Summary

- The Asia-Pacific region’s strong performance suggests a recovery for the global air cargo market, with a 1% increase in cargo volume compared to last year.

- Asia, the Middle East, and Africa saw significant increases in chargeable weight, while Europe and North America experienced declines.

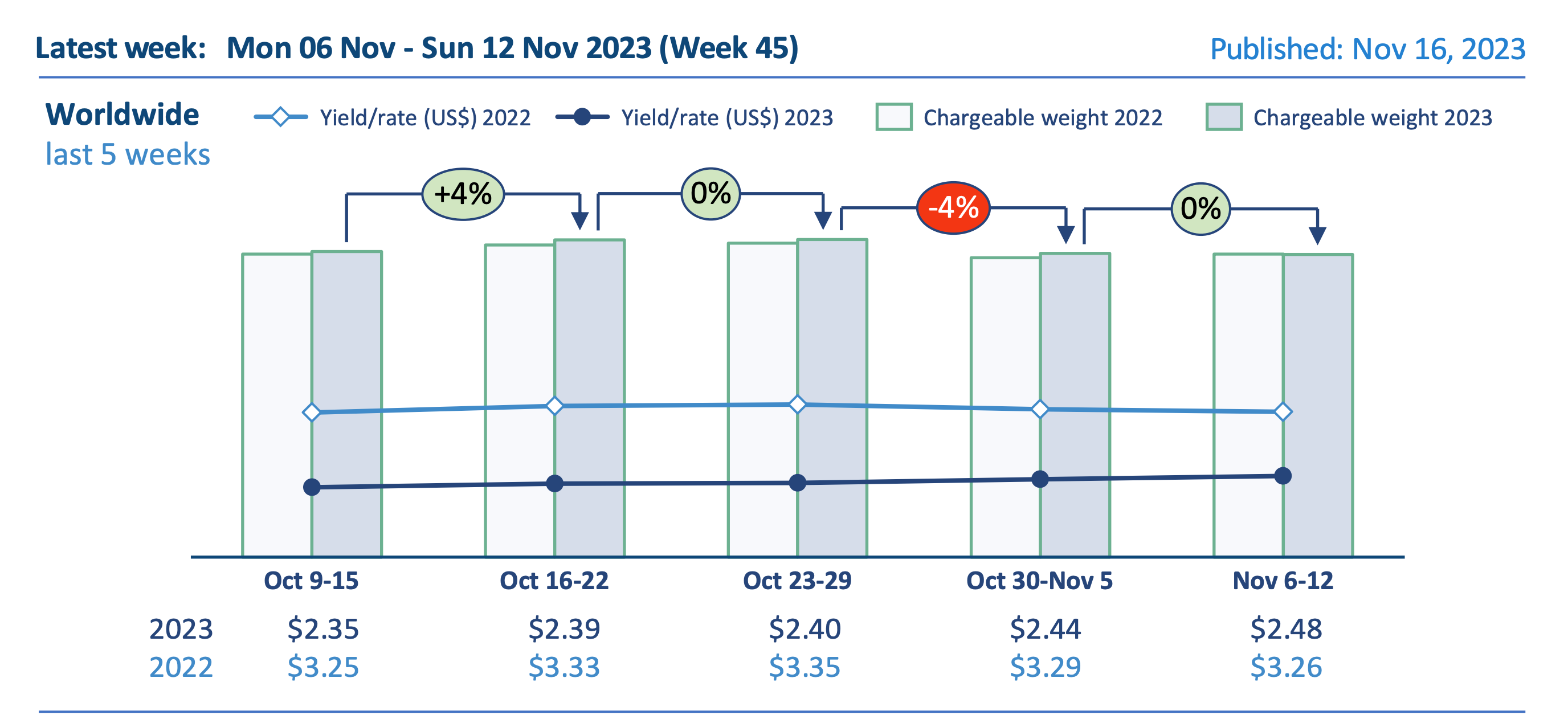

- While capacity and rates have grown, overall profits for cargo airlines have been affected, with a 25% drop in air cargo rates reported by WorldACD.

Strong market performance in the Asia-Pacific region could point to the beginning of a recovery for the global air cargo market, according to recently published data by the Dutch air cargo data specialist, WorldACD. The most recent edition of weekly reports of yearly cargo activity published on Friday indicated that the global volume of cargo moved this year compared to last year rose 1%, driven by solid performance in Asia, constituting the first increase in demand for air cargo in months.

