New Air Passenger Duty (APD) rules announced in the UK will mean higher prices for both commercial flyers and private jet passengers.

The new APD rules were announced on October 30, 2024, by the British Chancellor Rachel Reeves as part of the Labour government’s 2024 Budget that sets out the country’s financial plans for the next few years.

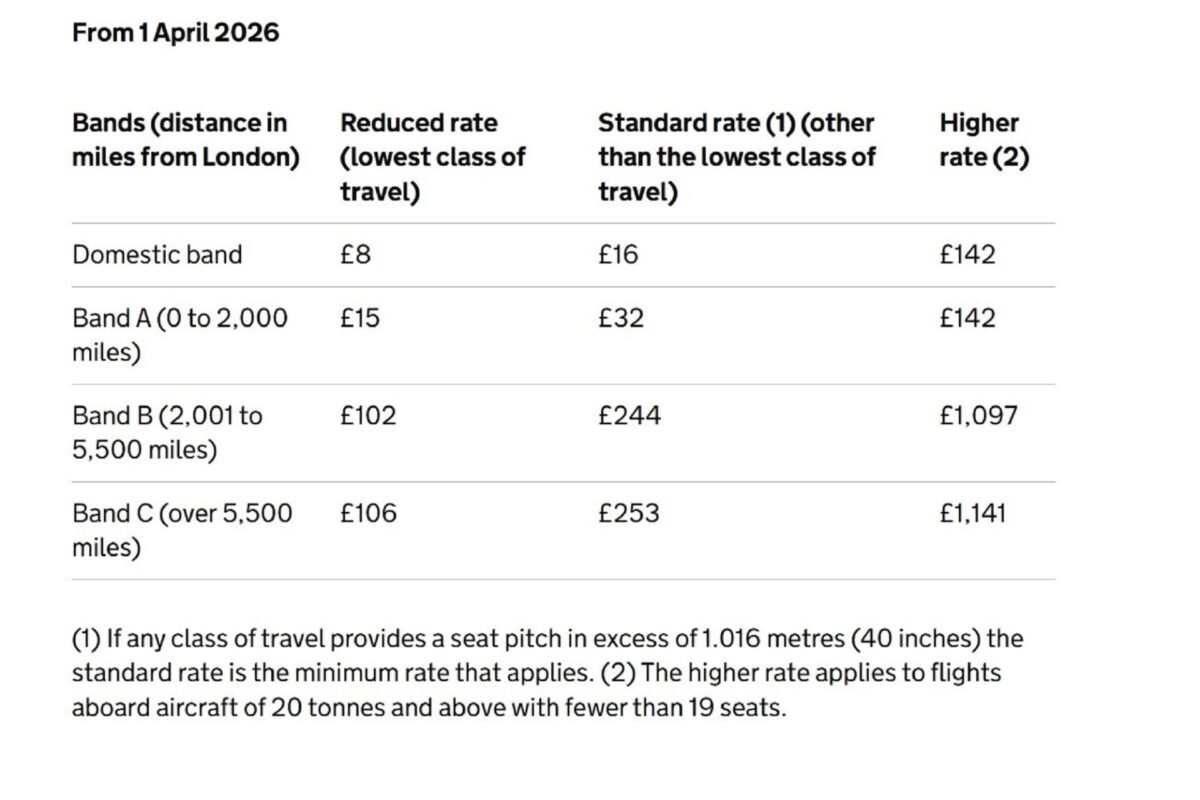

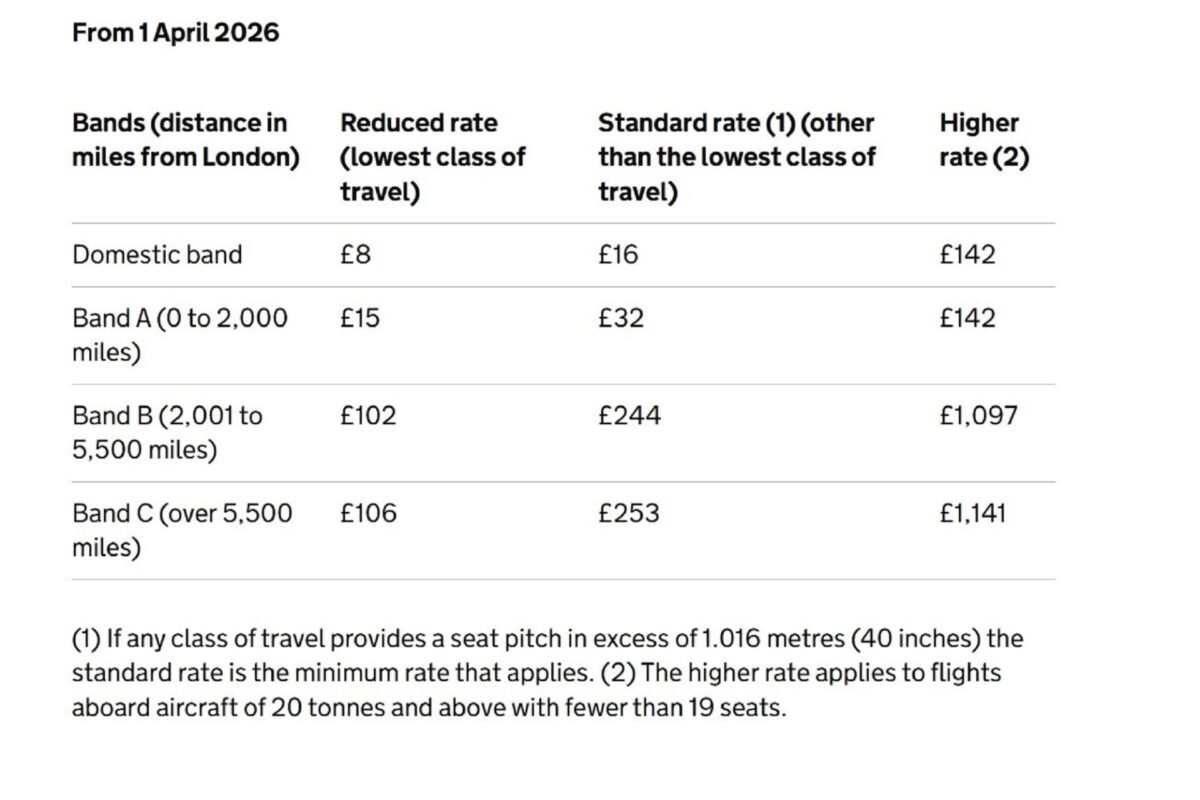

New APD rules for passengers departing the UK aboard commercial airlines will only take effect from April 26, 2026, as the previous Conservative government already set prices for April 2025 to March 2026.

Under the new government plans from April 2025, economy passengers will pay an extra £1 ($1.30) for domestic flights, £2 ($2.60) extra for short haul and £12 ($15.59) for long-haul flights, while children under 16 will be exempt from the charge.

“Air passenger duty has not kept up with inflation in recent years, so we are introducing an adjustment, meaning an increase of no more than £2 for an economy class short-haul flight,” Reeves told Members of Parliament during her Budget announcement.

AirportsUK, which represents over British 50 airports, welcomed Reeves’ extension of the advanced fuels fund by another year and an additional £975 million ($1.2 billion) in research and development funding for aerospace but expressed concern over the rise in APD.

