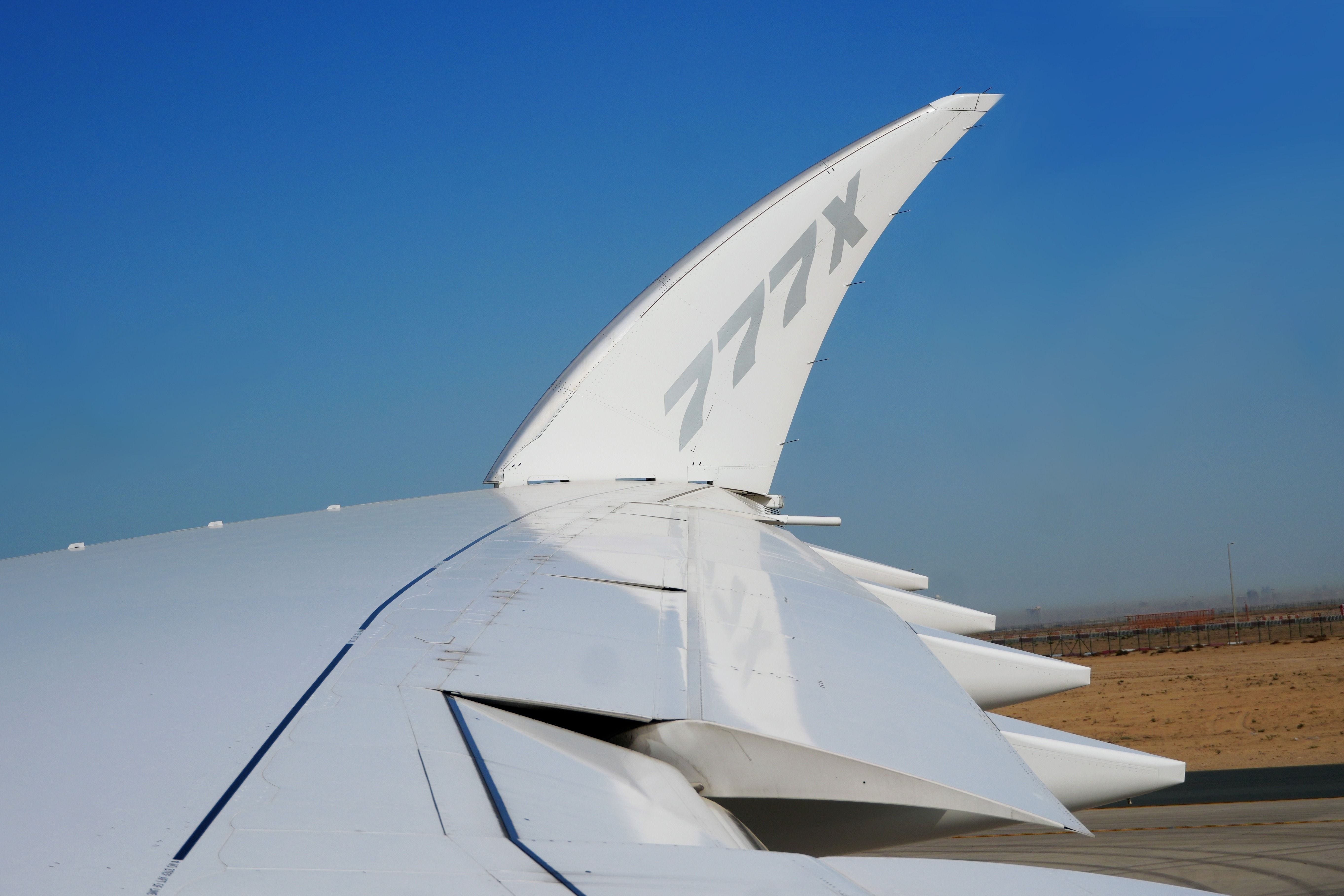

On October 11, as the machinists’ strike has continued for now more than a month, Boeing announced that the Boeing 777X

would be delayed once again.

The aircraft type, which was scheduled to enter service in 2020, should now begin commercial flights in 2026, starting with the 777-9. Two years later, the 777-8F, a freighter based on the smaller 777-8, would also begin leaving the company’s facilities in Everett, Washington, the United States, toward customers’ fleets.

Delaying the 777X again

In a publicly published message to employees, Kelly Ortberg, the President and chief executive officer (CEO) of Boeing, admitted that the company was in a difficult position financially. As a result, even without navigating a difficult today, returning Boeing to glory will require tough decisions, which will include structural changes and layoffs.

Photo: Tom Boon | Simple Flying

As a result, Ortberg announced that the 777-9’s entry-into-service (EIS) date has been delayed to 2026, which has also pushed back the 777-8F’s EIS to 2028.

|

Boeing 777X orders (gross, as of September 30) |

777-8 |

777-8F |

777-9 |

|

540 |

78 |

55 |

407 |

The CEO cited challenges in the development of the aircraft, the flight test pause, and ongoing work stoppage due to the strike by the International Association of Machinists and Aerospace Workers (IAM) District Lodge 751 and District W24 as the reasons behind the delay. In addition, Boeing said that it would build its last 767F

and conclude the commercial program, which should happen in 2027.

While new Federal Aviation Administration (FAA) fuel efficiency rules would have stopped the 767F’s production in 2028, Congress had granted a five-year production waiver, which would have allowed Boeing to continue producing the freighter until 2033.

Photo: Jonathan Hendry | Simple Flying

However, during the consultation phase, the FAA

quoted Boeing, FedEx

(a major 767F customer), and General Electric (the maker of the CF6 engine powering the type), who said that there would be limited demand for the 767F beyond 2028.

