Summary

- Ryanair posted a record profit of €1.92 billion due to increased passenger traffic and fare prices.

- Despite higher operating costs from fuel spikes, over 70% of fuel requirements for the current year are hedged.

- Ryanair’s ownership of its fleet, low operating costs, and strong financial foundation set it apart from competitors.

Europe’s largest low-cost airline group, Ryanair, has posted a record profit, following a busy financial year. Passenger traffic is up, as are fares, and despite not having as many 737 MAX on hand as it would like, it’s expecting to fly the biggest summer schedule in history.

Solid results

On the back of a busy 2023 and a good start to 2024, the Ryanair Group has posted a staggering €1.92 billion ($2.09 billion). The group, which includes subsidiaries Buzz, Lauda and Malta Air, grew its profit levels by 34% in the year.

Part of this was attributed to higher passenger numbers, as Ryanair’s traffic grew by 9% to 183.7 million fliers. Value per passenger also increased, as fares rose by 21% to an average of just under €5, and ancillary sales increased by 12% to an average of €23.40 per passenger.

Photo: Ryanair

The group is set to fly its biggest summer schedule in history, including 200 new routes and five new bases. However, the Group CEO Michael O’Leary noted that recent pricing has been softer than expected, and bookings required more price stimulation in Q1.

One area where the group didn’t perform quite as well as it should was in its operating costs. Following Russia’s invasion of Ukraine, fuel costs spiked, and the portion that was unhedged cost the airline dearly. Its full-year fuel bill rose by 32% to over €5bn.

For the current financial year, over 70% of its fuel requirements are hedged at just under $80bbl, saving the group approximately €450 million ($488 million).

Related

What is Fuel Hedging and Why Do Airlines Do It?

Fuel hedging can protect airlines from extreme changes in the cost of jet fuel.

The cost advantage

Hedging fuel is one of Ryanair’s ‘cost advantage’ plays, but there are more. Significant for the group is its ownership of its entire fleet of 556 Boeing 737 aircraft.

This has effectively shielded it from the rising cost of leasing aircraft, particularly amid shortages in the narrowbody fleet caused by Pratt & Whitney engine groundings and Boeing’s lower production levels.

Related

Increased Demand: Why Aircraft Leasing Rates Have Spiked By As Much As 30%

The practice is proving increasingly profitable.

