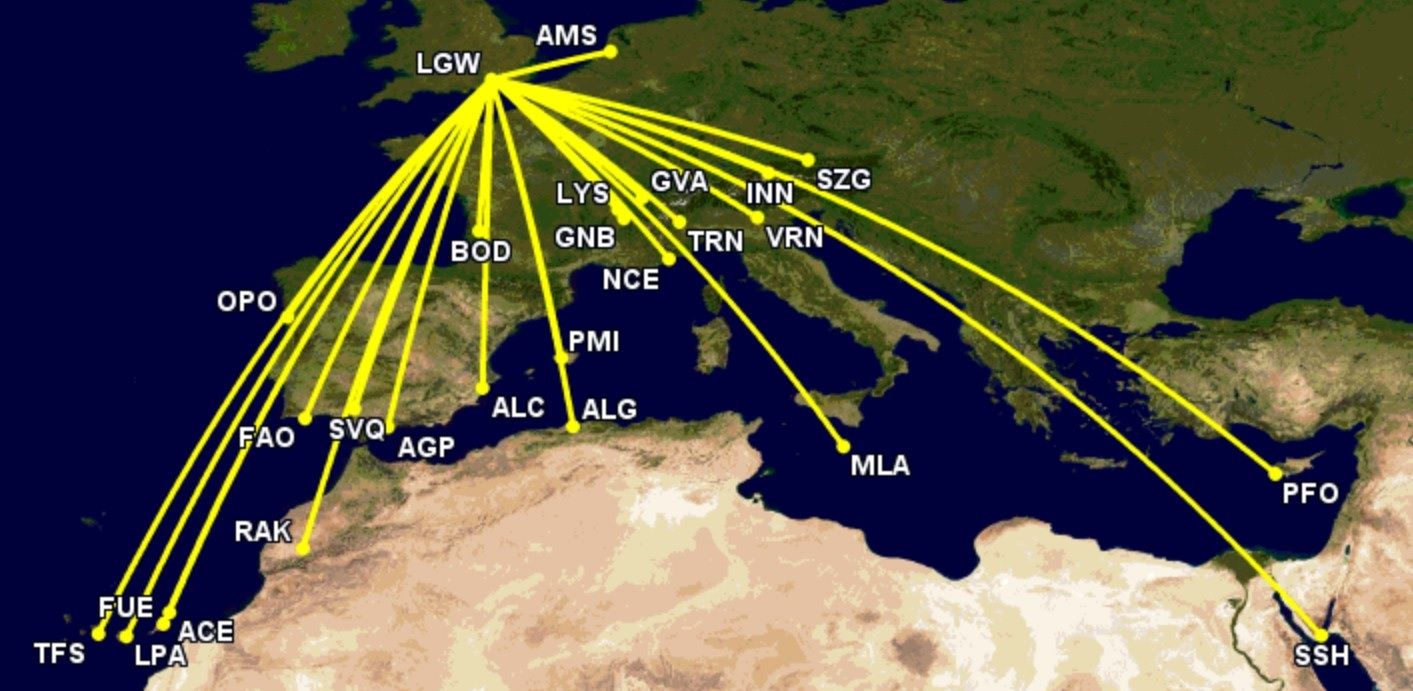

25 routes this winter

EuroFlyer’s network is shown below and excludes a few summer sun hang-ons that existed to benefit from end-of-season demand. Cirium shows it has more seats for sale to Geneva than anywhere else, followed by Amsterdam, Tenerife South, Malaga, and Marrakech.

Image: GCMap

BA itself serves 12 of the 25 destinations from Heathrow, and it would be interesting to compare how they do. Obviously, BA must get higher yields, or there’d be no point operating them given much higher fees/charges. But what of margins and traffic cannibalization versus local traffic, total traffic, and overall dominance and competitiveness to these places from London?

EuroFlyer vs. easyJet

Schedule analysis reveals that it competes directly with easyJet on 24 routes. The sole exception is Algiers, which returned to Gatwick when northern carriers switched to winter schedules.

It also competes directly with others, especially TUI (17 winter routes) and Wizz Air (six). Among other destinations, all four airlines compete to Sharm el Sheikh, with the following photo of me getting off there. (Yes, I do have two arms.)

Photo: James Pearson

EuroFlyer has 749,000 departing seats to the 24 destinations, while easyJet has about 1.2 million. The higher volume is from higher frequencies, not more seats per flight (easyJet has 184 vs. 197 for EuroFlyer).

EuroFlyer has the most capacity to Turin and Verona, although it would be dominant to more places if available seat kilometers (reflecting capacity and distance) were used instead.

Additional routes

Like many airlines, EuroFlyer is working hard to make winter work. After all, it is when many airlines lose money, which impacts overall performance. Getting it right would finally transform BA’s short-haul Gatwick operations, something it has always greatly struggled with. To this end:

- Algiers: started October 29th; served by BA from Gatwick until 2020, then switched to Heathrow

- Porto: started October 29th; BA from Gatwick until 2020, then switched to Heathrow

- Fuerteventura: started November 2nd; BA from Gatwick until 2018

- Sharm el Sheikh: started November 3rd; BA from Gatwick until 2015 (see below)

- Innsbruck: starts December 8th; BA from Gatwick until 2020 (also served from Heathrow)

- Venice: ended on October 28th (still served from Heathrow)

Photo: BA

Expect more former Gatwick routes to switch back. And – who knows? – possibly other routes that are important enough to be served by the Group but which could do better financially using EuroFlyer’s platform. They would be more point-to-point markets and driven by leisure and/or visiting friends and relatives demand.

Hello, Egypt!

I was pleased to have flown with EuroFlyer to Sharm el Sheikh on November 4th, a great winter market with temperatures of 30 °C+ in November. Alas, I missed out on the inaugural by one day.

Given Wizz Air was offering returns for a truly ludicrous £26, suggesting way too much capacity for the demand, let us hope it is not as much of a bloodbath as it seems. If it does not settle down soon, cuts will inevitably be made.

Served three to four times weekly, EuroFlyer is the only operator with business class. While Club Europe is obviously a ‘European’ and straightforward business offering, it has lounge access at both ends, surprisingly tasty hot meals, and decent legroom.

I flew 21.3-year-old G-GATL, an A320ceo, in both directions. Its life started by flying in Colombia. In 2004, it became Wizz Air’s fifth aircraft, an amusing circle given the increasing rivalry at Gatwick nowadays.

Stay aware: Sign up for my weekly new routes newsletter.

The return flight took 5h 34m and would have had a payload restriction if it was full. I felt sorry for the crew, whose duty time was a whopping 14 hours.

Have you flown EuroFlyer yet? If so, share your experience in the comments.

Sources: Cirium, OAG, Flightradar24, ch-aviation