“It was disappointing that the chancellor increased air passenger duty, especially at a time when airports are investing in new security technologies, sustainable flight and airspace modernisation, as well as facing increasing burdens in other areas,” said Karen Dee, CEO of AirportsUK.

Dee added: “If the Government is serious about realising its aim for the UK is to become the fastest growing economy in the G7, then it must recognise and champion the role that airports play in growth and international connectivity and minimise the cost and regulatory burdens imposed.”

Reeves also confirmed that the government was consulting on a proposal to extend the scope of the higher rate of APD, which is currently charged for passengers travelling on the largest business aircraft, to all private jets.

At present, the higher rate only applies to jets of 20 tons or more that are equipped to seat fewer than 19 passengers.

However, Reeves said as a first step in ensuring the private jet industry is taxed “more fairly”, there would be a 50% increase to the higher rate.

Mocking the former Prime Minister Rishi Sunak’s apparent love for flying by private jet and rumored desire to live in the US, Reeves quipped that the 50% rise is “equivalent to £450 per passenger for a private jet to, say, California.”

“The operators of many private jets are currently taxed at the reduced or standard rates of APD because their jets do not meet the definition to be liable for the higher rate. The higher rate is at least six times greater than the reduced rate for all distance bands and will increase further as a result of the Autumn Budget announcement,” the UK government said.