It’s been another wild year across the airline loyalty landscape, with Delta Air Lines and United Airlines raising their status requirements, Alaska Airlines acquiring Hawaiian Airlines, and American Airlines adding new features and rewards for its Loyalty Points-based AAdvantage program.

Hotels, too, are undergoing some big shifts, with Small Luxury Hotels of the World moving from World of Hyatt to Hilton Honors and Mr and Mrs Smith properties moving from IHG to Hyatt.

I got really lucky this year with the ability to roll over Medallion Qualification Miles from Delta into an extra year of top-tier Diamond Medallion status. That will take me through next year, but the huge spending requirements for 2026 mean I will likely give up on top-tier Delta status after that.

I was also able to requalify for top-tier American Airlines AAdvantage status and World of Hyatt Globalist status. Those two programs will earn the bulk of my travel next year, but I’m increasingly intrigued by Alaska Mileage Plan. That program could end up being my focus in the years ahead, since the airline is making it easier (not harder) to achieve top-tier status.

In 2025, I’ll continue to hold Platinum Elite status with Marriott Bonvoy and IHG One Rewards as well as Hilton Honors Diamond status just for carrying credit cards.

I also added a new status to the mix: I got Air Canada Aeroplan Elite 25K status for signing up for a credit card, and I’m excited to start playing around with Aeroplan points.

Here’s the full breakdown of where I am heading into 2025 and how you can use my lessons to your advantage (no pun intended).

American Airlines AAdvantage: Executive Platinum

I’ve held AAdvantage Executive Platinum status for a few years now, and it’s the program I’m most committed to currently. I’ve requalified for Executive Platinum for 2025 already, and I still have a few months to try to hit a few of the airline’s new Loyalty Point Rewards milestones. Good news for me and other AA elite members: We just learned American Airlines is not raising status requirements for next year.

I’ve really enjoyed my status this year, with a few complimentary domestic upgrades and a few even bigger perks.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

This year, I’ve been able to use three systemwide upgrades. I used two for international flights, including an upgrade from premium economy to business class on an American Airlines flight from Tokyo to Los Angeles.

I was able to use another one on a transcontinental flight from New York City to San Francisco on my favorite plane: the not-long-for-this-world A321T.

