![]() United Airlines

United Airlines

took over Pan Am’s Asia-Pacific network in 1986. It reportedly paid $750 million for Pan Am’s Pacific division, which would be $2.2 billion today. A crucial part of the deal was obtaining the Tokyo Narita Airport

hub, which helped United to become a global player. It is still a larger long-haul operator than American Airlines ![]() American Airlines

American Airlines

and ![]() Delta Air Lines

Delta Air Lines

.

A Japanese hub for a US carrier?

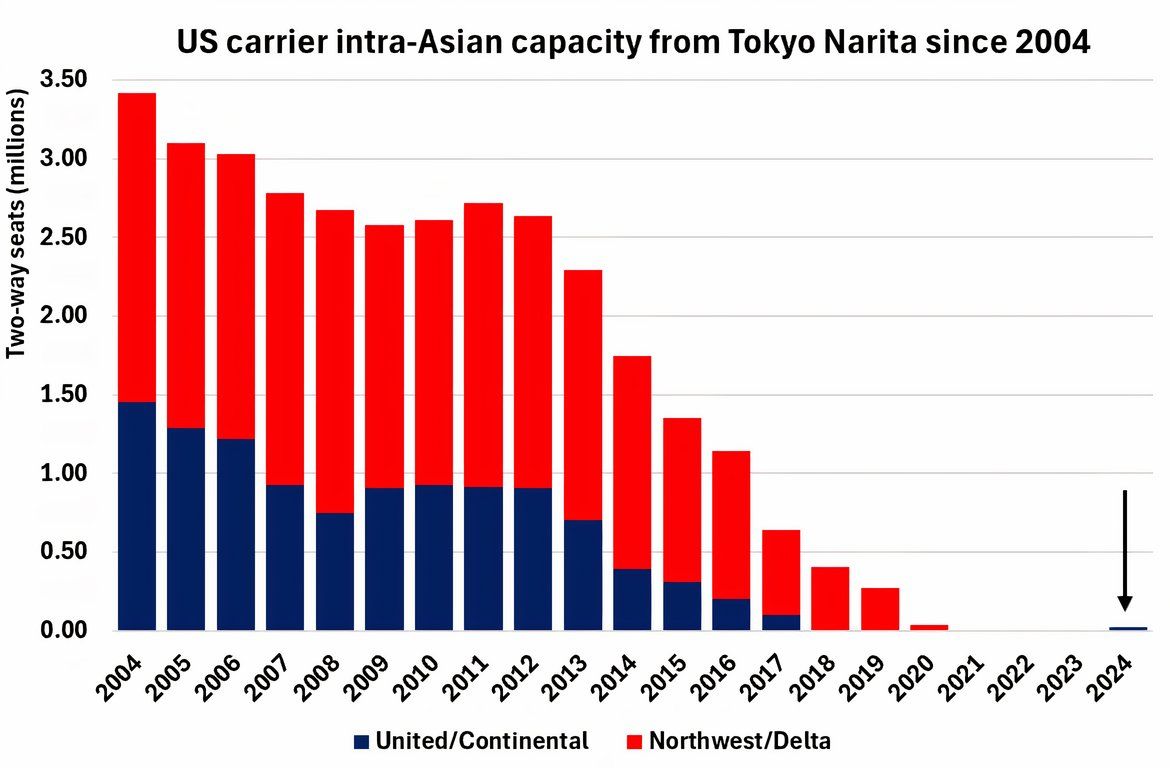

It was not just Pan Am or United that used Narita as a hub. Northwest (and later Delta) also did so, while Continental served Narita-Hong Kong in 2011/2012. Cirium data shows that Delta’s Japanese capacity has necessarily fallen considerably as seats to South Korea, due to SkyTeam, have increased markedly.

The carriers’ Narita hub presence was from traffic rights awarded post-World War II. They could carry passengers and freight from Narita across Asia, transforming the airport into a connecting hub for the carriers. Passengers could fly from multiple US hubs to Narita and then across Asia.

