Summary

- Emirates balances high-demand hubs with niche routes in its broad network strategy, focusing on global connectivity and flexibility.

- Route frequencies are impacted by market demand, competition, and strategic choices, shaping Emirates’ operational planning.

- Emirates operates strategically in West Africa and Central Africa, efficiently connecting less popular destinations to its global network.

Emirates, one of the world’s leading airlines, is renowned for its extensive network that connects major cities across the globe. However, not all routes are equally trafficked and serviced. Some destinations see far fewer flights, offering unique insights into the airline’s operational strategy and market presence. We’re taking a closer look into Emirates’ least-served routes for June 2024, analyzing the factors influencing these lower frequencies and comparing them with other carriers on these corridors. Data for this analysis is sourced from Cirium, an aviation analytics company.

Photo: kamilpetran | Shutterstock

Understanding Emirates’ route strategy

Balancing high demand and niche markets

Emirates operates a vast network, primarily focusing on high-demand routes connecting major hubs while balancing the need to maintain a presence on niche routes that are crucial for strategic reasons. These routes may serve less populous destinations, seasonal markets, or specific demand spikes, contributing to the network’s overall diversity and flexibility.

Related

Not All About Long-Haul: What Are Emirates’ Shortest Routes?

Emirates is known for its long-range flying, but the carrier also flies short-haul routes to maintain its strategic positioning. Let’s find out more!

Factors influencing route frequencies

Several factors determine the frequency of flights on a given route. These include market demand, competition, economic conditions, seasonal variations, and strategic partnerships. By taking a closer look at the data for June 2024, we can identify trends and strategic choices that shape Emirates’ route planning.

A closer look at Emirates’ least-served routes

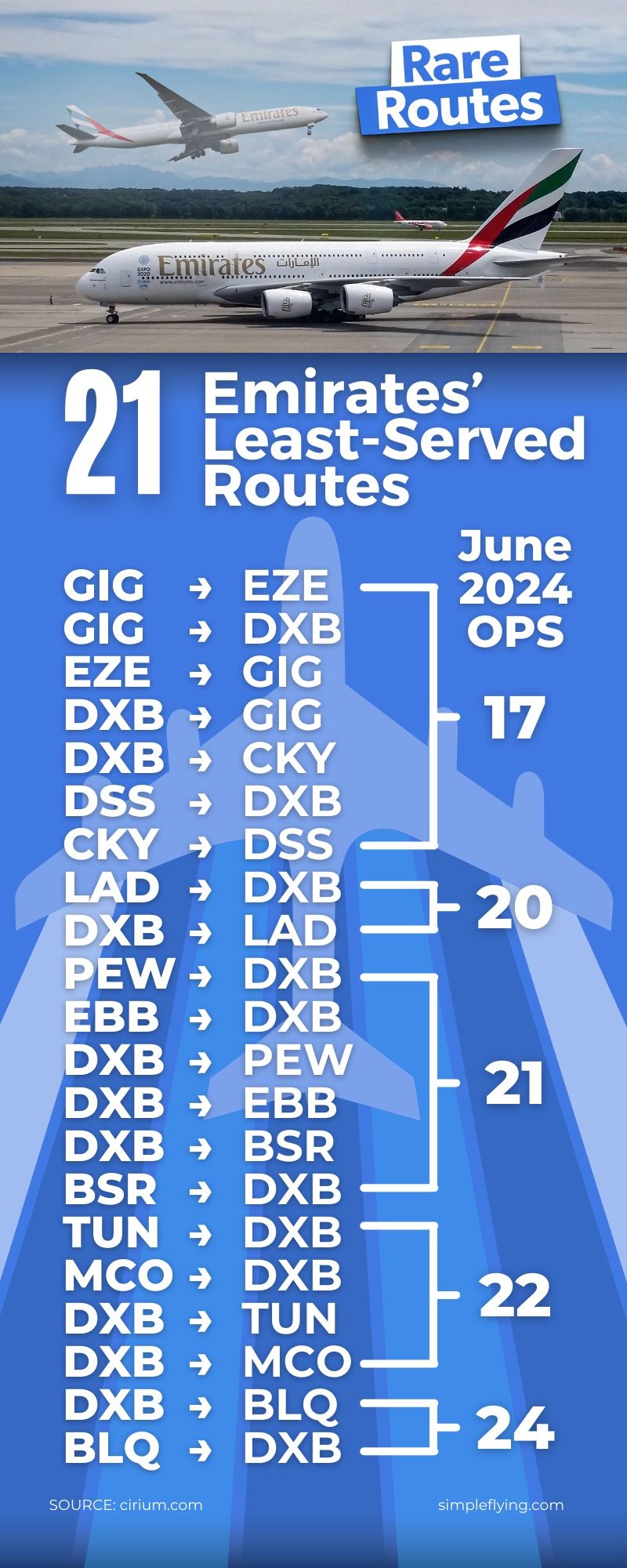

We’ve identified the following routes as Emirates’ least-served for June 2024, with fewer than 25 operations in that month:

Key Metrics:

- Ops: Number of operations (flights)

- Seats: Total seats offered

- Seats/Dep: Average seats per departure

- ASMs: Available Seat Miles (a measure of airline capacity)

Photo: iamlukyeee | Shutterstock

Rio de Janeiro to Buenos Aires (GIG – EZE)

- Ops: 17 (each way)

- Seats: 5,134 (each way)

- Seats/Dep: 302 (each way)

- ASMs: 6,366,160 (each way)

This route sees moderate traffic between two major South American cities. Despite the relatively low frequency, it connects the South American market with Emirates’ global network. The region is less served by Middle Eastern carriers than European or Asian ones, highlighting Emirates’ commitment to maintaining a presence in diverse markets beyond its primary hubs.