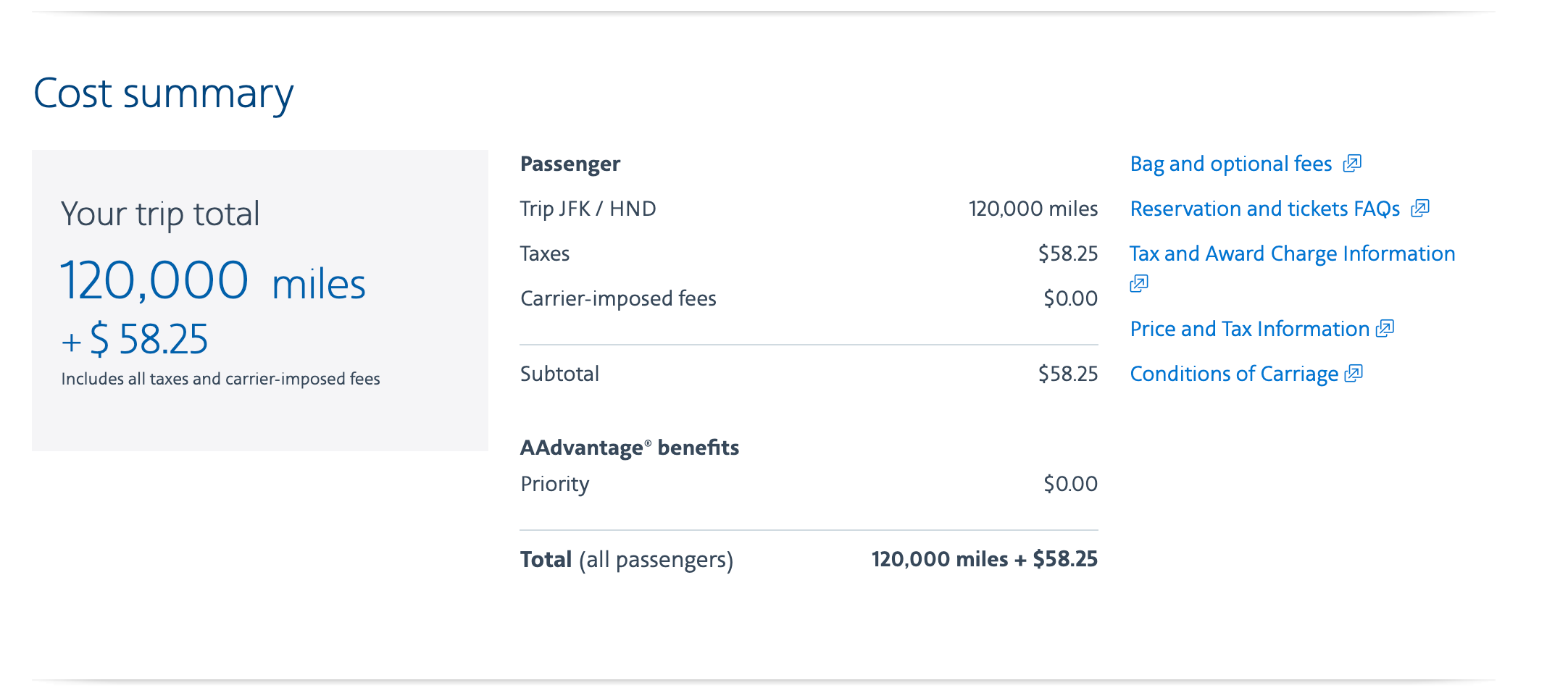

I was also able to score a few great redemptions this year using AAdvantage miles. I flew round-trip to Tokyo in business class for just 120,000 miles.

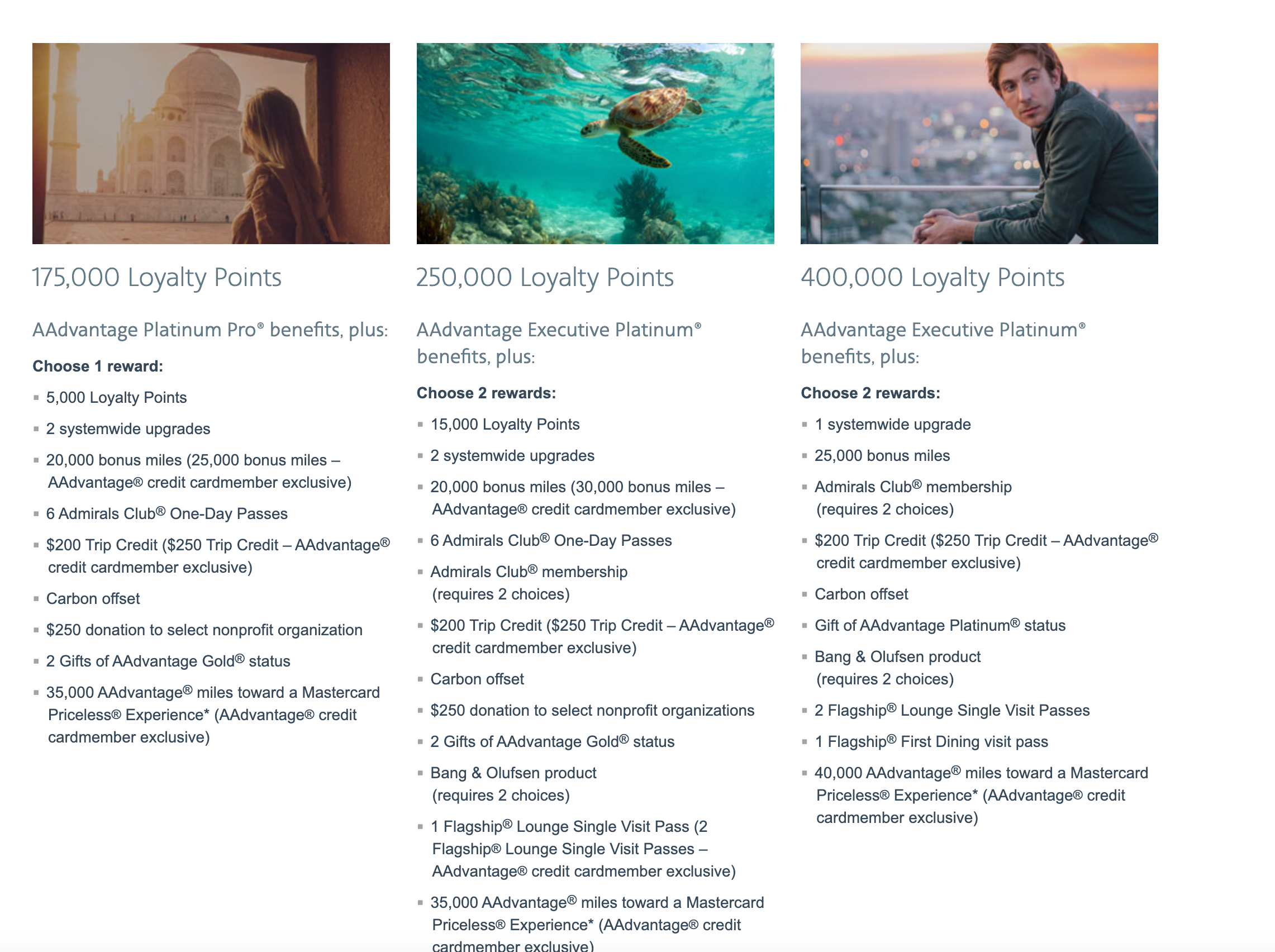

So far this year, I’ve earned 229,881 Loyalty Points. The qualification year runs through Feb. 28, so I should be able to hit one more reward tier (at 250,000 Loyalty Points) to claim one of a slew of AA benefits, including more systemwide upgrades, bonus miles or a $200 to $250 trip credit.

