Summary

- Hong Kong took the top spot in cargo handling in 2023, handling over 4.3 million tonnes.

- Memphis, the second-busiest airport in cargo handling, saw a 4% decrease compared to the 2022 figure.

- Cargo handled by the top 20 airports accounts for 42% of global air freight transferred.

While passenger traffic is a metric used to identify the amount of traffic handled by airports, another metric utilized is the amount of cargo handled by airports around the world, and this can drastically change things. Earlier this week, the Airports Council International released the figures for 2023, and this article will take a look at the top five busiest airports in terms of cargo handled.

1

Hong Kong takes the Top Spot

While the airport does not rank among the top 20 for passenger traffic handled, HKG handled more cargo than any other airport in 2023

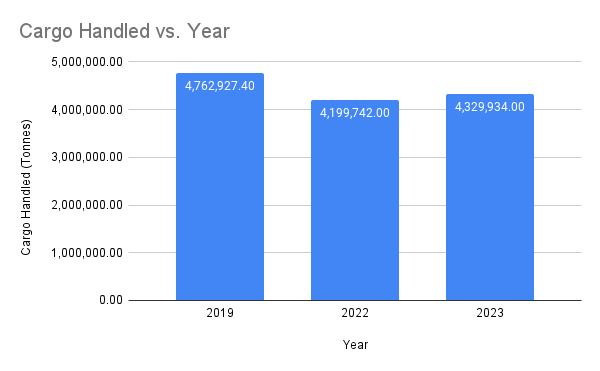

Hong Kong International Airport (HKG) in 2023 handled over 4.3 million tonnes of cargo, which is an increase of 3.1% from 2022. With Cathay Pacific being based at HKG, it is no surprise that the airline’s cargo division – Cathay Cargo, handled the largest portion of the cargo through the airport, of around 32% (1.4 million tonnes).

Photo: Vincenzo Pace | Simple Flying

Interestingly, HKG held the top spot in 2022 and 2019 as well, but when comparing the numbers, there have been a few changes.

Photo: Abid Habib | Simple Flying

The airport acts as a cargo gateway for air freight traveling across the Pacific Ocean, and other cargo operators, such as UPS, Atlas Air, and Cargolux, operate scheduled freight services to and from HKG.

Related

Why Hong Kong Airport Remains An Integral Aviation Hub

Hong Kong is only 5 hours flight to 50% of the world’s population and is one of the world’s top airport hubs.

2

Memphis, USA

Memphis is one of the two airports to appear in this top five list, falling behind HKG by less than half a million tonnes in cargo handled

In 2023, Memphis International Airport (MEM) handled over 3.8 million tonnes of cargo. However, this figure is down 4% compared to 2022 data and 10.2% compared to 2019 levels. Yet, the airport has held the number two spot during all three years. The major cargo operator at MEM is the cargo giant FedEx, which utilizes a strong fleet of various dedicated cargo jets.

Photo: Vincenzo Pace | Simple Flying

The air freight division of FedEx still uses an interesting mix of freighter aircraft types as part of its fleet.

|

Airbus Aircraft |

Boeing Aircraft |

ATR Aircraft |

Cessna |

McDonnell Douglas |

|---|---|---|---|---|

|

A300F |

Boeing 757F |

ATR 42 |

C208B Super Cargomaster |

MD 11 |

|

Boeing 767F |

ATR 72 |

|||

|

Boeing 777F |

The diverse fleet allows the airline to carry out various types of missions across its worldwide network.

Related

FedEx Phases Out 22 Boeing 757-200 Freighters

The airline has been reducing the number of its planes as part of a larger fleet downsizing plan.

