On today’s episode of Catalysts, Yahoo Finance’s Alexandra Canal and Seana Smith break down the morning’s trending tickers — with BYD (1211.HK) trading higher on a long-range electric vehicle announcement and Cava (CAVA) shares sliding after a slowdown in same-store sales growth.

The episode also explores major moves in the energy sector with Sankey Research President Paul Sankey, as ConocoPhillips (COP) is set to acquire Marathon Oil (MRO) in a $17.1 billion all-stock deal. Hess (HES) shareholders have also voted to approve the oil company’s pending $53 billion merger with Chevron (CVX).

Moving to the transportation sector, American Airlines (AAL) has slashed its second quarter guidance and announced the departure of its chief commercial officer, Vasu Raja. Raymond James Managing Director Savi Syth joins Catalysts to share her outlook on the company’s path forward.

Later, Yahoo Finance Executive Editor Brian Sozzi joins Catalysts to interview Chewy (CHWY) CEO Sumit Singh, who describes the “normalization” he is seeing in the pet industry highlighted by demand tailwinds and more balanced pet adoption rates.

And with the verdict in former President Trump’s criminal trial looming, AGF Investments Chief US Policy Strategist Greg Valliere joins Catalysts to discuss how the case’s outcome may impact markets and the election.

This post was written by Gabriel Roy

Video Transcript

It said here in New York City, I’m John Smith alongside Alexandra Canal.

Let into the catalyst.

Moving markets today stocks are falling this morning with the NASDAQ pulling back after closing at a new all time high on Tuesday A I for I might no longer be able to come, be around the f next move.

But could Fridays PC be the next positive catalyst for the market rally will discuss and big deals in the oil and gas industry.

Chevron closer to buying has after shareholders approved the $53 billion bid and comical Phillips is nearing a deal with a marathon oil.

Could regulatory scrutiny put these deals in jeopardy.

Plus American Airlines slashed its sales outlook and booted its chief commercial Officer on Tuesday.

The news and shares of American and its competitors lower will discuss what American Airlines was says about the industry.

But first, today’s top story, big deals in the energy space, the US oil and gas industry went on a $250 billion buying spree in 2023 and we’re seeing that trend continue.

Has shareholders just approved Chevrons $53 billion acquisition of the company joining us now as Paul.

Thank you.

Thank you, President and lead analyst, Paul.

Thank you so much for joining us.

As we just mentioned, we’ve seen increased consolidation in this industry, not just with Chevron and has but also Exxon and pioneer and now a new report about Can go Philips and marathon oil.

Why is this happening now?

And what can it mean for the future of oil production down the line?

Well, generally speaking, this is a capital, capital, intense business.

So the bigger you are, the more efficiencies you gain.

So for example, today, in the case of Conoco buying marathon oil, they’re talking about $500 million a year of synergies.

And of course, what we additionally get is a high free cash flow whilst they, they spend a lot of money in, in next generation, particularly in liquid natural gas.

So it, it does all make sense, Paul, what do you think the regulatory scrutiny is going to look like here for the deal with Chico and Marathon oil?

And then also just in terms of the likelihood and how everything is going to going to play out with Chevron and House.

Well, unfortunately, the government agencies here, the, the Fair Trade Commission and uh the Environmental Protection Agency, the FTC and the EPA have both become quite highly politicized.

And of course, as you’re well aware, we’re in an election year.

So there’s more scrutiny without any doubt about these deals.

But we have just seen Exxon for pioneer get approved with a little bit of a, a grandstanding uh proviso that Scott Sheffield the CEO as was of pioneer would not be allowed to go on the board of Exxon, that the big picture there was that nevertheless, that the deal was approved Exxon Pioneer.

And so the expectation is that without any great potential to change gas prices at the pump, these deals uh will be approved over the course of the next six months.

You mentioned that we’re in an election year.

How has the oil industry been bracing for this upcoming election?

And what’s the risk reward situation here depending on who’s in that oval office come November?

Well, over time, we found that actually the oils tend to do better under the Democrats than they do under the Republicans.

I mean, this is really something that’s occurred since uh since Obama.

Um And then, you know, there was a very tough period for the oils, but of course, it was COVID related during the Trump administration.

So it’s not, you know, necessarily obvious whilst the stocks tend to go up, for example, in the case of a Trump win or go down in the case of a Democrat win.

Uh in reality, the way they perform uh tends to, to be unrelated to the specifics of an election victory because the bigger picture is that whilst everyone in politics and DC grandstands about the oil industry gouging and changing prices at the pump and everything else.

All of that stuff has been illegal since 1910, I mean, 100 or plus years of, of not being allowed to do that.

And so, whilst politicians tend to grandstand about the evil oil industry, in reality, there are much bigger issues of monopoly that they should be addressing in the cases of things like tech or private uh private uh agriculture companies that are, are much more egregious in my view.

So the point is that whilst there’s a lot of political grandstanding, it doesn’t tend to come too much.

Uh Once we actually get through the hysteria around the election.

So Paul given all this, given the number of deals that we’ve seen within this space and then also coupling that with just a supply and demand dynamics that we’ve seen playing out within energy.

When we talk about the catalyst here for the price of oil going forward, where do you see the pricing of oil headed between now and your end?

Well, there’s a big obvious one which is that you’ve got an OPEC meeting this weekend.

Uh It’s expected that Saudi will lead a continuation of the cuts.

They’ve been holding over a million barrels a day off the market, which has really held us up in this 80 plus dollar brand uh range.

