Summary

- Miles & points hold value depending on redemption method – typically around 1 cent, but can vary significantly.

- Calculating value with CPP for airline redemptions is crucial to determine best value for flights.

- Choosing loyalty programs carefully, staying flexible in searches, and utilizing partner airlines enhance point value.

One of the main aspects of any airline loyalty program is the ability to earn and spend miles and points. These are the currency of any loyalty program and, as such, have value. This is never specifically defined by the program – the value instead depends on how you choose to use the miles of points. Typical values are around, and often just above, one cent per point or mile – but there are many cases where you can get much better value.

Calculating the value of miles and points

Airline points and miles do not have published or fixed values. The value you get depends on what you use them for and thus will vary each time used. In general, the best value comes from using points and miles for flight awards rather than other travel or retail options.

Photo: Markus Mainka | Shutterstock

The value you get depends on how miles or points are used and, crucially, the alternative cash price option for the same flight or flights. Value is normally determined using a metric of Cents per Point (or Mile) – CPP. This is calculated as follows for any redemption:

CPP = [(Cash price of the flight – taxes and fees) / cost in miles] x 100

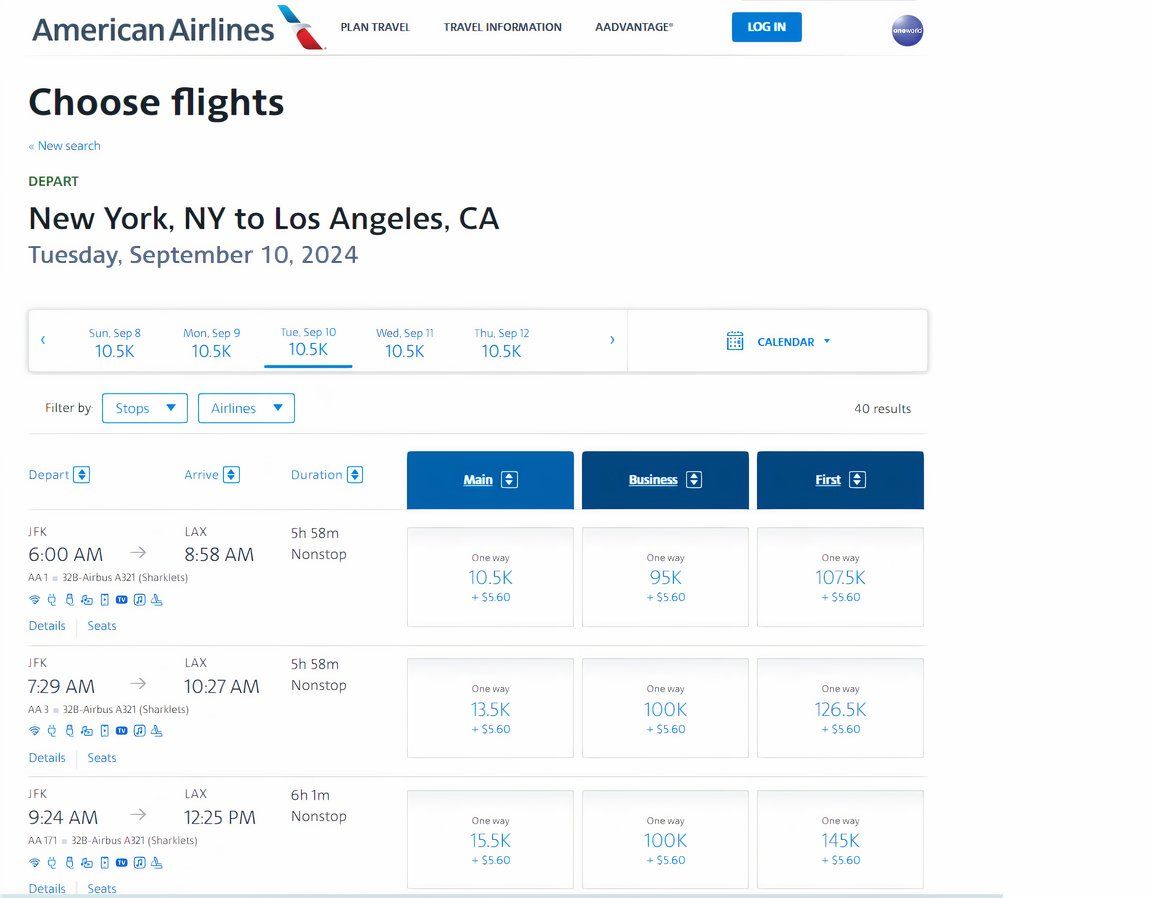

As an example, consider a miles redemption with American Airlines AAdvantage. As shown in the images below, a simple search for a one-way flight between New York JFK and Los Angeles LAX about three months in advance gives the following rates:

- An economy flight (main cabin) for 10,500 miles versus $143 in cash (including $7.50 in taxes). This gives a CPP value of 1.29 cents per mile.