But it hasn’t been a totally smooth ride with American in the past few years. In 2018, the airline started making it more difficult (and expensive) to achieve top-tier status.

That’s when I decided to try some new programs. I did status challenges for both Delta and Alaska Airlines, and I mostly stopped flying with American. Still, I managed to hit AAdvantage Platinum Pro in 2019, and that status was extended for multiple years during the COVID-19 pandemic. My Platinum Pro status finally expired at the end of January 2022, though, and I dropped to the dreaded entry-level member status.

However, something interesting happened during that period. Alaska and American became Oneworld partners, and because I had top-tier Alaska Airlines Mileage Plan MVP Gold 100K status, I ended up with perks when flying American. I even wrote about how I’d been upgraded a ton as an Alaska elite member flying on American Airlines.

Thus, flying Alaska sent me back into the arms of American AAdvantage.

Related: What is American Airlines elite status worth?

Fast forward to 2022, I moved back to New York City after a few years of living on my father’s ranch in Montana. I wasn’t able to requalify for Alaska MVP Gold 100K status since I was no longer near their Seattle fortress hub. My timing was good, because that was when American unveiled a new Instant Status Pass; this granted me Platinum Pro status until the end of March and the opportunity to extend it in rolling phases. If I earned 67,000 Loyalty Points, I could get boosted to Executive Platinum. I did just that.

Playing the Loyalty Points game has been wildly fun, and I earned enough Loyalty Points in three requalification phases to keep Executive Platinum status. Eventually I unlocked Executive Platinum status the old-fashioned way: earning 200,000 Loyalty Points in a qualification year (March to February). Of all my airline statuses, AAdvantage is the one I plan on sticking with beyond 2025 because of how fun it has been to acquire Loyalty Points.

