Summary

- Co-branded Barclays cards are linked to airline loyalty programs like American Airlines and JetBlue.

- Barclays cards offer perks such as bonus points, free checked bags, and companion ticket certificates.

- Different Barclays cards cater to various airlines like Hawaiin Airlines and Emirates, each with unique benefits.

Credit cards have become an increasingly important part of the airline loyalty market. Many airlines now offer co-branded credit cards linked to frequent flyer loyalty programs. These, of course, allow points or miles to be earned from spending. They often offer an expedited route to elite status and give benefits to cardholders when traveling.

Several of these co-branded cards are issued by Barclays. This article looks at the main card options for US residents and what benefits they offer.

Co-branded cards issued by Barclays

There are currently (as of mid-2024) at least seven airline loyalty programs offering co-branded Barclays cards. These include:

|

Airline loyalty program |

Barclays cards available |

|---|---|

|

American Airlines |

AAdvantage Aviator World Elite Mastercard (series) |

|

JetBlue TrueBlue |

JetBlue Card, JetBlue Plus Card |

|

Hawaiian Airlines HawaiianMiles |

Hawaiian Airlines World Elite Mastercard |

|

Frontier Airlines |

Frontier Airlines World Mastercard |

|

Breeze |

Breeze Easy Visa Credit Card |

|

Emirates Skywards |

Emirates Skywards Rewards World Elite Mastercard, Skywards Premium World Elite Mastercard |

|

Lufthansa Miles and More |

Miles and More World Elite Mastercard |

American Airlines AAdvanatge cards

American Airlines AAdvantage is one of the oldest loyalty programs around (the oldest still in existence) and remains one of the largest and most popular programs today. Along with other large US airlines, it has led the way in introducing credit cards into loyalty programs and continues to innovate.

AAdvanatge offers two sets of cards—one through Citi and one through Barclays. These cards have different features but are largely a legacy of the cards previously offered by US Airways.

Related

Why Does American Airlines Have Two Sets Of Cobranded Credit Cards In The US?

The airline offers cobranded cards through both Citibank and Barclays.

Through Barclays, American Airlines offers the AAdvantage Aviator World Elite Mastercard range – with Silver, Red, and Blue card options. Each of these cards has different annual fees, miles earning options, and other benefits.

Some key features include:

- Earn AAdvantage miles on all purchases (with bonuses of three miles per dollar on American Airlines purchases with the Silver card).

- Earn Loyalty Points towards status with all cards (at a rate of one Loyalty Point per Dollar).

- Receive a companion ticket certificate for $99 (with the Red and Silver cards).

- One free checked bag and priority boarding (with the Red and Silver cards).

Image: American Airlines

JetBlue TrueBlue cards

Barclays offers two JetBlue TrueBlue co-branded cards – the JetBlue Card and the JetBlue Plus Card. The standard card is free and offers some good but basic benefits. The Plus card has an annual fee of $99 but offers a lot more. It has been ranked top for Customer Satisfaction for Airline Co-Branded Credit Cards (in the J.D. Power 2023 U.S. Credit Card Satisfaction Study).

Photo: JetBlue Plus Card

Some of the benefits of the cards include;

- Good bonus points earning. With a card, JetBlue offers the chance to earn as much as 15 points per $1 spent on travel.

- Generous signup bonuses for new cardholders.

- Points earning counts towards Mosaic elite status.

- 50% savings on inflight purchases.

- Extra benefits with the Plus card include a free checked bag, a 10% rebate when purchasing award tickets, and a $100 statement credit with vacation packages.

Related

The Top 5 Benefits Of The JetBlue Plus Card

Here’s why it’s ranked #1 for Customer Satisfaction for Airline Co-Branded Credit Cards

Frontier Airlines Frontier Miles cards

Frontier Airlines Frontier Miles offers one co-branded card with Barclays – the Frontier Airlines World Mastercard. This has an annual fee of $89, and there is a generous sign-up bonus for new card members – up to 60,000 miles in 2024.

Other major benefits include:

- Points earnings of up to five miles per dollar for airline purchases (then three miles per dollar at restaurants and one mile per dollar elsewhere).

- A $100 flight voucher after every account anniversary (subject to spending requirements). This effectively offsets the annual fee.

- Priority boarding on Frontier Airlines flights.

- There is no standard offer to include elite status with a card. However, there are periodic offers to boost this.

Related

5 Unique Benefits Of The Frontier Airlines World Mastercard

A great gateway towards key rewards.

Hawaiian Airlines HawaiianMiles cards

Hawaiian Airlines HawaiianMiles offers the Hawaiian Airlines World Elite Mastercard with Barclays. This single card has a $99 annual fee, and a sign up bonus of up to 70,000 miles for new card holders.

Photo: christopheronglv | Shutterstock

Other card benefits include:

- Miles earning of three miles per dollar on airline purchases, plus two miles per dollar on gas, dining, and grocery store spending.

- Two free checked bags

- A companion discount of 50% (one time) and an annual $100 companion discount.

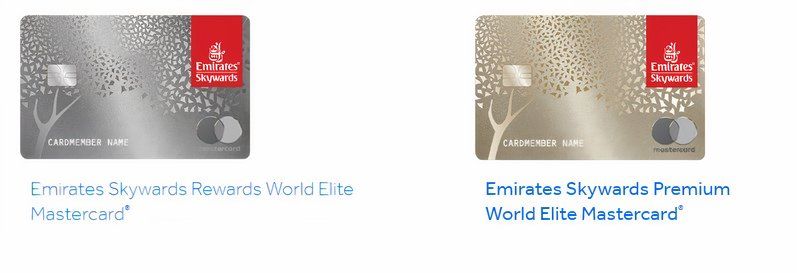

Emirates Skywards credit cards

Emirates targets several of its key markets for credit cards, with cards available in the UAE, India, and the US. Emirates Skywards offers two Mastercard credit cards with Barclays in the US – the Skywards Rewards and Skywards Premium World Elite Mastercard.

The basic Rewards card has an annual fee of $99, and the Premium card a hefty $499, but with much better benefits.

Image: Barclays

The card benefits include:

- Miles earning of up to three miles per dollar on airline purchases (plus two miles per dollar on other travel spend).

- A sign-up bonus of up to 70,000 miles.

- The Premium card’s additional benefits include complimentary Gold status with Skywards (with a spending requirement after year one), a 10,000-mile annual bonus, Priority Pass Select membership, and a Global Entry or TSA PreCheck credit.

Do you have any of these Barclays credit cards – or any others? Feel free to discuss the card benefits, fees, and usage further in the comments section below.