John M Lund Photography Inc

Introduction

I first wrote up my initial investment thesis on SkyWest, Inc. (NASDAQ:SKYW) in June 2024. Back then, I felt that SkyWest was a strong American regional airline that had been experiencing improving asset utilization, which was leading to both top and bottom line growth. As a testament to its resiliency as a regional airline coming out of the COVID-19 crisis, I believed the company deserved its premium multiple relative to peers. With flying agreements promoting revenue growth in the company’s latest Q2’24 results, I’m maintaining my ‘buy’ rating on the company. Moreover, as shares have sold off 11% since the recent highs, I’ve personally initiated a position in the company, noting that much of its aircraft will be fully owned and paid for by 2026.

Company Overview

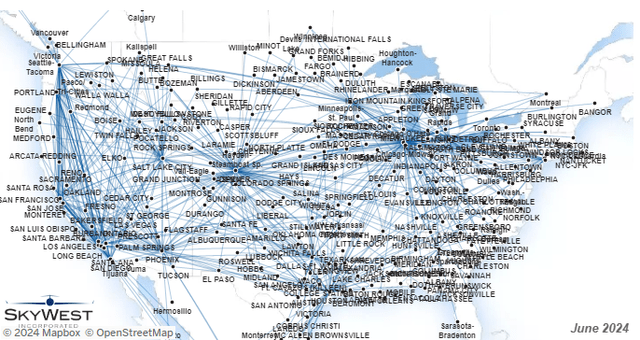

SkyWest is a regional airline and happens to be the largest regional airline operation in the United States. Under the SkyWest Inc holding company, the company owns both SkyWest Airlines as well as SkyWest Leasing. Through SkyWest Airlines, the company operates about 500 aircraft that connect 240 destinations throughout North America, allowing passengers to access a wide network of end points. Having carried more than 38 million passengers last year, the company has partnerships with major airlines like United Airlines (UAL), Delta Air Lines (DAL), American Airlines (AAL), and Alaska Air Group (ALK).

The way the company’s business model works is that through those major airlines, SkyWest operates regional jet aircraft in their network systems. The big airline companies handle all the marketing, flight schedules, passenger fares, ticket sales, and reservation bookings. Through their agreements, SkyWest operates the flights under their banner, often adhering to certain procedures and operating standards (which could look slightly different from airline to airline).

That’s what makes SkyWest’s business model so unique and less risky. Because of the nature of their agreements, SkyWest’s margins tend to be better and more durable, particularly when we consider that the airline partners pay fixed fees and arrange and pay for fuel used on capacity purchase flights. These capacity purchase agreements (CPAs) represented 94% of the company’s fleet last year.

The remaining 6% is under prorate agreements, where SkyWest operates flights using the major airline partners’ ticketing and reservation systems. In contrast to CPAs, under prorate agreements, the major airline partners handle the collection of passenger fares for the routes operated, which can involve adjustments when passengers connect to flights of the major airline partners. SkyWest has greater flexibility in setting flight schedules and passenger fares under prorate agreements, and is responsible for arranging and paying for the fuel used on these flights.