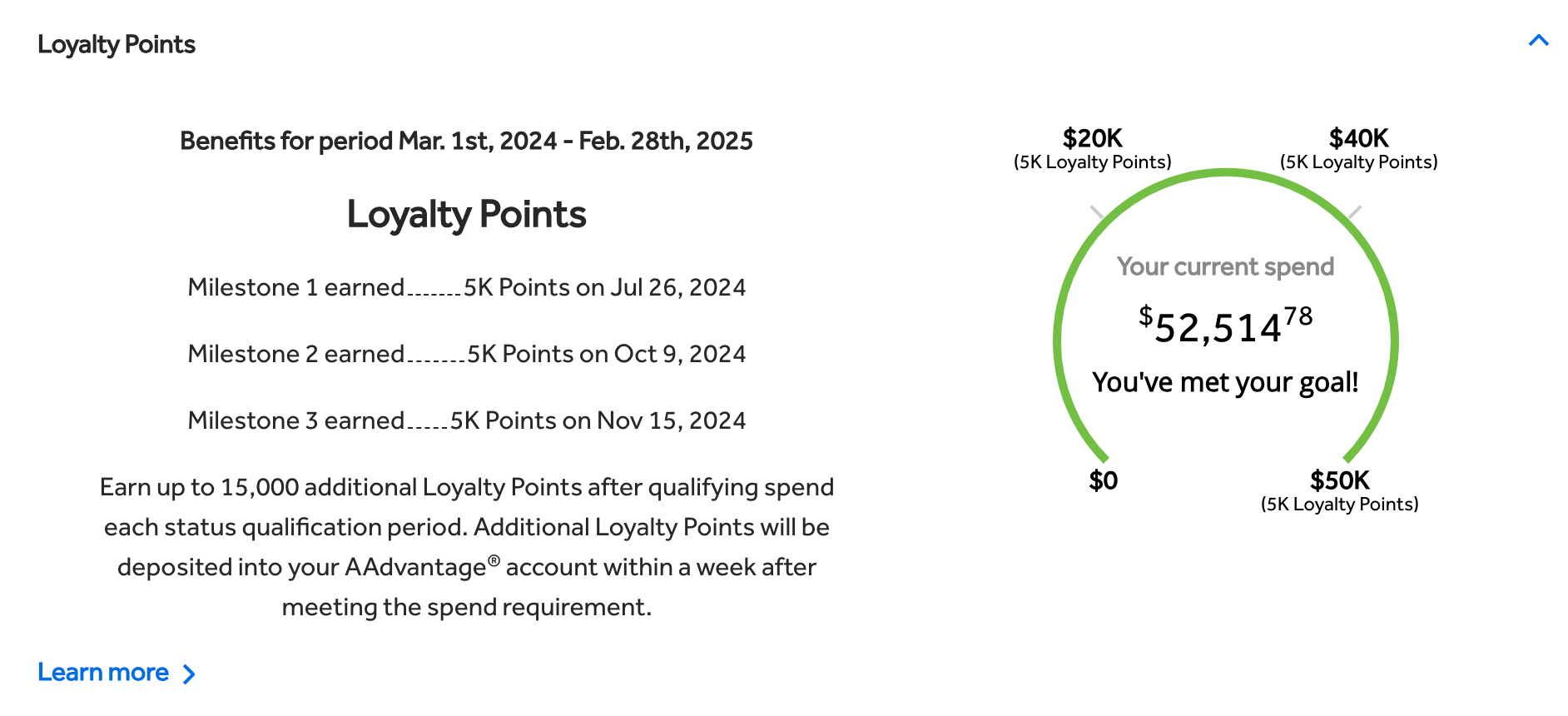

Since I went all-in on attaining Executive Platinum status, I decided to open the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) to make it easier to rack up Loyalty Points. That alone went a long way toward helping me reach my goal. It netted me an extra 20,000 Loyalty Points — 10,000 bonus Loyalty Points after reaching 50,000 Loyalty Points and another 10,000 bonus Loyalty Points after reaching 90,000 Loyalty Points.

This year, I’ve also hit the spend required via my Barclays AAdvantage® Aviator® Silver Mastercard, unlocking a total of 15,000 Loyalty Points. Normally, I wouldn’t recommend people put that much spending on this card since it mostly earns just 1 mile per dollar spent (except on American Airlines flights and travel). However, my father is an authorized user on the card, and he’s been able to help me hit the spend requirements. The information for the Barclays AAdvantage Aviator Silver Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

That card also comes with an annual companion pass good for up to three passengers once you’ve hit $20,000 in spending — a nice benefit.

The future of the Aviator cards has been in doubt since we learned Citi will become the sole issuer of all AAdvantage credit cards starting in 2026. However, I did get a letter from Barclays saying the card would retain the ability to earn AAdvantage miles and Loyalty Points through 2025, so I’m good for at least another year. Hopefully, Citi will keep the same benefits on the card when it migrates from Barclays.

In any case, I’m firmly back in the arms of the AAdvantage program. The next question: Do I team back up with American partner Alaska for 2026?

Alaska Airlines Mileage Plan: Member, but going for Gold?

Alaska Airlines Mileage Plan had been my go-to elite status for the past several years, but that came to an end in 2023.

When I first started at TPG in 2019, I signed up for a status challenge that got me to MVP Gold 75K; that kept me on the status hamster wheel with Alaska for several years. I moved to Montana during the pandemic, and that Alaska status got quite a workout. I used it to travel all over the place, including to a new country when Alaska launched service to Belize.

Related: It’s all about the upgrade: How and why I went for Alaska’s new top-tier MVP Gold 100K status

I even earned Alaska’s new top-tier MVP Gold 100K status when it was unveiled in 2021.

Alaska had as many as five daily flights to its hub in Seattle from my then-home airport in Bozeman, Montana, which really ramped up my Alaska flying.

But all good things must come to an end. Moving back to New York City in 2022 made flying Alaska tougher than when I was in Big Sky Country. I lost elite status altogether in 2024.

That didn’t mean an end to my mileage program use, though. This year, I used Alaska Mileage Plan miles to fly on partner Starlux in business class to Taipei, Taiwan, and back.

I have more partner award flights booked using Alaska miles for 2025, including one to Tokyo on Japan Airlines and one from Taiwan to Seattle on Starlux again.

Alaska’s partnership with American Airlines means I can still fly on Alaska flights, which inherit my top-tier American Airlines AAdvantage status. I also still get a lot of good use from the companion certificate from my Alaska Airlines Visa Signature® credit card.

With this card, you get a $99 companion fare (plus taxes and fees from $23) for each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year. I used mine to take my friend to Maui.

Related: Alaska Airlines credit cards get additional perks, new restrictions — and a higher annual fee

While I won’t have Alaska status for 2025, I am considering making the move back to Alaska in 2026. Alaska acquired Hawaiian Airlines this year, and they’ll be combining the loyalty programs into one unified platform next year. I have a feeling there will be some interesting potential shortcuts to status. In fact, we know of one already: Alaska is offering waitlist access for a new premium card that it says will help holders accelerate their path to status.

