Summary

- Elliott Investment Management aims to end groupthink at Southwest Airlines, noting lack of airline operating experience among directors.

- Concerns raised about outdated software and operational processes at Southwest Airlines leading to December 2022 meltdown.

- Investor frustration with Southwest Airlines’ rising CASM and net loss in Q1 2024, calling for a more profitable route network.

Last week, Elliott Investment Management invested $1.9 billion in Southwest Airlines. The investment firm has no position on any particular new revenue tool for Southwest Airlines but made clear in a 51-slide presentation and 3-page letter that it desires to end the airline’s groupthink.

Ending groupthink

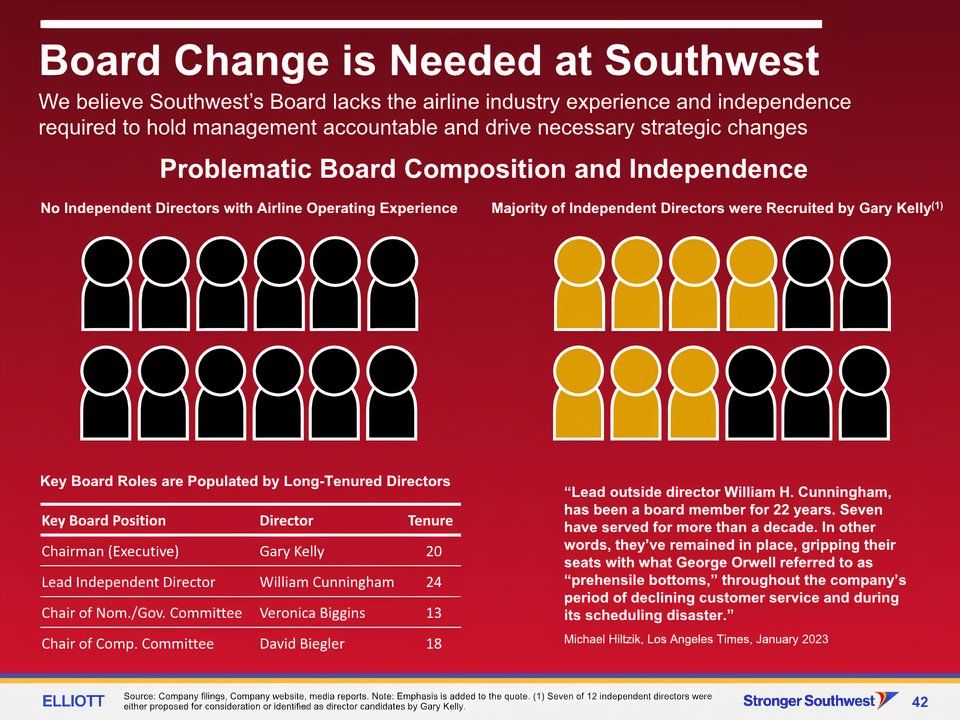

Slide 42, one of the slides created by Elliott Investment Management, notes that Southwest Airlines Chairman Gary Kelly recruited the majority of the airline’s directors. None of the directors have airline operating experience.

Graphic: Elliott Investment Management

One could recall during the recent Southwest Airlines Pilots Association (SWAPA) labor negotiations and in response to the infamous late December 2022 meltdown that SWAPA had the same concerns. SWAPA went so far as to state in an April 17, 2023 statement the following after noting SWAPA and other employee groups attempted to warn of inadequate technology support for Southwest Airlines’ operations;

“We know the priority of increasing shareholder value through dividends and buybacks has been a constant theme, but what about our airline’s operational performance? … We, as Pilots and long-term investors in the Company, have a significant stake in the success of Southwest Airlines. We believe the Southwest BOD has not provided adequate oversight or taken appropriate actions necessary to address the multitude of operational issues since 2014.”

Additionally, Elliott Investment Management in its public-facing letter stated,

“Southwest’s rigid commitment to an approach developed decades ago has inhibited its ability to compete in the modern airline industry; this ethos pervades the entire business with outdated software, a dated monetization strategy and antiquated operational processes. This failure to modernize is vividly underscored by the December 2022 operational meltdown that was caused by the Company’s outdated technology, which led to Southwest stranding over two million customers over the holidays.”

So one of the things that Elliott Investment Management wants done is a comprehensive business review of Southwest Airlines. However, Southwest Airlines has publicly responded:

Related

Southwest Responds To Elliott’s Letter Demanding Leadership Upgrade

The two companies have engaged in a public back-and-forth, with one harshly criticizing the other’s leadership while the airline has defended it.