Q2’24 Results and Outlook

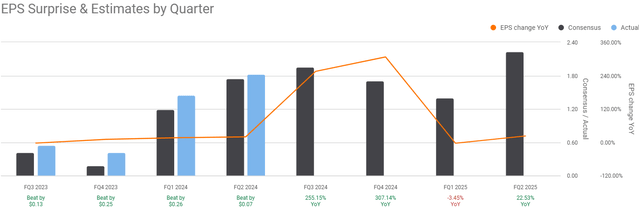

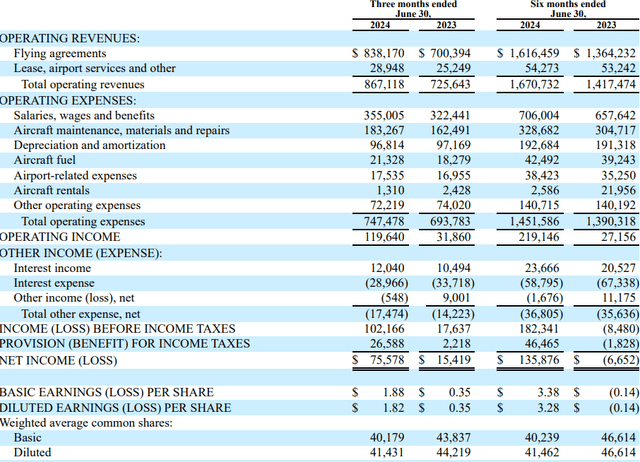

In SkyWest’s second quarter results for the fiscal year, the company reported revenues of $867 million, which represented a 19.5% increase versus last year’s Q2’23 revenues of $726 million. Compared to sellside estimates, this represented a more than 5% beat for about $41 million above what the Street was expecting.

On net income, SkyWest recorded net income of $75.6 million during the quarter for about $1.82 in EPS, a 9 cent beat against estimates. Compared to just 35 cents in earnings per share in the same quarter last year, it would seem that SkyWest had a great quarter on both the top and bottom line.

Q2’24 Results (Company Filings)

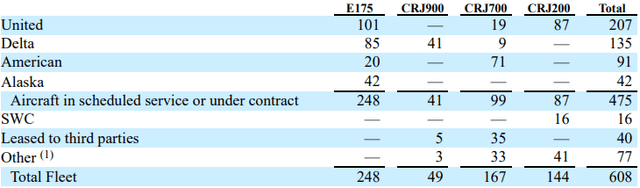

At the end of the quarter, the company had a fleet of 248 E175s, 49 CRJ900s, 167 CRJ700s, 144 CRJ200s. The brought the total fleet to 608 aircraft and the company anticipates that will continue to grow, as they are on track to add one new E175 aircraft with Delta sometime in Q3’24 or Q4’24, along with 28 new E175 aircraft with United, and one new E175 aircraft with Alaska Airlines sometime next year. These capital expenditure plans indicate that the company is growing nicely and is making capacity to fund their growth in partnership with the major airlines, particularly as travel rebounds. This will also help to improve profitability, as older aircraft that have high maintenance capex expenses can be replaced with less costly newer models.

At quarter end, about 44% of aircraft in scheduled service or under contract were operated for United, 28% were operated for Delta, 19% were operated for American Airlines, and 8.8% were operated for Alaska Airlines. The table below represents SkyWest’s current fleet with each of their partners.

SkyWest Fleet (Company Filings)

So what drove the results this quarter? A higher number of aircraft in the fleet with higher block hours were the main drivers. As travel demand picks up and SkyWest continues growing its fleet, the number of aircraft in scheduled service decreased from 492 in Q2’23 to 475 this quarter. Moreover, the number of block hours grew by 12.3% year over year as the scheduled daily utilization of SkyWest’s aircraft continued to grow.

In my view, these are excellent signals and give me confidence in SkyWest’s business, even after shares have run up 45% year to date. But it’s not just revenue growth that should get investors excited about the name; expense growth is also moderating, which is leading to some pretty significant margin expansion.

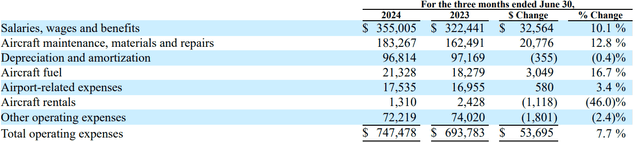

For example, during the quarter, the company’s operating costs grew only 7.7% year over year. Against revenue growth in the high teens, this allowed margins to expand to 13.8% from 4.4% last year. The major component was wages and salaries, which grew 10.1%. In my view, this is something that should be expected given its correlation with higher volumes and block hours.