But of course, because they’ve got spare capacity, there’s no real potential for oil to go, you know, beyond 90 $95 a barrel we’ll see over the course of Q three because there is an expectation that the market will tighten as you peak demand here in the US.

And in the Middle East, a lot of extra oil demand comes from power generation.

And as a result, we’re thinking that the market will continue to stay in this range of 80 to $95 through the end of the year.

That’s good for the companies because it’s a great price for them.

It’s not too high, it’s not too low and their cash returns and their efficiencies, as you can see from these deals are getting better.

So we’re looking for multiple expansion in the stocks.

We’re not that excited about the commodity, Paul, do you see any scenario in which OPEC doesn’t extend the cuts?

Well, you can always be surprised by these things, but they’ve switched the meeting to virtual which suggests that they basically already got an agreement.

So they’re not actually meeting in Vienna.

The expectation is always, if you have an actual OPEC meeting in Vienna, the potential is there for a major shock or disaster.

It looks like this time, we’re not going to get one.

And so attention will turn to the December OPEC meeting, which is likely to be in person and could be a tough one.

But for now, it looks like with the market tightening in summer, OPEC will just roll over the existing agreements all right.

We have crude hovering today just below 80 bucks a barrel, Paul Sane.

Great to have you.

Thanks so much for your insight here this morning.

Thank you, research president and lead analyst.

Thanks.

Let’s continue the conversation rounding Energy Exxon claiming a right of first refusal over hess’s lucrative assets in Guyana ahead under a joint operating agreement.

Yahoo Finance’s legal reporter, Alexis Keenan is here with the latest on that.

Alexis.

Hi.

Yes.

So this announcement by Hess that its shareholders say ok to this deal, uh that’s raising a problem.

It’s rearing ahead of a problem that was already there.

And that is Exxon’s rights over this Giana Coast oil Reserve area, this very lucrative oil reserve area.

Now, Exxon has about 45% share in that particular asset.

He at 30% and then a China State owned company owning 25%.

And so what Exxon is saying is that its majority of stake that gives them the right to counter whatever Chevron would be offering for hess’s stake.

So back in March, Exxon had already filed for arbitration of this matter.

So the thinking is that this could delay any prospective deal here, Alexis Exxon is also facing a high stakes shareholder vote uh meeting later today when it comes to the future of its CEO some of those board of directors, what are the implications of the shareholder meeting and what happens with the vote either way?

Yeah, so we don’t know what’s gonna happen with the vote, but it’s a big deal, lots of eyes on this and look, there’s a rift between the company and its stakeholders and major stakeholders are now getting involved.

Now, this rift started back when the company wanted to block these activist shareholders, Juna Capital, as well as follow this trying to submit these proposals for environmental steps and these are steps that other major us western companies have taken.

Exxon is the only one who has not gone in this direction.

And the SEC allows for these activist shareholders, any shareholders to bring these proposals three times.

It’s sort of a three time strike you out.

So they’re at two different attempts at getting these proposals in front of shareholders for a vote and the company is pushing back, they filed suit against the shareholders and that is a bit unprecedented.

And so that is the fight here.

And so you have major stakeholders, Calpers, the US s largest public employee pension fund, $1 billion stake in the company putting its weight into the year and saying we want all of the directors gone and we want Ceo Darren Woods gone too.

So that is what investors are going to be looking at here is this decision of whether any of them, all of them are going to get to stay.

But certainly this issue is coming to a head uh environmental proposals perhaps less prevalent than they were in the past.

Few years but still an issue and shareholders want to have their say.

All right, we will see how this all plays out.

Alexis.

Thanks so much for bringing us the latest on that.

Well, American Airline shares are sinking this morning after cutting its sales outlook for the second quarter.

The airline also announcing that its chief commercial officer will leave his role next month and this comes after United Airlines reiterated its adjusted earnings outlook for the second quarter.

American Airlines has certainly been struggling to keep up with its competitors, United Airlines and Delta, both of which are up single digits this year compared to the losses that we’re seeing here from American Airlines.

What happens next?

We want to Reagan Ssai Ramond James managing director joining us here for more on this si it’s great to see you when you take a look at the losses that we’re looking at in American Air here this morning shares off just around 16%.

The biggest drop that we’ve seen since June 2020 just your reaction to this guidance cut.

And what exactly that means in terms of the positioning here for America?

I think we’re, you know, surprised by the level of the guidance cut, but the the factors behind it is probably not surprising to us and we’ve called this out before um too much capacity, uh American inclusive and, and the industry.

Um and then also Americans can have made some decisions on the corporate sales front.

Um Some of them are smart but just the way they execute it, it, it uh I think was uh probably not wise and I think they’re recognizing that.

So I’m really encouraged by, you know, Rob Eisen’s comments this morning as to what the kind of go forward solution is.

Do you think this is an American specific problem or is it a broader demand problem here?

Yeah, I think it’s interesting where demand is holding.

The interesting thing is that I think there is more price sensitivity, peak, uh peak periods, you know, the summer.

Um you know, we saw Labor Day Weekend is really strong demand and, and not a lot of price sensitivity during that time, but in the off peak, there’s just too much capacity.

And you know, some of the things that Americans said that they will go and do is look at that, you know, capacity that they’re adding into those off peak shoulder periods s when it comes to also the fact that their Chief commercial Officer is leaving this abrupt departure.

What do you think that tells us our signals about the strategy shift that we’ll likely see here at American?