Nevertheless, when approached for this story, Boeing responded that it had nothing to add beyond the company’s statements on October 11. The delay announcement also said that the company would recognize a $2.6 billion pre-tax charge, which, coupled with a $400 million charge related to the 767F, will result in a $3 billion charge at Boeing Commercial Airplanes (BCA).

“This schedule and resulting financial impact are based on an updated assessment of the certification timelines to address the delays in flight testing of the 777-9, as well as anticipated delays associated with the IAM work stoppage.”

Related

New FAA Efficiency Rules Confirm End For Boeing 767F Production

With the new fuel efficiency rules going into effect on April 16, this would mark 2027 as the final year of the production of the 767F.

Remaining positive

The charges were part of Boeing’s preliminary Q3 results announcement on October 11, with the company scheduling the release of its financial report of the quarter on October 23.

Just a few months ago, the manufacturer’s executives were positive about the future of the 777X. During its Q2 earnings call on July 31, David Calhoun, the now-former president and CEO of Boeing, said that the 777-9 had received its type inspection authorization (TIA) and began certification flight testing with the FAA’s representatives during the month.

“Our team has put the 777-9 test fleet through more than 1,200 flights, 3,500 flight hours across a wide range of regions and climate condition, and the certification of flight testing will continue validating the airplane’s safety, reliability, and performance.”

At the time, Brian West, the chief financial officer (CFO) and executive vice president of finance of ![]() Boeing

Boeing

, added that the company would follow the FAA’s lead and expected the 777-9 to enter service in 2025.

Photo: Coby Wayne | Shutterstock

Furthermore, West said that the 777X’s cash flow would be similar to other development programs. The company would use cash before EIS and it would turn cash-positive about a year after deliveries begin.

“And yes, it’s going to be underwritten by that robust backlog that we have the high confidence in and the customers love the airplane. So, we feel pretty good and these are just investments in timing and over the long term, it’s going to be a great payoff.”

Boeing’s cash situation has worsened in the past few months, primarily driven by the IAM strike. In an update on October 14, S&P Global, the credit rating agency, said that the manufacturer was estimated to be losing $1 billion per month during the strike.

The agency added that Boeing’s reported cash position of $10.5 billion was better than anticipated, with S&P Global previously estimating a higher than the manufacturer’s $2.1 billion actual cash usage during Q3.

Related

Boeing Strikes Deal With US Banks For $10 Billion Credit Line

In total, two separate announcements indicated that Boeing could add up to $35 billion of additional liquidity.

Engine supply issues?

On September 13, West appeared at the Morgan Stanley Laguna Conference, where he spoke about several topics related to Boeing, including the 777X.

By that time, the manufacturer had discovered severed thrust links on all of its 777X test aircraft, namely N779XW, N779XX, N779XZ, and N779XY. The severed thrust links, with the part being a structural component between the engine and the aircraft structure, were first found on the latter airframe.

Related

4th Boeing 777X Test Plane Inspection Finds Cracked Thrust Link

It has remained unclear whether this will affect the entry-into-service date of the Boeing 777X.

The CFO stated that the team was working to understand the root cause of the problem, which would enable Boeing to estimate any changes to the estimated EIS date. West also reiterated that once the manufacturer begins delivering the aircraft, it will begin turning cash-positive.

“We still think it’s a terrific airplane, the customer thinks it’s a terrific airplane, got to get through this flight-test item that I discussed, but we still feel confident in that airplane.”

The 777X is exclusively powered by the GE GE9X, a derivative of the GE90, an engine that is the one of the power plant options for the preceding 777 aircraft family.

Photo: Aerospace Trek | Shutterstock

Still, since the thrust link issue was discovered, none out of the four 777X test aircraft had operated a flight, with the only exception being N779XY, Flightradar24 records show. The aircraft returned from Hawaii to King County International Airport/Seattle Boeing Field (BFI) in September, several weeks after the manufacturer discovered the thrust link issue.

|

N779XY |

N779XZ |

N779XX |

N779XW |

|

|

Last Boeing 777X test airframe flights |

Landed at King County International Airport/Seattle Boeing Field (BFI) on September 8 |

Landed at Everett Paine Field (PAE) on November 18, 2021 (spotted active on Flightradar24 on April 4, 2024) |

Landed at King County International Airport/Seattle Boeing Field (BFI) on August 9 |

Landed at Everett Paine Field (PAE) on August 12 |

Going back to the Morgan Stanley conference in September, West also mentioned an important detail: Boeing will deliver fewer 777F aircraft year-on-year (YoY), “driven to a large extent by engine availability.” “That has been a constraint,” West added.

“I would say that more broadly, there are real supply chain constraints in the industry and they are particularly impacting our [widebody] deliveries.”

As of September 30, Boeing had delivered 11 777Fs, while during the same period in 2023, the aircraft manufacturer handed over 17 aircraft of the type, including none in January 2023.

Photo: Tom Boon | Simple Flying

Whatever the case might be, the latest delay to its future flagship aircraft family, the 777X, will be a hit. Customers, including Lufthansa and Emirates, with the airline’s president, Tim Clark, predicting that Boeing would delay the aircraft to 2026 in February, have been publicly unhappy with Boeing’s inability to deliver aircraft on time.

The US-based plane maker’s European rival, Airbus, has also received a fair share of criticism due to aircraft delivery delays, with Airbus struggling to deliver aircraft on time as the company has continued facing issues with its supply chain.

Related

Sir Tim Clark Raises Concerns: Is Boeing At Risk Of Bankruptcy?

Emirates’ Clark warned that if credit rating agencies downgrade Boeing, it could result in the company filing for Chapter 11 bankruptcy protections.