The management firm is unhappy at Southwest Airlines’ operating costs. Those costs are best expressed in a metric called CASM.

Demanding improvement in CASM

The Cost Per Available Seat Mile (CASM) statistics are a key frustration with most Southwest Airlines investors. According to Elliott Investment Management, the CASM jumped $1.7 billion between July 2023 and April 2024. Again, Elliott Investment Management, as per a June 10 open letter, invested approximately $1.9 billion, taking about an 11% economic stake.

Photo: Southwest Airlines

Additionally, Southwest Airlines reported a net loss of $231 Million for the first quarter of 2024. This collectively raises concerns if Southwest Airlines can again have profitable quarters in 2024 as the airline did in 2023.

Concerned about unproductive routes

Another investor concern is the productivity of Southwest Airlines routes. Although Southwest Airlines is withdrawing from four cities this summer due to a lack of new 737 MAX airplanes and airline profitability, this is seemingly inadequate.

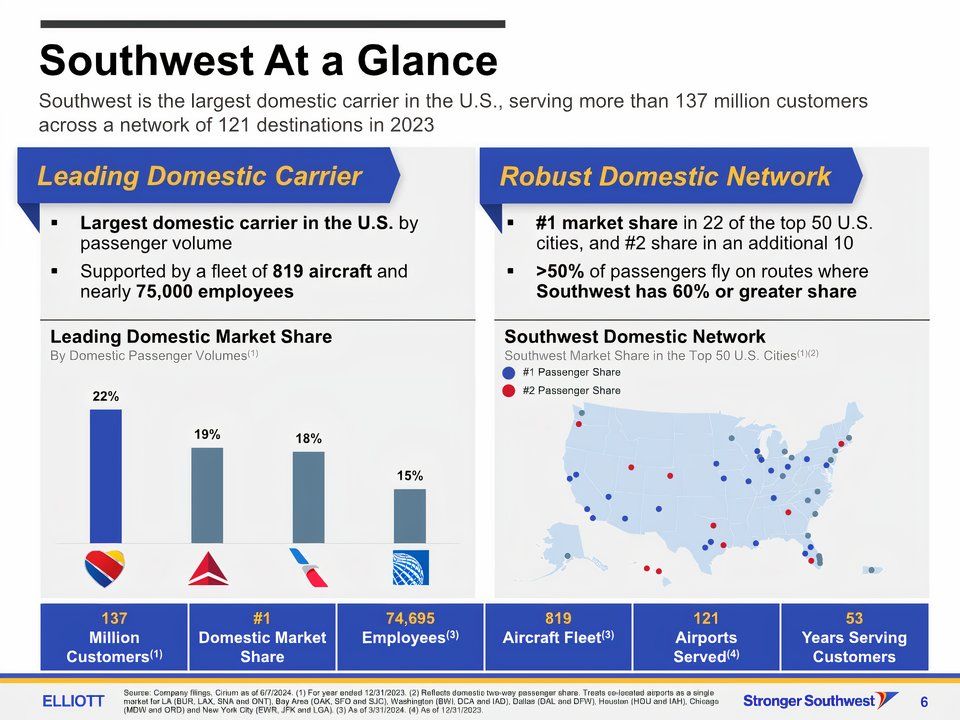

However, according to Elliott Investment Management’s presentation, more than 50% of Southwest Airlines passengers fly, and Southwest Airlines has a 60% or greater share. Southwest Airlines has top market share in 22 of the top 50 United States cities and is second place in another 10 of those top 50 cities as per slide 6 below.

Graphic: Elliott Investment Management

Additionally, Southwest Airlines has 16 routes with 10 or more daily flights. So, to Elliott Investment Management, Southwest Airlines can trim its route network from 121 US airports to a more profitable one.

Bottom line

Elliott Investment Management hopes to turn Southwest Airlines around. Other key Southwest Airlines investors, such as SWAPA, the pilot’s union, share some of Elliott Investment Management’s concerns. Nonetheless, to quote Southwest Airlines founder the late Herb Kelleher,

“We have a strategic plan — it’s called doing things.”

As the desire not to be prescriptive about new revenue sources beyond improving technology and the network seem helpful but inconclusive… One wonders what precisely those future “doing things” will be.

What are your thoughts? Please share with civility in the comments.

.jpg)