Spirit Airlines

, which declared Chapter 11 bankruptcy yesterday, has unveiled plans for how it will target and offer more premium leisure options, which should restore the airline’s sustainable profitability during the latter half of the decade.

Shifting customer demand and Project Bravo

Together with its Chapter 11 bankruptcy announcement, Spirit Airlines disclosed plans for how it will return to sustainable profitability, as well as the near-term challenges it has faced following the pandemic.

The low-cost carrier, which classified itself, Frontier Airlines

, and Allegiant Air

as the three major airlines within this market segment and described ![]() Alaska Airlines

Alaska Airlines

, JetBlue

, and  Southwest Airlines

Southwest Airlines

as ‘value’ carriers, pointed out it was the seventh-largest airline in the United States.

Photo: Spirit Airlines

Its main customer base comprised domestic and visiting friends and relatives (VFR) travelers, with the airline’s focus being serving the largest US metro and several large US and Latin America markets.

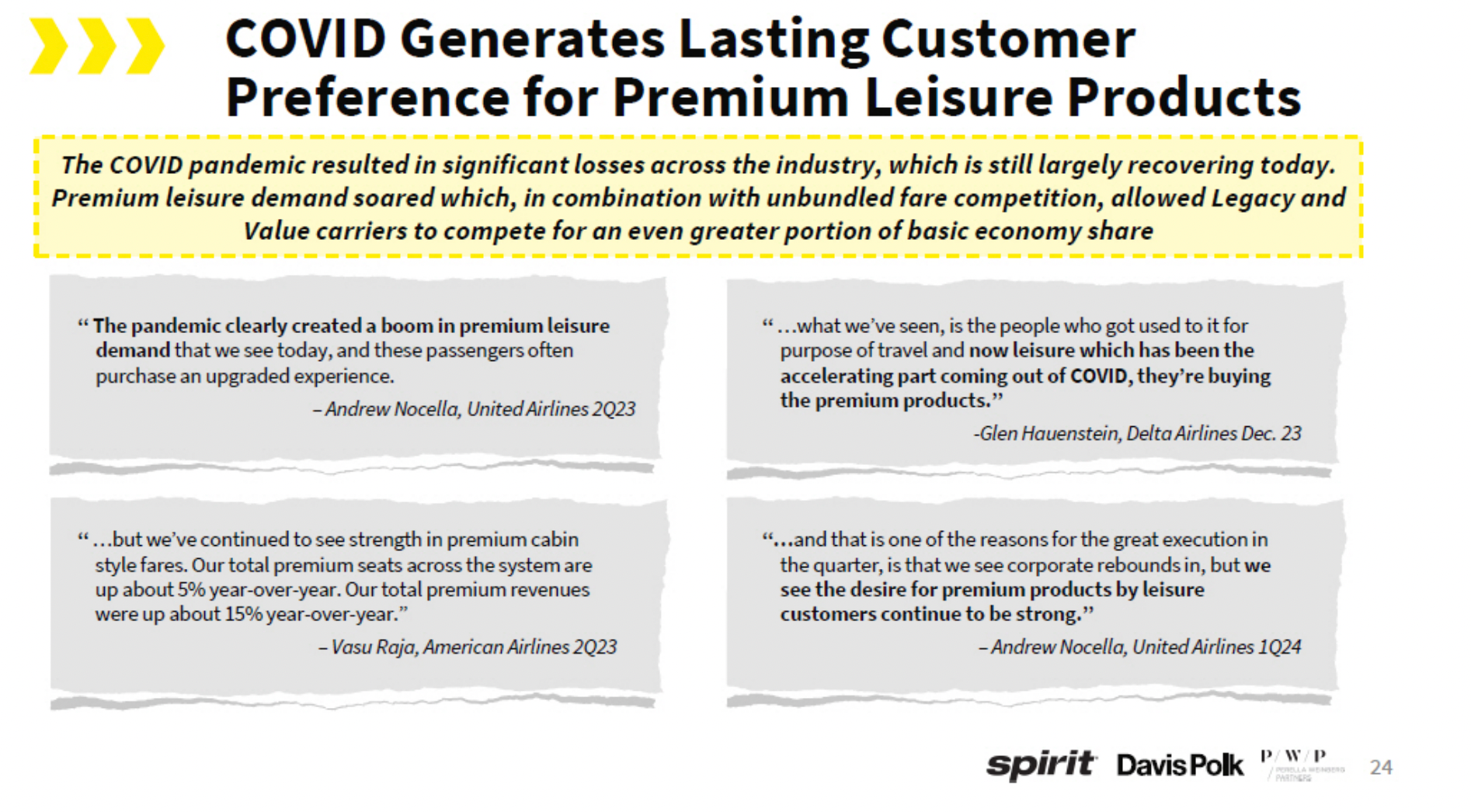

According to Spirit Airlines, the industry has changed significantly during the post-pandemic period due to shifting customer demand and operational headwinds.

Firstly, the supply of low-fare options from non-low-cost carriers has increased alongside more demand for ‘premium leisure’ options, with business travel failing to recover to its pre-pandemic volumes.

