Throughout the first few decades of commercial aviation, airlines were overwhelmingly state-owned, seen as the government’s mandate to support air transportation for its people.

Over time, however, air travel became far more popular, and it began to make sense for more than just a single state-owned airline to be present in any given market. This sentiment led to the widespread airline privatization that defines the market in the most developed regions like Europe and North America today.

That is not to say that there is still not an important place for state-owned and operated airlines in the market today, as many such carriers still rank among the world’s largest on most international metrics.

For the most part, when a government believes that, either due to economic philosophies or a lack of industrial organization in the private sector, an airline should be launched, they will typically do so with what is known as a flag carrier

.

A flag carrier is typically referred to as a large, dominant airline that controls the vast majority of international passenger traffic to and from a given nation.

In the United Kingdom, for example, British Airways is typically referred to as the flag carrier of the United Kingdom. Typically, state-run flag carriers are large-scale enterprises that are backed by hefty government funding and will typically take marching orders directly from politicians.

Why the Chinese system differs

Over the past four decades, commercial aviation in China has expanded rapidly, likely due to the nation’s newfound economic prosperity and massive population.

Instead of pursuing a more traditional path, one which would involve creating a single flag carrier, the Chinese government has instead created three major airlines, among smaller players, which mimic the three-player market structure of the commercial aviation industry in the United States. These airlines are as follows:

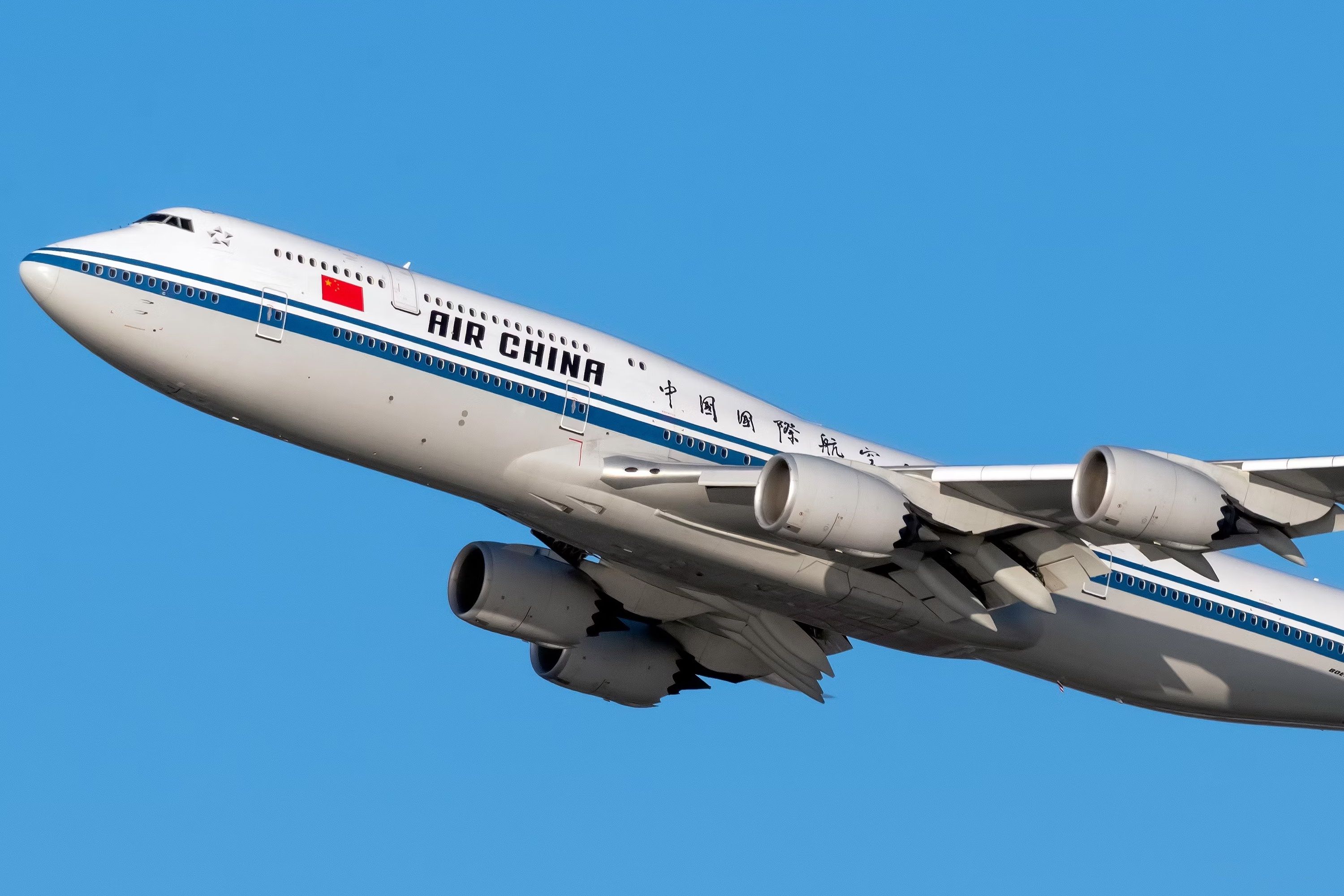

- Air China

- China Southern Airlines

- China Eastern Airlines

Related

What Has Happened To China Southern Airlines’ Former Airbus A380s?

How long did each of the carrier’s Airbus A380s operate for, and where are they now?

With the same state owners, it is unsurprising that these three carriers historically operated as a cartel or an organization of multiple different companies that collude to control prices and demand.

In recent years, this cartel has broken down, and despite all being owned by the Chinese government, the three airlines have been forced to begin competing with one another.

Let’s take a deeper look at the factors behind the unique competitive dynamics that exist between China’s three state-owned major airlines.

Shifting market conditions have forced the carriers to interact in different ways

When originally launched, the three major carriers in China had relatively little operational overlap. Air China primarily served destinations from Beijing, China Southern, which operated from airports in the nation’s South, and China Eastern, which was based mostly out of Shanghai.

Therefore, there was little reason for the carriers to interact with each other, and as a result, they were rarely forced to compete for the same pool of customers.

Photo: Markus Mainka | Shutterstock

Over time, however, market conditions have changed, and the rapid expansion of these airlines’ networks, as well as the surge in passenger demand that has given rise to new airlines in the market, has forced these carriers to interact with each other.

Now, more than ever before, these airlines operate flights that directly interact with each other. According to data published by the Department of East Asian Studies at the University of Leiden, the carriers’ operations have expanded rapidly into each other’s markets, with China Southern flying routes like Beijing to Shanghai it never would have before.

Related

Air China Only Has 1 US Boeing 747 Route Remaining

Now only New York JFK is down to see its passenger 747s this summer.

Furthermore, it appears that these new competitive dynamics have helped some carriers while harming others. The table below provides details on how the market shares of these three major airlines changed between 2015, 2020, and 2024, using data from Statista and OAG:

|

Year: |

2015 |

2020 |

2024 |

|---|---|---|---|

|

Air China market share: |

28.1% |

21.6% |

12% |

|

China Southern market share: |

29.3% |

17.86% |

16% |

|

China Eastern market share: |

31.2% |

23.18% |

15% |

New competitors have drastically shifted market dynamics

Over the past five years, China’s three big state-owned airlines have lost a significant portion of their market share, and the industry as a whole has become significantly more fractured.

Today, the ten largest airlines in China only represent about 71% of domestic air travel capacity, with airlines like Hainan Airlines, Sichuan Airlines, and Xiamen Airlines increasingly serving an important role in the market.

Photo: Suparat Chairatprasert | Shutterstock

To balance the challenges of having so many different state-owned airlines in the market, the Chinese government has been forced to institute price controls on many shared routes.

On flights where multiple airlines compete, one will often find identical prices, ensuring that carriers do not undercut each other based on price alone. Furthermore, the gradual expansion of high-speed rail in China has further taken a toll on the carriers’ short-haul passenger figures.

So how do these airlines compete with each other if they can’t change prices on each other?

When carriers are unable to lower prices to attract customers, standard economic intuition would imply that an airline would need to improve its product quality to compete.

This is exactly what has happened in China. According to an extensive analysis performed by Xiaowen Fu and James Peoples in their 2019 book Airline Economics in Asia, data confirmed that customer satisfaction has been one of the most important factors driving airline profitability in China. At the end of the day, if customers are unhappy and prices are the same, they are likely to try a different airline the next time they fly.