If an algorithm was created to track the number of times premium was used in North American airline discourse over a couple of years, the results would be significantly higher than profits at some of the region’s airlines.

Premium products, ranging from seats to lounge access, are cornerstones of nearly every major North American airline’s strategy – regardless of business model.

As a case in point – the decision by the ULCC Frontier Airlines to introduce a first class offering.

The push into premium products is arguably more than a decade old; but various factors have accelerated the adoption of them by unlikely airlines.

Now the question for 2025 and beyond is: if there’s a risk for oversupply in the premium space.

Summary

- Alaska Air Group effectively explains shifting fundamentals in the US marketplace.

- North American airlines plan to expand premium offerings as revenues from those products grow.

- For now, operators feel comfortable with the premium seat growth in the North American market.

- Lounges also remain a key tool in the competitive arsenal of those airlines.

Alaska Air Group believes that shifting trends in the US market will persist

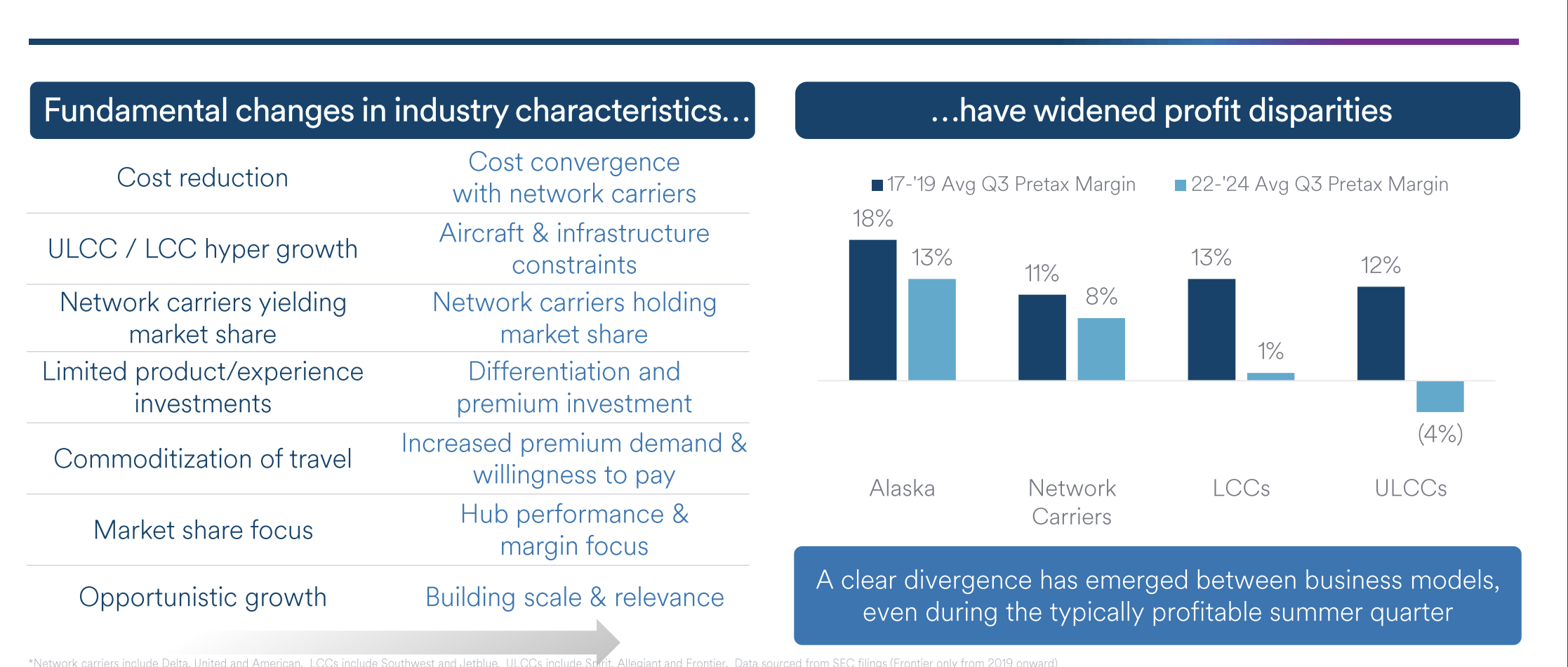

Management at Alaska Air Group offered a useful assessment during a recent investor day of changing fundamentals in the airline industry creating the “haves” and “have nots” in the market place – evidenced by average pre-tax margins of ultra-low cost carriers from 2017 to 2019, compared with 2022 to 2024.

Changes in US airlines industry dynamics and margins by business type-comparison for 2017-19 and 2022-24

Source: Alaska Air Group.

Citing those changes that have driven margin divergence, the Alaska CFO Shane Tackett said that those shifts would likely be persistent, “…and they are informing our thinking about our own business model going forward”.

The flurry of announcements in the ultra-low cost and low cost space regarding product refinements in the US culminated with Frontier Airlines‘ decision to introduce a dedicated first class, which was on the heels of its announcement to block the middle seat on the first two rows of its Airbus narrowbodies.

The 2×2 first class seats will replace the blocked middle seats.