Yeah, and, and I this morning kinda out outlined some of those changes and, and I think they are, you know, they’re still in the early stages of evaluating it.

Um you know, this big aggressive push on NBC that they did.

I think that was right.

There’s a lot of frustration as to how slow the, um you know, the, the community has been in adopting NBC, but doing it at the same time that you slash your sales force and make some other changes, I think was not wise.

So I think they’re looking at providing better support uh to their partners.

Um And I, I think another kind of good move that they’ve talked about is they were going to differentiate how much miles you earn based on uh which distribution channel you booked.

And they, they, they decided not to go through with that, that was planned for June.

And from the sec filing, it seems as though American has a potential revenue problem when you compare American to some of the other major airlines, what’s missing or what’s hurting them more than some of those other carriers.

So they, they talked about, you know, close in bookings, uh or close in pricing being weak.

And that’s really that corporate traveler.

So what you saw in the first quarter was all of its kind of major uh us competitors that would have any kind of corporate exposure.

Um They’re showing, you know, double digit increases in corporate reven as especially the tech sector and some of these sectors that haven’t traveled so far post COVID are starting to come back.

And American really only saw, you know, mid to high single digit growth.

So that’s where they’re seeing that shortfall.

And that’s why they need to kind of go back and revisit their corporate strategy.

S do they cater more towards the budget carrier?

Just given the fact that they’ve underperformed on revenue?

Um I, I don’t, I wouldn’t say that necessarily, you know, they, they are taking a very different path with their product in the domestic market, but they still have a first class product.

They still have, you know, extra leg room seating, so they do have a premium offering.

Um So it, it might be more of a function of, you know, the the areas that they are exposed to a lot of sun destinations, that more leisure uh based.

Um But again, I think, and, and the fact that they don’t have as much um or they’re relatively less uh kind of strong in, in some of the coastal markets where you’re seeing the recovery now.

But I really think it comes back down to, you know, their large corporate strategy I think was execution was not good since, since they rolled this out last year.

Um And they’re hurting from that now and it is reversible but it will take time.

So you mentioned that shift away from corporate clients.

But what about the loss of that jetblue partnership?

How impactful has that been on the company?

Yeah, I really like some of the things American has tried, they’ve been, you know, very creative on, on revenue strategy front and, and one of those was kind of the, the Northeast alliance and, and, and the, the alliance that they have with, with Alaska, which is continuing.

Um So they’ve tried some, you know, creative things to do and, and the Northeast Alliance would have been a good move.

So unwinding that is probably a little painful and, and also adding to the drag.

Um and it’s unfortunate that they couldn’t continue with that.

And so just taking a step back and putting demand aside these airlines, many of them in addition to America and obviously, most of them dealing with the rise of geopolitical tensions.

You also just got, you have the simple fact that costs are rising here across the board.

And then when you also step back and talk about the scarce supplies right now of new aircraft, how overall is the industry positioned heading into the second half of the year?

Yeah, it’s, it’s definitely been challenging.

Um It’s, it’s been a long road, you know, coming out of the pandemic uh for this industry.

Um And you’re right, you’ve seen this across the uh you know, us is that you’ve been a lot of inflationary pressure.

Um and then the, you know, the supply chain.

Um and, and other kind of infrastructure including in the air traffic control, it’s been a lot of pain points that airlines are trying to move through, I think 22 24 was, is the kind of the first year you’re starting to see a little bit of normalizing uh but clearly in terms of OEM deliveries and maintenance downtime, it’s still a lot of issues and they’re continuing.

But, but the industry adapts and I, and I think right now the the best answer is to, to be a little smaller in terms of capacity.

So you can kind of protect the uh the operation and then you can manage through some of these kind of supply chains.

Sissy Raymond James, the managing director.

Thank you so much for joining us.

Thank you.

Coming up to CEO joins us to discuss how inflation is impacting spending on our furry friends.

That’s next a pet company chewy surging.

After reporting a boost in sales in its first quarter, its auto customer as sales were up over 6%.

As consumers looked to seek out seek their best deals on some of their pet needs.

You’re looking at a jump, but just about 26% the biggest jump that we seen the stock in well over a year.

We want to bring in some saying the CEO of and Yahoo Finance’s executive editor Brian Sazi here joining us submit.

I it’s great to see you.

Congratulations on a strong quarter.

We’re looking at shares here surging in early trading.

So talk to us just about the trends that you’re seeing within your business and whether or not some of the strength that you saw last quarter, whether or not that’s carrying over into the current quarter, right now, it’s nice to see both of you.

Thank you for having me, you know, um couple of things uh are really positive one, you know, we’re seeing green shoots in the industry.

So we’ve called this the year of normalization and we believe that we’ve got a fairly good sense of demand and fairly good sense of how this normalization is occurring.

You know, second inflation was an important point carrying through last year And you’re starting, you know, to see that sort of win off, you know, third, we saw healthy sort of balances between net adoption rates and relinquishment rates that came through from shelter and rescue community every month, this year, this year to date.

So all of these are good inputs that essentially lend some encouraging signs towards the normalization of pet that we’ve been talking about.

And you put, you know, our great service and this quasi subscription model that we talk about, which is auto and it just, you know, consumers were able to attract the right type of consumers and get them to really spend on a repeat basis.

Uh We pass on value and we drive a ton of convenience and the overall value proposition is resonating really loudly.

