Recently ranked as our most valuable cobranded credit card partnership, ![]() Delta Air Lines

Delta Air Lines

and American Express have a line of four personal credit cards which each come along with an impressive slate of benefits. There is truly a credit card for all consumers, whether they are looking for a no-frills-attached way to earn miles on everyday purchases or gain access to elite lounges.

A set of cards individually tailored

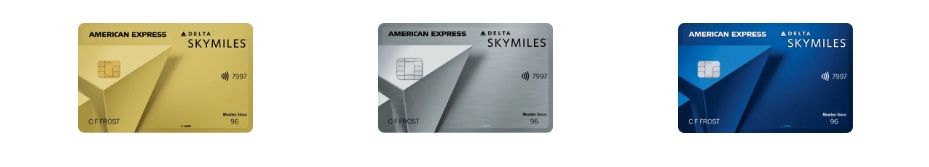

There are four cards, each of which is carefully designed to serve a specific sector of the consumer market. These four cards are as follows:

- Delta SkyMiles Blue American Express Card

- Delta SkyMiles Gold American Express Card

- Delta SkyMiles Platinum American Express Card

- Delta SkyMiles Reserve American Express Card

These cards range in benefits quite significantly, with some such as the Blue card coming along with nearly nothing and the Reserve card coming along with status boosts and access to the Delta Sky Club. As one would expect, the cards also come along with different annual fees, which range from just $0 for the Blue card up to the $650 commanded by the Reserve card.

With such a broad array of credit cards available, it can be difficult to successfully identify the correct card for you. One of the best ways to determine this is by identifying the card that provides the best money for value, a metric that depends on one’s travel and spending habits. Therefore, let’s take a deeper look at the best Delta Air Lines credit cards, by examining which of these cards provides the best money for value.

A look at each credit card and the card’s primary value proposition

As previously discussed, each credit card is primarily meant to appeal to a specific type of consumer and, as a result, has a value proposition aimed at that group. Therefore, certain groups of customers will be better able to capture a credit card’s maximum value than others. Let’s take a deeper look at all these cards, starting with the SkyMiles Blue card.

Photo: Delta Air Lines

SkyMiles Blue Card: Rewards at no cost

The American Express SkyMiles Blue card is the carrier’s principal cobranded card offering that comes along with no annual fee. While all major US legacy airlines do offer a credit card with no annual fee, none can come along with all the benefits of American Express membership.

This card does have its drawbacks, however, with the first and most noticeable being the card’s minuscule welcome bonus. The Blue card only offers new customers 10,000 bonus miles once they make $1,000 in purchases within the first six months.

Furthermore, the card comes with extremely few flight benefits and offers some other perks like no foreign transaction fees. This card only offers the best value to those who rarely fly, don’t want to pay an annual fee, and are not expecting a large welcome bonus.

Skymiles Gold Card: The bestseller

The SkyMiles Gold Card has many accolades on its resume, including being named Simple Flying’s best US airline credit card of 2024. Currently, the card comes along with an impressive 80,000 bonus miles which are awarded after just $3,000 is spent within the first six months, according to the Delta website.

Like most standard airline credit cards, the SkyMiles Gold card comes along with free first checked bags and priority boarding (in zone 5). These benefits are relatively standard within the industry and are offered by competing cards like the United MileagePlus Explorer Card.

Adding to its value, the SkyMiles Gold Card includes a $200 per year annual flight credit, which can effectively account for the card’s $150 annual fee, which is even waived the first year. The Gold card is the best for those who fly Delta a few times per year on vacation and are looking to get the best value out of their loyalty program.

SkyMiles Platinum Card: Maximizing rewards

Offering 90,000 bonus miles for an annual fee of $350, the SkyMiles Platinum card brings along its own set of benefits. While not offering lounge access, the card does let you get on the complimentary upgrade list.

Photo: American Express

The biggest value-add for the card is the inclusion of the companion certificate, which offers the cardholder a free companion ticket with the purchase of one’s ticket. Only the applicable fees and taxes must be paid for a companion. The card also includes three fees, which used effectively can account for the card’s total annual fee:

- A $120 Resy credit

- A $120 credit for an eligible rideshare service

- A $150 Delta Stays credit

At the end of the day, the SkyMiles Platinum Card is meant to serve as a good middle ground between the Gold and the Reserve. The SkyMiles Platinum card will provide the best value for those who fly Delta consistently and are looking to optimize their rewards and travel experience, while also not being concerned about lounge access.

SkyMiles Reserve Card: Luxury travel experience

The SkyMiles Reserve Card is the most expensive in Delta’s commercial credit card lineup, with an annual fee of $650. The card primarily justifies this exceptionally high charge with access to the airline’s flagship lounge system, the Delta Sky Club. It is important to note, however, that Reserve cardholders do not receive unlimited visits and unlimited guest access. Reserve cardholders are also granted access to the American Express Centurion Lounge.

Photo: American Express

The card comes along with most of the same reward benefits as the Platinum card, with the exception that some credits are higher and that elite status-earning points will be a bit easier to rack up. At the end of the day, the Reserve card will provide the best value for money if you are looking for lounge access, and are willing to pay $300 more for it.

So what’s the bottom line?

When considering which of Delta’s many cobranded credit cards to open up, one needs to consider the major differences between their offerings. When one evaluates their spending and travel habits in conjunction with the benefits offered by each card, they will determine which one offers the best value for money given their unique individual needs.