The third edition of the Future Aviation Forum, which took place in Riyadh on May 20-22, 2024, served as a platform on which to present Saudi Arabia’s ambitious plans to become one of the epicenters of growth for the aviation industry over years to come.

While a handful of flagship projects such as the launch of new national carrier Riyadh Air and the gigantic expansion of Riyadh’s King Salman International Airport (RUH) have often monopolized the headlines, the Saudi plans are holistic, encompassing the whole aviation value chain.

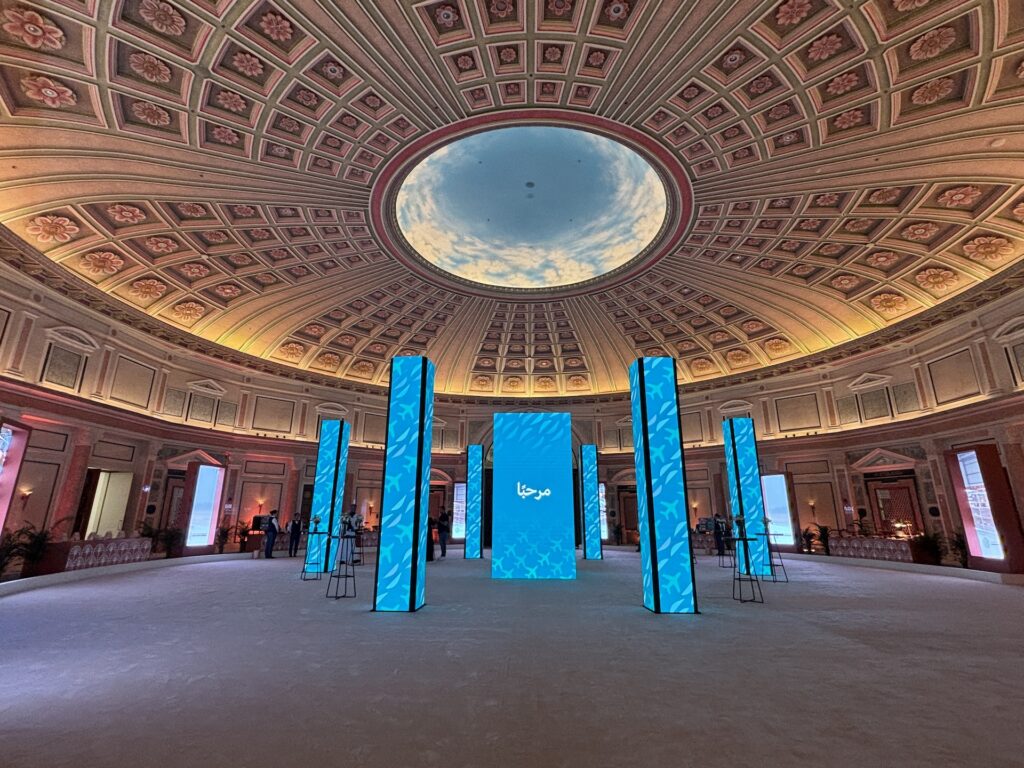

AeroTime was on the ground at the King Abdulaziz International Conference Center (KAICC), in Riyadh, to learn more about the Saudi Aviation Strategy (SAS), which was presented during the Forum, and we spoke with some of the main players involved in its design and implementation.

The backdrop to this apparently sudden interest in a fast-paced development of the Saudi aviation industry is nothing other than the Vision 2030, which acts as a sort of strategic masterplan for the whole Kingdom and has economic diversification as one of its core pillars.

The Saudi vision for aviation is also closely intertwined with the broader goal of making the Kingdom one of the world’s top tourist destinations.

Gloria Guevara, a former Mexican Tourism Minister who is currently Chief Special Advisor to the Saudi Ministry of Tourism, explained to AeroTime: “Why do we want to diversify? Well, this country has had a lot of oil for many years, but it also has a lot of assets and great culture and great gastronomy and a lot of natural resources. We also want to share it with the world, create employment and have a benefit.”

Guevara explained that the country is investing $1 trillion in tourism and infrastructure. A large chunk of this investment is going to NEOM, a massive development project in the northwest of the country, with the rest going to a combination of other giga-projects, plus infrastructure initiatives and companies tasked with the further development of the sector.

To provide a reference for the scale of these plans, Guevara alluded to the fact that, in order to fulfill them, Saudi Arabia is looking to expand its hotel capacity by at least 500,000 rooms.

