Despite growing passenger demand, many European airlines are still struggling to grow operating profits — including Ryanair, who posted a fall in operating profits in the nine months to September.

Low-cost competitors EasyJet and Wizz Air managed to increase their operating profits in the period, while IAG — the Aer Lingus parent — also increased operating profits.

Ryanair, however, recorded a 23% lower operating profit in the year to September, compared to the same period last year.

While results for the winter period are generally reported to have been buoyant and still to be published, Ryanair may still struggle to recoup earlier months’ lost operating profits.

Recent data highlights a landscape marked by both significant recovery in passengers’ appetite for travel, but also aircraft and engine supply bottlenecks.

The fourth quarter will have pushed total seat volumes above pre-pandemic levels, driven by sustained demand. However, the growth dynamic is not uniform across the different airlines or countries they operate in.

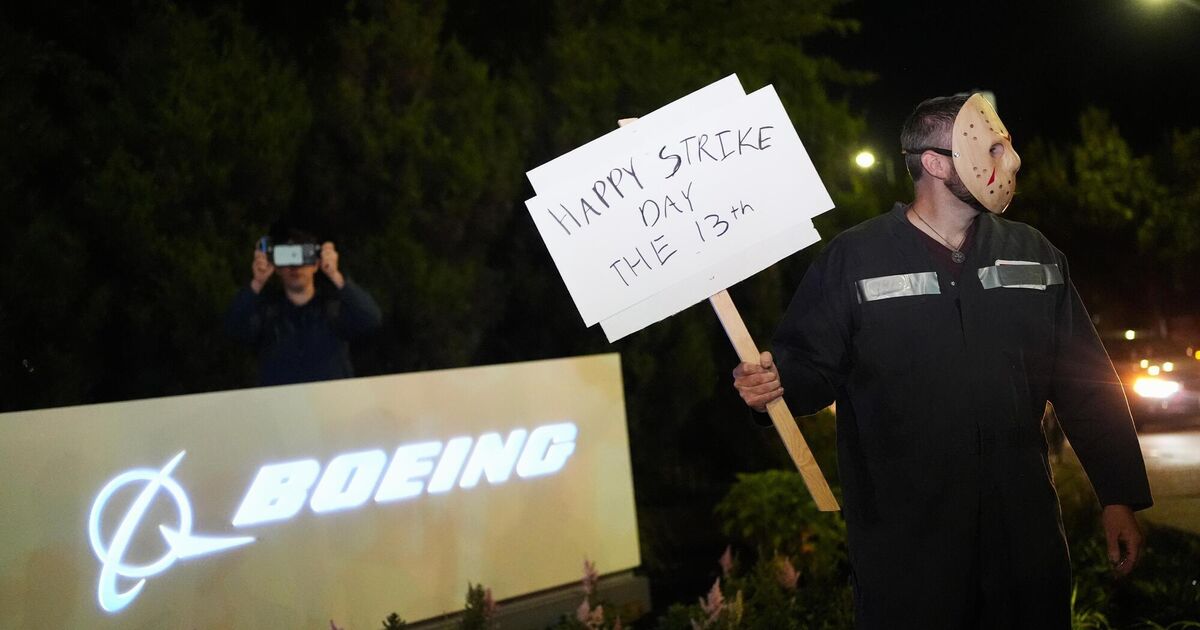

Boeing began 2024 with a door plug blowing off the side of a 737 Max flown by Alaska Airlines minutes after take-off. After settling a damaging union strike in the second half of the year, Boeing’s very bad year ended tragically on Sunday, December 29, as a 737 flown by Korean low-cost carrier Jeju Air crashed — killing 179 passengers and crew.

This did not help airlines such as Ryanair, who rely almost exclusively on Boeing for new aircraft supply. However, airlines across Europe who mainly use Airbus have also been forced to slow their rate of growth through 2024.

For example, Wizz Air has grounded 21% of its Airbus fleet due to engine problems — significantly limiting its ability to expand in key markets.

The troubles at Boeing and Airbus have a significant impact on the low-cost airlines who depend on continuous capacity expansion to boost revenue and maintain low operating costs.

The International Airline Transport Association (IATA) in its year end report stated that passenger numbers are expected to reach 5.2bn in 2025, the first time that the number of passengers has exceeded the 5bn mark.

However, the association separately warned of capacity issues across European airports — not just in Dublin Airport.

The imbalance between passenger demand and capacity at airports, most pronounced among domestic-focused low-cost airlines, may see budget airlines — such as Ryanair, EasyJet, and Wizz — pivoting into more long-haul routes to attract travellers with bigger budgets.

Operating profit margins will remain under pressure, according the association’s director general, Willie Walsh, with costs stemming from keeping older planes in circulation due to aircraft delivery delays at Boeing and Airbus, the volatility in the price of oil, and the cost of decarbonising in the year ahead.

However, the incoming Trump administration may re-introduce tariffs on Airbus aircraft and parts — forcing the EU to reciprocate on imports of Boeing. Tariffs and trade wars would dampen demand for air cargo and potentially also impact business travel.

Should the business-friendly stance of the first Trump administration continue into this term, gains from deregulation and business simplification could be significant. There is uncertainty regarding government support for aviation’s decarbonisation efforts in the US until the path that the new administration will take becomes clearer.

However, there is optimism amongst airline executives that Trump’s pledges of lower taxes will boost demand further and be more friendly toward mergers than president Joe Biden’s administration — which pressed carriers on issues like automatic refunds, and blocked a tie-up between JetBlue and Spirit Airlines Inc.