Summary

- Both Virgin Atlantic and Qantas have decided to suspend their China route this year.

- Western airlines withdrawing from China, while Chinese airlines show recovery to over 90% of 2019 levels.

- Chinese airlines strategically expand into new markets like the Middle East and Belt and Road countries.

British airline Virgin Atlantic recently announced that it will suspend its London-Shanghai route starting October 26 this year. Virgin Atlantic first launched the Shanghai-London route on May 22, 1999. Although it temporarily halted flights during the pandemic, the route resumed operations in May 2023 and has been in service for over 25 years.

If Virgin Atlantic’s main reason for its decision is the inability to use Russian airspace, which would result in an additional 1–2 hours of flight time from Europe to China and thus increased costs, then Qantas’ earlier announcement to suspend the Sydney-Shanghai route this month (July) is purely based on market considerations.

Photo: Qantas

On the other hand, just last week, Xu Qing, Deputy Director of the Transportation Department of the Civil Aviation Administration of China (CAAC), mentioned at a press conference that in the first half of 2024, China’s civil aviation transportation remained stable overall, with both domestic and international scales exceeding those of the same period in 2019; international routes have recovered to over 80%.

Why is it that while Western mainstream airlines are continuously withdrawing from the Chinese market, the CAAC, China’s aviation regulatory authority, remains optimistic about the recovery of international routes compared to pre-pandemic levels? In fact, after the pandemic, the structure of China’s international routes has undergone significant changes.

Structural changes in China’s international routes

In fact, the “international routes recovery exceeding 80%” mentioned by Xu Qing at the CAAC press conference refers to passenger transportation volume data. However, if we look at the number of international flights, the data for 2024 has only recovered to 70.6% of the same period in 2019.

Analyzing this 70.6% further, not only is the total number of international routes still below 2019 levels, but the regional distribution is also highly uneven.

According to the data, the international routes that China has resumed or newly launched in the first half of the year are mainly concentrated in the Middle East, Southeast Asia, and some European countries. The volume of international flights in these three regions has surpassed the levels of the same period in 2019. In contrast, the highly demanded and previously expensive North American routes have only reached about 20% of the 2019 levels due to various factors.

|

Percentage of passenger flight numbers between mainland China and major countries/regions around the world compared to the same period in 2019 |

|

|---|---|

|

Country/Region |

June |

|

U.K. |

119% |

|

UAE |

106% |

|

Singapore |

105% |

|

Germany |

83% |

|

Australia |

83% |

|

South Korea |

82% |

|

Japan |

75% |

|

Hong Kong SAR |

70% |

|

France |

51% |

|

U.S. |

24% |

|

Canada |

9% |

Recently, Air China revealed that it has increased its international route capacity for popular outbound destinations during the summer travel season. The company plans to launch the Beijing-Dhaka and Chengdu-Milan routes, resume the Shanghai-Barcelona route, and increase the frequency of 13 international routes, including Beijing-Copenhagen and Chengdu-Singapore. By then, Air China’s international and regional routes will have recovered to more than 90% of the 2019 levels.

Before this, China Eastern Airlines announced that in May, its international market passenger capacity had recovered to 93.66% of the same period in 2019. In the Japanese market, capacity investment increased by 10.65% month-on-month, reaching 87.34%, and in the Southeast Asian market, capacity reached 131.96% of the 2019 levels.

Related

Direct Flights Linking China And France Get A Boost Ahead Of The Summer Olympics In Paris

As the Olympics approach, direct flights between mainland China and France have slightly increased but are still far from pre-pandemic levels.

Other medium-sized airlines also show significant recovery. For instance, Juneyao Airlines’ international route capacity had already surpassed pre-pandemic levels in the first half of the year, partly due to the airline launching several new routes to Europe this year.

Not only Juneyao Airlines but also the three major airlines have launched many new intercontinental routes post-pandemic, with one major direction being the Middle East. For example, in the past month alone, China Southern Airlines, China Eastern Airlines, and Air China have successively launched direct flights from China to Riyadh, Saudi Arabia, a route that was exclusively operated by Saudia before the pandemic.