Another initiative called Air Connectivity is also supporting the establishment of new air routes linking Saudi airports with international destinations. Guevara explained that, in the 12 months preceding the Forum, around 20 new routes have been launched within the framework of this scheme. A lot of this growth is expected to happen within the Middle East region, but Europe, America and Asia are also seeing increased traffic to Saudi Arabia.

A case in point is the Chinese market. By 2030, Saudi Arabia wants to attract between four and five million Chinese visitors.

In February 2024, Saudi Arabia signed an agreement with China to promote air links between the two countries. This has resulted in the establishment of new nonstop routes by Chinese airlines. On April 2024, China Southern launched nonstop flights between Beijing (PKX) and Riyadh (RUH), followed a couple of weeks later, on May 6, 2024, by Air China, which started its own thrice weekly service between the two capitals. These route inaugurations followed the launch in April of 2024 of China Southern Airlines of nonstop flights between Shanghai (PVG) and Riyadh.

Are these growth expectations realistic? At the Future Aviation Forum, AeroTime had the chance to pose this question to André Martins, a partner at consulting firm Oliver Wyman and head of the firm’s Transportation and Services Practice in India, Middle East and Africa.

“We see that the global growth in air traffic is moving towards Asia and the Middle East via other parts of the world and there is still a very, very sizable connection flow that connects through this region. We expect that connecting flow to pretty much double or even triple in the next few years. So, there are still very sizable opportunities for Middle Eastern carriers to tap into,” explained Martins.

“There are different drivers of that. One of them is obviously GDP growth. Traffic is highly correlated with GDP growth and with population growth, which would be the second driver. What’s more, in some countries in this region there was historically a lack of connectivity and the propensity to travel for the citizens was not the same as that of other markets. There is a lot of tourism opening as well, with new events happening in the region: conferences, sports events, other types of big activities that attract a lot of inbound traffic as well.” he continued.

“Some of the markets in the GCC (Gulf Cooperation Council) have been a bit more advanced than others, but when you look here, at Saudi Arabia, there is a big push on the tourist offering side, which will attract domestic as well international tourism in years to come. We expect that all these underlying drivers will help traffic grow.” Martins said, before adding a note of caution. “There will be more competition as well, because supply is catching up very fast in terms of new airports, new airlines, new aircraft. Therefore, we expect that, in years to come, there will be a bit more pressure on the revenue management side of airlines and some more pressure on the yields and on the financials.”

So far, the Saudi aviation and tourism sectors appear to be delivering.

In December 2023, Saudi Arabia reached the 100 million tourist mark defined in terms of trips, seven years ahead of its target. Of these, 27.4 million were international travelers, and the rest domestic travel. Following this success, the visitor figure target for 2030 has been revised upward, to 150 million, of which 70 are expected to be international.

Saudi Arabia also aims to play a larger role in global logistics, with the air cargo sector being another object of a thorough growth and development plan.

AeroTime spoke with Awad Al Sulami, Executive VP for Economic Policies and Logistics at GACA, the Saudi Civil Aviation Authority.

In addition to acting as the country’s regulator, GACA is also the governing body of the free trade zones that have been established in the vicinity of Riyadh airport (and soon of other airports in the Kingdom too).

“These free zones are designed to be an economic accelerator. We are creating an environment for investors to come here. Not only creating an environment for investors to come with incentives such as zero corporate and capital repatriation taxes plus 100% ownership. Plenty of others are doing the same thing, but we are also providing access to the market, to the economy, and a direct connection to the airport itself. Investors don’t need to do clearance between the zone and the airport. It’s the gateway for re-export and, at the same time, to serve a big market in Saudi Arabia.” he explained.

Al Sulami explained also how the airport free zones will be connected to each other and with other key multimodal logistic hubs.

“The first free zone in Riyadh is connected to the airport, also with the bonded warehouse that we have on the East Coast, at Dammam International Airport, and has also an inland transport connection with a dry port. So, it’s well connected with whichever other (customs-)bonded areas you find within the country. The one in Jeddah is going to be connected to the port and the airport and with bonded warehouses in the south. The regulation and policies of these zones are 100% about enabling all this connectivity”.

Saudi Arabia has also been rolling out new laws specifically in support of the country’s aviation goals. Al Sulami alluded to new laws being passed in Saudi Arabia in October 2023, providing a new legal framework for air freight and airport ground handling.

“By creating these laws, we’re making sure that whoever comes to us as an investor in the zone is getting transparency when it comes to the relationship between the private sector, the airport and the rest of the stakeholders,” he explained.