Alaska is now the only major U.S. airline that lets you earn elite status from flights based on actual flight miles. As such, you don’t have to spend an outrageous amount of money to earn top-tier Mileage Plan status. Alaska also made several positive changes on the status-earning front. Alaska Mileage Plan members will now earn miles on award redemptions, and there will also be new ways to spend toward status.

As of Jan. 1, 2025, cardholders with the current Alaska Airlines Visa Signature credit card will earn 1 EQM for every $3 spent, up to a total of 30,000 EQMs each year on qualified purchases. That could get you a good part of the way toward top-tier 100K status, which requires 100,000 EQMs.

That may be even easier for me than earning Executive Platinum status on AA in 2025 — and it’s something I’m strongly considering for 2026. Stay tuned.

Related: Last-minute strategies for earning Alaska Mileage Plan elite status

Delta SkyMiles: Diamond Medallion (for now)

I’ll keep top-tier Delta Medallion status through 2025, even though it has been a bit of a roller coaster ride with the airline these past few years. Delta announced much higher elite status requirements in its SkyMiles Medallion loyalty program and its cobranded credit card portfolio. Delta is also making it much more expensive to achieve various status levels.

But in an interesting twist, I ended up with a few years of top-tier Delta Diamond status thanks to rollover MQMs. In fact, I’ve been happily not paying much attention to requalifying for Diamond status because I was able to extend my status by a year via a special one-time Choice Benefit. It allowed me to take my unusued rollover MQMs and turn this into Diamond status until 2026.

Delta hiked the cost of earning status several times in the past few years. The most recent increase was dialed back a bit this year after consumer outcry, but essentially, if I wanted to re-earn status for 2026, I’d need to spend a whopping $28,000 on Delta next year. That’s simply out of reach for me (and most others).

My total spending for 2024 is less than $10,000 in MQDs. This includes $2,500 in MQDs just for holding the Delta SkyMiles® Reserve American Express Card, as well as $1,000 in MQDs received as a one-time status boost for travelers with the Delta Reserve card prior to Feb. 1 as a “token of appreciation.”

The $650 annual fee (see rates and fees) for the Delta Reserve is steep, but it’s often worth it for those chasing status — or, at least, it had been, because of a spend waiver up to Platinum status.

The waiver is gone, but the Reserve card does give 1 MQD for every $10 you spend on the card. Technically, you could spend your way to status, but there’s no way I can put that much spend on my Delta SkyMiles Reserve American Express Card. While I still like the card for all its perks, I’m not putting much spend on it anymore.

All that said, I have enjoyed my Diamond status this year. I had a Global Upgrade Certificate clear me from Premium Select to Delta One on a flight from New York City to Geneva this summer.

Also, I was able to use a Regional Upgrade Certificate to fly all the way from New York City to Honolulu in Delta One on an 11-hour flight. Talk about a great use of a cert.

I’ve also made great use of SkyMiles. I lucked out recently with an award from Mexico City International Airport (MEX) to Los Angeles International Airport (LAX) and then to Australia’s Brisbane Airport (BNE) in Delta One. There was a brief moment when the flight was available for just 73,000 SkyMiles one-way. I jumped at the opportunity to fly in Delta One on the newly launched, more-than-14-hour flight to Australia.

Related: Some of the best ways to use Delta SkyMiles

I’ve had a great run on Delta.

Still, after my “free” Diamond status runs out in 2026, I’m going to get off the Delta hamster wheel and bid a fond farewell to Delta status. It’s just getting too rich for my blood. Those SkyMiles will continue to be appealing, though, and I’ll keep my Reserve card for the long term.

Related: Last-minute strategies for earning Delta Medallion elite status

Air Canada Aeroplan Elite 25K

This is a new one for me. I’ve been increasingly intrigued by Air Canada’s Aeroplan program, which oftentimes allows bookings as low as 60,000 to 70,000 points for business class on partner airlines (like United).

I signed up for the Aeroplan® Credit Card from Chase, which currently has best-ever offer of up to 100,000 bonus points. Earn 75,000 bonus points in the first three months from account opening. Plus, 25,000 bonus points after you spend $20,000 on purchases in 12 months from account opening.

Related: 5 of the best ways to redeem 75,000 Air Canada Aeroplan points

The bonus points have already hit my account. In fact, I’m already sitting on nearly 195,000 points. I accumulated them from that generous sign-up bonus and a current offer to transfer Chase Ultimate Rewards to Aeroplan and earn a 20% transfer bonus.

