Summary

- AirAsia X will start Kuala Lumpur to Nairobi, replacing Jeddah as its longest route.

- Kenya flights will run four times a week on the Airbus A330-300.

- Challenges include distribution, a lack of brand recognition in Africa, a tiny point-to-point market, and reliance on connections for passengers.

The expectation has become a reality. In the latest filing to OAG and Cirium, AirAsia X has scheduled flights from Kuala Lumpur to Nairobi. Set to begin in November, it will be the carrier’s longest route. It will replace Kuala Lumpur to Jeddah by distance, although longer routes existed historically. It will be AirAsia X’s first time on the African mainland, although it served the island nation of Mauritius in 2016 and 2017.

AirAsia X to Nairobi

The 3,900 nautical mile (7,223 km) airport pair will begin on November 15. It will be served four times weekly with the carrier’s only aircraft type for now, the Airbus A330-300. The 377-seat version, the highest capacity of its three layouts, is scheduled. The market has not been served before, at least not in 20+ years.

Photo: Ryan Fletcher | Shutterstock

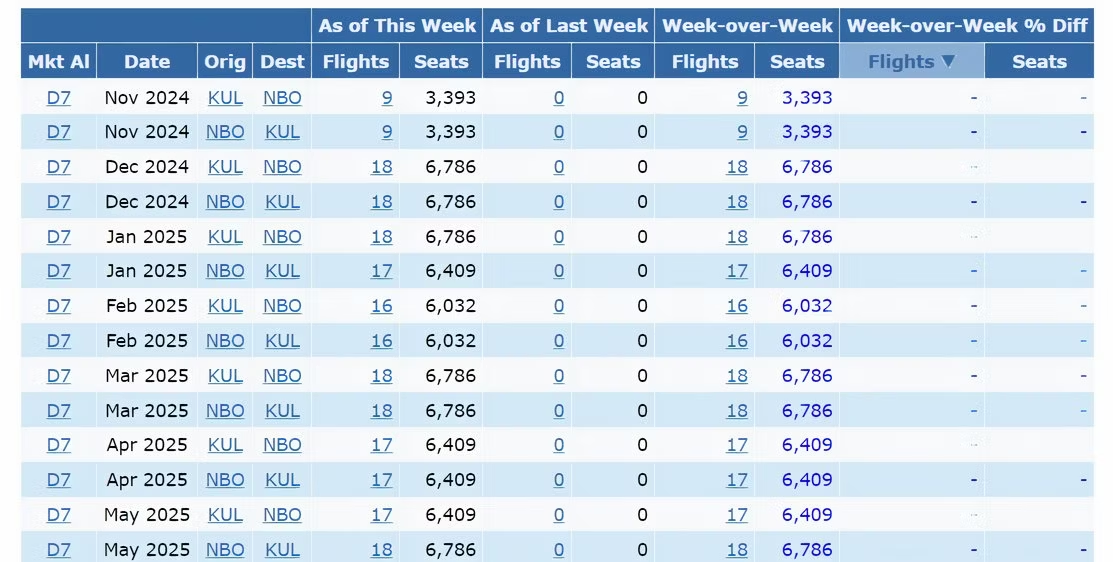

According to Cirium data, it is scheduled as follows, with all times local. It will operate year-round and will soon be available to book.

- Kuala Lumpur to Nairobi: D7101, 19:00-23:00 (9h block time)

- Nairobi to Kuala Lumpur: D7102, 00:30-15:10 (9h 40m)

It becomes AirAsia X’s new longest route. However, until earlier this year, the carrier flew Kuala Lumpur-Sydney-Auckland, which was much longer. And historically, it had even longer services: from the Malaysian capital to Paris Orly, London Gatwick, London Stansted (which I flew once), and, the longest of all, Honolulu via Osaka Kansai on a fifth freedom basis.

(How I see changes.) Image: Cirium

What is the verdict?

Speaking anonymously, an Africa-based airline network planner and industry commentator said, “I think it will be a big disaster.” Africa specialist Sean Mendes, aviation consultant, former airline Chief Operating Officer, and more, told me,

“They will have challenges with the distribution on the African side of the route given AirAsia’s traditional dependence on direct sales and its relative lack of brand recognition in Africa. They will need to leverage the Kuala Lumpur hub to feed the flights from all over Southeast Asia to make this work.”

