Both Philippine Airlines [PAL 4.40 ?6.6%] and Cebu Pacific [CEB 34.50 ?1.6%] posted their FY24 earnings on Friday. PAL booked P8.1 billion in net income (down 62%) on P178 billion of gross revenue (down 1%). CEB booked P5.4 billion in net income (down 32%) on P105 billion of gross revenue (up 16%).

> The good: Passenger volumes are way up. PAL flew 15.6 million passengers in FY24 (up 12%), while CEB flew 24.5 million passengers (up 18%). While PAL’s number is not a corporate record (that’s the 16.7 million people it flew in FY19), CEB’s number is a corporate record that defeated its previous best of 22.5 million passengers set in FY19. Overall, it’s safe to say that the number of passengers is at least back to pre-pandemic levels.

> The bad: Planes are ridiculously expensive to buy, maintain, and operate. Both CEB and PAL saw their positive operational trends cut off at the knees by expenses like fuel, repairs, and maintenance. There’s a worldwide shortage of new planes, used planes, and plane parts, so any repairs are more expensive and more time-consuming to conduct than they were before. Anyone flying on PAL will know that the duct tape is already out of control. The number of malfunctioning entertainment units in Business Class is shocking.

> The ugly: Money is ridiculously expensive to rent, and that’s been the more insidious expense eating away at the profitability of our airlines. Interest rates are at or near generational highs, and while the business community was excited for the possibility of lower rates after the BSP’s pivot, that rush to cut rates has really stalled out. Sure, the BSP is thirsty to cut the reserve rate for banks, but that’s not helpful to consumers (or to airlines) who are trying to hold on for dear life.

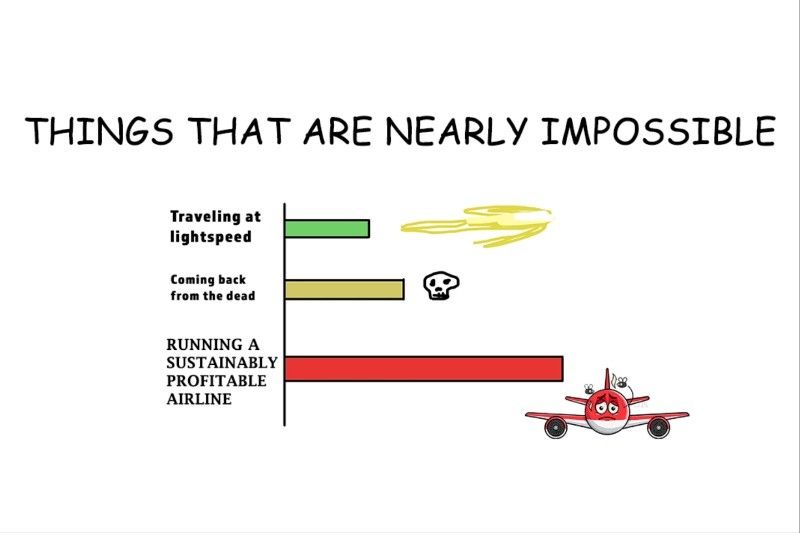

MB BOTTOM-LINE: Airlines are just so exposed to every problem. Inflation makes planes and fuel cost more, and eats away at the discretionary income that passengers use to fly. Fuel price shocks erode profits, and consumers are notoriously sensitive to ticket price shifts to offset those losses. Basically, every natural disaster known to man can throw off schedules, from typhoons to earthquakes, or (as COVID and SARS taught us) communicable diseases. Like a delicate desert flower, when they’re in bloom, they’re amazing to look at–so vibrant and full of life. But when the rains dry up and the ground turns to dust, the petals wilt and the leaves wither, and the whole thing just starts to look like an exercise in futility. I recognize that those are pretty big words for two businesses that pulled in a combined P13.5 billion in net profit last year on P283 billion in revenue, but Robinsons Land [RLC 11.96 ?2.4%] pulled in P15.3 billion in net profit and only took P43 billion in revenue to do it. Land development isn’t a risk-free business by any stretch of the imagination (just look at what’s happened to the commercial real estate market), but those slim airline profits look mighty perilous considering all of the long-term obligations needed to fly and all of the headwinds that can knock an airline off course along the way.

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.