The card also comes with automatic Aeroplan 25K elite status, which has a slew of benefits, including priority check-in and boarding, a 50% discount on Preferred Seats and 20 eUpgrade credits each year. I’ve selected upgrade credits and lounge passes, which are already in my account.

1 of 2

Air Canada Aeroplan status benefits page. AIR CANADA

I’m excited to explore the Aeroplan program and potentially use my points on one of the airline’s cheap stopover offers. You can add a stopover on a one-way itinerary for just 5,000 Aeroplan points.

Related: Why Air Canada Aeroplan has become my favorite Star Alliance loyalty program

World of Hyatt: Globalist

I’ve loved having top-tier Hyatt status again this year after an incredible offer through Bilt in 2023 to get World of Hyatt Globalist status through February 2025. Bilt Rewards offered a chance to earn Hyatt Globalist status with 20 nights instead of the usual 60, and I jumped at the opportunity.

Related: 6 reasons I love my Bilt Mastercard as a renter in the most expensive city in the US

World of Hyatt Globalist is one of my absolute favorite statuses. Back in 2023, I used a suite upgrade at the Park Hyatt Paris-Vendome courtesy of Hyatt Globalist status; I scored a one-bedroom suite on a points redemption of just 40,000 World of Hyatt points per night.

Globalist benefits include guaranteed 4 p.m. late checkout, free breakfast and better upgrade odds, among other perks.

This year, I’ve earned top-tier status organically with stays all over the world. I stayed at the Grand Hyatt Taipei, the Park Hyatt Kyoto, the Andaz Munich (where I was upgraded to a suite) and the brand-new Park Hyatt London River Thames (where I was able to use a suite night upgrade award to a gorgeous one-bedroom suite).