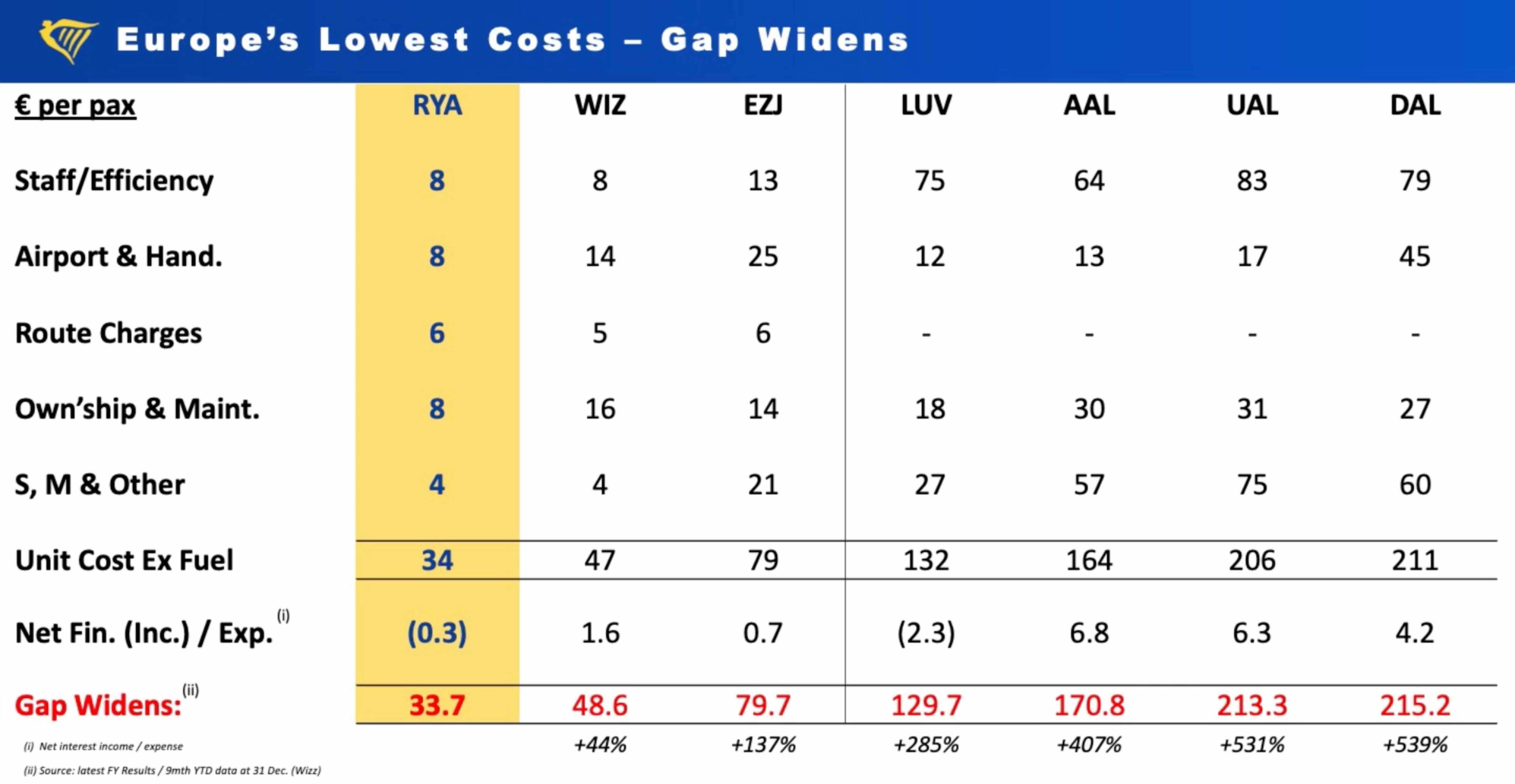

The airline claims to be the lowest-cost airline in Europe, and not just in terms of ticket costs. Its operating costs are also incredibly low, as the group shared in its presentation slide below.

Measured in euros per passenger, Ryanair pips the two other big European low-cost carriers on airport and handling charges, as well as ownership and maintenance costs. Ryanair is known for aggressively negotiating lower airport costs, even leaving some destinations once the ‘new airline bonus’ runs out.

Underscoring all this is Ryanair’s strong financial position. While competitor airlines are taking on expensive leases and debts, Ryanair has paid back a billion euros of debt and still has €4.12bn ($4.42bn) gross cash at year-end.

This cash is earning it interest, giving it a net interest of approximately €0.3 per passenger. In contrast, Wizz Air’s debt burden costs it €1.6 per passenger.

Photo: Wizz Air

Ryanair notes that the ‘gap is widening,’ showing that Wizz Air’s unit cost (excluding fuel) rose by 44% year on year and easyJet’s by 137%.

In addition, the group has more than €10bn of’ long-lived’ assets—property, plant, and equipment—which adds to its solid financial foundation.

The MAX advantage

It seems only yesterday that Ryanair was taking delivery of the first of its long-awaited 737 MAX aircraft. Flying a specially designed high-capacity variant, the MAX 8-200, Ryanair has often referred to the aircraft as the ‘gamechanger,’ thanks to its high efficiency.

The Airlines That Have Ordered The High-Density Boeing

By the end of last year, the airline group was flying 146 of the type. It expects this number to grow to 158 by the end of July, just in time for the busy summer break.

Photo: Rudzenka | Shutterstock

But even Ryanair, one of Boeing’s best customers, isn’t immune to the problems the planemaker is facing. Getting 158 jets by the end of July is 23 aircraft short of what it was expecting, and things could slip further, as noted in its results,

“We continue to work closely with Boeing CEO (Dave Calhoun), CFO (Brian West) and the new Seattle management team to improve quality and accelerate B737 aircraft deliveries. There remains a risk that Boeing deliveries could slip further.”

Related

The Ripple Effect: How Boeing Production Delays Are Costing Airlines

Boeing’s production woes have downsteam effects on airlines and may eventually result in higher airfares.