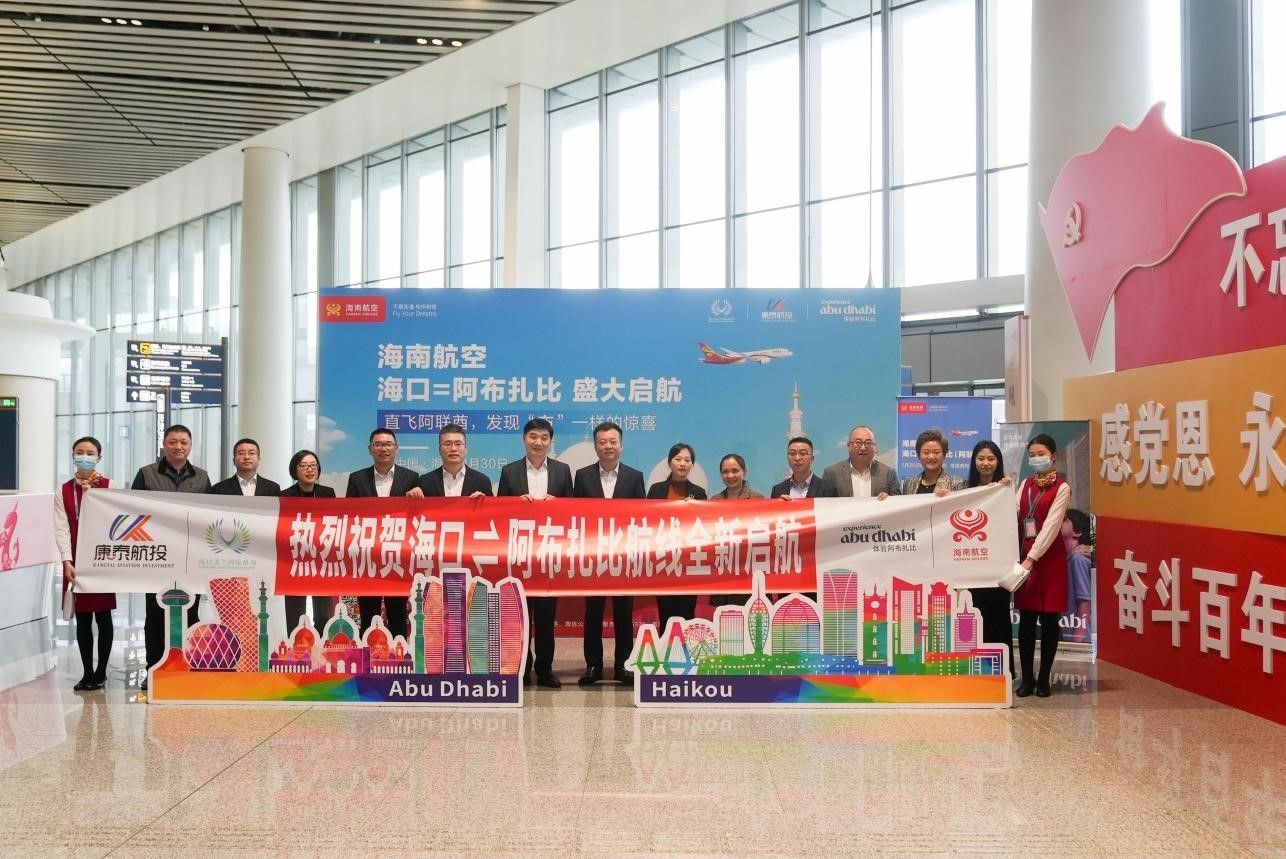

Additionally, Air China and China Eastern Airlines have launched new routes to Istanbul, Turkey, while China Southern Airlines and Xiamen Airlines have launched new routes to Qatar. Hainan Airlines, which had never flown to Abu Dhabi, UAE, before the pandemic, also launched a twice-weekly Haikou-Abu Dhabi route in 2024.

Photo: Hainan Airlines

For domestic airlines, flying to the Middle East and other countries along the Belt and Road Initiative is politically correct. For example, Air China has launched 61 Belt and Road routes, reaching 36 cities in 28 countries, accounting for 60% of its total international routes.

Expanding into the Middle East and other countries with available air rights, like Australia, is also a way to utilize excess capacity. Previously, wide-body aircraft were heavily deployed on routes to the United States, but due to reciprocal air rights limitations, capacity has only recovered to 20% of pre-pandemic levels.

Under these circumstances, China’s international routes have undergone significant structural changes this year. Passenger flight volume to Belt and Road countries, including the Middle East, now accounts for 73.8%, a 4.4 percentage point increase from pre-pandemic levels. Chinese airlines are launching more routes to non-traditional markets.

Divergent attitudes of Chinese and foreign airlines towards Chinese international routes

In July 2024, only 19 European and American airlines are operating routes to and from mainland China (including Virgin Atlantic, which is about to cease operations), compared to 27 in 2019, a decrease of 8 airlines. The only addition is Air Serbia operating the Tianjin-Belgrade route, while 9 airlines have stopped operating routes to mainland China (including Iberia Airlines, Aeromexico, etc.).

Photo: Air Serbia

Among the European and American airlines still in operation, most have not reached their 2019 capacity levels. Only Turkish Airlines, LOT Polish Airlines, Neos Airlines, and the soon-to-suspend Virgin Atlantic have restored their capacity to 2019 levels.

|

Currently operating international flights to mainland China by non-Chinese airlines |

|---|

|

Lufthansa |

|

Turkish Airlines |

|

Aeroflot |

|

United Airlines |

|

Delta Air Lines |

|

Air France |

|

KLM Royal Dutch Airlines |

|

British Airways |

|

Virgin Atlantic |

|

Swiss International Air Lines |

|

American Airlines |

|

Austrian Airlines |

|

Scandinavian Airlines |

|

Air Canada |

|

LOT Polish Airlines |

|

Pegas Fly |

|

Finnair |

|

Neos Airlines |

|

Air Serbia |

North American airlines have an average recovery rate of less than 30%, with Air Canada recovering only 11.8%. Among European airlines, the Lufthansa Group has seen a better recovery rate, with Lufthansa, Swiss International Air Lines, and Austrian Airlines collectively reaching 59.8%, nearly 20 percentage points above the average. Air France and KLM Royal Dutch Airlines, both under the Air France-KLM Group, have recovery rates of around 44%, not even reaching half of their 2019 flight numbers. Finnair has the slowest recovery among European airlines, with only three direct flights to mainland China in 2024, a recovery rate of just 10.7%

Related

Why Are Western Commercial Airlines Pulling Out Of China?

Virgin Atlantic announced this week that it would end service to Shanghai. It left its only other connection in that region – Hong Kong – in 2022. Qantas has revealed plans to pull out of Shanghai on July 28th, leaving only Hong Kong in its Far East network. Carriers from other countries, including the USA, have flagged difficulties in making China operations work. The problem for many airlines is the closure of Russian airspace, which has meant longer trips to destinations in China. For example, Virgin’s Shanghai route had to add an hour outbound and two hours inbound to accommodate the increased flight time. Compounding the problem is the fact that Chinese airlines are not required to circumvent Russian airspace, so can complete trips heading West faster and with less fuel and crew than competitors. This lack of a level playing field has frustrated many airline leaders and is clearly taking the wind out of many carrier’s sails as they struggle to build back their pre-pandemic China n