I I did a casual shirt search your website, a couple others, dry dog food, 40 bags of dry dog food.

I was looking for Blue Buffalo, $65 and this stuff is pretty expensive.

What is your outlook for inflation.

Maybe you could speak to the consumer environment are prices for any of these products, for food, for pets going to come down at any point this year.

Yeah.

So Brian, it’s a great question.

You know what we’ve seen the last few years is an unprecedented amount of inflation that has passed through the system.

Normally, when you look at pet over a 1015 year period, you know, it’s uh it’s natural to expect pricing to be somewhere between the two and 4% range on a comp basis.

And yet the last three years has been in double digit percentages.

You know, now I I started this call by saying that we have started to see that come down into the low, low single digit starting this quarter.

And you know, most of pet food and consumables is map compliant, which is there is actually a floor underneath, you know, the the pricing and brands do a good job maintaining that pricing structure.

So not really expecting uh you know, something structural to change in pricing uh moving forward.

But what we could expect the latter half of this year is incremental discounting as both vendors and retailers sort of lean in to both incent demand generation as well as conversion.

And we’re starting to see that, you know, treats are, are seeing a little more elasticity than they were in the past.

So that I think trend will continue to the back of the year we’ve incorporated that in our guidance, we expect higher profitability even as a result of that.

And we’ll pass that value on back to the consumer and submit.

We did see active customers declined by 95,000 quarter over quarter.

What would you tell investors who maybe want to see greater confidence in the stabilization story and that return to growth?

Yeah, you know, there are certain inputs to uh active customer formation.

When you look at net customer acquisition, you know, it’s tied to this this trend of pet household formation, which is then closely linked to inflation.

And that’s keeping back demand for discretionary products or demand for, you know, categories such as wet food, et cetera.

And so as I talk about the normalization, you know, we’re seeing some green shoots there and we were pleased with our acquisition rate and they continued higher than our reactivation rate.

The reactivation rate was particularly strong.

This quarter, we reactivated, you know, sort of mid teens level, higher number of customers than from a year over year comp point of view.

And then we also saw greater retention of cohort, especially starting the back half of 2022 cohorts, second order purchase rates were good.

Uh So overall, you know, as you sort of put this together, we’re quite encouraged with the efforts that were taken.

It just has to sort of take a little bit of time through this normalization to occur.

Uh But in the meanwhile, you know, share of Wallet with us continues to grow.

Uh, we were up 9.5% on a year over year basis.

Uh, reaching $560 share of Wallet per customer, which we’re very happy about some new areas of discussion on the earnings call moments ago.

Uh, at least that I picked up on one.

You’re now opening vet clinics.

You have four of these opened and it sounded like you have maybe a couple more coming in the back half of the year.

And you’re testing paid membership.

What’s your hope with the vet clinics?

And then on the paid membership front, how should investors think about that?

Is it a more of a model like target’s doing with its new paid membership or is it something like Costco?

Yeah, you know, on, on True Vetcare, the clinic initiator, Brian, you and I have spoken in the past and health has been a strategic vertical for us for many years.

And so what you’re seeing is a culmination of all of the products and solutions and technology that we’ve built both for customers as well as for the veterinarian community for the past five years or so.

And so imagine, you know, this kind of first party proprietary tech and product orientation that we built?

And we said, well, what do you do with this?

Well, we have two paths we could offer it as a SASS offering to you know, clinics that seeking this improved and sort of modernized experience and architecture, you know, as as the industry, you know, progresses forward or we could dog food our own innovation.

And we said, well, this is a great way of keeping the chewy customer into our ecosystem, letting them experience the magic, you know, that so far had been led by product merchandise and making chewy physically present, right, with that experience into the marketplace.

And so far, we like it, you know, another, another positive trend is vet recruitment and retention is a real pain point in the industry.

And so, you know, we want to be experienced forward to our veterinarian community as well.

And so far, you know, we’ve been able to attract and retain the right quality of veterinarians, which we’re super happy about.

So broadly speaking, we believe this will be a fly wheel and ecosystem that will continue to drive greater retention, greater new customers to the platform and also a greater engagement from existing customers.

So more to come, we’ve launched four, we’ve given guidance of about 4 to 8 this year.

And so far, we’re on track your second point about membership.

You know, we feel first of all, auto is a tremendous loyalty program for us, right?

77% of our net sales this quarter went through auto at the same time.

You know, we believe there’s an opportunity to bring forward, you know, the discovery of the chewy platform to consumers, millions of consumers and paid memberships, right?

When you go out and attract customers who are locked into the ecosystem with tremendous value, it can essentially be another choice for customers to select your platform.

So we feel paid membership and auto ship are complementary to each other.

A lot to learn through the back half of the year, we launch it to a cohort of customers starting last week and I’ll be back here to talk more about it in the future.

That’s good to hear.

You know, the push to the vet clinics really reminded me it’s expensive to own a pet.

You know, something goes wrong with a pet.

Uh They break their leg could be thousands of dollars out of pocket.

And I think that cost really surprised a lot of consumers as an industry.

Is there any way to bring these costs down and, and don’t laugh at me here, but is there a way to create like Medicare for pooches?

Uh uh what do we need to do to help alleviate the burden on people that do own pets?

No, it’s actually a very good question because if you, if you know our submission behind the health care uh vertical is to make pet health care affordable, but also accessible, right?

So accessible and affordable and pet health care is expensive.

