Summary

- Minimal network overlap reduces competition concerns since Alaska & Hawaiian compete on only 3% of routes.

- In fact, increased competition with legacy carriers is likely, benefiting customers with lower costs & more route options.

- Alaska-Hawaiian’s fleet diversity enhances international service, bolstering tourism & aiding Hawaii’s economy.

Alaska Airlines’ proposed $1.9 billion acquisition of Hawaiian Airlines is currently undergoing intense scrutiny from the Department of Justice (DOJ), with a decision expected within the next few days. If given the green light, it would see America’s fifth-largest airline combine with its tenth-largest in a deal that would bring together two carriers rooted in markets uniquely reliant upon air travel.

Photo: Alaska Airlines | Hawaiian Airlines

At face value, the combination makes sense to both carriers and their customers. But mere months ago, the DOJ blocked JetBlue’s planned $3.8 billion acquisition of ultra-low-cost carrier Spirit Airlines due to concerns about the erosion of competition in the domestic market. Do those same concerns exist with the Alaska-Hawaiian deal, and how do they balance out against the advantages of the proposed merger?

Related

Analysis: Winners and Losers From Alaska Airlines’ Acquisition Of Hawaiian Airlines

Which industry players are in a stronger position as a result of the merger?

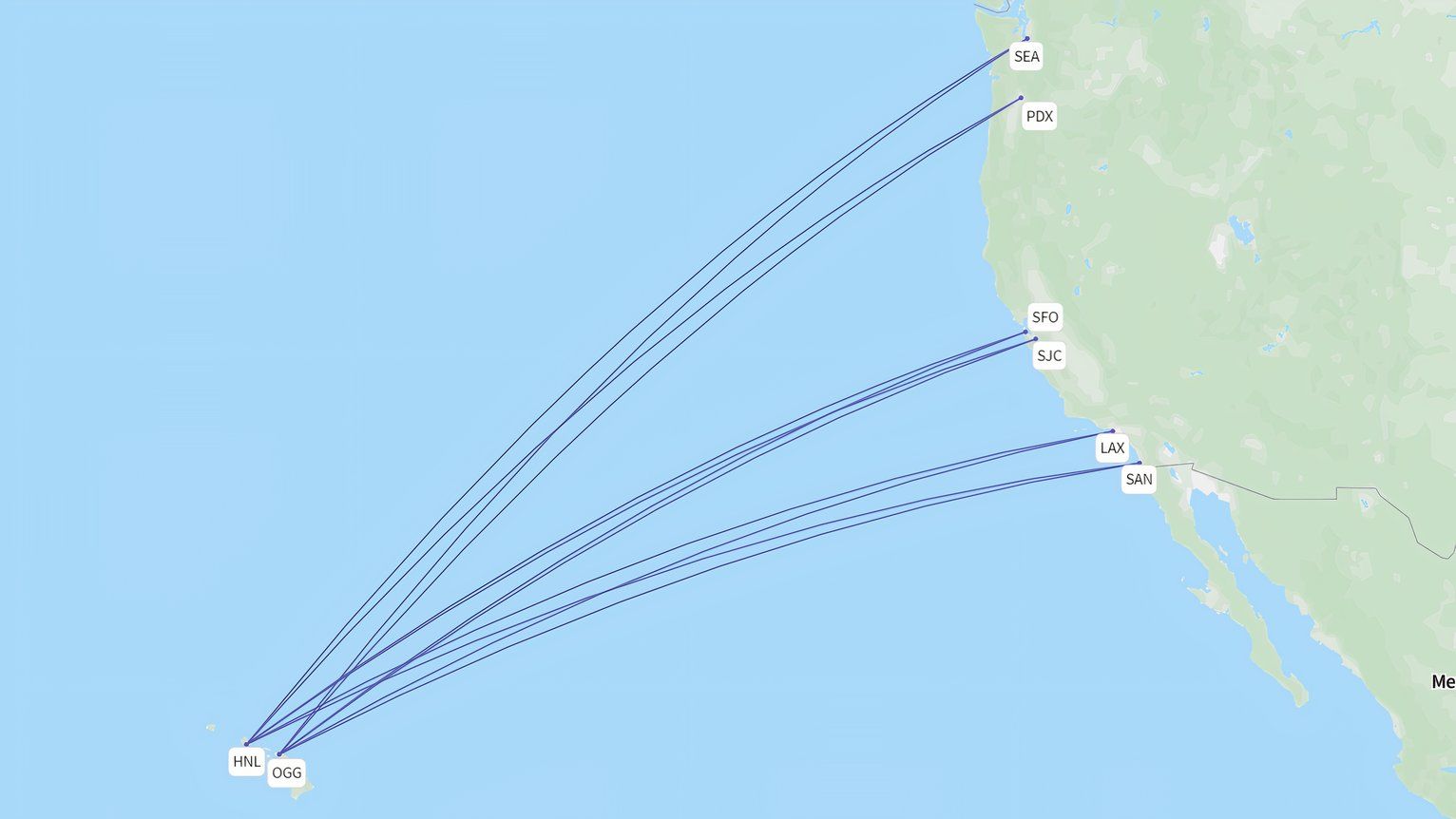

Minimal network overlap

The concerns about the merger leading to reduced competition are minimal because there is minimal network overlap. The two carriers offer a combined 348 routes and compete directly on only 12 (or 3% of all routes). By comparison, the JetBlue-Spirit overlap was close to 20%. The overlapping routes are six each for Honolulu (HNL) and Kahului (OGG) to Los Angeles (LAX), Portland (PDX), San Diego (SAN), San Francisco (SFO), San Jose (SJC) and Seattle (SEA).

Map: OAG Mapper

Portland is the only market where Alaska-Hawaiian would have no competitors. In every other market, they face intense competition from the “Big Four” legacy carriers, especially Southwest Airlines, which has significantly expanded its connections to Hawaii and inter-island services. Indeed, the combined carriers would have barely a 40% market share of services between Hawaii and the mainland US, with each of the big four carriers retaining a 12-24% share each. There is certainly plenty of room for competition.

Photo: Alaska Airlines