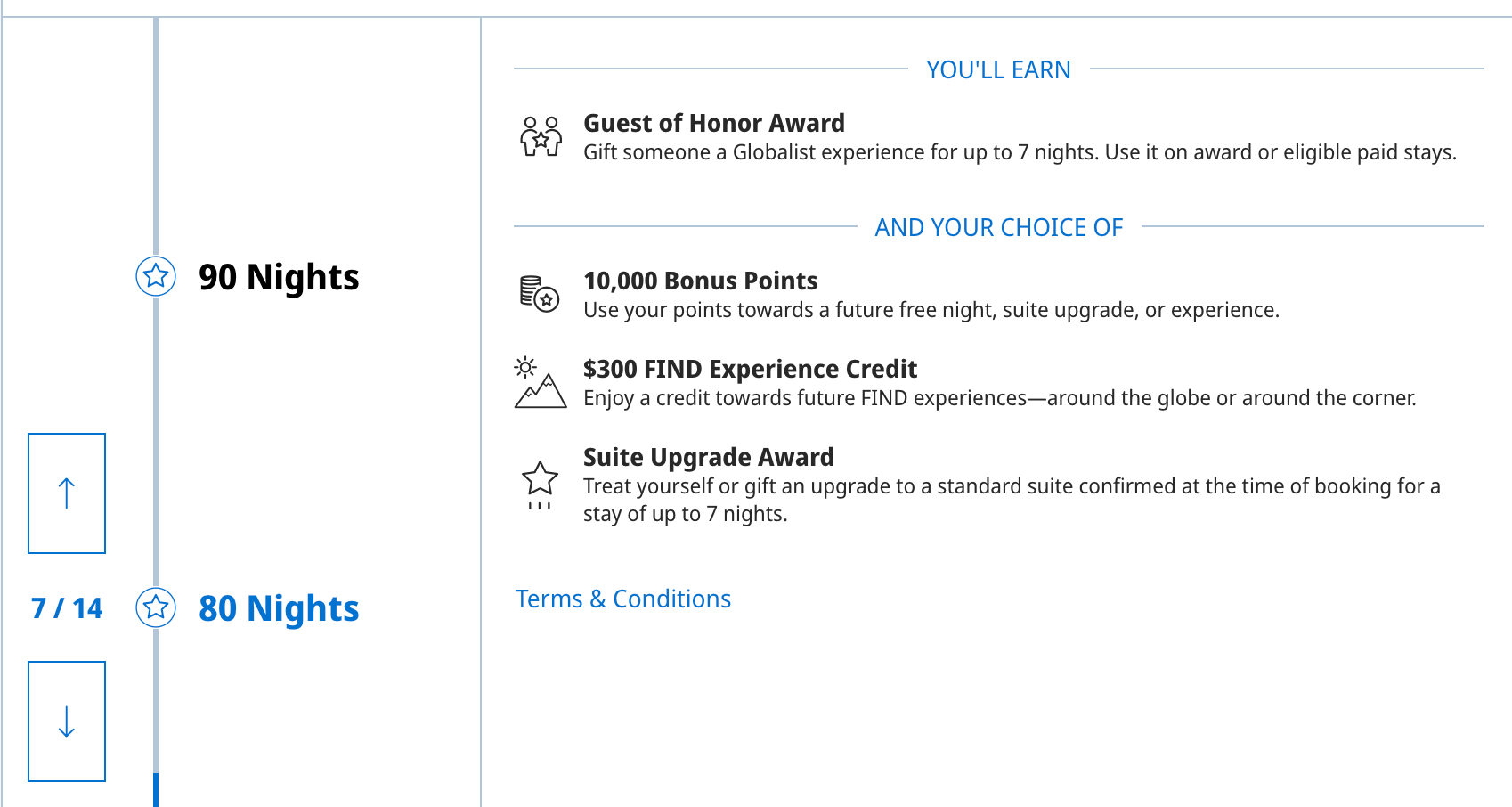

I’ve earned a total of 75 nights this year so far at Hyatt hotels. You need just 60 for Globalist status. I may try to hit 80 nights in 2024, so I can earn another Milestone Rewards choice of a Hyatt Guest of Honor award, plus either 10,000 bonus points or a Suite Upgrade Award.

I also plan on keeping both my World of Hyatt Credit Card and my World of Hyatt Business Credit Card. They’ll help me get more elite nights toward status each year. (For example, the personal World of Hyatt card comes with five nights upon renewal.)

Related: Which credit card should you use for Hyatt stays?

I don’t need to spend on those cards for World of Hyatt points since you can transfer Chase Ultimate Rewards points to Hyatt. I tend to earn a lot of Chase Ultimate Rewards points via spending on my Chase Sapphire Preferred® Card.

But I have been putting Hyatt stays on my World of Hyatt Credit Card since you earn 4 points per dollar spent at Hyatt hotels and resorts. You also get two elite nights for every $5,000 you put on the personal card. In 2024, I earned six nights this way (and a heck of a lot of World of Hyatt points).

To me, Hyatt is the most valuable hotel loyalty program, and I will try to hit the 60-night threshold again next year.

Related: Why I aim to spend $15K on my World of Hyatt Credit Card each year

Hilton Honors: Diamond forever

Hilton Honors is the easiest of my top-tier status achievements to reach. While I only stayed at a Hilton hotel a few times this year, I still have the program’s highest status level: Diamond. How did I manage that? It’s a perk of holding the Hilton Honors American Express Aspire Card.

Related: What is Hilton Honors elite status worth?

The card comes with Hilton Diamond status for as long as you have the card. Despite recent “enhancements” and a change to the card’s hefty annual fee — it’s now $550 (see rates and fees) — the card is still worth keeping. There are other valuable inclusions, such as $400 to spend at Hilton resorts every year ($200 from January to June and another $200 from July to December), $200 in statement credits for flight purchases ($50 per quarter) and a free weekend night when you open the account and reach your annual card anniversary.

The information for the Hilton Aspire Amex Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Thanks to having this card, I’ve now had Hilton Diamond status since 2020.

This year, I used one of my $200 stay credits at the Hilton Cancun Mar Caribe. I used another at the Rome Cavalieri, A Waldorf Astoria Hotel. In total, I’ve only had seven stays at Hiltons this year, and that pattern will likely hold for 2025.

I’ve also been able to use the airline fee credits regularly. When using the Aspire card to pay, you get $50 in statements credits for airline purchases once a quarter.

While I have had some nice stays at Hilton properties — including the stunning Conrad Bora Bora Nui — over the years, I’ve rarely been upgraded despite my Diamond status. Still, the statement credits alone justify keeping the Aspire card and my Diamond status for 2026, even if I don’t have as much luck getting upgrades with Hilton as I do with Hyatt.

Marriott Bonvoy: Platinum Elite via credit card

In the past, I’d been very content with the Marriott Bonvoy Gold Elite status I received courtesy of The Platinum Card® from American Express; it gives status in several hotel programs, including Marriott Bonvoy (enrollment required).

Related: Guide to Marriott and Hilton elite status with the Amex Platinum and Business Platinum

Then came 2022. When American Express surprised everyone by announcing that holders of the Marriott Bonvoy Brilliant® American Express® Card would get Platinum Elite status for as long as they hold the card, I jumped at the chance to apply for the card. As a result, I’m now a Platinum Elite member and will be keeping this card in 2025 since I’ve found this elite status super useful.

Although I’ve only spent 12 nights at Marriott properties this year, having Platinum Elite status certainly enhanced my trips. I stayed at the brand-new Tokyo Edition, Ginza in Tokyo and reviewed it for TPG.

I also had a fantastic stay at the glorious Sheraton Maui.