And you know, it’s a couple of ways that you could bring insurance down costs down, for example, is the advent and the growth of the insurance category, right, when you look at kind of European countries or all the way to Australia and New Zealand, I mean, insurance has penetrated to sub kind of teens or mid 20% ranges in the United States.

It’s sub 3% right?

But growing fast.

So as one of building into the Chewy Wet Clinic, we first launched insurance with a couple of high bar providers And now we can bundle in or layer in that insurance as part of our experience or the membership plan that you might actually, you know, procure when you’re a Chewy Wet Wet customer per se.

And that greatly subsidizes, you know, it lowers the barrier for visits into the clinic and greatly subsidizes medical cost per se.

Second thing is, you know, lowering overall cost to serve from a veterinarian and industry point of view, which you can do using smart technology and digitalized experiences.

When you do that, you can essentially pass that value and that savings back to the customer, which is very much as part of our road map.

So we’re, you know, we’re, we’re, we’re, we’re trying and the road has road ahead is long, but we, we’re bullish.

So I mean, I’m curious, what do you expect to see those spending trends to look like in an uncertain macroeconomic environment like we’re in right now just in terms of how much, how much there is it just on the willingness the part of the consumer, the part on the customer here to spend on their pets during a time when they’re forced to cut back on spending elsewhere.

Are you seeing that at all?

And, and will you, do you think be forced to offer a bit more promotional activity in order to boost some of that business specifically?

Also what’s going on within your vet’s clinic?

Yeah.

You know, health is, health is even more resilient than the typical food and supplies.

So your typical consumables categories or non discretionary categories.

Health is the most resilient of them all.

In fact, when you survey pet parents, over 80% of them will tell you that they would rather treat their pet before they actually put, you know, their treatment sort of in picture per se.

So it’s a very sticky category from that standpoint, you know, and as we sort of continue to make health care more accessible and lower barriers and make it more affordable, you know, we’re seeing, you know, you’re in the, in the age of sort of digitalization of animal health, right?

And so food and supplies came first and now, you know, it’s the time of health and I believe we’re credibly participating.

So, no, I don’t see, you know, a tremendous risk of deflation or tremendous risk of, of price compression in categories like these.

Uh you know, we’ve talked about some incremental discounting to incent demand generation in some other food and supplies type of categories, but health is likely more insulated sumit, Singh Chui, CEO and Yahoo Finance executive editor Brian Sazi.

Thank you both so much for joining us.

Great to see you guys.

Thank you.

Chinese automaker Byd is rolling out cars capable of driving more than 1300 miles without refueling or recharging.

This is the company’s fifth generation of its plug in hybrid technology that can travel about 800 miles on one tank of gas.

And for context here, sha about 1300 distance basically traveling from New York to Miami.

We know range anxiety that’s been a big pain point for consumers when it comes to some of these.

So hopefully that relieves some of that pain there.

But the cost is also attractive $13,800 which is the low end for the sedan market in China.

And when you think about Byd as a company, they’ve been on an absolute tear right now surpassing Tesla as the world’s largest sellers of evs, which is especially impressive considering the increased competition in that country, the price wars.

And you have to think that’s going to up the pressure on some of those foreign automakers that are already losing market share in China.

Yeah, and I think even just taking a look at what some of the actions that have taken place over the last several months, right.

Byd has clearly put pressure on so many of these foreign automakers to lower their prices.

That’s part of the reason why we’ve seen this pricing war break out, not only within China, but obviously um on an international level as well, even what’s taking place here in the US.

As many of these us automakers try to just even remain competitive with each other, but specifically going on in China when you have a price point, that is so low, what you were just talking about 13 to $14,000 significantly lower than many of the foreign competitors.

So it is going to make it tougher for people like or for companies like Tesla, for Toyota for some of those other larger automakers to compete within China.

And we talk about China being so critical just in terms of that growth story, that demand story and the opportunity that lies there for these foreign automakers.

So again, having these types of new uh vehicles here launching at such a uh cheaper price point is clearly going to make that battle just even tougher for the bigger names like Tesla.

And clearly, we’ve heard Elon Musk talk about that time and time again.

Although he does remain optimistic on Tesla’s prospects.

Obviously within China, let’s get to another training take here on Yahoo Finance this morning and that is Kava shares they’re following this morning after the company reported a slowdown in same store sales growth in the latest quarter.

Kava saying that while check size is mostly by higher prices did increase by around 3.5%.

The guest traffic actually declining by about 1% from a year ago.

And ali not exactly a huge change in the story right now is what we’ve seen with a lot of these other fast casual restaurants where many consumers are being forced to pull back just a bit in terms of their spending trends.

They’re not going into these, uh, restaurants as often as they were.

But outside of that, it does look like Hava has been able to pass down some of those higher prices to customers they are paying for at least when you take a look at the average transaction amount and what is being paid per visit.

But again, overall, there has been a bit of a pullback but not too much to be too worried about.

Don’t think just yet.

It doesn’t surprise me that we’re seeing this especially since we’ve seen from the inflation reports that dining away from the home, that’s been increasingly sticky.

It’s just simply cheaper to make food at home.

And it’s interesting because same store sales, they did beat expectations.

However, given the share price action today still fall short from those investor expectations.

And just to compare, I was curious, the company reported in 11.4% ST seems to sell increase in the fourth quarter.

So when you think about sequentially, this is a pretty big drop there, but I will say that analysts seem to remain bullish on the stock.

We Bush reiterated their out perform rating of their price target to 90 bucks a share from the prior 74.

