Quick Links

Over the past few weeks, airlines, mainly ![]() British Airways

British Airways

, have been in the headlines for canceling long-haul routes. On multiple occasions, the British carrier has said that it was forced to manage its capacity due to supply shortages related to Rolls-Royce and the company’s Boeing 787 engine choice, the Trent 1000.

However, even before the British propulsion provider had faced issues with the supply of the engines, airlines have begun switching their choice of power plants for their 787s to the other provider: GE Aerospace and its engine for the Dreamliner aircraft family, the GEnx.

Potential performance differences

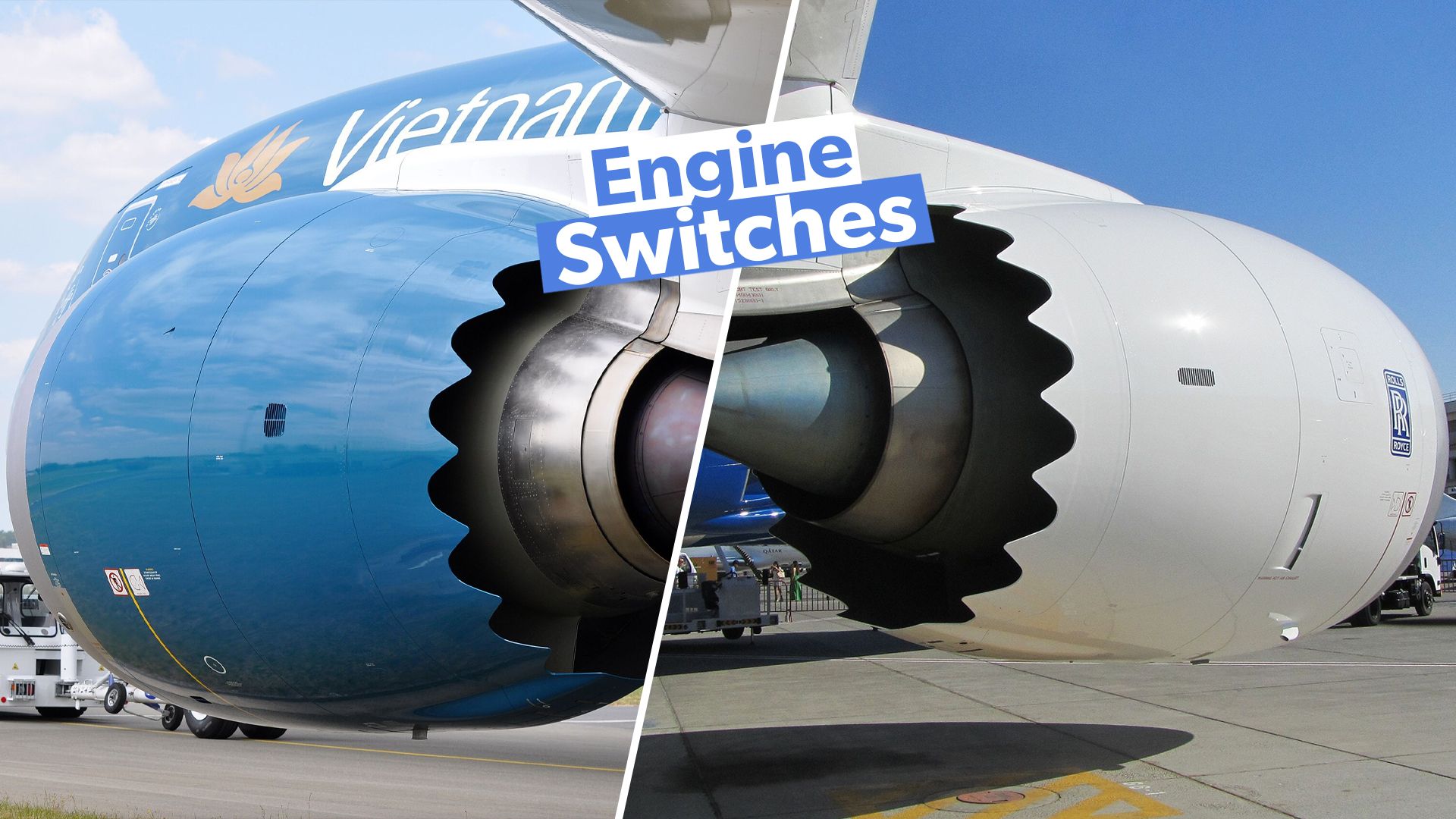

On the surface, one of the main reasons airlines could be switching between engines is that one has been performing better than the other. GE Aerospace has boasted that the GEnx

offers 1.4% better specific fuel consumption (SFC) versus “the competition for a 3,000 nautical mile mission.”