Dubai to Conakry (DXB – CKY)

- Ops: 17 (each way)

- Seats: 6,018 (each way)

- Seats/Dep: 354 (each way)

- ASMs: 27,881,394 (each way)

Conakry is a key city in West Africa, and Emirates’ service here reflects its strategic interest in emerging markets. Flying larger aircraft on this route indicates a focus on cargo capacity and premium passengers, providing insights into Emirates’ operational priorities in Africa.

Photo: Miguel Lagoa | Shutterstock

Conakry to Dakar (CKY – DSS)

- Ops: 17 (one way)

- Seats: 6,018 (one way)

- Seats/Dep: 354 (one way)

- ASMs: 2,533,578 (one way)

Another significant route in West Africa reflects a similar strategic interest as the Dubai-Conakry route. The frequency here suggests steady but not overwhelming demand. This route within West Africa also highlights Emirates’ intra-regional connectivity, showing the airline’s efforts to facilitate travel between African cities (which can be less accessible than major international hubs).

Dubai to Luanda (DXB – LAD)

- Ops: 20 (each way)

- Seats: 7,080 (each way)

- Seats/Dep: 354 (each way)

- ASMs: 26,054,400 (each way)

While not a major aviation hub, Luanda represents Emirates’ strategy to connect less frequented Central African destinations to its global network. This route is a prime example of the airline’s approach to serving diverse and underserved markets with passenger and cargo traffic.

Dubai to Bologna (DXB – BLQ)

- Ops: 24 (each way)

- Seats: 8,496 (each way)

- Seats/Dep: 354 (each way)

- ASMs: 23,695,344 (each way)

Bologna is an important cultural and industrial city in Italy. This route illustrates Emirates’ focus on European destinations that may not be primary hubs but are significant for business and leisure travel. The lower frequency suggests careful market analysis and optimization of resources as the airline considers seasonal travel patterns and competitive market dynamics with European carriers.

Comparing Emirates with other carriers

Comparing Emirates with other carriers

Competitive landscape

When analyzing Emirates’ least-served routes, comparing them with other major carriers operating on similar corridors is essential. Airlines such as Qatar Airways, Turkish Airlines, and Etihad Airways often compete on overlapping routes, providing valuable context for Emirates’ operational strategies.

Emirates vs. Qatar Airways

Route: Dubai to Buenos Aires (DBX – EZE)

- Emirates: 17 operations, 5,134 seats

- Qatar Airways: Similar route via Doha with slightly higher frequency.

- Comparison: Qatar Airways may offer more frequent services but with smaller aircraft, affecting total seat capacity and market strategy. This comparison highlights how Emirates manages route frequency and aircraft deployment to balance load factors and market presence.

Emirates vs. Turkish Airlines

Route: Dubai to Buenos Aires (DBX – EZE)

- Emirates: 17 operations, 5,134 seats

- Turkish Airlines: Route operated via Istanbul with competitive frequency and seat capacity.

- Comparison: Turkish Airlines often utilizes a hub-and-spoke model from Istanbul, offering similar routes with competitive frequency.

Turkish Airlines utilizes aircraft like the Boeing 777 or Airbus A330, providing a high seat capacity. The competition here is significant as both airlines aim to capture long-haul traffic from Europe, the Middle East, and South America. Turkish Airlines’ extensive network and strategic positioning at Istanbul’s cross-continental hub provide strong competition for Emirates, particularly in terms of connectivity and transit times.

Emirates vs. Etihad Airways

Route: Dubai to Bologna (DBX – BLQ)

- Emirates: 24 operations, 8,496 seats

- Etihad Airways: Services the Italian market with routes to Milan and Rome, offering competitive frequencies.

- Comparison: Etihad Airways’ presence in Italy includes other major cities, often served with fewer but highly premium flights. Etihad’s approach typically involves leveraging codeshare agreements and partnerships with European carriers to extend its network reach. This strategic difference highlights Etihad’s focus on quality and connectivity through partnerships, whereas Emirates emphasizes direct routes and higher frequency operations to capture a broader market.

Strategic insights and future trends

Growth potential in emerging markets

Emirates’ presence in regions like West Africa and Central Africa indicates potential for growth in these markets. The airline’s strategic choice to operate larger aircraft with fewer frequencies suggests a focus on maximizing cargo capacity and premium passenger services.

Related

Finally Happening? Emirates To Resume Lagos Nigeria Flights In October

While it is great news, the carrier’s African flights remain down compared to before the pandemic.

Seasonal adjustments

Lower frequencies on certain routes could also reflect seasonal demand fluctuations. Routes to leisure destinations or cities with significant seasonal travel peaks may see adjustments in flight frequencies based on the time of year.

Photo: Aerovista Luchtfotografie | Shutterstock

Fleet utilization and efficiency

Emirates’ deployment of specific aircraft types on these routes highlights the importance of fleet utilization and operational efficiency to the airline. By matching aircraft capacity with demand, Emirates strives to achieve optimal load factors and profitability across these limited-service routes.

Emirates’ niche market strategy in action

Emirates’ least-served routes provide a fascinating glimpse into the airline’s broader strategy of balancing high-demand routes with niche markets. By maintaining a presence on these less frequent routes, Emirates can offer comprehensive global connectivity, cater to diverse market needs, and leverage its fleet’s versatility.

Follow our coverage of airline operations and market strategies for more in-depth analysis and updates on carriers like Emirates. Share your thoughts and experiences with dynamic route strategies in the comments below, or connect with us on social media to continue the conversation about Emirates’ network.