Summary

- Pratt & Whitney’s GTF engine problem has impacted numerous airlines globally, leading to the grounding and inspection of Airbus A320 fleets.

- Over 40 airlines and lessors have been affected by the engine issues, with potentially thousands of engines being impacted.

- Airlines like Air New Zealand, JetBlue, Cebu Pacific, Viva Aerobus, Volaris, IndiGo, and All Nippon Airways have experienced significant disruptions and have had to ground or inspect their aircraft due to the engine issues.

Pratt & Whitney’s GTF engine problem has impacted plenty of airlines globally. Earlier this year, RTX, the parent company of P&W, disclosed a rare condition in powder metal used to manufacture certain engine parts. This condition is forcing airlines to ground their Airbus A320 fleets and disassemble the engines for inspection. Many carriers have updated about the impact this issue has on their operations, including Cebu Pacific, Spirit Airlines, All Nippon Airways, Air New Zealand, Hawaiian Airlines, Viva Aerobus, IndiGO, and Volaris.

What’s happening?

In July, Pratt & Whitney determined that a rare condition in powder metal used to manufacture certain engine parts would force an accelerated inspection of the PW1100G-JM (GTF) fleet, which powers the A320neo. RTX said approximately 700 engines would have to be removed for shop visits between 2023 and 2026, possibly impacting at least 600 Airbus jets globally. The affected engines were manufactured between October 2015 and September 2021. The number of possibly impacted engines has grown to nearly 3,000.

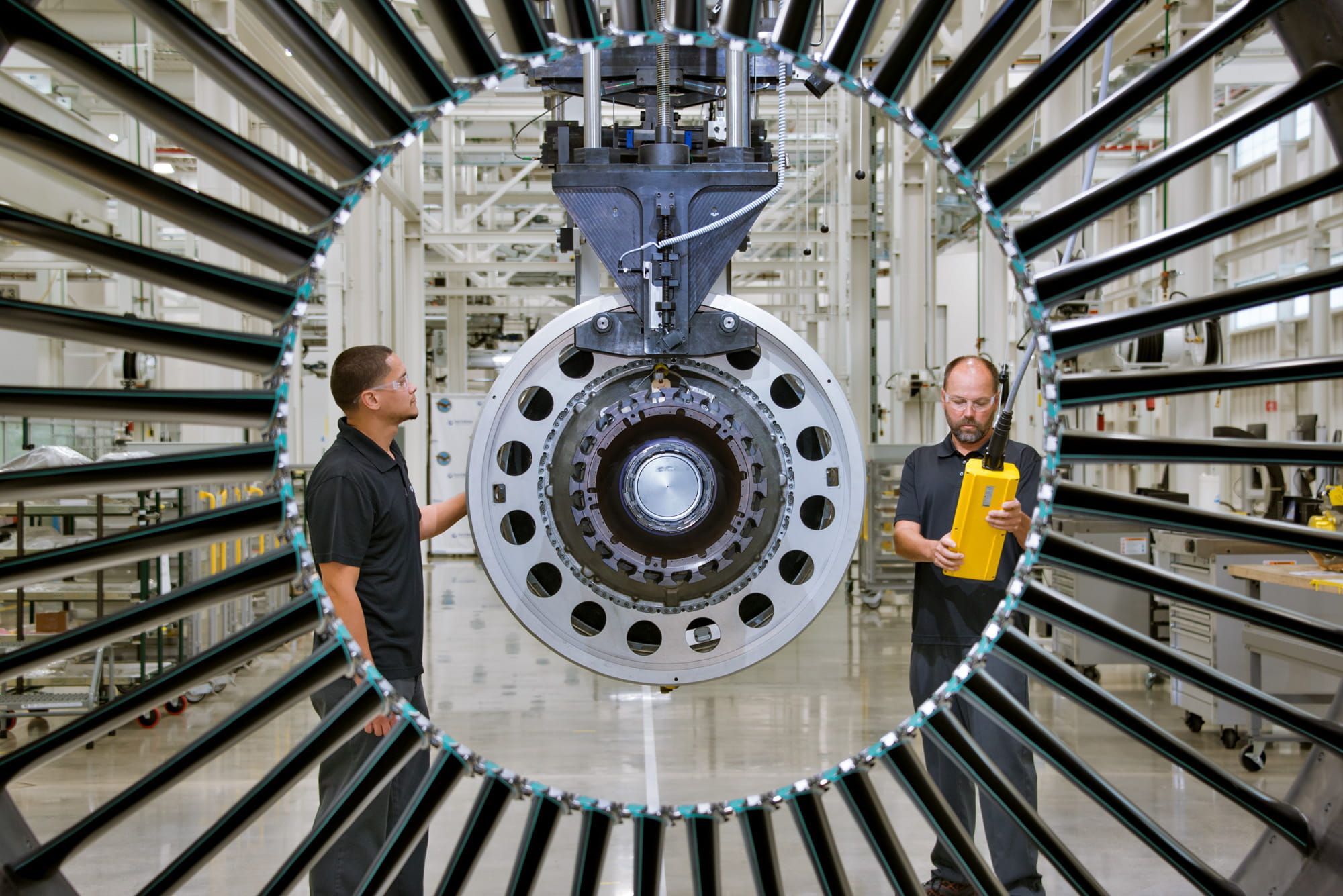

Photo: Pratt & Whitney

As reported on Simple Flying, Pratt & Whitney was investigating impurities in the parent material of the high-pressure turbine (HPT) stage 1 and 2 disks. These metal impurities could lead to premature cracks that could cause uncontained disk failures.