Photo: Tada Images | Shutterstock

Furthermore, the engine offers three times higher time on the wing, a 99.98% dispatch rate, and a 3% higher annual utilization. The time-on-wing and annual utilization advantage did not allude to comparison versus its competition.

Meanwhile, Rolls-Royce has highlighted that the Trent 1000

is 20% more fuel efficient than the 767

, which was replaced by the 787, and has 99.9% dispatch reliability since it entered service.

Photo: Joseph Creamer | Shutterstock

Boeing’s product page highlighted the design of the two power plants, namely the GE Aerospace GEnx and Rolls-Royce Trent 1000:

|

GE Aerospace GEnx highlights |

Rolls-Royce Trent 1000 highlights |

|

Leverages the GE90’s composite fan blades |

Latest swept aero hollow-fan-blade technology, an evolution of the Trent 900 ( Airbus A380 |

|

Incorporates a new composite fan case, providing significant weight savings |

Utilizes proven benefits of Trent three-spool engine architecture, providing operability and fuel consumption benefits |

|

An enhanced twin annular pre-swirl combustion system resulting in significant emissions reductions and turbine durability improvements |

Incorporates surface coolers for compact and efficient rejection of VFSG and engine oil heat |

|

Surface air-oil coolers to compactly reject the Variable Frequency Starter Generator (VFSG) and engine oil heat |

Uses the latest computational fluid dynamics-enabled 3D aerodynamics for high efficiency and low noise |

|

Uses the latest computational fluid dynamics-enabled 3D aerodynamics for high efficiency and low noise |

Allows power to be extracted for each VGSG through the second of three engine shafts, reducing idle speeds and consequently, fuel consumption |

While marketing materials presented by all three original equipment manufacturers (OEM), including Boeing, do not necessarily unveil the answer to why airlines have been switching toward the GEnx, there are certain advantages that the GE Aerospace engine has over the Trent 1000, including the SFC.

Photo: Kevin Hackert | Shutterstock

Data from the aviation analytics company Cirium showed that the average stage length of a 787 was 3,086 kilometers (1,666 NMI) in November. In June 2025, the average stage length should increase to 3,101 km (1,674 NMI).

Related

Rolls Royce Vs General Electric – Boeing 787 Engine Options Explained

Dreamliner customers have a choice of either Rolls-Royce or General Electric engines.

Reliability issues

However, the Trent 1000 suffered severe reliability issues until Rolls-Royce

was able to solve them in the early 2020s, with the pandemic, while grounding the majority of the global widebody aircraft fleet, providing Rolls-Royce with an opportunity. According to its 2020 annual report, it made excellent progress in resolving the Trent 1000 in-service issues during the year.

Photo: Chittapon Kaewkiriva | Shutterstock

“Partially aided by the lower aircraft utilisation due to the pandemic, we were able to meet our target to reduce the number of aircraft on ground to single digits by mid-year, subsequently reaching zero. We now have a buffer of available engines to safeguard against any risk of future disruption.”

Nevertheless, while the Trent 1000 was the first to enter service, and both engines have had reliability issues here and there, including the GEnx’s icing problems, the Rolls-Royce product began developing severe issues in 2016.

Then, All Nippon Airways

(ANA) was the first airline to discover turbine blade corrosion and cracking, with Air New Zealand

and Virgin Atlantic

later notifying that they had to ground some of its 787s due to the problems in 2017.

Photo: Toshi K | Shutterstock

Rolls-Royce’s 2017 annual report detailed that the company has discovered that “a small number of parts” had lower than expected durability, including compressor rotor blades and intermediate and high-pressure turbine (HPT) blades.

“We continue to make solid progress with longer-term solutions, largely through the re-design of affected parts, and we expect these to be fully embodied in the Trent 1000 fleet by 2022.”

In April 2018, Rolls-Royce disclosed that the intermediate pressure compressor (IPC) on Trent 1000 Package C engines had been experiencing durability issues. By May 2018, this had extended to a small number of Package B engines.