Total Operating Expenses (Company Filings)

Importantly, however, aircraft fuel growth makes up a very small part of the company’s total operating expenses. As such, given the bulk of expense growth is in salaries and wages, margins at these levels look sustainable. Moreover, with the second-largest contributor to total operating expenses being aircraft maintenance and repairs (which grew 12.8%), I feel confident in underwriting lower growth here going forward as the fleet becomes replenished with new fleet.

As for the outlook, I’m bullish on the near-term outlook for the company. Why? It’s not just the results from the latest quarter. On the earnings call, the company took the opportunity to revise guidance upwards, with expectations that now reflect an improvement for this year’s block hours to be up 9% to 11% compared to last year. This range is up from prior guidance of 7% to 9% a quarter ago, when I last reviewed the company

So as a result of this, along with GAAP EPS guidance expected in the high $6 range, the outlook has improved for the company. Why this matters is that this is helping to improve the company’s balance sheet and is enabling the company to buy back stock at reasonable levels.

From a balance sheet point of view, SkyWest is now sitting in a cash position of $834 million, a stack of cash fat enough to afford it the flexibility to buy back a third of its market capitalization or pay back a third of its debt. With strong free cash flow generation, the company has been active with its share repurchase program, buying back 177,000 at an average price of $75.23, quite close to where shares are trading currently.

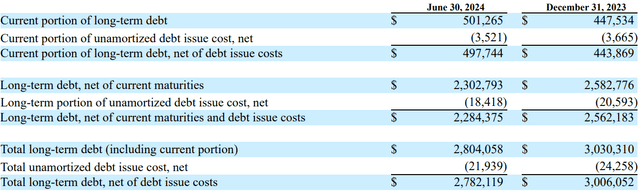

In addition, debt reduction has also been a focus as the company paid back $115 million in debt during the quarter, and plans to pay back a total of $400 million in debt during the 2024 fiscal year. In my view, this highlights SkyWest’s disciplined financial strategy and commitment to enhancing shareholder value while maintaining a solid balance sheet. By adequately managing its cash reserves, repurchasing shares, and reducing debt, management is demonstrating that it’s taking the right capital allocation steps to position the company well for the future.

Long-term Debt (Company Filings)

Conclusion

The sellside continues to be cautious relative to management’s guidance, with 2024 EPS expected at $6.78. From a valuation perspective, based on consensus estimates for 2024 and 2025, SkyWest trades for just 11.0x 2024 EPS and 9.7x 2025 EPS (source: S&P Capital IQ).

This is in spite of the fact that the company continues to regularly ‘beat and raise’, often surpassing sellside estimates, and even their own guidance occasionally. In my view, it’s clear that there is a persistent skepticism among analysts, in spite of majority ‘buy’ ratings on the stock. Despite a track record of exceeding expectations, the sellside seems to be factoring in potential risks or uncertainties that might not be fully apparent in the company’s historical performance.

Some of these risks include continued industry uncertainty around the lack of qualified pilots, economic weakness, and the threat of pandemics, terrorism, and war, as I’ve mentioned previously. While many of these factors are outside of the company’s control (and should still be monitored by investors with equal scrutiny), the company has been making excellent progress on attracting new pilots. On the earnings call, management mentioned that they expect to be at over 5,000 pilots by year-end, which is about a 25% increase compared to 2023. This alone should help improve block hours, in an industry where pilots are in short supply.

So in conclusion, I think SkyWest’s business model is above average for an airline and its strong financial performance during the latest quarter haven’t seemed to be properly reflected in the current valuation. In my view, margins look stable, with upside to improve, as the company increases its pilot workforce and fleet expansion, which will position it well to navigate any challenges effectively. As shares have recently experienced a pullback, the current valuation presents an attractive entry point for investors, reinforcing my confidence in the company’s long-term prospects. Overall, SkyWest remains a compelling investment opportunity, which is why I’m maintaining my ‘buy’ rating.