Photo: Spirit Airlines

Furthermore, inflation-related cost increases affected all airlines. However, no-frills airlines’ margins were disproportionately affected.

Lastly, issues at original equipment manufacturers (OEM), including 737 MAX issues, Airbus struggling to meet its delivery target, and Pratt & Whitney

PW1100G accelerated removals and inspections, have constrained capacity in the domestic market, according to Spirit Airlines.

The airline has been preparing for a post-failed merger with JetBlue reality since mid-2023. The merger was eventually blocked due to concerns about its impact on consumers in the US in January, and as such, Spirit Airlines has embarked on a comprehensive transformational plan called ‘Project Bravo.’

Related

Spirit Airlines Files For Chapter 11 Bankruptcy Protection

Spirit Airlines assured its passengers that its operations will continue during the process.

Preference for premium leisure products

The airline has already taken several steps to bolster its liquidity, which should provide a benefit of up to $1 billion at the end of the year. This included sale-and-leaseback (SLB) transactions in January, a $69 million termination fee it received from JetBlue, reduced pre-delivery payment (PDP) since it deferred numerous Airbus A320neo/A321neo deliveries, as well as PDP commitments, agreement with Pratt & Whitney for compensation over the grounded Airbus A320neo

/A321neo aircraft, direct lease and PDP transactions, and continued evaluation of asset financing.

Photo: Leonard Zhukovsky | Shutterstock

Spirit Airlines outlined that one of the pillars of ‘Project Bravo’ will be to maintain its cost advantage. The carrier admitted that while its unit costs have increased since 2019, it still has maintained a relative advantage versus its competition, with the exception of Frontier Airlines.

At the same time, the airline disclosed that its cost per available seat mile excluding fuel (ex-CASM) would increase by a low-double-digit percentage year-on-year (YoY), which will be offset by fuel efficiency gains. Thus, CASM, including fuel, will increase in the low single-digits (%) YoY.

Photo: Robin Guess | Shutterstock

The company acknowledged that its transformational project will modestly increase ex-CASM, yet the airline will still maintain its cost advantage.

A marketing campaign will also drive cost increases to overhaul its brand perception, onboard WiFi, catering, ground handling, and other product enhancements. Spirit Airlines noted that irrespective of ‘Project Bravo,’ unit costs will increase due to rising labor expenses.

Related

Spirit Airlines Postpones Q3 Report As It Negotiates Debt & Considers Alternatives

Spirit Airlines argued that all of its efforts have been diverted to ensuring it had enough liquidity to survive in the short term.

New passenger experience

Nevertheless, the core pillars of the project will be a reformed guest experience and network enhancements.

The former will apply to all customers, with the carrier taking a two-pronged approach: elevating the overall experience and differentiating premium and elite customers.

The overall experience improvements will include such items as free changes and a reduction or elimination of fees – already announced in May – on all fare types, a redefined check-in and boarding process, free WiFi for customers who have signed up for Free Spirit

, its loyalty program, and serving water and snacks for all passengers.

Photo: lorenzatx | Shutterstock

Loyalty program changes include the chance to redeem points for ancillaries. In addition, all customers are set to receive improved customer support service, which includes a promise to have a more customer-friendly approach to handling irregular operations (IROP).

To differentiate premium and elite customers, it will introduce four fare products – announced in July – and co-brand access for upgrades. The airline will also overhaul the airport experience, which includes dedicated check-in lines at key airports and priority boarding.

As a consequence of the new four fare products, which include the revamped ‘Big Front Seat,’ Spirit Airlines will introduce a new premium economy cabin with a blocked middle seat.

Photo: Spirit Airlines

Premium cabin passengers will get additional food and beverage items, with ‘Big Front Seat’ and ‘Premium Economy’ passengers having access to free WiFi for streaming, while economy travelers will get internet to browse the world wide web during their flight.

In terms of its network, Spirit Airlines outlined six key priorities that would be implemented with its transformational plan:

- Eliminating unproductive markets

- Shifting capacity to align with current market dynamics

- Increasing less-than-daily flying on specific routes

- Maximizing out-and-back flying

- Operating flights when profit is substantial and limiting capacity during off-peak periods

- Driving higher TRASM through codesharing, joint venture, and alliance agreements

Related

Spirit Airlines Raises $519 Million With Sale Of 23 Airbus A320 Family Planes

The deal should improve Spirit Airlines’ liquidity by $225 by the end of 2025.