Photo: Vincenzo Pace | Simple Flying

The Trent 1000 Thrust, Efficiency, and New Technology (TEN), which entered service in November 2017, also suffered problems, which Rolls-Royce disclosed in April 2019.

“Following sampling of a population of Trent 1000 TEN engines that have experienced a higher frequency of flights at the upper end of their operating range, a small number of these engines have needed to have their HPT blades replaced earlier than scheduled.”

Related

How Rolls-Royce Solved Its Trent 1000 Issues

Affecting orders?

However, has this affected how customers chose their engines before the widely reported engine issues that began cropping up in 2016 and onwards?

As of December 31, 2016, Boeing had secured 1,497 gross orders for all 787

variants, with 886 of those being powered by the GEnx, while 454 aircraft would be powered by the Trent 1000. The remaining 157 aircraft had unspecified engines, which included 787s that ![]() Boeing

Boeing

never delivered, such as Aeroflot’s purchase of 22 787s.

Photo: Lukas Wunderlich | Shutterstock

From 2017 until October 31, 2024, Boeing secured 891 orders for the 787, with aircraft engine choices being split between 640 GEnx, 96 Trent 1000, and 155 unspecified.

|

General Electric GEnx gross orders |

Rolls Royce Trent 1000 gross orders |

Not specified (gross orders) |

|

|

As of December 31, 2016 |

886 |

640 |

157 |

|

Between 2017 and October 31, 2024 |

640 |

96 |

155 |

|

Total |

1,526 |

550 |

312 |

Clearly, post-2017 has not been favorable for Rolls-Royce and the Trent 1000, with the discrepancy between the two engine OEMs’ backlogs growing ever larger in the past seven years.

In addition, some airlines have switched to the other side, including British Airways, which has had to manage its capacity on certain routes due to supply-side issues affecting Rolls-Royce.

Photo: Vincenzo Pace | Simple Flying

During the Farnborough International Airshow in July, GE Aerospace announced that the parent company of British Airways, International Airlines Group ( IAG

), has selected the GEnx to power six of the British airline’s 787s.

“The GEnx-1B powers two out of every three 787 aircraft in service. The engine also provides a 1.4 percent fuel burn savings for the typical 787 mission compared to its competition.”

So far, British Airways has no GEnx-powered 787s, with the current fleet of 41 Dreamliners being powered by Trent 1000s. According to ch-aviation data, four of the 41 aircraft of the type are stored.

Other carriers have also switched their 787 engine providers. In December 2023, LATAM Airlines, which has 37 787s powered by the Trent 1000, announced an order for five 787s, with the airline opting for the GEnx for the quintet.

Photo: Vytautas Kielaitis | Shutterstock

In October, the South American carrier ordered another then aircraft of the type. While the statement did not explicitly say which engine would power those aircraft, Boeing’s orders and deliveries filings revealed that at least five will utilize the GEnx.

|

Airline |

Number of Trent 1000-powered 787s |

Number of GEnx-powered 787s |

Number of GEnx-powered 787 orders |

|

Air New Zealand |

14 |

0 |

3 (estimated delivery between 2026 and 2029 |

|

Air Tanzania |

2 |

1 |

1 (delivered in August 2024) |

|

All Nippon Airways (ANA) |

78 |

7 |

15 (three delivered in 2021 and 2022, another four in 2024) |

|

British Airways |

41 |

0 |

6 (estimated delivery between 2025 and 2026 |

|

Ethiopian Airlines |

10 |

19 |

21 (11 ordered in December 2023, none of which have been delivered, some aircraft have been delivered from lessors’ backlogs) |

|

LATAM Airlines |

37 |

0 |

10 (could rise up to 15, current Boeing order book showing five aircraft with not specified engine type) |

|

THAI |

8 |

1 (ex-Bamboo Airways 787-9) |

45 (engine order announced in February) |

For the time being, Trent 1000-powered 787 operators’ fleets are much larger than their GEnx-powered 787 counterparts, with Ethiopian Airlines being the only carrier that has more GEnx-powered 787s than those equipped with engines from Rolls-Royce.

Related

Emirates President Says Airbus A350 Engine Is ‘Defective’

Tim Clark stated that the engines of the Airbus A350-1000 cannot perform properly, which is why the airline has not ordered the A350-1000.