So what might be the potential advantages of the merger? Let’s examine them in more detail…

Increased competition is a real possibility

In fact, one of the main benefits of the Alaska-Hawaiian merger could be increased competition. It would provide Alaska-Hawaiian with far greater economies of scale and fleet versatility to take the fight to the larger carriers. Changing the dynamic from six competitors with similar market share flying to Hawaii, and creating one larger competitor that crucially is not one of the big four, would likely force the legacy carriers to invest and compete more heavily in West Coast markets to retain their share.

Photo: EQRoy | Shutterstock

It would also introduce much-needed competition to large US markets that currently only have one option for direct flights to Hawaii, such as Houston (United), Dallas (American), and Atlanta (Delta). To understand the potential impact, just examine the table below of 10 large markets with direct flights to Honolulu. On average, the five markets with a single carrier are 240% costlier than those with multiple carrier options. The introduction of a strong competitor in the form of a merged Alaska-Hawaiian entity would undoubtedly help to reduce costs in these single-carrier markets.

| The average cost of a direct one-way ticket from Honolulu (main cabin) | ||

|---|---|---|

| Route | Carriers | Average Cost |

| Atlanta (ATL) | 1: Delta | $821 |

| Dallas (DFW) | 1: American | $857 |

| Denver (DEN) | 1: United | $482 |

| Houston (IAH) | 1: United | $537 |

| Detroit (DTW) | 1: Delta | $721 |

| Boston (BOS) | 2: Hawaiian, Delta | $346 |

| New York (JFK) | 3: Hawaiian, Delta | $429 |

| Phoenix (PHX) | 3: Hawaiian, American, Southwest | $244 |

| Salt Lake City (SLC) | 2: Hawaiian, Delta | $220 |

| Seattle (SEA) | 3: Hawaiian, Alaska, Delta | $200 |

| Sources: Airline and booking sites, average ticket costs in August 2024 | ||

New international options

Similarly, the Alaska-Hawaiian combination’s fleet diversity will allow it to be a far stronger competitor on international routes. Hawaiian currently has a fleet of more than 30 Airbus A330s and Boeing 787s, which it utilizes primarily on long-haul flights to Pacific Rim destinations such as Japan, South Korea, Australia, New Zealand, and Tahiti. Alaska intends to enhance Honolulu as a hub, pairing it with its existing network as a feeder to international routes and providing one-stop connections across Asia-Pacific.