The issue led to a $5.4 billion charge to RTX, which, in turn, reported a 21% decrease in third-quarter sales. Greg Hayes, RTX Chairman and Chief Executive Officer (CEO), said in the company’s third-quarter financial results,

“We are now focused on executing on our fleet managerial plans and are working relentlessly to mitigate further disruption to our customers.”

Impact on airlines

Impact on airlines

Over 40 airlines and lessors globally have been impacted by Pratt & Whitney’s engine issues. After all, the Airbus A320 family is one of the most successful in aviation’s history, selling thousands and thousands of planes. Let’s take a look at some airline’s ongoing impact.

Air New Zealand

In early November, Air New Zealand said it could see an impact on its services for up to two years due to Pratt & Whitney’s engine issues.

In a report made by Reuters, Air New Zealand said it will have to ground up to four aircraft at any one time due to engine maintenance issues and hadn’t shut down the idea of leasing additional aircraft.

JetBlue

The US carrier expects to ground up to six of its Airbus A321neo by the end of 2023, with the possibility of that number to rise in 2024. FlightGlobal reported the company expects to close the year with a high single-digit or low-double-digit number of aircraft on the ground. Fortunately for the company, most of JetBlue’s GTF engines were manufactured post-2021, so they are not impacted by the issues found.

Cebu Pacific

Cebu Pacific

The Philippines-based company believes up to 20 of its aircraft could be grounded. In January 2024, at least ten aircraft could be on the ground for inspection and possible maintenance.

Viva Aerobus

The Mexican ultra-low-cost carrier identified three GTF engines possibly impacted in July and sent them for inspection in September. During the third quarter, the ultra-low-cost carrier had an average of 3.5 A320neo aircraft grounded, primarily due to the P&W engine issues.

Photo: InsectWorld | Shutterstock

Viva Aerobus wet-leased up to three Airbus A320 aircraft to minimize the impact of the ongoing grounding. Finally, inspections in their maintenance workshops should begin in early 2024 and persist throughout 2025.

Volaris

Mexico’s largest company is also heavily impacted by the issue. The company recently downsized its workforce, firing about 200 employees as it temporarily adjusts its operations and extends the leasing contracts of 18 aircraft.

Photo: Markus Mainka | Shutterstock

Volaris is said to be working closely with Pratt & Whitney to obtain the necessary technical support and financial compensation for the affected engines.

IndiGo

The Indian company is one of the most impacted firms globally. Besides the engine issues, IndiGo is facing engine supply chain issues, which has forced it to ground several A320s. In a recent post-financial results analyst call, the company’s Chief Financial Officer, Gaurav Negi, said,

“Received communication from Pratt & Whitney regarding the powder metal issue. As shop floor visits increase, things will become more clear, and this might lead to high number of grounding of aircraft. We will take mitigating measures and lease more aircraft.”

All Nippon Airways

The Japanese company recently disclosed it will begin engine inspections across its Airbus A320neo and A321neo fleets in January.

Photo: KITTIKUN YOKSAP | Shutterstock

ANA expects 33 aircraft to be impacted by the inspections, which would lead to cuts in the domestic and international segments covered by the carrier.

Other impacts

Other companies that the issue has impacted include Wizz Air, Hawaiian Airlines, and Spirit Airlines. Due to the problem, the European ultra-low-cost carrier Wizz Air recently said it was forced to slash its capacity forecast by 10%. It will have to ground about 45 aircraft.

Hawaiian Airlines

Hawaiian Airlines, in particular, is set to be one of the most impacted airlines by the issue due to its reliance on the Pratt & Whitney engine. The company currently has 18 A321neos (two of which are inactive at the moment), and they are all manufactured between 2017 and 2020 and employ PW1000 engines.

In fact, Hawaiian Airlines’ A321neo capacity in November 2023 is 9.3% lower compared to last year’s, according to data from Cirium. The company has straight out canceled several A321neo-operated flights, such as Lihue-Oakland.

Photo: Markus Mainka | Shutterstock

In September, Hawaiian Airlines CEO Peter Ingram said it was infuriating to learn about the recall of PW100G engines. He argued airlines and guests would have to bear the impact of the groundings. “I think there needs to be a level of respect paid to people who bought the aircraft already.”

In their financial statements, Hawaiian Airlines said the unanticipated time out of service resulted in, among other things, lower-than-expected capacity growth in the quarter.

Per ch-aviation, a total of 110 Airbus A321neo aircraft powered with PW1000 engines are currently inactive globally. These planes could be stored or in maintenance for a variety of reasons.

However, certain airlines are more impacted than others. For instance, Turkish Airlines has 18 of 55 A321neos currently inactive and either listed as in maintenance or stored.

What do you make of Pratt & Whitney’s engine issue? Let us know in the comments below.

Source: Reuters, FlightGlobal.