Summary

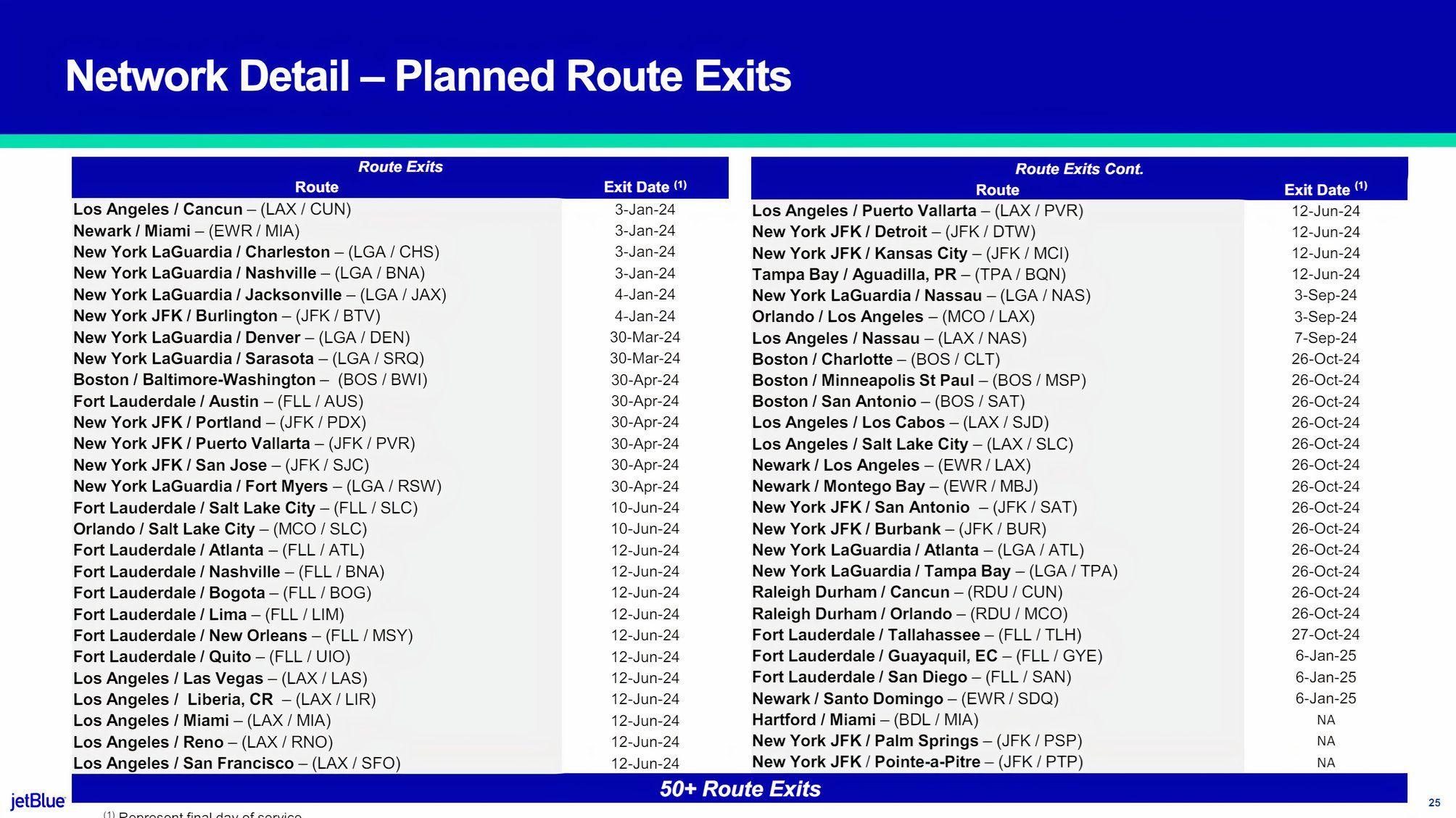

- JetBlue will cut 50+ routes and 15 airports from its network this year, with more eliminations coming.

- The carrier expects up to 5% lower capacity in 2024, which should improve revenue performance along with other changes.

