Boarding1Now/iStock Editorial via Getty Images

Airline stocks don’t make for the best investments due to the volatility in the stock prices. Typically, this is due to capacity expansions exceeding demand and if it is not that, then we see fluctuations in fuel prices increase volatility in airline stock prices. That, however, does not mean that airline stocks should not be considered at all for investment. In this report, I will be adding Türk Hava Yollari Anonim Ortakligi aka Turkish Airlines (OTCPK:TKHVY) to my coverage and determining a price target for the stock.

Strong Unit Revenues But Costs Are Elevated

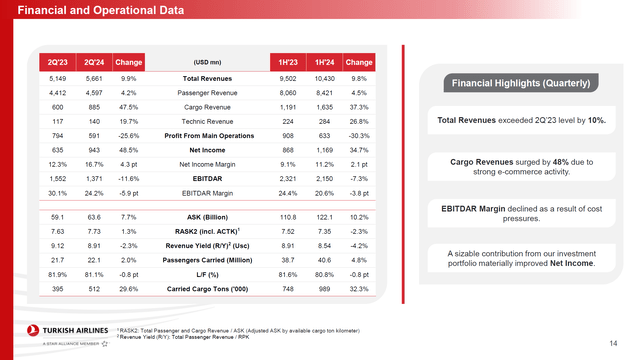

In the second quarter, total revenues climbed 9.9% carried by higher revenues in all segments. Passenger revenues grew 4.2% to $4.6 billion, but that was driven by 7.7% capacity expansion. Cargo revenues increased 47.5% on a 30% increase in cargo carried, driven by e-commerce activity. Overall, the top-line growth was good, with revenue growth exceeding growth in the passengers and cargo carried. However, operating income and EBITDAR decreased by 25.6% and 11.6% to $591 million and $1.37 billion respectively. Operating margins decreased from 15.4% in Q2 2023 to 10.4% in Q2 2024 while EBITDAR margins decreased from 30.1% to 24.2%.

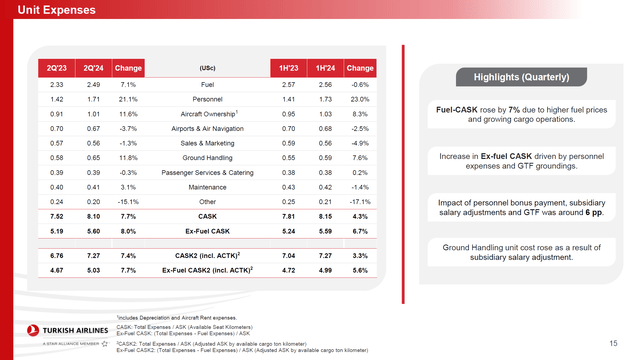

Currently, many airlines are increasing capacity while the unit revenue environment is softening and that is to keep the absolute revenues steady while improving the unit costs. However, just like many peers, Turkish Airlines can not quite achieve that as labor costs, ownership costs and ground handling costs have increased exceeding capacity expansion with unit costs excluding fuel rising 8%. Total operating expenses, including the costs for the maintenance division, grew by 18.3%, which is significantly higher than the capacity expansion. So, we are not seeing a favorable development on cost amortization.

What Are The Risks And Opportunities For Turkish Airlines?

For Turkish Airlines, the risks are the same as we see with many other airlines and that is that unit revenues might fall even further on continued capacity expansion while unit cost do not track favorably. For 2024, the company is aiming for a 10% increase in capacity and despite that, the airline expects mid-single digit growth in ex-fuel unit costs. So, the capacity increase is not expected to improve unit cost efficiency. The company’s functional currency is USD, so it is somewhat shielded from fluctuations in the Turkish Lira. Obviously, if there are cost items that have been translated to US dollars, then the weakening of the lira against the USD (USD:TRY) could provide a tailwind and in the same way, a strengthening of the lira provides a headwind. Another risk, is the continued turmoil in the Middle East that at times requires airlines to temporarily halt flights.

For investors, there is the possibility to buy Turkish Airlines stock in USD, where each of the ADS represents 10 ordinary shares. However, there is no volume of significance and if you want to buy Turkish Airlines stock, investors could consider buying Turkish Airlines directly from the Istanbul Stock Exchange where it has higher volume and trades under the ticker (BİST: THYAO). One thing to keep in mind is that the stock trades in lira, so whether you buy the dollar denominated ADS or the actual underlying stock, there is currency risk.

The opportunities for Turkish Airlines are the continued attraction of Turkey as a holiday destination and with stakes in SunExpress and ownership of Ajet, the company can also capitalize even more on the tourism attraction of Turkey. Furthermore, Turkey is trying to build out its position as a hub for logistics through air, railroad, and sea and is increasingly becoming a location for companies to open up new facilities.

Is Turkish Airlines Stock A Buy?

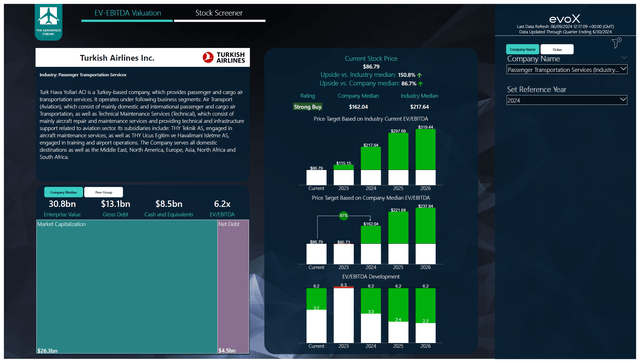

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions and the stock price targets accordingly. In a separate blog I have detailed our analysis methodology.

For Turkish Airlines, analysts expect 17% annual growth for EBITDA. However, it should be noted that most of the EBITDA growth is expected to be realized this year and next year. Free cash flow is expected to tick up this year and settle around $3.5 billion in the years after, as CapEx is set to increase again. Nevertheless, against a company median valuation there would be 87% upside, and even if we reduce the upside by half because there clearly are some risks, we would get to around 44% upside, which I believe warrants a buy rating.

Conclusion: Turkish Airlines Stock Has Significant Upside

The earnings that Turkish Airlines presented do show pressure on the cost side of the business that is bringing yields down. For now, the unit revenues are still holding up well. A fundamental analysis of the stock indicates that it is trading in line with its FY23 earnings, and the years ahead do present upward potential. Even if we attribute only half of the upside, that would still make for a compelling investment case.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.