Photofex-AT/iStock Editorial via Getty Images

In July 2023, I initiated coverage for Jet2 plc (OTCPK:DRTGF) with a buy rating and the stock has been doing well returning 25.9% compared to a 19% return for the S&P 500. In this report, I will be discussing the most recent earnings, provide a risk assessment for the leisure company and update my price target for Jet2 plc.

Jet2 Pre-Tax Profit Surges Despite Higher Costs

Revenues grew by 24% to £6.255 billion. This was driven by a 10% increase in capacity and 9% more passengers flown. A significant portion of the growth was realized through more package holidays being part of the mix. The share of package holidays in the mix grew from 64.9% to 68.3%. The number of package holidays customers grew by 15% while flight-only passengers decreased by 1%. On unit revenues, the flight-only pricing increased 14% while average package holiday prices increased by 11%.

Operating expenses increased 26% to £5.8 billion driven by a significant increase in hotel accommodation costs, fuel costs, higher maintenance costs and higher staff costs. The cost growth on almost all cost items was higher than the capacity growth. That was driven by more holiday packages being sold, but also was the result of increased fuel prices and continued labor cost pressures. Maintenance costs increased significantly due to the lease of airplanes, which come with higher maintenance rates while there also was some cost elevation due to the maintenance of older airplanes. This resulted in operating margins decreasing 100 bps to 6.8%. Nevertheless, operating profit still grew 9% to £428.2 million while EBITDA grew 17% to 680.3 million.

In the FY24 results, I see an indication that the business model with package deals as the core of the business is paying off. Jet2 is not really an airline, but it’s a company that primarily provides holiday packages and as part of that package it flies leisure travelers to their holiday destination.

What Are The Risks And Opportunities For Jet2?

The main risk for Jet2 would be any reduction in demand for package holiday deals. In FY24, the average length of holidays decreased from 7.8 days to 7.6 days which, I believe, is attributable to increased costs for holidays driven by inflation and higher cost of living that leaves less funds to be spent on holidays. Furthermore, the UK economy is having a rough time which could also impact Jet2.

There are also positives. Despite the pressures, demand for holiday package deals is high, and while it might seem somewhat counterintuitive, that does make sense. The package deals tend to have better pricing compared to people booking flights, transportation, and hotels themselves. Jet2 is taking advantage of its scale and offers holiday deals at better prices for leisure travelers and at better margins for itself.

Furthermore, the company is absorbing more A321neo airplanes in the fleet, which have superior fuel burn figures compared to the existing fleet as well as lower maintenance costs. The A321neo airplanes also seat more passengers, namely 232 instead of the 189 on the Boeing 737-800, and that allows the company to lower per-seat costs. Over the next few years, the average seat count per airplane is expected to rise from 195 to 218, which should significantly improve the cost efficiency of the airline.

Jet2 Stock Offers A Compelling Investment Case

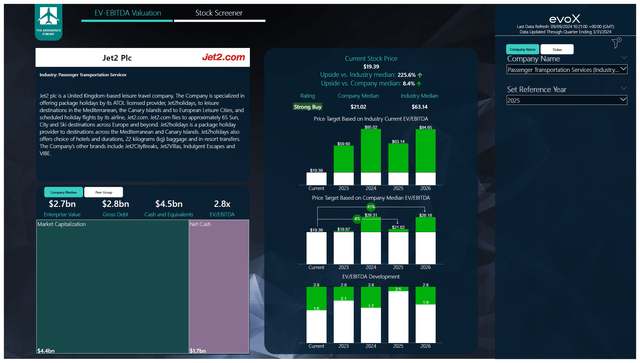

To determine multi-year price targets, we have developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions and the stock price targets accordingly. This details our analysis methodology.

For FY24, the price target had increased to $28.33. This was driven by the enterprise value of Jet2 remaining relatively unchanged year-on-year while its results continued to improve. For the years ahead EBITDA will grow at a rate of approximately 5.2%, but there will be some pressure on free cash flow as Jet2 will continue absorbing new airplanes which will increase capex. Nevertheless, I believe the stock is a strong buy with a $21.02 price target for FY25 and a $28.18 price target in FY26, which I believe provides a compelling investment case.

What Is The Best Way To Invest In Jet2?

I believe that before I discuss any results or upside, it’s important to point out that DRTGF stock is trading OTC (Pink Current Information) and due to a lack of volume, it might be hard for investors to buy and sell shares in desired amounts against desired prices. For those who are interested in purchasing Jet2 plc stock, I would suggest checking out the JET2 ticker on the London Stock Exchange.

Conclusion: Jet2 Stock Is Underappreciated

I believe that Jet2 stock remains underappreciated at current levels. The business is facing higher capex in the years to come and currently, there are still some inflationary costs creeping up in the cost structure, but the company is working on more efficient growth ahead, and it’s one of the few airlines that has a net cash position. With the current valuation and the forward projections in mind, I maintain my strong buy rating on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.