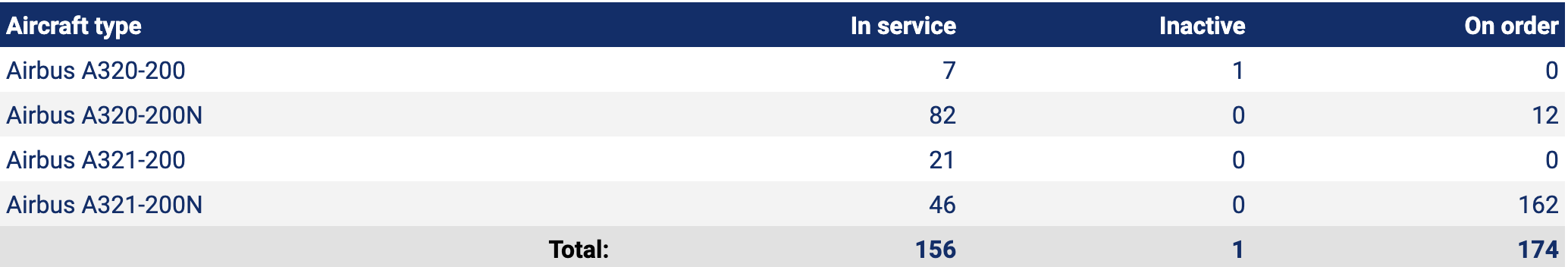

Frontier Airlines: fleet summary, as of late Dec-2024

Source: CAPA – Centre for Aviation Fleet Database.

“We’ve listened to customers, and they want more – more premium options, like first class seating, attainable seat upgrades, more free travel for their companions, and the ability to use miles on more than just airfare,” Frontier’s CEO Barry Biffle said.

But there is also an argument to be made that Frontier needs to bolster its revenue as its cost base increases. The airline has yet to forge a new pilot contract, after most of its US peers have negotiated agreements with record high salaries. Cost pressure will continue once a new contract is enacted.

Frontier’s fellow ULCC Spirit Airlines has also made product changes – but it is reorganising in US Chapter 11, and its future as a going concern is somewhat uncertain.

Spirit has warned that: “The outcome of Chapter 11 is dependent upon factors outside of its control,” including “actions” of the Bankruptcy Court.

See related CAPA – Centre for Aviation report: US aviation: is the ULCC model extinct in the US?

Opportunities to grow premium revenues are abundant…

It’s unsurprising that airlines across all business models in the US are flocking to premium products.

Delta Air Lines has forecast that premium revenue will surpass main cabin offerings by 2027. The company projects that premium revenue should represent 57% of its total revenue in 2024, with a long term target of 60%.

Premium revenues at both American Airlines and United Airlines grew faster year-over-year in 3Q2024 than their capacity.

Canada‘s only large global network airline, Air Canada, plans to grow its premium capacity by approximately 20%-25% by 2028, said EVP Revenue & Network Planning Mark Galardo during the company’s Dec-2024 investor day.