And they say a few catalyst here when it comes to future growth, the launch of ST continued menu innovation, the new loyalty program growth in digital.

So there’s a sentiment among the street that Kava seems to really be providing value to the consumer.

And I remember when the IP O there’s a lot of comparisons to Chipotle that seems to have been the gold standard in this fast casual space.

So we’ll see if Cava can eventually get there.

Yeah, we’ll see.

And again, they have raised prices just not the rate of some of their competitors have.

But when you take a look at these results still relatively strong across the board, you’ve got total revenue of 259 million here.

That’s up 28% from just around a year ago.

And same store sales growth of 2.3% which did exceed uh the street’s expectations at least overall.

All right.

Well, the dow leaving the stock move or the markets move lower here this morning.

Treasury yields are also moving to the upside after Tuesday’s government debt auction flopped.

The moves in the market reflecting worries that the fed is going to keep rates higher for longer.

So what’s the next catalyst that could push the markets higher?

Let’s talk about that with Adam Bars he is a Schroeder’s head of a multi asset for the Americas.

It’s great to have you here, Adams.

Let’s talk about some of the dynamics at play right now because here we are with markets not too far.

We had the NASDAQ closing at a record high yesterday and we have this set up, we’ve seen a bit of a pricing in terms of expectations for fed rate cuts.

So what does that set up then look like here for the markets heading into the summer?

So, you know, I think, uh first of all, it’s nice to be here.

Thank you very much.

Uh I think when you look at the markets, what we’re really excited about is the earnings power you’ve seen come through Q one, right?

And actually when you look out into 2025 we’re not seeing earnings cut yet.

Normally this time of the year you start to see sort of next year’s earnings starting to come down a little bit as analyst expectations sort of are rebased with, um with corporate guidance.

So I think earnings can really drive the market from here and that’s what we need.

Given valuations.

Can it still drive the market though in the short term?

Given the fact that we are at the tail end of earnings season, it seems like at least in the very short term that focus has almost shifted to this pricing out or what, what, what the expectation looks like over the short term.

Of course, it’s a, it’s a bit more of a wild card.

I think a lot of the catalyst from the corporate earnings side are, are passed.

So we see that shift into the focus on the inflation prints on the economic prints.

It’s why there’s so much reaction to the, you know, the bond market auction yesterday.

And, you know, there’s been a lot of talk about the potential broadening out of the market beyond those large cap names beyond the mag seven.

Where do you see that broadening playing out?

And what will be the big driver of that?

Especially as we head into the second half of the year.

So I think the market will be looking for signs that all this Capex that’s going into A I that’s been benefiting the top of the market.

Will we start to see a return to that in corporate earnings?

Will companies actually be able to use large language models deep learning all of these tools to start to drive efficiency within their companies?

I think that could be a big next leg for the markets.

And then when you start to look outside the US, we have, you know, we’re actually seeing a recovery in PM is in Europe.

So it’s not that we have a strong manufacturing cycle, but it’s come off the bottom.

We’re looking at the ECB probably cutting rates before the fed into the summer.

So that can create some optimism we think going out into uh Europe and into Japan as we go forward and within, I guess just sector specific here, when you talk about that broadening of the rally or broadening of participation, where do you expect to see the most strength or the most opportunity, at least at this point?

So in, in terms of opportunity, it’s I don’t have a strong view in terms of the sectors, but what I would expect is um manufacturing and sort of the goods cycle could be very interesting from here.

Um We see consumer pressures on the low end, but outside the US as China starts to recover on the manufacturing side, that tends to sort of move through the pipeline, we have P ce inflation data that’s out on Friday.

This is the fed’s preferred inflation gauge comes after we saw that rebounding consumer confidence.

What are your expectations for Friday and how that could play out to kick off June?

Sure.

So I mean, you got equal expectations out there.

Is it going to be soft?

Is it gonna be hot?

I mean, so the the consensus expectations about a 0.3 uh on that course, P ce whether you get a hot or a soft print.

The reality is that last mile of inflation is gonna take us some time to go down and the fed is not going to react, right.

So the fed is not going to change their trajectory if you get a soft print.

So let’s say we come like 0.25 on Friday.

I don’t think that changes the narrative from the FED.

It’s really about a series of data prints.

Do we see the labor markets coming into balance?

Do we see that sort of inflation trend getting to a point where the fed feels like?

OK, now I can put that cut in.

What do you think that timeline looks like?

Uh we’re expected in terms of the overall improvement?

Uh So in terms of the improvement on the, on the inflation side, I think later this year, um you’ve got a couple of countervailing forces.

So on the one hand, the labor market is coming back into balance.

Uh on the other hand, we know that sort of the year on year comparisons get harder as we go into the back half of the year, right?

So we, we’ve had that sort of move down in inflation and now you start to get those comparables are much tougher.

The other wild card is as we head into the election season, how does the market read sort of the inflation uh response of the two candidates policies?

Right.

So if you talk, start looking through those policies, you could see a pretty big response on the inflation side.

If they’re not careful, let’s look out for not only Friday but the rest of the year heading into the election, Adam Fsp Schroeder’s head of multi asset for the Americas.

Thank you so much.

Thank you.

Turning now to some breaking news from the Cleveland Fed.

They are announcing a replacement for outgoing president Loretta Mester Yahoo, finance fed reporter, Jennifer Scherer has the latest.

Good morning Ali.

