Shares of Southwest Airlines Co. (NYSE: LUV) were up over 6% on Thursday after the company beat earnings estimates for the second quarter of 2024. The stock has gained 4% over the past three months. Here’s a look at the airline’s performance in Q2:

Quarterly numbers

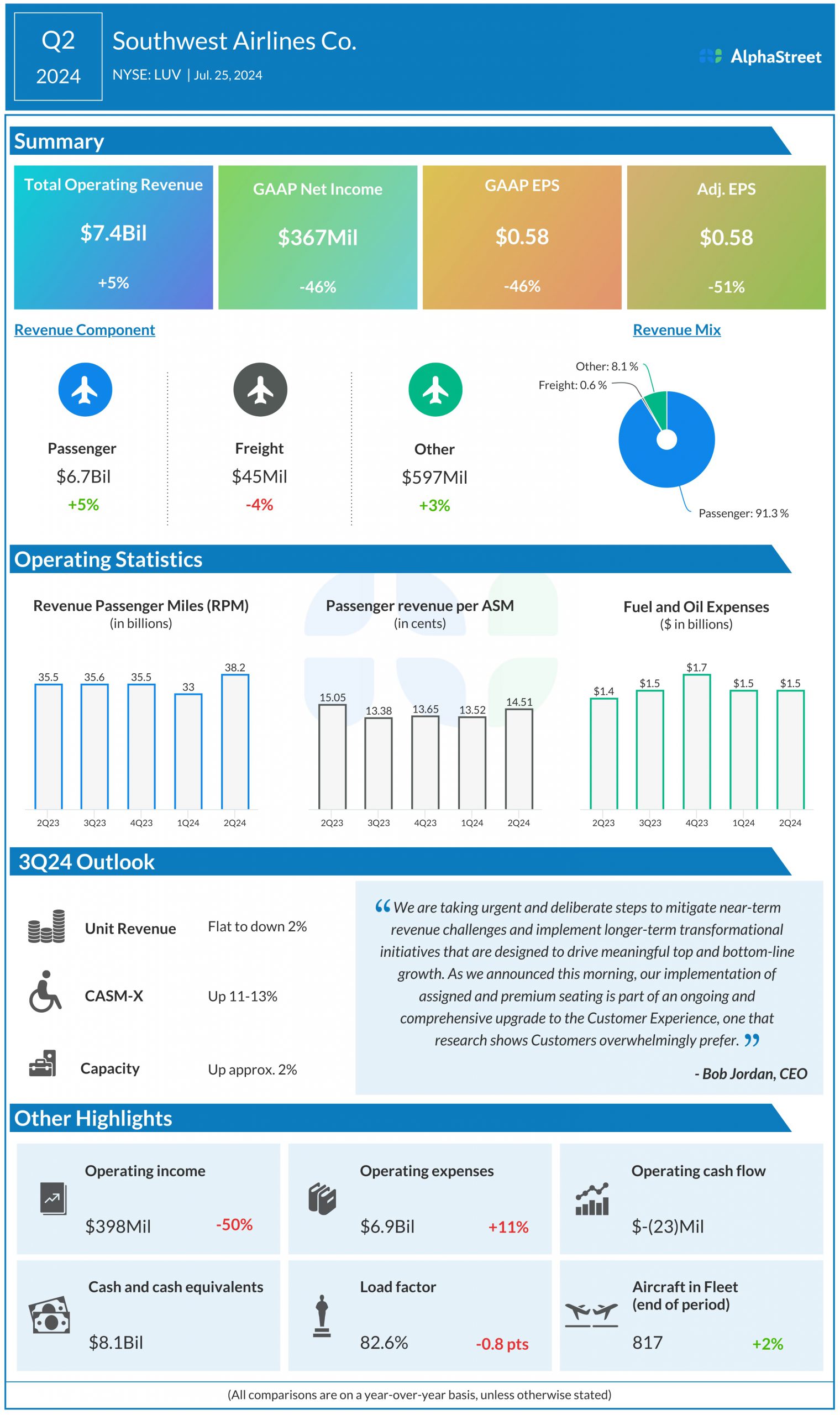

In Q2 2024, Southwest’s total operating revenue increased 4.5% year-over-year to $7.4 billion. The top line benefited from growth in passenger and ancillary revenue, and an improvement in managed business revenues. Passenger revenue grew nearly 5% in the quarter.

Unit revenue decreased 3.8% as industry-wide domestic capacity growth outpaced demand. The company also faced revenue management challenges as it sold excess seats for the peak summer travel period too early.

Southwest is implementing initiatives to drive revenue and profits, and as part of these efforts, it plans to roll out assigned and premium seating as research indicates customers prefer this option over open seating.

In Q2, revenue passenger miles were up 7.6% while capacity was up 8.6%. Load factor dipped slightly to 82.6%. Passenger revenue yield per available seat mile (PRASM) was down 3.6% YoY. Economic fuel costs were $2.76 per gallon in the quarter. CASM-X, or unit costs excluding fuel and oil, special items, and profit-sharing, rose 6% YoY, driven mainly by increases in salaries, wages and benefits, and higher maintenance expenses.

GAAP net income fell 46% YoY to $367 million, or $0.58 per share. Adjusted EPS dropped 51% to $0.58 in Q2.

Outlook

Southwest expects unit revenue for the third quarter of 2024 to be flat to down 2% YoY, with capacity up around 2%. The outlook assumes a revenue management headwind from bookings already in place as seen in Q2. Economic fuel costs per gallon are expected to range between $2.60-2.70 in Q3. CASM-X is expected to be up 11-13% YoY.

For the full year of 2024, the company expects capacity to be up around 4% YoY. Economic fuel costs per gallon are expected to be $2.70-2.80. CASM-X is expected to be up 7-8% YoY.