Summary

- Widebody aircraft dominated the Dubai Airshow, with several airlines ordering models from Airbus and Boeing, including the A350-900, Boeing 777X, and 787.

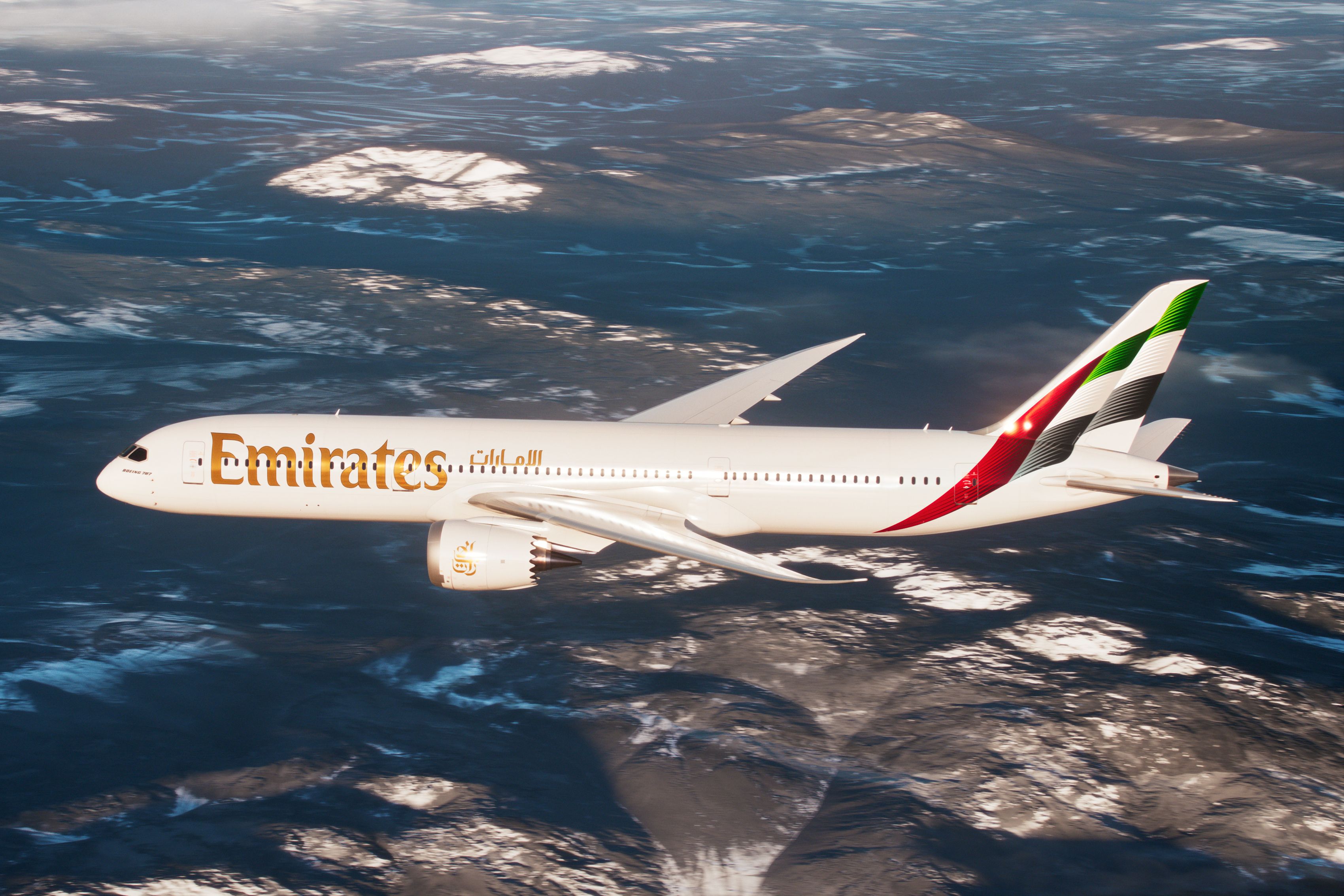

- Emirates was a key player, ordering 90 Boeing 777X aircraft and adjusting its Boeing 787 order, while flydubai also ordered 30 787-9s.

- The event saw fewer orders for narrowbody aircraft, with Boeing beating Airbus in terms of sales.

With the curtains closing on the industry part of the Dubai Airshow 2023, Simple Flying reviewed the trends, news, and developments that defined this year’s event. Throughout the five days, several airlines and lessors announced deals with manufacturers, which included orders booked by Airbus, Boeing, and ATR. Yet throughout the five days, the orders’ zenith was reached during the first few days, with the latter days of the trade show entering into a quieter lull.

Widebody aircraft dominance

Still, one of the most prominent trends of the event was that twin-aisle aircraft dominated the Dubai Airshow’s headlines. Emirates, EgyptAir, Ethiopian Airlines, flydubai, Royal Jordanian, and Royal Air Maroc ordered widebody aircraft, including the Airbus A350-900, Boeing 777X, and 787s. Some airlines, such as Emirates, EgyptAir, and Ethiopian Airlines, ordered aircraft from both duopoly members – Airbus and Boeing – yet none went with the largest A350 variant, the A350-1000.

EgyptAir only ordered the Airbus A350-900, with the Egyptian airline entering into an agreement with Air Lease Corporation (ALC) to lease 18 Boeing 737 MAXs, meaning it did not order any Boeing twin-aisle aircraft.

In total, all of the mentioned airlines booked 199 orders for widebody aircraft, excluding Ethiopian Airlines 15 options for the 787-9 and including the African airline’s Memorandum of Understanding (MoU) with Airbus for 11 A350-900s.