The Federal Reserve Bank of Cleveland has announced that former Goldman Sachs executive Beth Hammock will replace outgoing president Loretta Mester Mester is set to retire on June 30th in accordance with the Fed’s mandatory age and length of service policies of FED rules require that regional fed bank presidents serve a 10 year term if they were appointed after turning 55 a situation that applies to master, they also have to retire by age 65 if they were appointed before turning 55.

Now Hammock will assume the position starting August 21st while master will retire June 30th.

So to fill in that gap, Cleveland said first vice President, Ma Mark Metter will serve as interim president Hammock works for Goldman Sachs for more than 30 years.

Most recently as co head of global financing and holding roles from global treasurer to global head of short term macro trading and global head of repo trading.

She also worked very mostly with us policymakers in the capacity of chair of the Treasury borrowing advisory committee.

And as member of the Financial research advisory committee, Hammock will be a voting member of the all important FO MC interest rate setting committee when she assumes the position for the remainder of this year, guys, Jennifer Schomer, thank you so much for that report up next.

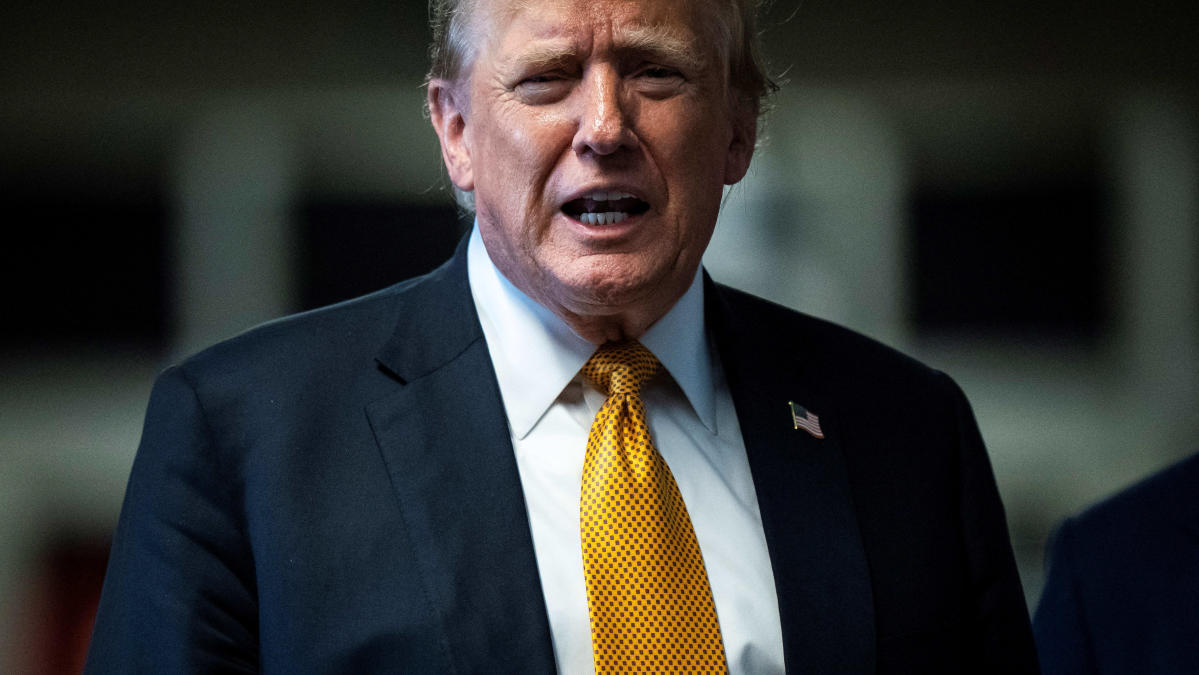

We with former president Trump’s alleged hush money trial, close to its conclusion, what impact they have on the presidential race and potentially the economy at large.

Stay tuned.

You’re watching Catalyst.

The jury and former president Donald Trump’s alleged hush money trial is set to start deliberating a verdict this morning, national polling average showing the former president in a tight race with President Biden.

What kind of impact can major events like Trump’s trials or next month’s presidential debate have on the race in the markets to give us his.

We welcome Greg Valliere, a GF Investments chief US Policy policy strategist Greg.

Thank you so much for joining us.

Like we said, we could get a verdict on that hush money trial soon, but Trump is facing multiple criminal indictments.

What impact if at all could these legal challenges have on his ability to win some impact?

But I don’t think a big impact.

I think that the bigger impact frankly would be the debate on the 27th of June.

There are people who are betting in Washington that Trump will be rusty, that he, he won’t be up to speed on a lot of issues and that, that could be far more important to his prospects than uh than the court cases.

But Greg, when you take a look at the polls right now, many of them do show one that we just had up on the screen that Trump is still leading by a very slim margin.

The odds that President Biden is able to rally back in the next five months.

What does that look like?

And, and what do you, where do you think that shift in tone and narrative needs to come from, from the administration in order to garner more of that support?

Yeah, not, not to throw out the old cliche, but it’s the economy.

I think that at the end of the day will be more important than the Mideast or court cases.

I think that most Americans still are nervous about inflation and I think we’ve got to get better data.

Uh I, I personally think the economy is in pretty good shape but when you look at inflation, it is a genuine source of anxiety, Greg.

When you take, when you take a look at what is happening right now, just in terms of President Biden and some of the pressure that is on the administration with what is going on in Israel, what is going on in Gaza and the deadly Rafah strike right now?