Returning to profitability

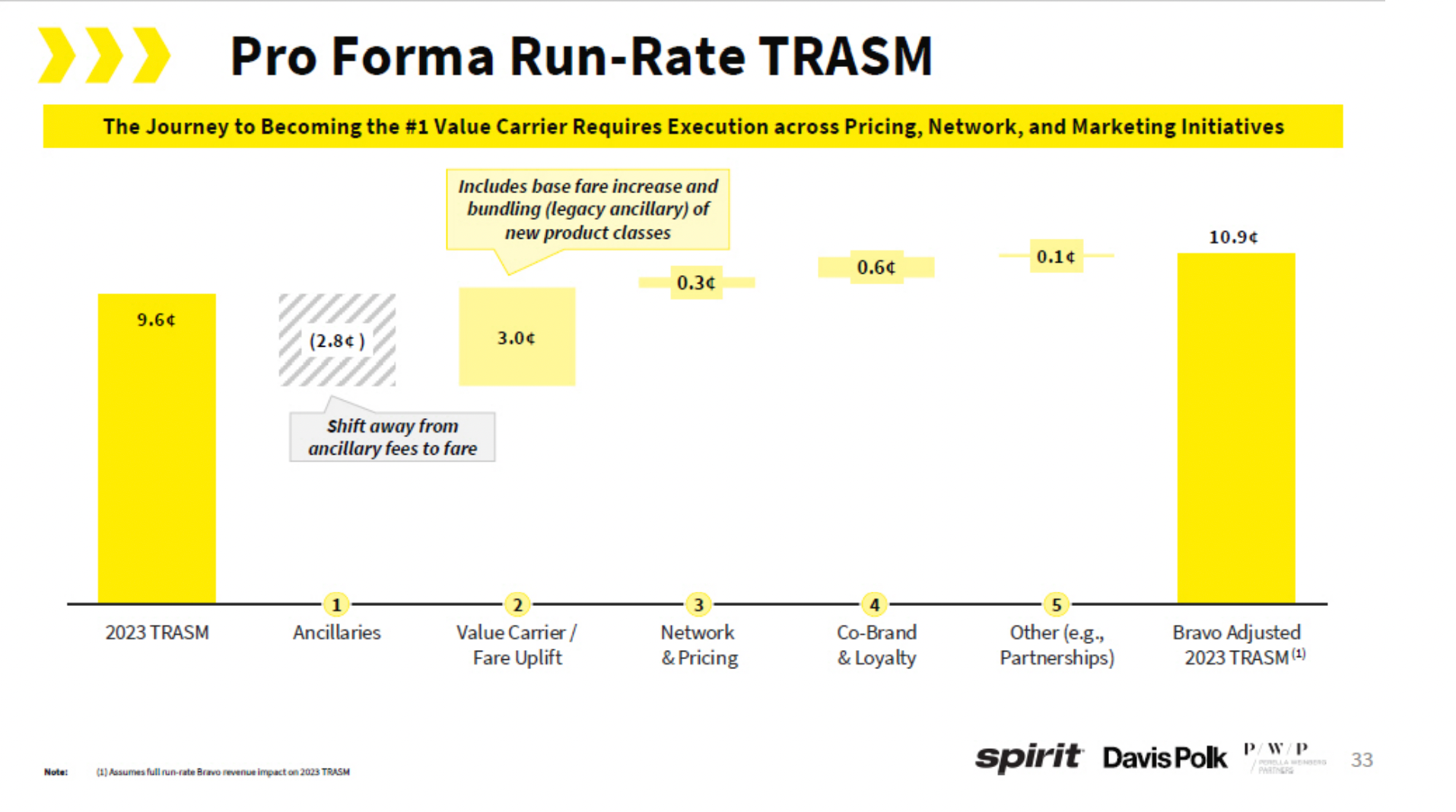

Spirit Airlines detailed that its 2023 total revenue per ASM (TRASM) was 9.6 cents, while its transformation plan-adjusted TRASM should be 10.9 cents, assuming a full run-rate ‘Project Bravo’ revenue impact on TRASM in 2023.

Photo: Spirit Airlines

The shift away from ancillary fees will result in a negative TRASM impact of 2.8 cents, which will be offset by a fare increase impact of 3 cents, and network and pricing, co-brand and loyalty, and other, including partnerships, positively impacting TRASM by 0.3 cents, 0.6 cents, and 0.1 cents, respectively.

In 2025, Spirit Airlines plans to revise its premium economy cabin, add in-seat power, new bins, and lighting inside the cabin, and introduce network and partner codeshare changes.

Throughout this whole process, which includes the already announced revamps of its cabin and fare products, it has conducted a marketing blitz to communicate about its improving operational reliability metrics, overall passenger experience, and the value of its loyalty program.

As a result of the new business model, Spirit Airlines aims to move from the $50 to $150 fare bracket to the $200 to $400 fare group, hoping to attract upmarket segments with higher engagement and willingness to pay.

Photo: Vincenzo Pace | Simple Flying

The company estimated that its average per-passenger revenue could grow from $122 (in 2023) to $138 following the implementation of ‘Project Bravo.’

Spirit Airlines estimated that it would end 2024 with a net loss of $915 million, swinging back to a profit of $316 million the next year and returning to a net loss of $10 million in 2026. During the next two years, the low-cost carrier plans to earn a net profit of $223 million and $484 million, respectively.

Related

Spirit Airlines Bankruptcy: Forecasting The Short And Medium-Term Ripple Effect On The Industry

Today’s news is bound to shake up the airline industry.