Photo: christopheronglv | Shutterstock

Related

Analyzed: The Aircraft Operated By Alaska Airlines And Hawaiian Airlines

With Alaksa Airlines looking to acquire Hawaiian Airlines, we take a look at how their fleets compare.

This would be a significant benefit for existing Alaska Airlines customers who have had to choose an alternative airline for international flights. We can also expect that Alaska-Hawaiian will introduce a free stopover program in Hawaii for passengers flying between the US and other Pacific Rim nations, similar to the very successful stopover programs that Icelandair has in Reykjavik or TAP Air Portugal has in Lisbon and Porto. This would not only provide it with a unique differentiator when competing with other trans-Pacific airlines (i.e., increase competition), but also contribute to tourism, the number one driver of the Hawaiian economy.

Photo: Hawaiian Airlines

Oneworld multiplies these benefits

These trans-Pacific benefits will be multiplied further due to Alaska Airlines’ membership of the oneworld alliance. Hawaiian already flies to key oneworld hubs in Tokyo (Japan Airlines) and Sydney (Qantas), and if the Alaska-Hawaiian merger goes ahead, we can expect that to expand to Hong Kong (Cathay Pacific) and Kuala Lumpur (Malaysia Airlines). This will provide far easier onward connections for current passengers of both airlines and new ways to accumulate and redeem miles. It will also work in reverse. If Honolulu becomes an oneworld hub, it will become more attractive to frequent fliers with the likes of Qantas and Japan Airlines.

Photo: Alaska Airlines

Let’s also not forget American Airlines, a founding member of the oneworld alliance. It has the lowest market share of all major US carriers flying to Hawaii, so an Alaska-Hawaiian merger might make for a larger competitor, but it adds new route expansion via codeshare, and for its loyal passengers, it creates new opportunities to earn and spend AAdvantage miles.

Investment in Hawaii

All of this adds up to significant benefits for Hawaii itself. The state relies heavily on tourism for its economic prosperity, and the COVID-19 pandemic and the 2023 Maui fires have battered it. Greater traffic from an Alaska-Hawaiian merger will only benefit the state and the people living there.

Photo: Phillip B. Espinasse | Shutterstock

The big caveat to that for the people of Hawaii is that Alaska respects the legacy of Hawaiian Airlines and its investment in local communities. To that end, Alaska has made substantial efforts to reassure the people of Hawaii:

- Hawaiian brand to remain: It has promised that the Hawaiian Airlines brand will be retained, including the iconic ‘Pualani’ livery. However, it remains to be seen if that will be true: Alaska made similar promises when acquiring Virgin America and quickly disposed of that brand.

- Protecting jobs: Alaska has committed to maintaining and growing union-represented jobs in Hawaii, including preserving pilot, flight attendant, and maintenance bases in Honolulu and airport operations and cargo throughout the state.

- Investing in inter-island routes: Any Hawaiian knows that the flights connecting its islands are vital to its people and economy, and Alaska has committed to investing in these. This will likely include a not-too-distant replacement of the Boeing 717s that Hawaiian Airlines currently uses on these routes.

- Investing in the local community: Alaska has directly engaged the Hawaiian community. It visited all of the islands and met with all of the mayors, who were unanimously supportive of the merger. It also created and engages with the Hawaiʻi Community Advisory Board (HICAB), which includes representatives of business, community, and local interests, with people from every island represented.

Photo: Robin Guess | Shutterstock

Assuring the future of Hawaiian Airlines

We must also remember that this merger removes the looming prospect of severe actions due to Hawaiian Airlines’ financial difficulties. The carrier has amassed about $1 billion of debt, which is increasing at a rate of about $1 million a day. As the airline hasn’t experienced the same sort of bounce-back as other US airlines, its financial future is bleak.

Photo: Angel DiBilio | Shutterstock

While the two airlines have not talked about “saving Hawaiian Airlines” in their representations of the merger, it is clear to anyone who has followed US aviation over the years that one of the biggest unspoken benefits of the merger might be ensuring the continued existence of Hawaiian Airlines. And that means preserving the jobs of nearly 7000 workers at the airline, and preventing the economic fallout that would follow from one of the state’s largest employers and generators of revenue going out of business.