As an example, Al Sulami mentioned a recent deal with SATS, a major Singapore-based airport ground services operator, which has recently invested in new terminals in Dammam (DMM) and Riyadh, followed by the signing of a 25-year concession agreement to build yet another terminal in Jeddah (JED).

“The fact that investors are rolling in after the passing of this legislation is a clear testimony to the fact that the new regulation is actually in favor of investors, it’s making it easier for them to penetrate the market,” he added.

Some other legislative changes have been aimed at fostering the growth of the executive aviation industry in the Kingdom.

As we reported on May 14, 2024, within the framework of the Kingdom’s aviation strategy, Saudi Arabia aims to expand its executive aviation industry tenfold.

The new regulatory framework provides more flexibility for private jet operators to sell empty-legs (that is, flights that otherwise run empty because of aircraft repositioning), and it has also removed VAT in order to equalize the obligations of local and foreign operators.

In addition to committing to reduce the cost of fixed based operators (FBOs) and maintenance, repair and overhaul (MRO) activities, the Saudi executive aviation plan also contemplates some investments in new physical infrastructure, such as the opening of six airports dedicated exclusively for general and executive aviation and the opening of dedicated terminals at seven additional airports (only two such facilities existed as recently as 2021).

The elephant in the room is, of course, the increasing concern in some quarters of international public opinion about aviation’s environmental impact.

AeroTime asked Captain Sulaiman Almuhaimedi, Executive Vice President for Aviation Safety and Environmental Sustainability at GACA, about this matter:

“We have developed an environmental sustainability program, which is based on seven pillars: greenhouse gases, noise, biodiversity, waste management, energy and water management and, last but not least, climate change adaptation, to protect the industry from new weather phenomena in order to assure the safety of operations. We are taking a comprehensive approach to lower the environmental impact to the minimum possible while guaranteeing the development of aviation activities to meet the goals of our aviation strategy.” he said.

Saudi Arabia also wants to be one of the global pioneers in the roll out of electrically powered advanced air mobility technology.

In fact, the Future Aviation Forum has a dedicated Advanced Air Mobility Pavilion, complete with full scale mockup of eVTOL aircraft such as Archer’s Prosperity, Joby Aviation’s S4, EHang’s EH216-S and Flynow’s unipersonal battery-powered helicopter.

US-based Archer, which has just completed one more step towards its FAA certification, is exploring partnerships for a Saudi roll-out, after having already signed a similar partnership in the UAE with neighboring Abu Dhabi.

Also during the Future Aviation Forum, EVE Air Mobility, the advanced air mobility arm of Embraer, announced a Memorandum of Understanding (MoU) with Saudia Technic, the MRO arm of the Kingdom’s flag carrier, to explore the possibility of servicing Saudi-based eVTOLs in the future.

Captain Sulaiman Almuhaimedi referred also to the Advanced Air Mobility Roadmap as an important part of the Saudi aviation strategy.

“The advanced Air Mobility roadmap has one main objective, which is the safe integration of the emerging technologies into the current ultra safe national navigation system. The roadmap looks at advanced air mobility integration from a wide scope, not only from an aviation point of view, since those technologies will be operating within urban areas and we need to coordinate and align with different governmental agencies which are not related to aviation,” he said.

“So, we built the roadmap upon six pillars, starting from the technology: we are contributing heavily to the incubation and testing of new technology. We have already tested several eVTOL vehicles in Saudi Arabia, especially in NEOM, and during the next Hajj, we are also going to test air taxis. These technologies will be employed to serve millions of pilgrims that gather in a very small and highly populated area. We want to make sure we can use the infrastructure, whether it is tangible, such as airports, vertiports or charging facilities, or intangible infrastructure, like the airspace. We’re planning to make sure that we properly design low airspace operations to make sure that these new technologies can operate safely and also coexist with conventional aviation activities,” explained Captain Sulaiman Almuhaimedi.

He added “We are also working on advanced communications, because those aircraft will need real time connectivity and we want to make sure we have the required communication to guarantee a continuous exchange of data.”

He also referred to other aspects that will be necessary for successful eVTOL operations such as human capital, public acceptance and the need to have the right regulatory framework, both on the aviation and non-aviation side of things.

“When it comes to non-aviation regulations, we particularly focus on cyber security measures to make sure that we will secure those technologies from hacking, interference and any other emerging cybersecurity risks.”

He concluded: “You know, the beauty of safety is that safety is never a competition. Rather, it’s a collaboration. We are reaching out to collaborate with all our partners around the world, be they aviation authorities, OEMs, service providers, experts, academia – all of them!”