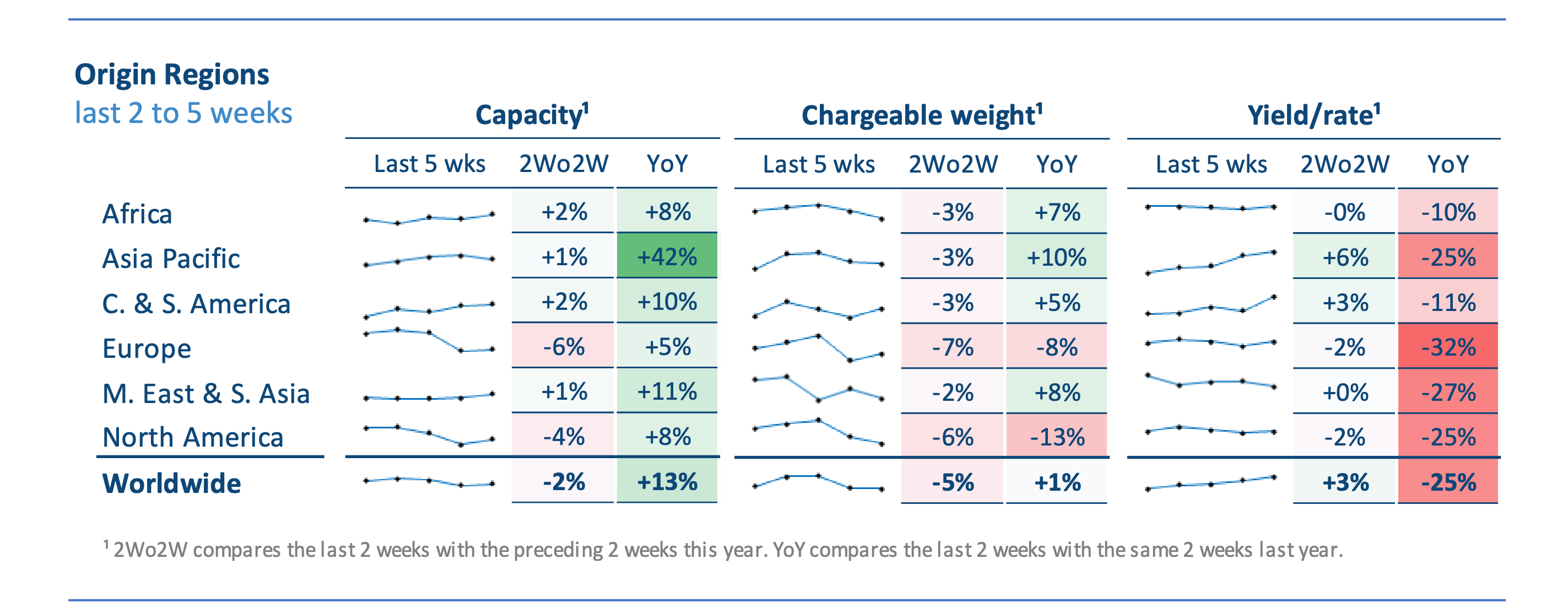

WorldACD’s data includes nearly 400,000 transactions from 90 airlines and 15,000 freight forwarders. This week’s data release, accounting for November 6 – 12, indicated that the chargeable weight of cargo moved in the Asia-Pacific region increased by 10% year over year, followed by increases of 8% in the Middle East and 7% in Africa, with a modest gain of 5% in Central & South America. The volumes of chargeable weight, however, declined in both Europe and North America by 8% and 13%, respectively, leading to an overall modest gain of 1% globally.

Photo: Soos Jozsef | Shutterstock

While the amount of chargeable weight onboard cargo aircraft is similar to the load factor of a passenger aircraft, where the goal is to fill empty seats, for the air cargo market, overall profit for cargo airlines is also affected by the rate charged per tonne flown and the capacity available.

Capacity and rates

For capacity concerns, once again, Asia led the way, increasing capacity by 42% compared to the same time last year. The Middle East, South Asia, and Central America also saw double-digit increases in capacity over the last year, leading to a global growth of 13%.

Photo: WorldACD

The jump in capacity in Asia is likely linked to the number of freighter aircraft deliveries as well as new airlines. Deliveries of new freighter aircraft adding capacity in Asia include Central Airlines growing its fleet of 737-800 freighters to five aircraft and SF Airlines continuing its widebody expansion with 767-300 conversions, with a steady stream of new A321 converted freighters entering the market for a growing number of operators.

Ultimately, adding more freighters and increasing capacity doesn’t always directly translate into profits. WorldACD reported a year-over-year drop in rates for air cargo of 25%, with rates in Africa and Central America dropping the least with 10% and 11% drops, respectively.