Over the past several years, I’ve had great stays at Marriott properties, including at the Sheraton Lake Como Hotel in Italy; the Hotel President Wilson, a Luxury Collection Hotel, Geneva; and The London Edition.

I’ve used the annual free night that comes with the Brilliant card two years in a row at Hotel President Wilson. I love the lakefront location.

Having Platinum Elite status made those stays better: I enjoyed benefits like guaranteed late checkout, lounge access, and complimentary breakfast. I even got a suite upgrade while staying at Le Meridien N’Fis in Morocco.

Free lounge access comes with Platinum status, and I used it during a stay at Le Centre Sheraton Montreal Hotel in Canada.

Even though many of our favorite Marriott Bonvoy properties now cost more points due to dynamic pricing, I still find that Bonvoy points come in handy.

I’ll end the year with just 39 Marriott nights. I won’t try to get higher status next year, though the idea of opening the Marriott Bonvoy Business® American Express® Card is intriguing. Each year you hold the card, you receive 15 elite night credits toward the next level of Marriott Bonvoy elite status.

At least for now, though, I’ll keep the personal Brilliant card open and enjoy Platinum Elite status without worrying about how many nights I need to stay.

Related: Last-minute strategies to earn Marriott Bonvoy elite status

IHG One Rewards: Platinum Elite via credit card

Like my other hotel statuses, I have Platinum Elite status with IHG One Rewards by virtue of holding its hotel-branded card. That’s where I’ll stay for 2025.

Over the years, I’ve stayed at several memorable IHG properties, including the stunning Six Senses Shaharut and the InterContinental David Tel Aviv.

This year wasn’t quite as aspirational. I did spend a night at the Hotel Eventi in New York City, where I used Kimpton’s secret password to score some bonus points.

I also enjoyed staying one night at a brand-new Crowne Plaza in Tainan, Taiwan.

But that’s it. Despite only staying three nights at IHG hotels in 2024, I will keep IHG Platinum Elite status simply by holding the IHG One Rewards Select Credit Card (no longer open to new applicants).

The card includes a handful of nice perks, but best of all, it gives holders Platinum Elite status and a free night award worth up to 40,000 points.

Related: InterContinental brand evolution part of IHG’s broader luxury liftoff

I used my free night award the first year I had the card on a stay in Singapore and again in 2021 for an incredible stay at the Kimpton Armory Hotel in Bozeman. Last year, I used it at the Holiday Inn Express & Suites Nassau in the Bahamas. This year, I used it on an overnight stay at another Crowne Plaza near the airport in Geneva. While I haven’t been able to maximize the free nights that come with the card in the past couple of years, they still provided decent value; nightly rates were around $200 at the time, and I only pay a $49 annual fee on the card.

The information for the IHG One Rewards Select card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Earn up to 140,000 points with these IHG card offers

The new version of the card is the IHG One Rewards Premier Credit Card, which also provides Platinum Elite status. However, it also comes with a fourth night free on award stays and the ability to add points to your 40,000-point certificate; this way, you can use it at more expensive properties. (These perks aren’t available on the Select card.) The annual fee is $99.

I’ll keep my IHG card for status (and a free night) again next year. I’m also sitting on a nice stash of points, so odds are I’ll enjoy some great redemptions in the not-too-distant future — though I don’t have any IHG stays planned so far in 2025.

Related: Last-minute strategies for earning IHG One Rewards elite status

Bottom line

TPG’s Summer Hull laughed at me last year when I told her I was going to go free agent and stop chasing status. This time last year, I was pretty sure I’d be more of a free agent with airlines and hotels than I had been in prior years. But the universe had other plans. Not only was I able to extend my Delta Diamond Medallion status for another year essentially for free, but ample travel earned me top-tier status in two more of my favorite programs.

I’ll have top-tier status with Delta, American, Hyatt and Hilton again next year. I’m excited to use some of my perks in 2025, and I will be reporting back on my 2026 plans next year. One thing is for sure: I don’t think I’ll be able to qualify for all these programs again. A shift to Alaska may well be in the cards in the future.

No matter which programs you’re loyal to (or are considering becoming loyal to), be sure to evaluate whether your current status plans and hopes for gaining status still make sense in this much more expensive loyalty landscape. While many programs come with valuable perks worth striving for, you may find that opting for a credit card that automatically grants elite status is the better way to go.

Don’t get on the elite status hamster wheel unless you know you will use the perks and that you can do it without spending a small fortune you wouldn’t otherwise spend. Sometimes just buying an upgrade here or there is cheaper and easier than trying to grab the precious ring that is top-tier status.

For rates and fees of the Amex Delta SkyMiles Reserve Card, click here.

For rates and fees of the Hilton Honors Amex Aspire Card, click here.

Related reading: