Summary

- Rex’s jet-operated unit entered voluntary administration.

- The airline’s attempt to diversify into large intercity markets with Boeing 737s was a high-risk and confusing move away from its tried-and-tested regional operation.

- In May 2024, Rex’s jets carried 175,000 passengers with an average seat load factor of 78% but just 9% of the market.

As you will know by now, Australia’s Rex Airlines entered voluntary administration. It’s important to note that this only applied to its Boeing 737-800 services, not the carrier’s backbone, its regional flights on Saab 340s. Given that its 737-operated routes are reported to have lost AUD$1 million weekly, the decision to drop the aircraft is understandable. It is believed the airline’s 10 Boeing 737 aircraft will be returned to lessors and they will not be flying in Rex’s colors again.

Related

Rex Boeing 737s Grounded As Airline Enters Voluntary Administration

In the space of a few months Australians have lost their best chance for a truly competitive domestic airline industry, but now its back to the future

Everything changed in 2020

For many years, Rex’s background involved operating very thin regional services, both government-funded and not, using a large fleet of Saab 340s. This was its bread and butter, underpinned by very little annual growth. Rex’s role and comfort zone was always managing seat load factors and yields on primarily monopoly routes. Nearly eight in 10 of its services had no direct competition.

Photo: Steve Worner | Shutterstock

Everything changed in 2020, during the pandemic, when Rex revealed that it would acquire up to 10 737s (or, as it said at the time, A320s) for large intercity markets. This was the antithesis of its highly focused, dominant regional flying.

Rex’s diversification from its core to something undeniably very high-risk was always massively puzzling. Perhaps management believed it made sense given the opportunity afforded by Virgin Australia being in administration at the time. However, Virgin’s redevelopment, following new ownership by Bain Capital, would always revolve more than ever on its core markets.

Photo: Rex

Perhaps Rex’s Singaporean owner prioritized growth amid Virgin’s problems. After all, it could not grow by focusing on Saab-operated regional routes. Were Rex’s owners drawn to the ‘bright lights’ of jet aircraft, or was there a genuine reason for their interest in something so radically different?

It always struck me as odd that it plastered ‘Our Heart Is In The Country’ on its 737s, a nod to its regional Saab flying. What does that have to do with flying jets on trunk routes?

It was clear it would need extremely deep pockets to pursue such an ambitious change. Had a standalone jet unit not been created to ringfence its operation, it would have risked the Group’s entire survival. The airline required far more than the $200 million investment for the big-stakes game.

Photo: Rex

Who did it target?

Rex’s first 737 service was between Melbourne and Sydney – where else? – in March 2021. Qantas, Virgin, and Jetstar served the spectrum of demand on such major airport pairs. (Virgin’s Tigerair Australia, which ceased to exist a year before Rex began, focused on the lower end of the market.)

Image: GCMap

With existing high frequencies, convenience, and usability, together with lower fares by low-cost subsidiary Jetstar, it was unclear who Rex would target and what ‘problem’ it would try to solve. What was missing that passengers didn’t have and that Rex could provide?

Leisure passengers seek lower fares, and business travelers desire higher frequencies. Unsurprisingly, Rex’s lack of scale meant it could not offer either. It was stuck in the middle, a highly challenging position for an airline, just like any business.

The incumbents could lower fares (cross-subsidized elsewhere), increase frequencies, offer more FFP points, etc., and it’d obviously be even harder.

Related

“The Most In Our History”: JetBlue Explains Cutting 50+ Routes & 15 Airports As Part Of Recovery

It’s better to be smaller and profitable than big and suffering.