Related

AirAsia X Revenues Soar From Airbus A330s While Planning A321XLRs

With its international expansion limited by aircraft shortages, AirAsia X is eagerly awaiting the arrival of the Airbus A321XLR.

AirAsia X is not part of a global distribution system, which is frequently used to sell tickets to/from/within Africa. It also does not give commissions to travel agents, further hampering sales and awareness in Africa. While many markets have adapted to having no inclusive baggage – like many operators, AirAsia X prices it separately – it is much more challenging in sub-Saharan Africa. And then there’s the size of the market.

A tiny point-to-point market

Generally, long-haul routes need a good chunk of point-to-point traffic. Such passengers are higher yielding and cost less to carry, so there’s less reliance on chasing lower-yielding transit passengers to fill aircraft.

Booking data for 2023 shows that only about 7,500 passengers flew between Kuala Lumpur and Nairobi – a tiny number. This was equivalent to 10 passengers daily each way (PDEW). In contrast, Kuala Lumpur-Cairo, also unserved, was a considerably larger African market (134 PDEW).

Image: GCMap

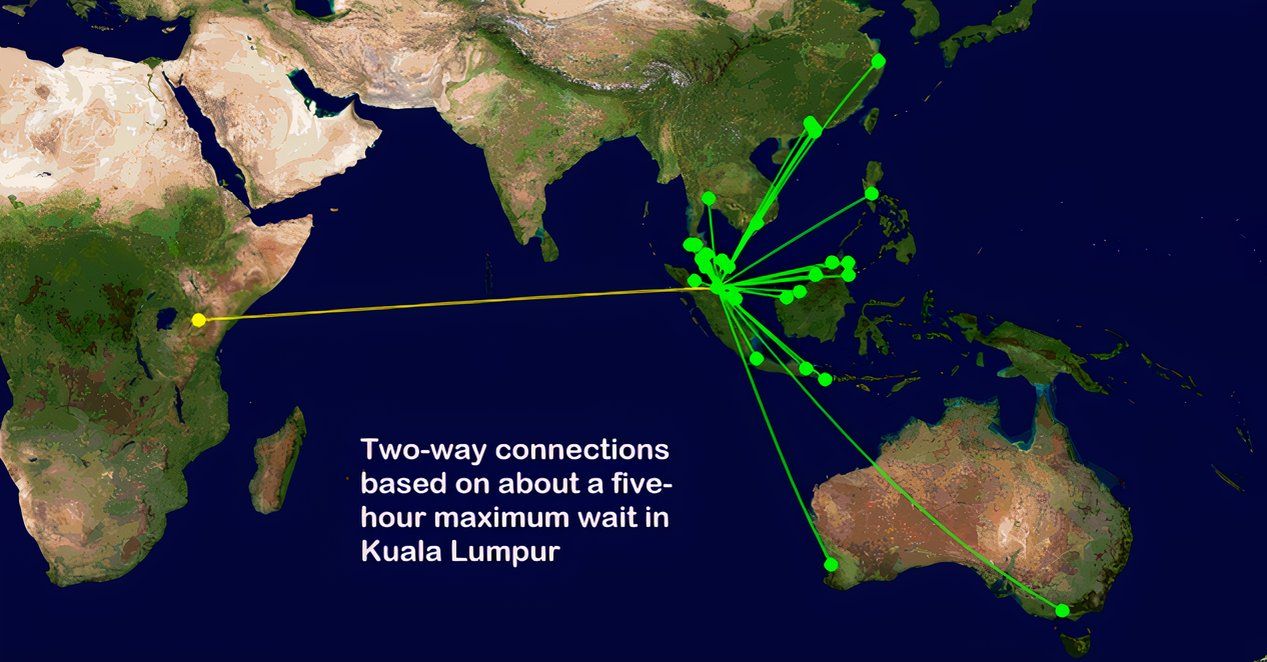

Yes, AirAsia X will grow the local Kuala Lumpur-Nairobi traffic – there is no doubt about that. But it will be very reliant on connections over the Malaysian capital. Probably 90%+ of passengers will transfer to another flight, a staggering proportion. Kuala Lumpur is well positioned to be a hub for the route and provides an alternative to Kenya Airways or the Middle Eastern carriers.

What do you make of it all? Let us know in the comments section.