Narita helped overcome aircraft range problems, although United’s Boeing 747-400s (obviously now withdrawn) and 777-200ERs from its San Francisco hub made more non-stop flying possible.

Of course, this has developed enormously in recent years with the 777-300ER and 787. United’s non-stop flights are now significant: its 787-9s fly as far as Singapore, while it inaugurated San Francisco-Manila 777-300ER flights in 2023.

At the same time, Tokyo Haneda—much closer to downtown Tokyo—opened to international operators and quickly grew to the US, especially since 2023. This airport is critical for point-to-point and higher-yielding flights, reducing the ‘need’ for a Japanese hub. The economics of serving Tokyo have changed.

Related

The USA Has 9 Of The World’s 10 Longest Non-Stop Boeing 777 Flights In October

The list has changed compared to a year ago.

Flashback: 20 years ago

In 2004, United had nearly 1.5 million two-way seats from Tokyo Narita across Asia. It flew to Beijing Capital, Bangkok, Hong Kong, Seoul Incheon, Singapore, and Taipei on the 747-400 and 777-200ER. Here’s when Tokyo flights ended:

- 2011: Beijing Capital (after that, United’s US mainland non-stop capacity grew strongly)

- 2012: Taipei (United flew non-stop from San Francisco between 2007-2008 and then from 2014)

- 2013: Hong Kong (United was already flying non-stop from the US mainland)

- 2014: Bangkok (will non-stop US-Bangkok flights materialize?)

- 2016: Singapore (non-stop US-Singapore flights began that year)

- 2017: Seoul Incheon (United was already flying non-stop from the US mainland)

Source of data: Cirium. Figure: James Pearson

United did not ‘only’ have intra-Asian flights from Narita. For example, it flew to Ho Chi Minh City via Hong Kong on the 747-400 for years until 2016; Hong Kong-Singapore on multiple equipment, but especially the 747-400 and 777-200ER, for years until 2017; and Nagoya-Taipei existed on the 777-200ER between 2005 and 2007.

The Narita hub is coming back

United last had intra-Asian flights seven years ago in 2017. Now they are returning. Its resurgence will begin with Narita-Cebu, with the 1,766 nautical mile (3,271 km) route taking off on October 27. I am sure it’ll be in my jam-packed new routes newsletter! It will be served daily using Guam-based 737-800s and crew. Helpfully, it is not a route that fellow Star Alliance member All Nippon serves.

In addition to capturing some of the Cebu-Tokyo traffic (108,000 point-to-point passengers in the year to July 2024), the US-Cebu volume is growing. United will target this with usually sub-two-hour connections in Narita to/from US cities.

Booking data shows that Los Angeles/San Francisco-Cebu each had 30,000+ roundtrip passengers. Chicago had 19,000, Greater NYC 25,000, and so on. It can capture some of this traffic with a quick connection in Tokyo.

Related

The 3 US Cities Philippine Airlines Says It Wants To Serve

Do they make sense?

Then there are these routes…

As previously announced, even more creative and different routes will begin in 2025. They include two more intra-Asian routes from Japan, each on the 737-800. Joining them will be a new Oceania route from Narita to Palau.

- Narita-Kaohsiung will start on July 11, 2025 (daily). All Nippon does not serve it. United will serve the city pair (187,000 passengers) and Taiwanese diaspora in the US (just ~16,000 passengers).

- Narita-Ulaanbaatar will begin on May 1, 2025 (three times weekly). All Nippon does not serve it. Ulaanbaatar-US has 40,000 US passengers, influenced by Mongolia’s tourism development, mining/engineering travel, travelers’ keenness for more adventure, Mongolian diaspora in the US, etc. Mongolia-Tokyo had 117,000 passengers.

Developing the Narita hub is a pretty low-cost and low-investment opportunity. There is little to lose, especially given United’s Narita slots and available 737s. Speaking earlier this year, Andrew Nocella, United’s EVP and CCO, said,

“We have a list of all these high-profile places that don’t have non-stop service to the U.S. that could be of interest. We’re going to try and see if we can make some magic.”