A look at May 2024 data

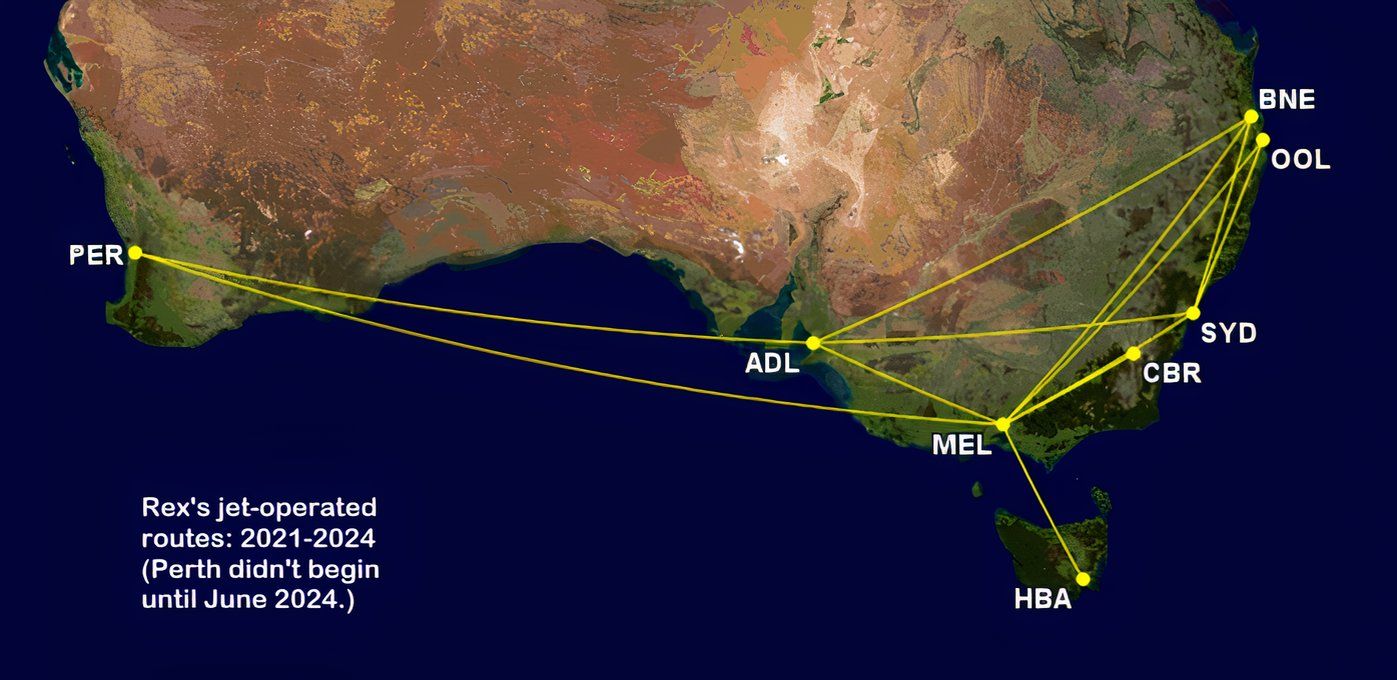

In May 2024, some 10 of Rex’s 12 jet-operated routes existed. Two more began in June: Melbourne-Perth (737-800) and Adelaide-Perth (using E190 wet-leased from National Jet Express).

Photo: Rex

May is the most recent month for which I have passenger data. It is estimated that Rex’s jets carried approximately 175,000 passengers during that autumn month in Australia. Melbourne-Sydney and Brisbane-Sydney accounted for over one in two passengers. While I do not have fare data, it is clear they were insufficient, given everything else.

With around 225,000 roundtrip seats for sale, an average of about 78% of seats were filled. Only two routes are believed to have exceeded 80%. Rex had an average of 9% of passengers in the 10 markets. It was the smallest operator in all of these routes except Melbourne-Canberra, where it was ahead of Jetstar.

|

Route |

Flights |

Est. passengers: May 2024 |

Est. seat load factor |

Est. % of the market |

|---|---|---|---|---|

|

Adelaide-Brisbane |

Daily |

8,100 |

77% |

12% |

|

Adelaide-Melbourne |

Double daily |

15,900 |

76% |

11% |

|

Adelaide-Sydney |

Daily |

7,900 |

75% |

6% |

|

Brisbane-Melbourne |

Double daily |

15,400 |

79% |

7% |

|

Brisbane-Sydney |

Five daily |

37,800 |

74% |

13% |

|

Melbourne-Canberra |

Daily |

7,800 |

74% |

10% |

|

Melbourne-Gold Coast |

Daily |

8,800 |

84% |

7% |

|

Melbourne-Hobart |

Daily |

8,500 |

81% |

12% |

|

Melbourne-Sydney |

Seven daily |

56,800 |

79% |

10% |

|

Sydney-Gold Coast |

Daily |

8,300 |

79% |

5% |