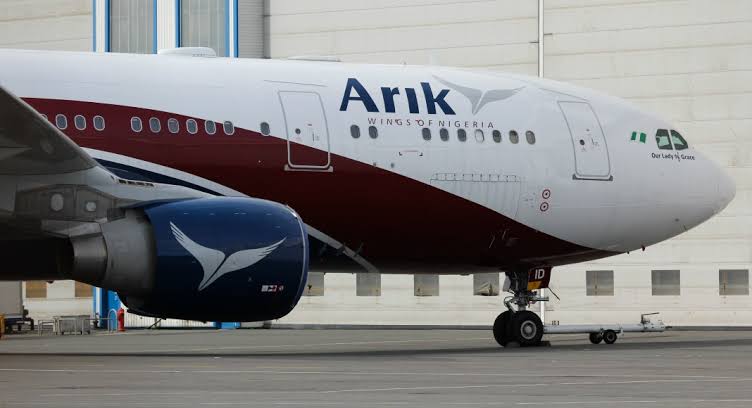

The Minister of Aviation and Aerospace Development, Festus Keyamo, has been championing essential air transport interventions to assure the safety of stakeholders’ investments. But one prolonged sob story that will further test his proficiency is the Arik Air tango between the Asset Management Corporation of Nigerian (AMCON) and Arik’s shareholders, WOLE OYEBADE reports.

Disputes are natural in all human transactions, including business transactions. Therefore, peaceful resolution mechanisms are in place, ranging from negotiation to conciliation and litigation.

However, the air transport sector is one industry that tends to lose more than it ever hopes to gain from litigation – the last resort in all dispute settlements.

A cursory look at the ramps and graveyards across major airports in Nigeria tells of the erstwhile serviceable aircraft that have come to ruins and losses over status quo ante while disputants are still battling it out courts, and often in clear violations of the Cape Town Convention that guides the dry-leasing of aircraft by major manufacturers.

Plenty of such instances of legal impediments have led to Nigeria being blacklisted by the likes of Boeing, Airbus, and the Aviation Working Group (AWG), which perceived Nigeria as a non-compliant country.

To change the narrative, the federal government introduced new guidelines last year for its Federal High Court to enhance compliance with the Cape Town Convention (CTC) and its associated Protocol on International Interests in Mobile Equipment, specifically concerning aircraft.

Days after the guidelines, the AWG – a not-for-profit legal entity comprised of major aviation manufacturers, leasing companies, and financial institutions – increased Nigeria’s CTC compliance index score from 49 to 70.5 per cent, and therefore, safe for aircraft leasing business.

This January, the Export Development Canada (EDC), a Canadian financial institution, was the first beneficiary of Nigeria’s new fervour for CTC compliance. The Federal High Court in Lagos granted EDC the right to repossess and teardown the controversial CRJ1000 aircraft with the registration number: 5N-JEE from the Arik Air’s fleet.

The court also stopped the men and officers of the respondent (Economic and Financial Crimes Commission) from harassing, intimidating, detaining and threatening to arrest the applicants or its contractor over the discharge of their lawful civil obligations to take custody, control and teardown of the aircraft.

It was a belated relief for the creditors but a victory for the industry and the national image, showing stronger character in honouring agreements with foreign partners.

However, of subsisting concern are several similar disputes between local parties and the dire need for similar interventions. One such industry embarrassment is the seven-year-old dispute between the Asset Management Corporation of Nigeria (AMCON) and shareholders of Arik Air.

A rescue mission gone awry

Recall that the federal government’s special asset recovery vehicle, AMCON, took over Arik Air in February 2017 as part of measures to “save” the airline from “imminent collapse”. AMCON had cited gross mismanagement by the owners of Arik and debt of over N300 billion.

Buoyed by what to do with the airline after six years, the federal government, through AMCON, decided on a new carrier, NG Eagle, from some viable assets of Arik Air. About four Boeing 737 airplanes that once belonged to Arik have been stripped and rebranded into NG Eagle’s livery in 2021.

But, if upturning Arik’s fortunes was difficult, flying NGEagle could only be harder. AMCON’s controversial exit strategy from the operations of embattled Arik Air ran into a conflict of interest, with the National Assembly ordering the Nigerian Civil Aviation Authority (NCAA) to withhold its Air Operator Certificate (AOC). The consequence is attendant losses on three grounded aircraft, insurance premium, staff salaries and other operating costs.

Former managing director of AMCON, Ahmed Kuru, said earlier that the plan was to keep the airline running through the receiver manager and find means of resolving the grey issues, not liquidate the carrier.

Kuru said: “There’s always a way out of every resolution situation; it’s just a question of give and take. What is important is for us to sit down with the owner of Arik Air, if he (Sir Johnson Arumemi-Ikhide) is ready, and then agree on what makes sense to him and us, to the government. Then, we’ll return to the Central Bank and the Ministry of Finance and share the resolution with him. We’ve resolved more complicated issues than Arik, but the two parties must understand that they want a resolution.” The resolution didn’t happen.