Regional breakdown

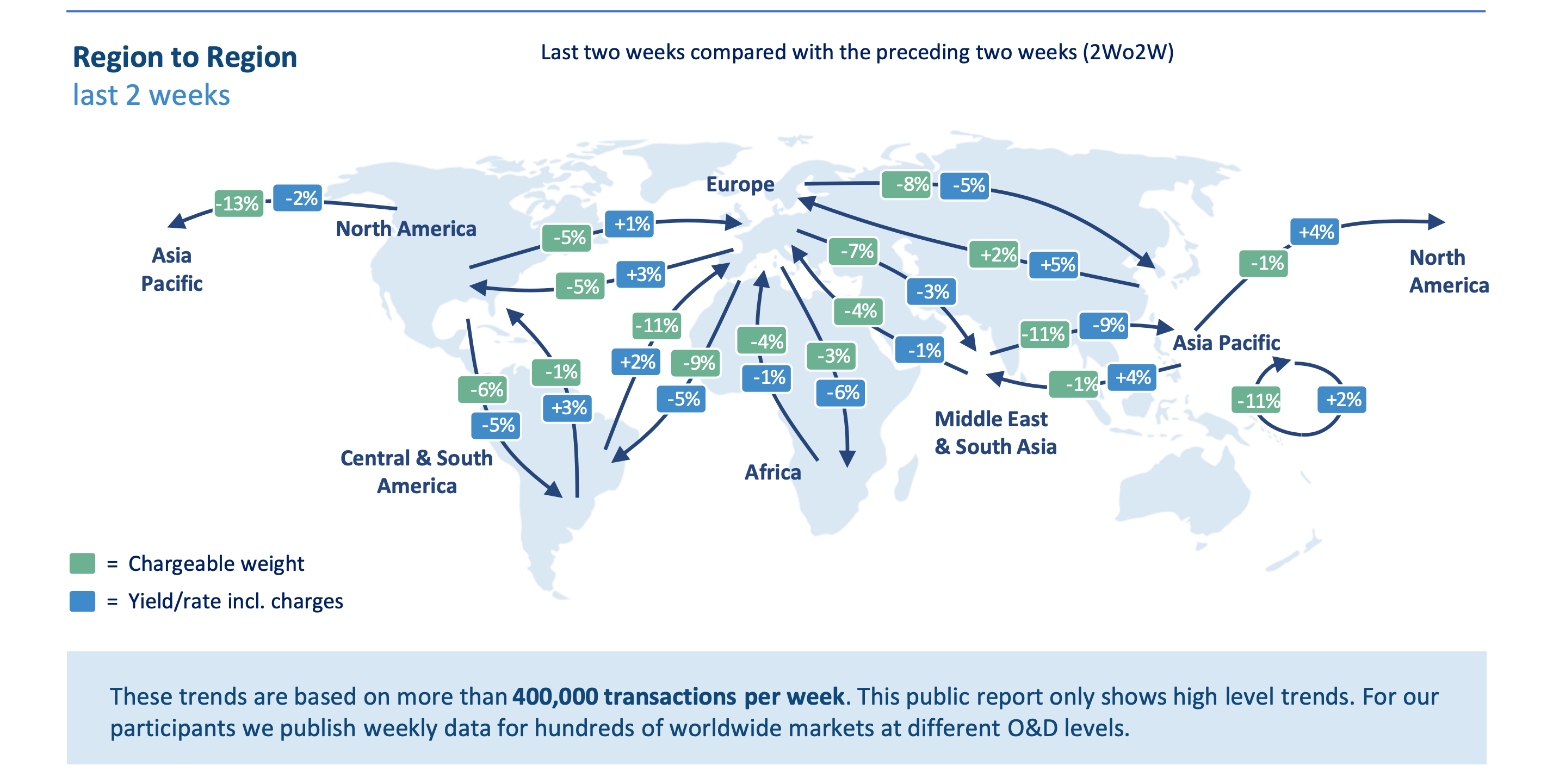

WorldACD’s data also gives us a glimpse at region-to-region growth. For this week’s release of data, air cargo transported between the Asia-Pacific region and Europe increased by 2% in chargeable weight and 5% in yield, indicating strong demand and growth for those routes in the last two weeks of data compared to two weeks of data this time last year.

Photo: WorldACD

The same data set indicated both drops in chargeable weight and yield on most routes, with a few exceptions from Asia-Pacific to the Middle East, Central & South America to North America, Asia-Pacific to North America, Central America to Europe, and both routes to and from North America to Europe that saw drops in chargeable weight paired with increases in yield.

While long-term cargo demand for the next twenty years is expected to double, the air cargo industry has remained stagnant for the past few years largely due to the market settling after a huge jump in freighter demand during the pandemic mixed with dramatic reductions in available capacity. As the passenger market has returned to normal, with passenger numbers in the US expected to set records this upcoming holiday season, the cargo market has also had to adjust to the return of belly capacity offered by passenger airlines.

Photo: WorldACD

While yield and rates have continued to be stagnant in the short run, airlines have moved to cancel orders for freighter aircraft and created major shakeups in the leaders of the Cargo Industry. At the start of the month, Air Canada canceled orders for widebody freighters, ATSG welcomed a new CEO, and FedEx encouraged its pilots to depart the cargo airline for regional passenger airlines.

What do you think of the cargo Industry? Will the Asia-Pacific region be able to start a worldwide turnaround? What is causing the stagnant growth? Let us know in the comments below.

Sources: WorldACD