- It is doubling down on its East Coast leisure, VFR, and transcon markets.

JetBlue’s considerable changes are part of its JetForward program. The carrier’s July 30 earnings presentation detailed its long-known challenges and how it intends to address them. The early results seem promising, with a $25 million net profit in the second quarter.

It expects its 2024 capacity to be up to 5% lower year-on-year. However, this should help with stronger revenue, compounded by focusing on better-performing markets and other developments. They include Even More Space sales, up by double digits year-on-year. However, lower capacity means higher seat-mile costs, which it plans to address through its latest cost transformation program.

Among many other changes, it will also defer the delivery of 44 Airbus A321neos, including XLRs, which means it will expand less to Europe in the coming years. I recommend going through the presentation to glean much more information.

Related

JetBlue Cuts 7 US & Caribbean Airports From Its Route Map

They join a handful of other airports that recently saw JetBlue’s last flights.

Gone: 50+ routes

The following image lists them. Naturally, many of them relate to JetBlue’s 15 airport exits: Baltimore, Bogotá, Burbank, Burlington, Charlotte, Kansas City, Lima, Minneapolis, Quito, Palm Springs, Pointe-a-Pitre, Puerto Vallarta, San Antonio, Stewart, and Tallahassee. It only had a tiny presence at them.

Cuts, including those from Los Angeles, relate to JetBlue’s pulldown and capacity redeployment to the East Coast and, still others, its reduction of corporate-focused routes. They reflect insufficient seat-mile revenue performance relative to what else it could do with its smaller fleet and its intolerance of loss-making services nowadays.

Image: JetBlue

Speaking during the earnings conference call, Marty St. George, who returned as JetBlue’s president, said,

“So far, in 2024, we’ve announced four tranches of network changes, collectively driving 15 city closures and over 50 route closures and redeploys. Every route end station needs to earn its way into our network and our push for profitability has lessened our patience for underperforming routes.”

The “so far” bit is intriguing, and I read that as suggesting more cuts are coming. Indeed, JetBlue’s CEO, Joanna Geraghty, confirmed this. “We’ve made a large number of cuts, the most in our history. We may have some more modest ones to come.”

Photo: Angel DiBilio | Shutterstock

St George added,

“Our focus now is squarely on what we call our core franchises. These have long been the profit engine for JetBlue: leisure, VFR [visiting friends and relatives], and transcon routes [some will see the A321LR].

They’re from our core East Coast geographies that know and love JetBlue, like New York, New England [Long Island and Manchester airports have been added], Florida, Puerto Rico, and the Caribbean.”

Related

Long & Short: Top US Airlines Ranked By Average Domestic Flight Length

This article examines the situation for 13 airlines with 94% of US domestic flights in July.

East Coast leisure

JetBlue is increasing attention on premium leisure passengers in its core markets, where it is strongest and can be offensive rather than defensive. As St George said,

“We want to be the best leisure choice for our customers. I’m not taking any victory laps right now as far as this network transformation. But I think we’re very, very optimistic about these moves.”

Photo: Minh K Tran | Shutterstock

As mentioned, it will focus far less on corporate travelers, although they will remain important in particular markets.

“We’re not really designing the network for corporates like we once did. And if you look at some of the changes we’ve made in New York, some of the routes we pulled, I think it’s very consistent with what we’ve seen as far as a slower recovery of corporate travel in the city.”

Given St George’s comments, I wonder if the lower focus on them is because of the slow market recovery or whether it is truly about moving away from markets in which it is much harder for JetBlue to win.

What about European routes?

JetBlue has 11 European routes this summer with 13 daily departures from New York JFK and Boston. It serves Amsterdam, Dublin (added in 2024), Edinburgh (added in 2024), London Gatwick, London Heathrow, and Paris CDG. It is the 17th largest operator between North America and Europe.

Asked about its European operation, especially given the postponement of 44 A321neos, Geraghty said,

“Transatlantic [sales and performance] has done nicely this summer. We continue to optimize the transatlantic markets to reflect the seasonality of that geography. It is an important part of the JetBlue network. Obviously, the deferrals for the XLR will have an impact on growth in that market, but it’s by no means a retreat.”