Summary

- OTT Airlines failed to achieve financial success due to repeated losses and increasing debt levels.

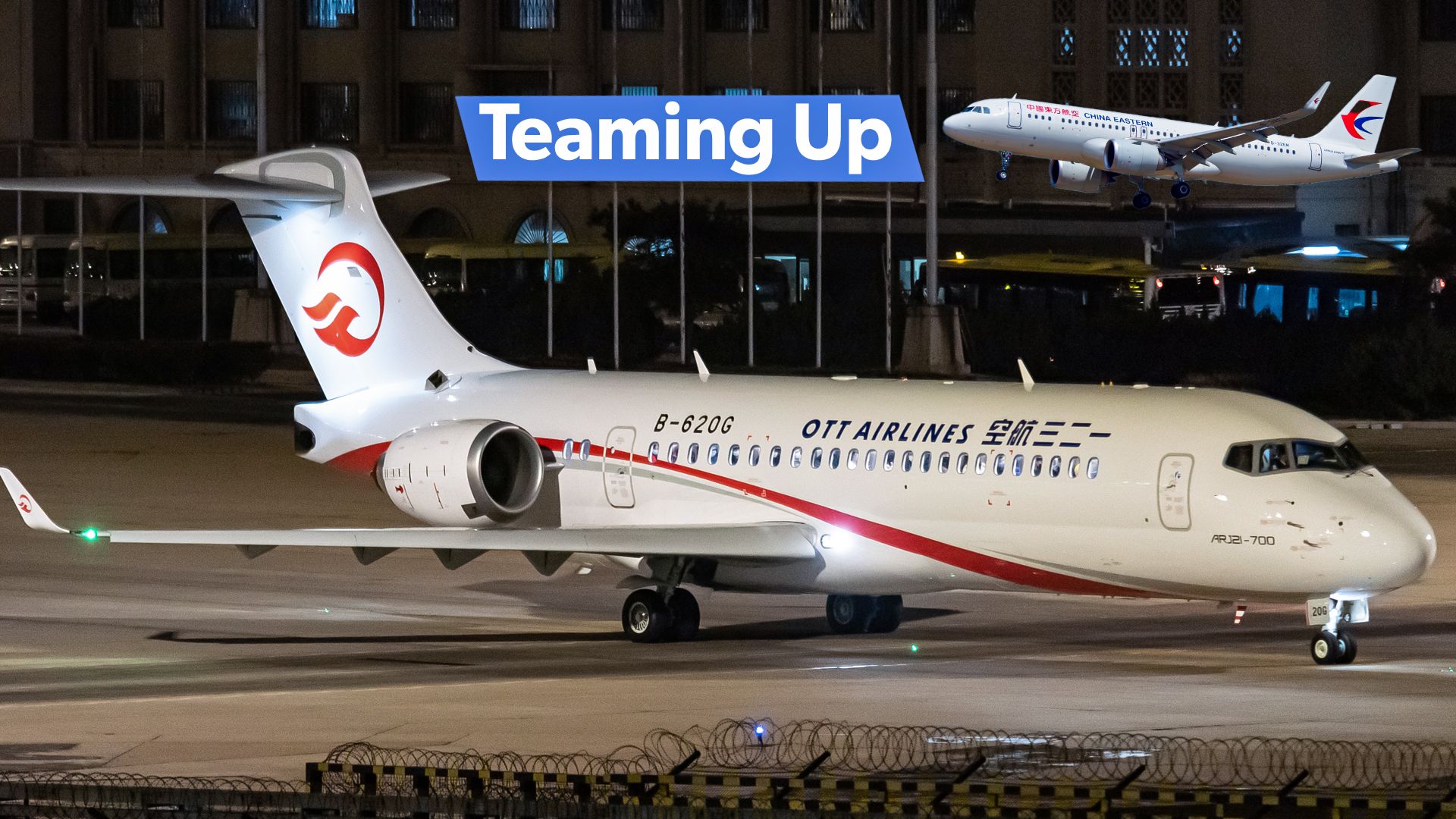

- China Eastern’s merger with OTT marks a strategic alignment to integrate the ARJ21s for operational efficiencies.

- Under new leadership, Wang’s focus on state responsibilities influenced the absorption of OTT into China Eastern.

On August 30, China Eastern Airlines made a significant announcement about absorbing its fully-owned subsidiary, One Two Three Airlines (OTT Airlines). This merger represents a crucial shift in the strategy for China Eastern, a move that will bring OTT’s operations under its larger fleet. As part of this move, OTT Airlines will be liquidated, marking the end of its short-lived but eventful role in China’s civil aviation market.

OTT Airlines was created in 2020 with a clear purpose: to operate and promote the use of China’s self-developed and self-manufactured aircraft. However, after just a few years of operation, China Eastern has decided to bring the airline’s operations into its larger framework, raising questions about the success of OTT’s mission and what this merger means for both companies.