3

Shanghai, China

In third place comes the Chinese city of Shanghai, which handled over 3.4 million tonnes of cargo last year

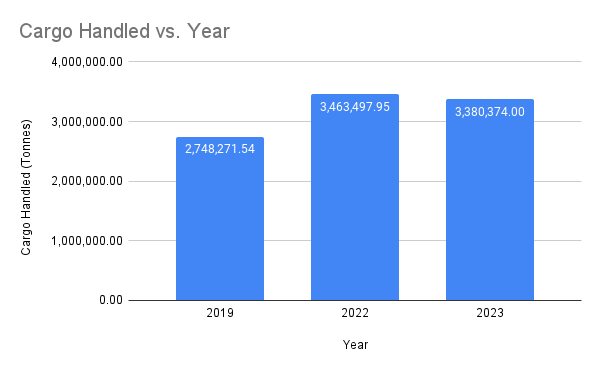

While Shanghai Pudong International Airport (PVG) was in fourth place in 2022, the airport saw an increase of 10.4% in cargo handling in 2023, which resulted in PVG climbing to third place. However, the figure (as seen in the previous two cases) is lower than the 2019 level by 5.3%. With various airlines operating scheduled cargo services, PVG is an extremely well-connected cargo hub.

Photo: Minh K Tran | Shutterstock

China Southern Airlines, Atlas Air, and Air China operate a considerable cargo network from PVG and offer significant cargo capacity on routes to the United States of America.

|

Anchorage |

Seattle |

San Francisco |

|

Los Angeles |

Dallas |

Memphis |

|

Chicago |

Detroit |

New York |

Cargo services are operated to five of the nine destinations, with the exception of – New York, San Francisco, Detroit, and Dallas.

Related

Shanghai: China’s First Dual International Airport City

In 1999, Shanghai became the first city in China to have two international airports. The second city, Beijing, achieved this milestone in 2019.

4

Anchorage, USA

Anchorage is the second US airport on this list, coming in at number four. While the airport held the third spot in 2022, it was overtaken by the aforementioned Shanghai

Anchorage Ted Stevens International Airport (ANC) takes fourth place on this list with 3.38 million tonnes of cargo handled. While the 2023 figure is 2.4% lower than the 2022 figure, ANC is the only airport on this list that has recorded a higher cargo handling figure than the 2019 levels, with an increase of 23.1%.

Photo: Mariusz Klarowicz | Shutterstock

ANC’s geographical location gives it a considerable advantage and enables it to act as a major cargo transit point between East Asia and the rest of the United States.

Photo: Abid Habib | Simple Flying

Both Atlas Air and Air China have a dominant presence at Anchorage due to the significant number of cargo operations both carriers carry out.

5

Seoul, South Korea

The last entry on this list is Seoul Incheon, having handled over 2.7 million tonnes of cargo in 2023, thus regaining its fifth-place position from Louisville, USA

South Korea’s major airport, Seoul Incheon International Airport (ICN), held the fifth spot in 2019 but briefly lost it to Lousiville International Airport (SDF) in the US in 2022 before regaining it in 2023. While ICN handled over 2.74 million tonnes of cargo in 2023, this figure is down by 6.9% when compared to 2022 and 0.7% from 2019 levels.

Photo: Tom Boon | Simple Flying

Both Korean Air and Asiana have ICN as their hub, and both carriers have their own cargo operations with dedicated freight jets.

|

Korean Air Cargo |

Asiana Cargo |

|---|---|

|

Boeing 777F |

Boeing 767F |

|

Boeing 747-400F |

Boeing 747-400F |

|

Boeing 747-8F |

The two carriers carry out considerable cargo operations. This domination of cargo markets between South Korea, the US, and Europe is a point of contention regarding Korean Air’s long-proposed acquisition of Asiana. In order to receive approval from European regulators and antitrust authorities, Asiana will sell its cargo division to another carrier.

Related

Asiana Airlines To Sell Cargo Branch As Part Of Merger Bid

Asiana Airlines is still awaiting approval from three antitrust authorities for its merger with Korean Air.

Fellow South Korean carriers – Air Premia, Eastar Jet and Air Incheon are interested in acquiring Asiana’s cargo assets and have already placed bids. If and when this acquisition happens, there will definitely be a change in cargo and passenger operations out of ICN, which will definitely be interesting to monitor.

Overall Conclusion

Data from across the industry indicate that cargo operations have decreased in 2023 compared to previous years. The data suggests that the top 20 airports handled around 42% of the global cargo operations (47.9 million tonnes) in 2023 but suffered a 3.2% (1.58 million tonnes) year-on-year drop.