- The same flight in business class for 95,000 miles versus $1,110 in cash (including $7.50 in taxes). This gives a CPP value of 1.15 cents per mile.

- The same flight in first class for 107,000 miles versus $1,610 in cash (including $7.50 in taxes). This gives a CPP value of 1.5 cents per mile.

Values will vary significantly

Of course, the value you get here can vary wildly between programs, and between different redemptions in the same program.

- Loyalty programs that use a revenue-based pricing system for awards tend to offer similar value for all awards (on the main airline). There is rarely a published value, though, and the rate you get can vary.

- Bear in mind that even with revenue-based pricing systems, awards with partner airlines will usually be fixed price. This opens up a totally different set of values.

- For loyalty programs that have fixed-rate awards, the range of value can be much more dramatic. As just one example, consider British Airways Executive Club. Shorter flights in Europe are priced (on off-peak dates) at 4,750 Avios plus taxes. This is the same rate (if it is available), whether the cash price is £49 or £400, clearly presenting a massive difference in value.

Related

How To Spend Avios With British Airways Executive Club

The best value is in using Avios for flights – with a range of airlines and a flexible booking system.

Some typical values for loyalty programs

To see the overall average values of miles and points it is necessary to consider more redemptions and different possibilities. For this, we turn to some analysis done over time by other sources. These sources have attempted to calculate an average for most loyalty program – anywhere from 1.1 to 1.5 CPP is common.

First, for the main US airline loyalty programs, we look at some analysis carried out by the financial website NerdWallet. It determined the following values in 2024:

- American Airlines AAdvantage: 1.7 cents

- Delta Air Lines SkyMiles: 1.2 cents

- United Airlines MileagePlus: 1.2 cents

- Southwest Airlines Rapid Rewards: 1.5 cents

- Alaska Airlines Mileage Plan: 1.4 cents

- JetBlue TrueBlue: 1.5 cents

- Frontier Miles: 1.1 cents

- Spirit Airlines Free Spirit: 0.8 cents

Photo: HorizonUI | Shutterstock

Turning to the loyalty website One Mile At A Time, its analysis gives wider values for more major loyalty programs. These include:

- American Airlines AAdvantage: 1.5 cents

- Delta Air Lines SkyMiles: 1.1 cents

- United Airlines MileagePlus: 1.1 cents

- Southwest Airlines Rapid Rewards: 1.2 cents

- Alaska Airlines Mileage Plan: 1.5 cents

- Avianca LifeMiles: 1.4 cents

- British Airways Executive Club: 1.3 cents

- Iberia Plus: 1.3 cents

- Air France / KLM Flying Blue: 1.3 cents

- Lufthansa Miles&More: 1.2 cents

- Virgin Atlantic Flying Club: 1.1 cents

- Singapore Airlines KrisFlyer: 1.4 cents

- Emirates Skywards: 1.2 cents

- Turkish Airlines Miles & Smiles: 1.4 cents.

Photo: MMXeon | Shutterstock

Getting the best value out of miles and points

With this wide-ranging value of miles and points, it can pay to be aware of ways to maximize the value you get. While there are big differences between programs, the following general tips should be useful:

Choose the loyalty program you will use carefully. The value of points and miles can vary widely between programs. Sometimes, we have little choice in which program to use, especially if we are aiming for elite status with a particular airline. But in other cases, you may have the chance to choose between programs. This is especially the case with alliance-member airlines, where miles and points can be credited to any member airline program, opening up the value and award choice of several airlines.

Search flexibility. This may seem obvious, but staying flexible in searching for awards can make a huge difference. Think about not just different times, but different airports, routes, or even partner airlines. With revenue-based pricing, this can make a big difference in price (but not necessarily value), for fixed price awards, it can open up otherwise sold out awards.

Photo: American Airlines

Consider partner airlines. Remember that points and miles can be used not just for the main ‘home’ airline but also with a number of partner airlines (alliance member airlines where appropriate, plus often several others). With loyalty programs that use a revenue-based pricing system, awards with partner airlines will usually be fixed price. This opens up a totally different set of values and can often be where some of the best value in the program is found.

Photo: Vincenzo Pace | Simple Flying

Changes and cancelations are often more flexible. This is not often discussed, but it is another area where you can see excellent value from points and miles. The terms for changes and cancelations vary between programs, but in most cases, they are very different from the terms for paid cash fares. In many cases, they are much more flexible than cash fares, and this should be considered when looking at value. For example, American Airlines AAdvantage has removed all change and cancellation fees on award tickets. British Airways Executive Club charges a fixed fee (of around £35) regardless of the route or original cost.

What do you think about the different values of loyalty programs, miles, and points? What value do you normally expect to get, and what efforts have you made to improve this? Feel free to discuss in the comments section below.