The rise and fall of OTT Airlines

OTT Airlines was initially seen as a strategic initiative to promote China’s self-developed aircraft. In 2020, it started flying ARJ21s with plans to incorporate C919s later on, positioning itself as the first airline in the world to fly C919 aircraft. Its mission was clear: to support China’s ambitious goal of expanding its footprint in global aviation manufacturing. OTT’s formation came with much fanfare, with the expectation that it would help Chinese self-developed aircraft gain market credibility and success.

However, despite these grand ambitions, the airline struggled to gain momentum. Since its launch, OTT has been operating ARJ21s primarily on regional routes, flying from Shanghai Pudong International Airport (PVG) to smaller cities like Shantou, Guilin, and Nanchang.

The airline faced a variety of challenges, from limited route flexibility to an inability to secure its own operational codes—OTT continued to use China Eastern’s MU code for all flights, making it difficult for the airline to establish a strong independent brand identity.

Further complicating the situation, OTT Airlines did not see the expected expansion with the C919 aircraft. Although the airline was supposed to be the first to operate the C919, China Eastern opted to integrate these aircraft into its own main fleet instead. This decision not only sidelined OTT from the C919’s much-anticipated debut but also signaled a shift in the airline’s strategic importance within China Eastern’s broader plan.

Financial troubles and mounting losses

OTT Airlines’ financial performance also proved to be a significant burden. The airline was consistently unprofitable during its short history. From 2020 to 2023, OTT’s net losses ballooned from 58 million yuan (US$8.2 million) to 584 million yuan (US$82.5 million), more than a tenfold increase. Additionally, its debt levels skyrocketed, with its debt-to-asset ratio reaching over 102% by mid-2023. These numbers painted a grim picture of the airline’s financial health, and it was clear that maintaining OTT as a separate entity would continue to be costly for China Eastern.

|

OTT Airlines’ financial performance |

||

|---|---|---|

|

Year |

Net Profit |

Asset-Liability Ratio |

|

2020 |

-58 million yuan (US$ -8.2 million) |

16.50% |

|

2021 |

-250 million yuan (US$ -35.3 million) |

46.85% |

|

2022 |

-409 million yuan (US$ -57.7 million) |

76.04% |

|

2023 |

-584 million yuan (US$ -82.5 million) |

92.89% |

|

2024 H1 |

-273 million yuan (US$ -38.5 million) |

102% |

As OTT’s financial losses deepened, the airline’s ability to operate as an independent entity became increasingly untenable. China Eastern’s decision to absorb the subsidiary is widely seen as a cost-saving measure designed to streamline its operations and eliminate a struggling division.

Merging into the larger fleet

China Eastern’s decision to integrate OTT Airlines and its fleet of 24 ARJ21s into its main operations can also be viewed as a move to align with other major Chinese carriers. Competitors like Air China and China Southern, which also operate ARJ21 aircraft, have never maintained a separate entity for regional operations. Instead, they’ve seamlessly incorporated these regional jets into their broader fleets, leveraging their established network strengths.

Photo: Comac

Bringing OTT Airlines under China Eastern’s umbrella will allow the ARJ21s to be managed as part of the larger fleet, where economies of scale can be better realized. This will help China Eastern optimize crew and maintenance schedules, improve route planning, and potentially enhance the profitability of these aircraft. With OTT no longer a separate brand, the ARJ21s can now be flown on a wider range of routes and be better integrated into China Eastern’s broader network, a key advantage that may have been missing from OTT’s isolated operations.

Leadership transition at China Eastern Airlines

In July 2022, after 14 years at the helm, Liu Shaoyong stepped down as Chairman of China Eastern Airlines. Liu took over in 2008 during a time of crisis when the global financial downturn had severely impacted the airline. That year, China Eastern recorded a record loss of nearly RMB 14 billion, and its debt ratio soared to 115%, leaving the company on the brink of insolvency. However, by 2019, prior to the pandemic, the airline had achieved ten consecutive years of profitability.

Under Liu’s leadership, he earned unmatched authority within the company, making any major shift in policy difficult without a change at the top. In October 2023, after more than a year without a permanent chairman, Wang Zhiqing, former Deputy Secretary-General of China’s State Council, took over as the new Chairman of China Eastern. Just three days before Wang officially assumed his role, China Eastern signed a second purchase agreement with COMAC for 100 C919 aircraft, far exceeding the five C919s ordered under Liu’s tenure.

Photo: China Eastern

The recent merger of OTT Airlines, which was personally named by Liu, into China Eastern marks a significant shift under Wang’s leadership. While Liu prioritized the airline’s financial performance, having navigated the company through near-bankruptcy, Wang’s tenure appears to place greater emphasis on China Eastern’s role as a state-owned enterprise, shouldering broader national responsibilities.

While the merger marks the end of OTT Airlines, it also signals a potential fresh start for China Eastern’s ambitions with domestic aircraft. By folding OTT’s operations into the larger company, China Eastern will have more control over how to utilize the ARJ21s and potentially the C919s in the future. This decision reflects a broader industry trend, where airlines look to simplify operations and reduce overhead in a challenging post-pandemic environment.