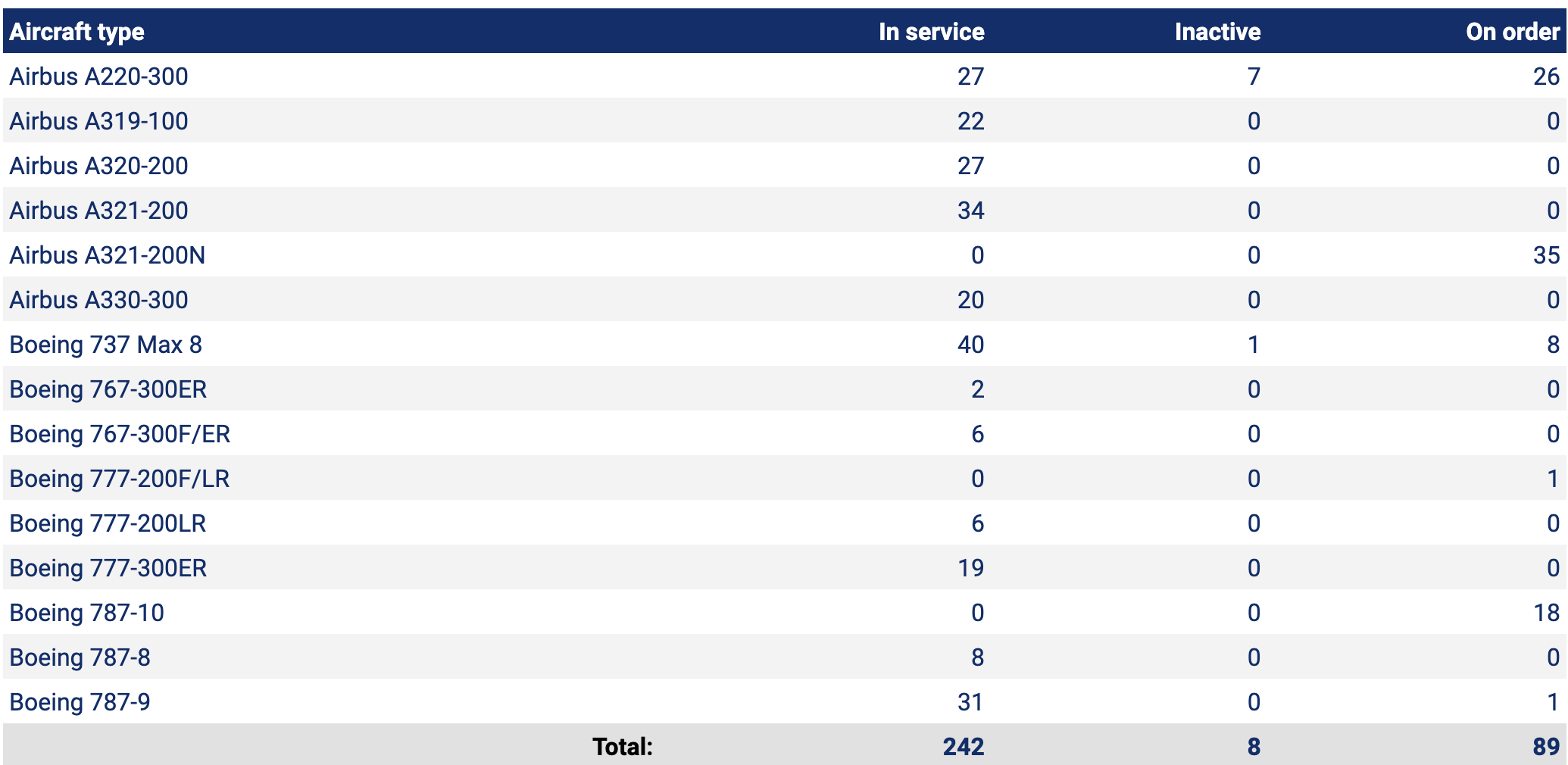

“We’re currently in the process of evaluating the options at our disposal to drive more of this capacity on our current wide-body fleet.” The airline’s twin-aisle fleet consists of Boeing 787-8s/9s, 777-200s/300s and Airbus A330s.

Air Canada: fleet summary as of late Dec-2024

Source: CAPA – Centre for Aviation Fleet Database.

…but do current premium demand levels have staying power?

The obvious question is: will a correction in premium supply become necessary? For now, airlines do not believe there is any risk of premium demand waning.

“Customers want premium seating, and at American our fleet plan is going to enable us to grow premium seats that we’re able to sell over the next few years by 20%,” said the company’s CEO Robert Isom at the Skift Aviation forum in Nov-2024.

Demographics appear to be playing a role in the popularity of premium products.

“If you look at the people who are sitting in the Delta One product right now on the trans Atlantic, the average age is probably 50, 55. And that’s skewed, right? There are people in their 30s and 40s, but there are people in their 60s and 70s. And I think that demand from this retirement [group] is going to carry us really, really well through the next few years here as the baby boomers continue to retire”.

Alaska’s management believes that passengers are willing to pay more for premium cabins on longer fights, said the company’s Chief Commercial Officer Andrew Harrison.

“Our data demonstrates that guests are willing to pay for [a] comfortable experience, the longer the flight,” he explained.

Importantly, said Mr Harrison, “…70% of our capacity is deployed on routes that [are] over four hours in length, so we are uniquely positioned to sell premium seats and experiences. These are flights where our guests are willing to pay 275% more than main cabin fares for first class, and over 90% more for a premium cabin seat.”

United‘s CFO Mike Leskinen explained to investors in Sep-2024 that while demand for premium products “…as far as we can see is not insatiable, but the level of increase in supply is being metered at a pace that I feel comfortable [with]. We will continue to see demand that is in excess of supply.”

North American airlines work to cultivate a comprehensive premium experience

Although premium products centre on cabin offerings, airlines stress that value extends throughout the journey.

“Premium is not simply about your seat on a flight,” said Mr Harrison, explaining Alaska aims to reach passengers at every point in their travels. The company has “…created an entire premium ecosystem through years of investment that just cannot be replicated overnight”. Components of that system include modernised terminals in its hub at Seattle, and fast check-in.

Lounges are Air Canada‘s most popular premium product, the company’s EVP Marketing and Digital Mark Nasr explained at the company’s investor day. He said that customers visiting a lounge generate 20% higher spend per booking.

Over the next three years, the airline company plans to add nine net new lounges and will renovate eight lounges, for an expansion of overall lounge capacity by 43%.

In addition to debuting its own first class in 2026 on aircraft not featuring its ‘Mint’ business product, JetBlue plans to open lounges at New York JFK and Boston Logan International in late 2025.

“Lounges are probably the single most significant thing customers have asked for that we have not offered,” the company’s CEO Joanna Geraghty said earlier in 2024.

Premium ambitions for North American airlines are high for 2025 and beyond – who will succeed, and who will fail?

There’s no shortage of ambitions among North American airlines to grow premium revenues, and they are putting the pieces in place during 2025 and beyond to capitalise on favourable prospects in that passenger segment.

As the industry embarks on 2025 and beyond, winners and losers will emerge in the execution of various strategies catering to passengers seeking a higher-end experience.