Really turning up the political pressure on President Biden.

How do you see that if at all swaying the November election and whether or not he’s going to turn a bit more and please those that are turn more and satisfy those that are further on the left just in terms of his narrative and approach right now with Israel.

These two horrific wars are hardly a plus for Joe Biden.

I don’t think all the arms will get to Ukraine until July.

And I think we’re still going to be looking at a stalemate, a very bloody stalemate in Ukraine.

The, the Mideast is, is just as serious.

I never thought in my entire career, I would see the US president and the Israeli Prime Minister be estranged and they’re basically estranged right now.

So I, I think that is going to with one big big wild card and that of course, is the Iranians.

So I don’t see these stories getting any better for Joe Biden.

And I think the American public would like to get a message to the public would like to hear what the plan is and we really haven’t heard that.

So we have those geopolitical tensions.

You were just talking about the economy.

What do you think is going to be the biggest talking point at that debate next month?

Yeah, pro probably the economy, I think that would, there’s a pervasive belief that’s not going to change that.

All the spending we did two or three years ago was the major contributor for the inflation that we have.

Now.

I think there are a lot of reasons why we have inflation now.

But uh I think the level of spending is a big deal.

I would make this point.

Also, I think the market are uneasy over regardless of who wins over a, the spending and inflation and the deficit.

And b the, the likelihood that both Biden and Trump are going to be protectionists, both of them have sounded very hawkish to China.

So I think complicating all of the geopolitical stories, you have the likelihood of a trade war.

Yeah.

And Greg and the FTO over the weekend bill gross was uh made the argument that he expects a Trump win to really disrupt the bond market saying that Trump could actually be worse here for the bond markets than Biden.

What do you, who do you think?

Do you think one is better than the other for the markets?

Given those two issues that you just raised here?

One of them being the deficit and the other being some of those geopolitical risk, specifically the approach here with China, they’re both taking a similar stance or lack thereof on both of those issues.

Well, I would say first and foremost beware of predictions on how elections will affect the markets that that was very humbling when Donald Trump won and the markets went down for a day or two and then went on a rip roaring rally.

So it’s hard to say the markets might act.

I would say though if Trump wins, there will be the factor of uncertainty that I think will dominate.

Trump has even stated that he wants revenge that before anything else, he wants to get revenge against people who aren’t nice to him.

So I, I do think the unpredictability will be significant but both of them, again, both of them will preside over very high deficits that’s locked in, baked in the cake and they’ll prevail over what I think is a protectionist trade policy, Greg Valliere, a GF Investments chief us Policy strategist.

Thanks so much for joining us.

Coming up.

Sports streaming is expanding.

We’ll tell you where you can watch your favorite team.

Next, the battle over sports while it’s heating up for the big streaming companies.

The latest is the fight over the NBA Warner Brothers.

Discovery reportedly considering matching NB C’s offer for the media rights to package NBA games.

But his biggest competition, it actually might be Amazon, not NBC and we’ve talked about this time and time again, just as focus here, Ali from the streaming companies on sports.

We have the news not too long ago about Netflix when it comes to the NFL games that they will be broadcasting on Christmas day over the next three years.

But what does all this say just about, I guess how this is reshaping the entire media landscape and also reshaping how many of us are watching these games and what we’re paying for to get access to.

It is very complicated to watch sports.

It’s obviously not great for the consumer that’s now more and more confused about where to watch their favorite games.

And now they’re having to pay more to subscribe to all of these services because now we’re seeing these leagues really have one off games and exclusive games for playoffs for even regular season games.

We’re seeing that with the FL, you were just talking about the NBA, that’s a possible streaming package there with Amazon and this is all coming as there are more streamers entering the space, there’s a lot of disruption and these leagues, they’re realizing that they can get a lot more money, not just from the linear and traditional cable providers and broadcast partners, but also from the streaming companies.

So we’re seeing this A la carte is a, is what I’m calling it of sports at large as the leagues seek diversification and as the stream companies, they want a sticky and loyal subscriber sports is on demand viewing.

That’s how you can get there.

But I guess at what point though does the consumer start to push back?

Right.

Because, and, and then at what point is that going to ultimately drive some of the decisions that the leagues are making in terms of their content deals or their media partnerships, right?

Because they want eyeballs at the end of the day, they need that fan base in order to grow these leagues.

So you have to think that at some point people aren’t going to be willing to subscribe to XYZ just to get access to a couple of games right now, Peacock did have exclusive NFL playoff game.

They did report a surge of subscribers after that.

The big question though is how long did those subscribers stay on the Peacock platform?

So I think we’re gonna have to see more experimentation within this.

We’re already seeing increased bundling.

We’re seeing increased sports packages.

We have that Warner Brothers Fox ESPN Sports Bundle coming out later this fall.

EPN over the top coming out in 2025.

So there’s going to be more options for consumers.

But I do think to your point, we’re going to have to see increased consolidation more M and A in the space as a result of this because there is a certain point where consumers are just gonna say, I don’t wanna watch it at the same time though.

If you’re a die hard sports fan, you’re gonna find a way to watch it and maybe it’s going to be going to bars and going to watch it there.

If you don’t subscribe to somebody’s partner, like I’ve already reached that point with all my.

It’s a very show.

All right.

Thanks so much for jumping on the show here today.

But coming up next, we’ve got wealth.

It’s dedicated to all of your personal finance needs.

Brad Smith.

He has you for the next hour.

We’ll see you guys tomorrow.