Photo: Tom Boon | Simple Flying

Hometown airlines dictating the headlines

Emirates was also the only airline to order the 777X, with its 90-aircraft order being split between 35 777-8 and 55 777-9s. Before the trade show, the airline already had a substantial backlog of 115 777Xs.

According to Boeing and Ahmed bin Saeed Al Maktoum, the Chairman and Chief Executive Officer (CEO) of Emirates, the manufacturer should deliver the first units to the Dubai International Airport (DXB)-based carrier in 2025, with the plane maker still in the middle of the process of getting the type certified by the United States (US) Federal Aviation Administration (FAA).

The airline also rejigged its Boeing 787 order book, dropping the order for 30 787-9s and instead choosing 20 787-8 and 15 787-9 aircraft. Interestingly, on the airline’s and Boeing’s press releases, Al Maktoum said few – none, actually – words about the 787, instead dedicating his attention to the 777X. “Emirates is the biggest operator of Boeing 777 aircraft, and today’s order cements that position,” he said, adding that,

“The 777 has been central to Emirates’ fleet and network strategy of connecting cities on all continents non-stop to Dubai. We are pleased to extend our relationship with Boeing and look forward to the first 777-9 joining our fleet in 2025.”

Emirates also stole the headlines following its president’s comments about the A350 engine. However, in a late twist, the airline ordered 15 more A350-900s.

Another notable order during the event came from the other hometown airline, flydubai. The self-described airline with “a travel experience that’s affordable and comfortable” potentially took over Emirates Boeing 787-9 aircraft order, as the airline ordered the same number of 787-9s.

Before it eventually takes delivery of its first 787-9 in 2026, its fleet comprised all Boeing 737 aircraft, including the Next Generation (NG) and 737 MAX families. Considering that airports globally are becoming ever-more slot-constrained, including DXB, adding the 787 makes sense, as it will allow flydubai to reduce frequencies and, at the same time, increase capacity on its routes.

Photo: Markus Mainka | Shutterstock

However, considering how closely aligned Emirates and flydubai are, including using the same Emirates Skywards loyalty program, it could unlock route opportunities from DXB and/or Al Maktoum International Airport or Dubai World Central (DWC) at destinations where Emirates is already seen as an incumbent airline.

Since flydubai technically would be a newcomer, it might be easier for the carrier to obtain slots at the world’s hubs, where slots have become a rare commodity. For example, the International Air Transport Association’s (IATA) worldwide airport slot guidelines have outlined that each Level 3 airport has to have a coordination committee, which, among other things, has to consider “any serious problems for new entrants at the airport concerned.”

Photo: Tom Boon | Simple Flying

Comparatively few narrowbody purchases

While during the Paris Air Show 2023, both Airbus and Boeing added significant narrowbody orders to their backlogs, including the record-breaking IndiGo deal, the Dubai Airshow 2023 has been relatively muted in this market. On the first day of the event, Turkey-based SunExpress ordered 90 737 MAX (45 options), while later on, Kazakhstan’s SCAT Airlines added eight more 737 MAXs to its fleet.

But the highlight order for the Boeing 737 MAX was the one from Ethiopian Airlines, whose passengers suffered a fatal accident with the type in March 2019, resulting in the more than a year and a half grounding of the 737 MAX. During the announcement, Mesfin Tasew, the CEO of Ethiopian Airlines Group, said that the airline was now confident in the type since they believe that Boeing has addressed every design flaw of the 737 MAX after the fatal crash more than four years ago. In total, the African airline ordered 20 737 MAXs with 21 options.

Photo: Skycolors | Shutterstock

Meanwhile, Airbus has only secured a single order for its narrowbody aircraft during the event. Latvia’s airBaltic has continued to trust its all-A220 business model, ordering 30 aircraft of the type with 20 more options.

As a result, the carrier could potentially operate up to 100 Airbus A220-300s, only enforcing its status of being the largest operator of the type in the world. Martin Gauss, the President and CEO of the carrier, noted that the A220-300 has been the backbone of the airline’s operations for almost seven years, with the type playing “an integral role in the international success story of airBaltic.”

Boeing winning the sales efforts

By the end of the event, it had become clear that Boeing had won the sales race between it and Airbus. The European plane maker only managed to secure four orders: 30 Airbus A220-300 from airBaltic, 10 A350-900 from EgyptAir, MoU for 11 A350-900 from Ethiopian Airlines, and Emirates’ 15 A350-900 aircraft order. In total, the European plane maker added 66 aircraft to its backlog, which includes the MoU that may not materialize.

Boeing reversed the roles of the Paris Air Show 2023 when the plane maker was overshadowed by its European counterpart. During the event at the capital of the Emirate of Dubai, the manufacturer secured a total of 246 firm orders. This is assuming that Emirates rearranging its 787 order book would count as a new deal in Boeing’s books, with the number excluding any options.

Photo: Emirates

What has been surprising is that Saudi Arabia-based airlines, including SAUDIA, Riyadh Air, and SAUDIA’s low-cost arm flyadeal, had not made a deal at the event. Just a week before the event, Tony Douglas, the CEO of Riyadh Air, told Reuters that the airline concluded its narrowbody campaign after receiving bids from Airbus and Boeing, teasing that the carrier would announce the order soon. However, during the Dubai Airshow 2023, Douglas stated to Reuters that the deal would be made public in a few weeks. SAUDIA and flyadeal were also concluding their own single-aisle jet campaign, yet no order also materialized during the event.