The Head of Corporate Communication at AMCON, Jude Nwauzor, told journalists in Lagos that at the heart of the conflict is the total debts of N455 billion as of December 31, 2024, and in all his investments by the carrier’s shareholders.

Giving the breakdown of the total debts, Nwauzor alleged that Arik, as of December 2024, owed AMCON N227.6 billion, Rockson Engineering N163.5 billion, while Ojemai Farms owed the corporation another N14 billion, totalling N455 billion. Arumemi-Ikhide owns the three indebted companies.

The spokesperson further said that Arumem-Ikhide, in some of its agreements with AMCON, agreed to the debts owed the corporation and signed an agreement on payback but failed to honour his words.

AMCON insisted that despite the campaign of calumny against it, it would ensure the debts were recovered and return the companies to profitability.

Nwauzor noted that Arik Air was taken over through due process. He said AMCON had been part of Arik Air since 2011 but was compelled to take over the company in 2017 by appointing a receiver manager after several interventions failed.

He explained that the receiver manager also had the option of either managing or selling off the assets of a debtor company like Arik Air. Still, AMCON decided to keep the airline running through the intervention of the Federal Government.

In reaction, the Arik shareholders denied all wrongdoing. The Media Office spokesperson for Arik shareholders, Godwin Aideloje, said that the airline’s financial state claims were false.

Aideloje said that the airline’s challenges stemmed not from financial mismanagement by the airline itself but from AMCON’s poor handling during the receivership process.

He noted the loss of both aircraft and equipment. “One notable incident involved the seizure of a Boeing 737-800NG in Lithuania in 2023 due to AMCON’s failure to meet the airline’s financial obligations. Another Boeing 737-700NG was abandoned in Malta, where it was later dismantled and sold in the grey market.”

He added that two other aircraft were left in a deteriorated state in Johannesburg and Addis Ababa, with missing engines. These developments further exemplify the disastrous handling of Arik Air under AMCON’s receivership, causing irreparable damage to the airline’s assets and operations.

“AMCON’s mismanagement of Arik Air under AMCON’s receivership has caused immeasurable harm to the airline, its employees, and Nigeria as a whole. AMCON must stop its pattern of misinformation and be held accountable for the destruction it has caused.”

The shareholders’ office urged the public to demand transparency in AMCON’s dealings and to hold the corporation responsible for the long-term consequences of its actions.

Aideloje emphasised that this issue transcends Arik Air alone. “It is about the need for proper governance and accountability within AMCON to prevent further damage to Nigeria’s corporate and aviation sectors.

“This is not just about Arik Air; it’s about ensuring that AMCON does not continue to harm Nigeria’s corporate landscape while avoiding accountability,” he said.

However, for neutrals, it behooves the parties and the industry at large to find a better mediatory mechanism to resolve the embarrassment.

Where litigation stalls, try mediation

Aviation union leader, Olayinka Abioye, reckoned that the Arik Air episode was a good business gone sour, and saddened by the unfolding drama whereby certain individuals are being arraigned in court on the grounds of embezzlement, and the concerned parties unable to reconcile the debt toll.

His worry partly stems from AMCON’s failing to inform Nigerians how much it had made (in profit) since taking over the airline and how much has been retrieved from the former owner, given the fact that payments were said to have been made, and companies seized to recover loans taken but not repaid.

“I agree that this embarrassment to the industry can be checkmated if the Honourable Minister of Aviation and Aerospace Development intervenes, given his legal profession and deep knowledge of loan repayment issues and all of that.

“He can call all parties to a roundtable and sort them out. Maybe they may be advised to settle out of court and forget about their bruised ego and the usual Nigerian pride. I advocate for an amicable solution to this controversial issue through dialogue outside of the courts,” Abioye said.

Apparently in agreement, Secretary of the Aviation Safety Roundtable Initiative (ASRTI), Olumide Ohunayo, noted that the embattled shareholders of Arik Air are now emboldened by the fresh EFCC case against the ex-MD of AMCON, Kuru, and other staff over their roles at Arik.

He said: “I see that as one side of the coin, and with that, I see the need for AMCON to either get out of Arik or liquidate the airline immediately. Either the owners pay the debt owed, or the federal government step in to take the two carriers under AMCON (Arik Air and Aero Contractors) and merge them into one to form a strong carrier.

“Whichever way, arbitration and negotiations should be important. But if they continue on this warpath, I see liquidation imminent, with dire consequences for all parties. While AMCON was applauded at the point of entry, they also have the responsibility to account for the revenue recovered since they stepped in to manage the situation,” Ohunayo said.

Above all, the Arik Air conundrum is an ill wind that blows nobody good. But the parties can still come to a win-win solution rather than prolong mutual loss.